by Anonymous on 4/12/2007 09:46:00 AM

Thursday, April 12, 2007

Washington Post: Bailout Update

As is all too typical, the Post serves up a nice issue salad today on foreclosures, loss mitigation, and bailouts. It takes a fair amount of effort to untoss the thing and figure out what information you might want that you didn't get. The title of the piece, "$1 Billion Pledged to Help Fend Off Foreclosures," appears to refer to existing commitments by banks--Citi and Bank of America--to Neighborhood Assistance Corporation of America. The funds were originally earmarked for low-to-moderate income borrower purchase loans, but have been reallocated to refinancing troubled mortgages currently held by subprime lenders. This issue is happily tossed with potential federal bailout legislation in the works:

If the "proposal" being "applauded" here by NACA is that any rescue funds should be administered by community-based nonprofits like NACA with a track record of decent performance on its own purchase-money mortgages, then I'd have to agree it's probably a wise idea, even if I'm not ready to start clapping. If this is going to be another one of those "faith-based initiatives," I consider that we've already been fleeced enough there.Sen. Charles E. Schumer (D-N.Y.), the committee's chairman, plans to propose legislation that would provide "hundreds of millions of dollars, maybe more," in federal money to help borrowers avoid foreclosure by refinancing mortgages they cannot afford.

That money should reach borrowers primarily through community nonprofit groups that are already helping homeowners refinance burdensome mortgages, Schumer said. But he has not worked out the details of whether banks and other groups would be conduits for the aid or where the money would come from. Schumer has said it might come from a federal appropriation or perhaps the Federal Housing Administration or mortgage financiers Fannie Mae and Freddie Mac.NACA, the housing advocacy group, applauded the proposal, saying it has a better track record of keeping people in their homes than subprime lenders, whom it characterized as predators that mislead borrowers into taking on loans they cannot repay. NACA requires that people who ask for its help attend intensive housing counseling workshops. It also assesses the person's ability to own and maintain a home. It then helps the person obtain a mortgage with one of its partner lending institutions, the biggest ones being CitiGroup and Bank of America. In 2003, Citigroup made available $3 billion in mortgage loans to NACA through 2013. Bank of America, which has worked with NACA since 1995, committed at least $6 billion through 2015.

The group traditionally found the money was best used to finance new home loans for low- and moderate-income buyers. But with the mortgage crisis unfolding, it decided that $1 billion should be used to refinance the loans of people preyed upon by abusive lenders. The group expects to refinance about 7,000 mortgages -- a small number, given estimates that more than 1 million homeowners nationwide could be at risk of foreclosure.

The rest of this proposal is, of course, another story. It's not that I object to Citi or BoA committing loan dollars here, but there's something about them being "conduits" for such funds that does things to my eyebrows. Taxpayers, beware of "conduits."

But of course, the question of what Citi or BoA is actually committing to fund here is left unanswered. Here are the questions I have (hint, reporters, hint):

- Are the 7,000 or so loans NACA wants to work out with a subsidized refinance originally purchase loans? In other words, is the current unaffordable mortgage a result of "ownership society" push to make home purchase money funds available to subprime buyers, or is this an effect of homeowners using the subprime lending market to extract equity?

- The above item might matter if we addressed the question of who, actually, holds the loans being refinanced. Aside from the question of which homeowners are being bailed out, we have the question of which lenders are being bailed out by having a nonperforming loan taken off their books. Are we clear that Citi and BoA are not holders of the existing notes?

- If NACA is using these funds to refinance loans that were originally made at predatory terms--predatory lending being not the same thing as subprime lending, necessarily--what is the provision for penalizing the originator or holder of the current loan? Is Citi or BoA paying "the fine" here for illegal lending practices, by providing the funds to refinance the loans?

- Is there really no money at all left to be wrung out of the subprime lenders, such that we're now ready to talk about the taxpayers stepping in? How could that be?

- Is Schumer's "hundreds of millions or more" a question of capital to make refinance loans with? A subsidy on the interest rate of such loans? A cash transfer to the original lender in the form of debt forgiveness on the loan being refinanced? Additional credit enhancement (i.e., a subsidy of insurance premiums) to make the refinanced loans investment quality? An additional guarantee to the refinancing lender? Is there, in other words, any potential return to the taxpayers? Do I get a lien? Am I now a bondholder? Or am I, the taxpayer, just covering the losses?

