by Calculated Risk on 11/21/2006 06:59:00 PM

Tuesday, November 21, 2006

Lazear Still Misunderstands Housing

"The housing market, as you know, it has been hit, I think, harder than most of us had expected."During the housing boom, there were two distinct views of the causes of the boom. The consensus view was that the boom was mostly driven by fundamentals and perhaps a little "froth" in 2005.

Edward Lazear, Q&A Nov 21, 2006, chairman of the White House's Council of Economic Advisers

The minority opinion was that the housing market had become a bubble. The minority view was based on evidence of speculation: flippers, a high percentage of investment purchases, and homebuyers using excessive leverage, especially with nontraditional mortgage products.

Now that the housing bust is here, there are also two views of the bust. The consensus view is that the "worst is over". The minority view is that the bust has a ways to go.

Not surprisingly, those that felt the boom was based on fundamentals now believe the worst is over. And those that felt the boom was driven by excessive speculation believe the housing market will continue to slowdown. How one viewed the housing boom colors how one looks at the housing bust.

All the evidence so far suggests the minority view was correct. The severity of the bust has caught the majority off guard as evidenced by Lazear's comments above. Here are Lazear's comments today on housing:

Question: I was wondering if you could talk more about your outlook for the housing market. Do you expect there to be -- it to bottom in 2007? And is the worst behind us in your opinion? And what are the risks, in your mind, of a recession?And Lazear's answer:

CHAIRMAN LAZEAR: The housing market, as you know, it has been hit, I think, harder than most of us had expected. Most forecasters were expecting a slower decline. What that probably signals is that the future will not be as negative as it otherwise would have been because we've probably had much of the decline that we're expecting to have.Maybe. The other possibility is that Lazear and most forecasters misunderstood the housing boom, and they remain too optimistic about the housing bust. Lazear:

That said, there are -- you know, there are a number of indications that things are still not as strong as they were last year in the housing market. You know, do I see that as a problem for the economy? Obviously, we don't like to see any one industry get hit and hit hard. That affects people's jobs. The good side of that, of course, has been that non-residential construction has taken up much of the slack in that industry. So we haven't seen construction jobs fall off dramatically as a result of the housing decline.Residential construction is off $55 Billion (SAAR), and non-residential construction is up $38 Billion from December 2005 (Census Bureau, Construction Spending). So Lazear is correct that non-residential spending has "taken up much of the slack".

But Lazear is overlooking a few facts: Even though starts have fallen off a cliff, completions are still near record levels - and when completions fall (they trail starts by about 6 months), construction spending will drop significantly. Also, non-residential investment tends to trail residential investment.

And the reason residential construction jobs haven't fallen "off dramatically as a result of the housing decline" is jobs track housing completions (for obvious reasons). I've presented these graphs before, but they fit here ...

Click on graph for larger image.

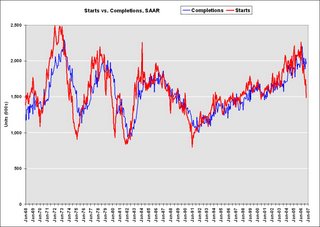

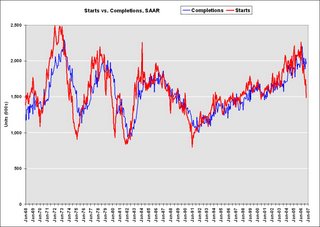

Click on graph for larger image.The first graph shows Starts vs. Completions.

Starts have fallen "off a cliff", but completions have just started to fall.

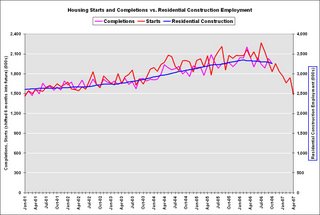

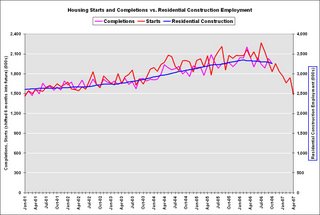

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff".