Wednesday, April 11, 2007

Moody's: Commercial-Mortgage Risk Forcing Change

by Calculated Risk on 4/11/2007 05:17:00 PM

From Bloomberg: Commercial-Mortgage Risk Forcing Change, Moody's Says (hat tip Brian)

Moody's Investors Service ... will require more protection for investors in securities backed by mortgages on apartment buildings, offices and other commercial properties because of "a continued slide" in lending standards.Clearly the incipient credit crunch has moved beyond subprime.

emphasis added

From this previous post: Commercial Bank Exposure to Real Estate: We know, from the FDIC Semiannual Report that the concentration of CRE and C&D loans has increased:

Small and mid-size institutions have been increasing their concentrations in riskier assets, such as CRE loans and construction and development (C&D) loans. This suggests that, although small and mid-size institutions have been more successful in limiting the erosion of their nominal NIMs, they have achieved this success in part by assuming higher levels of credit risk.

... continued increases in concentrations and reports of loosened underwriting standards at FDIC-insured institutions signal the potential for future credit quality deterioration. In addition, regulators have noted increasing C&D and overall CRE loanThe housing crisis is now front page news, but there is little discussion about U.S. bank exposure to CRE loans. If a CRE slump follows the residential real estate bust (the typical historical pattern), then the mid-sized institutions might have a serious problem.

concentrations, especially at institutions with total assets between $1 billion and $10 billion.

The Impact of MEW on PCE

by Calculated Risk on 4/11/2007 01:51:00 PM

Barry Ritholtz of The Big Picture and Don Luskin are debating the economic outlook at the USNews.com.

Round 1 is here: The Bullish versus Bearish Economic View

Round 2 can be found here: Don’t Worry–Be Happy vs Worry a Lot–Housing Will Hurt the Economy

Note: I no longer use the second chart presented by Barry - it is correct, but it is easy to misinterpret. See my notes here to apparently get even more confused!

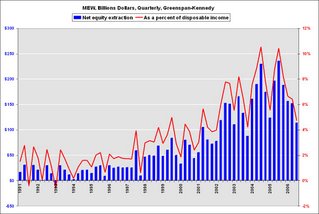

I'd usually stay out of this debate, but since both Barry (with credit - thank you!) and Don (without crediting me) are using my graph, I thought I'd offer some comments. Click on graph for larger image.

Click on graph for larger image.

This graph shows the Greenspan-Kennedy MEW (Mortgage Equity Withdrawal) calculations (through Q3 2006), both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income. Note: Q4 2006 has not been released by the Fed yet.

Mr. Luskin took my chart and added the Year-over-year change in PCE and suggests there is no correlation. Here is a better comparison. This is of the trailing four quarters of MEW as a percent of PCE vs. the annual change in nominal PCE.

Here is a better comparison. This is of the trailing four quarters of MEW as a percent of PCE vs. the annual change in nominal PCE.

Some observers might think this chart is sort of a Rorschach inkblot test. They would suggest observers see what they want to see.

In fact the correlation is low over this period, around 0.07. But that is the point that Barry is making. In the earlier periods, MEW wasn't important for PCE growth, but in recent years MEW probably was a very important component of PCE.

I think most economists agree that declining MEW in 2007 will negatively impact consumption. The current debate is on the size of the impact. Greenspan has argued that about 50% of MEW flows to consumption. This may be too high or too low - the percentage is difficult to estimate because other factors also impact consumption.

Round 3 should be available shortly.

WSJ: Realtors Predict Annual Price Drop

by Calculated Risk on 4/11/2007 10:59:00 AM

From the WSJ: Realtors Predict Annual Price Drop, Lower Forecasts for Home Sales

A real-estate trade group lowered its forecasts for U.S. home sales this year, while projecting what would be the first annual decline in the median national existing home price since it began keeping records in the late 1960s.My projections are for existing home sales to fall to 5.6 to 5.8 million units and prices to fall from 1% to 3% nationwide (as measured by OFHEO).

In its latest forecast for the real-estate market, the National Association of Realtors projected that existing home sales will fall 2.2% this year to 6.34 million, compared with its previous forecast of a 0.9% decline. The NAR said new home sales are likely to fall 14.2% to 904,000, compared with the prior forecast of a 10.4% drop.

...

The national median existing home price will likely slip 0.7% to $220,300 in 2007, following a 1% gain last year ...

Option ARMs: The Band Plays On

by Anonymous on 4/11/2007 09:06:00 AM

Yesterday’s foray into bond market vigilantism was so fun, I’m tempted to try it again. This morning’s news item, via CNN (hat tip, Wayne!), “Risky loans - alive and well”:

NEW YORK (Money) -- Option ARMs remain an option. Despite problems in the mortgage market, brokers say lenders are still willing to make risky loans - including those that allow borrowers to make monthly payments that don't even cover the interest (so-called "option ARMs").Does anyone else remember M&T and AHM announcing that they couldn’t get a bid for an Alt-A security? If so, could you direct me to the relevant press release? The ones I read seem to suggest that whole loan bids went away.

Also still widely available are "no-doc" loans, which require no income verification, and mortgages with no downpayment. . . .