More Lazear:

And I would say that as we go forward what we'd be concerned about is employment in that industry and looking to see how it transmits to the rest of the economy. I don't believe that it is going to transmit to the rest of the economy. There's been no indication that it has. Other sectors remain strong. And that would be the primary danger that I would see from the housing market, whether it's bottomed out now or whether it will take another quarter or so to bottom out I think is still up for grabs, and I wouldn't want to speculate on it.Lazear doesn't want "to speculate" on when the housing market will bottom out, but then says "now ... or another quarter or so". Lazear has been consistently surprised by the housing bust, and my guess is he will be surprised some more! But on the last point, job numbers do tell us the economy is decent right now, but they tell us nothing about the future.

But I would be willing to tell you that I don't think that this signifies any kind of weakness throughout the economy, in fact the reverse. The job numbers I think are probably the best indicator that the economy is very strong and in really good shape.

Question: And the risk of recession, do you have a --What can I say? Oh, Lazear also revised down the White House estimates for GDP growth for Q4 and 2007.

CHAIRMAN LAZEAR: Well, again the economy is growing. I don't even think we should be talking about going in the other direction at this point. The economy is growing. The economy is strong. The labor market is strong. You know, you see -- when you see jobs added at this rate, when you see unemployment at 4.4 percent, it's pretty hard to be thinking about things going in the other direction. I mean obviously at some time in the future things can change, but right now, as long as we keep our policies consistent with economic growth, which means keep taxes low, make sure that we don't put impediments, strong impediments to trade and business in there, I think we're on track for a strong economy.

Interest on National Debt

by Calculated Risk on 11/21/2006 12:51:00 PM

Click on graph for larger image.

Click on graph for larger image.

The Treasury Department reports that interest on the National Debt was $405.9 Billion for fiscal 2006. The fiscal 2006 interest payment is an all time nominal record.

However, as a percent of GDP, interest on the National Debt is rising, but still low compared to the previous couple of decades. This is because the effective interest rate is very low compared to previous periods, even though the National Debt is increasing rapidly.

For October 2006 (first month of fiscal 2007), interest payments were $22.3 Billion compared to $18.8 Billion for October 2005.

As a rough estimate, interest payments will probably be in the $440 Billion to $460 Billion range for fiscal 2007. I'll work up a better estimate soon. Last November, I projected interest payments of $411 Billion for fiscal 2006.

Monday, November 20, 2006

Morgan Stanley's Roach: Two-Engine Slowdown

by Calculated Risk on 11/20/2006 11:38:00 AM

Stephen Roach, Chief Economist of Morgan Stanley, writes: Two-Engine Slowdown

"The US and Chinese economies are slowing sharply as 2006 comes to an end. Inasmuch as these two engines have accounted for about two-thirds of the cumulative increase in world GDP over the past five years, this two-engine slowdown can hardly be taken lightly. In my view, it poses major downside risks to the global soft-landing call embedded in liquidity-driven financial markets."Please read his piece for the details. Roach concludes:

"As I put this all together, I continue to believe that global growth will fall well short of consensus expectations in 2007. The IMF’s forecast of another year of 4.9% world GDP growth in 2007 -- identical to the trends of the past four years and the strongest surge in global activity since the early 1970s -- is very much in line with what I hear from the broad consensus of investors I meet with around the world. Implicit in this view is that nothing can stop the American consumer or the Chinese producer -- conclusions that are both being drawn into sharp question in the final months of 2006. With slowdowns in the US and China likely to have a meaningful impact on two-thirds of the global growth dynamic, the burden of proof for the case for global resilience has shifted to the decoupling crowd. The sharp -2.8% annualized decline in Japanese consumption in the third quarter of CY06, together with recent disappointing trade date from Taiwan and Korea, do not exactly bode well for the decoupling case.

There’s one word that permeates virtually every discussion I have with investors around the world -- liquidity. It’s literally the only thing they want to talk about. In the view of most fund managers, liquidity remains more than ample to support ever-frothy markets -- irrespective of the outcome for the global economy. I continue to suspect that this disconnect between the global growth and liquidity cycles will be resolved one way or another in 2007. For my money, the risks of the “global fizzle” are being taken far too lightly."

Saturday, November 18, 2006

Q&A with Professor Thornberg on Housing

by Calculated Risk on 11/18/2006 03:07:00 PM

From the OC Register Insider Q&A: Economist Chris Thornberg. Here are some excerpts: Q. Do you have a firm projection of, say, 2007 price movements?

A. There is no such thing as firm projection. But all in all there are two scenarios. The first is that the rest of the economy keeps chugging ahead and the market is stabilized by job and income growth. Price growth remains at zero. This is the good scenario. The bad is that the rest of the economy also cools, and prices fall. But don't expect that prices will collapse by, say, 30%. Housing markets aren't that liquid. Declines will be moderate.

...

Q. What might change your outlook -- good or bad?

A. The key is consumer spending. If people respond to a cooling in housing prices by cutting back on home spending it could get ugly out there in the rest of the economy very quickly. This would turn a bad housing market into an abysmal one. I don't see much upside for the next few years regardless of what may happen.

Friday, November 17, 2006

RealtyTrac: Foreclosures Pass 1 Million for 2006

by Calculated Risk on 11/17/2006 06:19:00 PM

RealtyTrac reports: Foreclosures Surpass 1 Million Mark in October

“So far this year more than 1 million properties have entered some stage of foreclosure nationwide, up 27 percent from the same time last year. ... Our data from the last three months shows that foreclosures are definitely trending upward...”Check the report for your state.

James J. Saccacio, chief executive officer of RealtyTrac.

Here is a table from an earlier post on default notices in California (source: DataQuick):

| California Default Notices, Source: DataQuick | |

| Year | Default Notices |

| 1992 | 100,573 |

| 1993 | 121,416 |

| 1994 | 122,530 |

| 1995 | 135,713 |

| 1996 | 162,597 |

| 1997 | 141,180 |

| 1998 | 122,775 |

| 1999 | 101,053 |

| 2000 | 88,666 |

| 2001 | 81,003 |

| 2002 | 78,784 |

| 2003 | 66,127 |

| 2004 | 52,674 |

| 2005 | 54,476 |

| 2006 (through Q3) | 66,185 |

There were 26,705 default notices sent to California homeowners in Q3. At that pace, the number of default notices sent in 2006 would be the highest since 1999 (66,185 through Q3 + 26,705 = 92,890).

That projection now seems optimistic. RealtyTrac shows 13,601 default notices sent to California homeowners in October alone (half of my Q4 estimate in one month).

The rapid increase in foreclosure activity, combined with falling home prices and a weakening California economy, lead me to believe there will be a record number of default notices sent to California homeowners in 2007, surpassing the previous record of 162,597 in 1996.

Note that 1996 was the last year of the previous housing bust in California. The bust lasted over 6 years. Next year will only be the second year of the current bust.

Housing: Starts and Completions

by Calculated Risk on 11/17/2006 10:05:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Permits are falling:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,535,000. This is 6.3 percent below the revised September rate of 1,638,000 and is 28.0 percent below the October 2005 estimate of 2,131,000.Starts are falling:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,486,000. This is 14.6 percent below the revised September estimate of 1,740,000 and is 27.4 percent below the October 2005 rate of 2,046,000.And Completions are still just below record levels:

Privately-owned housing completions in October were at a seasonally adjusted annual rate of 1,953,000. This is 3.8 percent below the revised September estimate of 2,031,000 and is 0.7 percent below the October 2005 rate of 1,967,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

Starts have fallen "off a cliff", but completions have just started to fall.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 400K to 600K residential construction employment jobs over the next 6 months.

Thursday, November 16, 2006

Seven States Adopt CSBS Nontraditional Mortgage Guidance

by Calculated Risk on 11/16/2006 08:21:00 PM

The Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators (AARMR) have announced that seven states have agreed to adopt the new Nontraditional Mortgage Guidance.

The CSBS has created a web page to track the states that have adopted the Guidance. The seven states so far are: Georgia, Idaho, Iowa, Massachusetts, Montana, New Hampshire, and Wyoming.