In early March, rising delinquencies caused a dramatic sell off in the bonds backed by mortgages to the borrowers with poor credit quality. Analysts predicted that the investor distaste for those mortgages would spread into the Alt-A market as well. Indeed, in the past week two New York lenders American Home Mortgage and M&T Bank said they would pull back from making loans to the Alt-A market because investors were willing to pay less for those securities.

But mortgage bond traders say investors, who seemed nervous about the bonds a month ago, in the past few weeks have been coming back to the market. "We are seeing demand for these bonds picking up again," said a bond trader at one of the largest mortgage lenders in the country. He said yields, which rise with investor concerns, on most Alt-A bonds are up less than one tenth of a percent.

Of course there is a relationship between a whole loan bid—that’s the investment bank buying loans—and a security price—that’s the bond the investment bank created out of the whole loans it may have purchased, or just originated.

But we had some serious confusion in the comments to an earlier post about who knows what when—and whose rules are in effect—when whole loans are purchased from a loan originator, so it’s really best to be clear about this. The investment banks set their own whole-loan guidelines, which include product type, credit underwriting, documentation levels, maximum LTV, and so on. They put out rate sheets when they buy those loans on a flow basis (one by one, as some originator originates them). When they buy in bulk, from someone like M&T or American Home, they may or may not price each loan off of a rate sheet, although however bid price is calculated by the buyer, it uses the same math as the rate sheet. That bid price will include a spread somewhere (between the bid and the ask). A whole-loan market can start getting ugly if the bids are too low, or if the bids just aren’t there. My reading of what M&T and AHM reported recently was that both of those things happened: there were too few bids at too low a price. In this context, “too low a price” is relative to what M&T and AHM needed or wanted or expected.

It is in any case true that the guidelines of acceptability for this stuff are set by the investment banks, as is the bid price. Since the investment banks buy tons of whole loans on a flow basis—or from their wholly-owned origination outfit—they don’t actually have to buy whole loans from M&T or American Home or anyone else to keep a pipeline going. Two of the largest originators of Alt-A are EMC—owned by Bear Stearns—and Aurora Loan Services—owned by Lehman.

I also noted in the comments to an earlier thread that FED, a California thrift specializing in Option ARMs, just hired itself a new Wholesale Lending Manager. These loans do not have to be purchased by someone who intends to securitize them; there are portfolio lenders out there buying from correspondents and funding for brokers. It is not clear to me, at least, that the market for Option ARMs is exhausted by the appetite of securitizers for whole loans to securitize.

This has been a public service announcement on behalf of vigilant nerds everywhere.

MBA: Purchase Applications Rise, Refinance Applications Decline

by Calculated Risk on 4/11/2007 09:05:00 AM

The Mortgage Bankers Association (MBA) reports: Purchase Applications Rise, Refinance Applications Decline in Latest MBA Survey

The Market Composite Index, a measure of mortgage loan application volume, was 646.6, a decrease of 0.4 percent on a seasonally adjusted basis from 649.5 one week earlier. On an unadjusted basis, the Index decreased 0.1 percent compared with the previous week and was up 10.8 percent compared with the same week one year earlier.Mortgage rates increased:

The Refinance Index decreased 4 percent to 2015 from 2098.3 the previous week and the seasonally adjusted Purchase Index increased 2.7 percent to 413.8 from 402.9 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.16 percent from 6.13 percent ...

The average contract interest rate for one-year ARMs increased to 5.88 from 5.87 percent ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average decreased slightly to 409.6 from 409.7 for the Purchase Index.

The refinance share of mortgage activity decreased to 42.8 percent of total applications from 44.5 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 18.7 from 19.2 percent of total applications from the previous week.

NY Times: Rent vs. Buy

by Calculated Risk on 4/11/2007 12:07:00 AM

David Leonhart at the NY Times writes: A Word of Advice During a Housing Slump: Rent

... in a stark reversal, it’s now clear that people who chose renting over buying in the last two years made the right move. In much of the country ... recent home buyers have faced higher monthly costs than renters and have lost money on their investment in the meantime. It’s almost as if they have thrown money away, an insult once reserved for renters.Try out this interactive tool too: Is it Better to Rent of Buy?

Most striking, perhaps, is the fact that prices may not yet have fallen far enough for buying to look better than renting today, except for people who plan to stay in a home for many years.

Tuesday, April 10, 2007

Mortgage delinquency rates hit an all-time high

by Calculated Risk on 4/10/2007 05:13:00 PM

From CNBC: Mortgage delinquency rates hit an all-time high

Mortgage delinquency rates hit an all-time high in the first quarter of 2007, according to data compiled by Equifax and analyzed by Moody’s Economy.com.

The percentage of mortgages in default rose to 2.87%, surpassing the worst levels following the 2001 recession.

Homebuilders: No Joy in Mudville

by Calculated Risk on 4/10/2007 04:54:00 PM

Citigroup has been the poster child for Wall Street being bullish (i.e. wrong) on housing. Finally, in a research note yesterday and using excerpts from Thayer's "Casey at the Bat", Citigroup has at least admitted that the mighty Casey (aka the Spring Selling Season) is facing an 0 and 2 count in the bottom of the ninth. And we all know what happens to Casey:

Oh, somewhere in this favored land the sun is shining bright;But don't think the last bull has thrown in the towel, Citigroup still remains bullish on housing longer term.

The band is playing somewhere, and somewhere hearts are light,

And somewhere men are laughing, and somewhere children shout;

But there is no joy in Mudville—mighty Casey has struck out.

Bagholder Bondholder Liability: Can’t Have That

by Anonymous on 4/10/2007 12:03:00 PM

This gem from Bloomberg has popped up in the comments and my inbox. According to “Mortgage Bondholders May Bear Subprime Loan Risk” (yes, that’s what that says):

April 10 (Bloomberg) -- The top Democrat and Republican on the House Financial Services Committee said investors in mortgage bonds should be liable for deceptive loans made by banks.You go, Barney. You too, Spence. "No Liquidity Without Responsibility!" I'd put that on my license plates.

Democratic Chairman Barney Frank of Massachusetts and Spencer Bachus of Alabama, the committee's highest-ranking Republican, said such legislation would discourage lenders from extending loans to people with poor credit histories by making it more difficult and expensive for the banks to sell the mortgages.

``More money was being lent than should have been lent,'' Frank said in an interview from Washington. Frank, who last month predicted that the House would approve such a bill this year, said growth in the market for mortgage bonds ``provided liquidity without responsibility.''

An agreement by the two lawmakers may increase the likelihood legislation will be passed this year. The cost of borrowing would rise and curb financing for some lenders and subprime homebuyers, said David Brownlee, who oversees $14 billion as head of fixed income at Sentinel Asset Management in Montpelier, Vermont. It would also reduce opportunities for the Wall Street firms that pool the home loans as securities. . .

``There is no doubt that securitization has had an impact on looser underwriting standards we have seen by lenders,'' Federal Deposit Insurance Corp. Chairman Sheila Bair told the House Financial Services subcommittee on March 27.

Investors in bonds backed by subprime mortgages currently face sufficient liability, [David] Brownlee said. The investment banks underwriting the bonds ``aren't idiots, they're already laying off the risk of subprime loans on investors.'' . . .

Bachus said he favors legislation similar to a law enacted in New Jersey in 2003 enabling homeowners whose loans are the result of predatory lending to gain compensation from lenders and investors who purchased the mortgages. The indemnity includes attorneys' fees, the borrower's total loan payments and the cost of terminating the borrower's remaining liability. . . .

Lenders this decade have increasingly relied on mortgage- backed securities to fund new loans rather than tap capital from federally insured bank deposits. Frank called the process flawed, saying that as a subprime financing mechanism, banks' exposure to the risk of default is excessively diluted.

By dispersing risk, the bonds fueled reckless and unscrupulous lending and compromised underwriting standards, he said. ``There should be a decrease'' in the money available for subprime mortgages, he said. . . .

Bachus said there is a danger lawmakers could overreact and cut off financing for too many subprime borrowers.

``It's very important to preserve the liquidity in the subprime lending market,'' he said. ``If you get too aggressive with assignee liability, you dry up the ability of low and middle income families to own homes.''

Reckless investors shouldn't receive any sympathy, Frank said.

``Our job is to continue to have money available for people to continue to buy homes with minimal chance of these kind of disasters,'' Frank said. ``The effect this has on the ability of people in the bond market to make money is simply not a factor.''

Tanta fails to see why bondholders should be allowed to earn all the reward—those fat juicy yields on predatory and reckless subprime loans—while being allowed to shove the risk back down the chain to the originator in the event that someone sues for deceptive or predatory lending practices. Tanta also fails to see exactly why raising the cost of subprime credit has so many undies in a bunch. (OK, well, I see that. I just don’t care.)

The fact of the matter, it seems to me, is that as long as there is almost no real barrier to entry at the bottom of the mortgage food chain—any idiot can get a broker license, and probably every third idiot can get a mortgage banker license and a warehouse line from someone with more money than sense—there is no way to stop predatory and deceptive lending by writing fancy disclosures for consumers or forcing back enough loans to bankrupt the originators. We’ve noticed that the loans just get originated elsewhere.

I’m ready to entertain the notion that if bondholders had to actually hold the bag, there might come some changes to this hideous misallocation of investment dollars. Among other things. I eagerly await being told that there’s something downright commie about making sure the risk is held by the party reaping the reward.