Here is a typical announcement:

Industry Letter Regarding Guidance on Nontraditional Mortgage Product Risks

--------------------------------------------------------------------------------

By the Division of Banks

November 14, 2006

SUBJECT: REGULATORY BULLETIN 5.1-103

GUIDANCE ON NONTRADITIONAL MORTGAGE PRODUCT RISKS

To the Chief Executive of the Licensee Addressed:

The purpose of this letter is to inform you of the Division of Banks’ (the "Division") intention to issue Regulatory Bulletin 5.1-103 (the "Bulletin"), applicable to licensed mortgage lenders and mortgage brokers, and to provide licensed entities with a copy of the proposed Bulletin in advance of its issuance by the Division. The proposed Bulletin sets forth the Division’s policy relative to Guidance on Nontraditional Mortgage Product Risks.

On October 4, 2006, the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, and the National Credit Union Administration (the "Agencies") issued an interagency guidance relative to nontraditional mortgage product risks. This interagency guidance applies to all banks and their subsidiaries, bank holding companies and their nonbank subsidiaries, savings associations and their subsidiaries, savings and loan holding companies and their subsidiaries, and credit unions.

Recognizing that the federal interagency guidance does not cover a majority of loan originations in the Commonwealth, the Division, in cooperation with the Conference of State Bank Supervisors ("CSBS"), has developed parallel guidance for licensed mortgage brokers and mortgage lenders in this state. The Division strongly supports the purpose of the guidance adopted by the Agencies and is committed to promote the uniform application of consumer protections for all borrowers.

This Bulletin is intended to promote consistent regulation in the mortgage market and clarify how licensed mortgage brokers and mortgage lenders (referred to as "providers") can offer nontraditional mortgage products in a way that clearly discloses the risks that borrowers may assume.

In order to maintain regulatory consistency, this guidance substantially mirrors the interagency guidance, except for the deletion of sections not applicable to non-depository institutions.

The Division is pleased to accept comments on the Bulletin from interested parties which should be submitted by December 4, 2006 via email to dob.comments@state.ma.us or by mail addressed to Steven L. Antonakes, Commissioner of Banks, One South Station, Boston, MA 02110.

Very truly yours,

Steven L. Antonakes

Commissioner of Banks

DataQuick: California Sales Lowest Since 1997

by Calculated Risk on 11/16/2006 02:58:00 PM

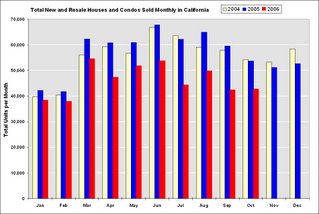

DataQuick reports: California October Home Sales Click on graph for larger image.

Click on graph for larger image.

A total of 42,750 new and resale houses and condos were sold statewide last month. That's up 0.7 percent from 42,450 for September and down 21.7 percent from a 54,600 for October 2005.Although some areas are already seeing YoY nominal price declines (San Diego, Ventura, Contra Costa), the median YoY price in California increased slightly.

Last month's sales made for the slowest October since 1997 when 41,850 homes were sold.

The median price paid for a home last month was $467,000. That was up 0.2 percent from September's $466,000, and up 2.9 percent from $454,000 for October a year ago.

NAHB: Builder Confidence Improves in November

by Calculated Risk on 11/16/2006 02:26:00 PM

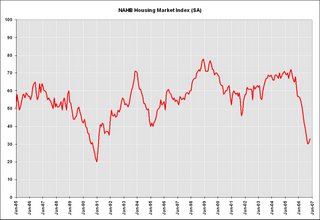

From NAHB: Builder Confidence Improves in November Click on graph for larger image.

Click on graph for larger image.

... home builder confidence in November edged up for the second consecutive month, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI gained two points from the previous month to stand at 33.

...

Derived from a monthly survey that NAHB has been conducting for almost 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes moved higher in November, including a one-point gain in the current sales index, to 33. The component gauging sales expectations for the next six months rose four points to 46 and the component gauging traffic of prospective buyers moved up three points from last month, to 26.

...

On a regional basis, the HMI for builders in the Northeast rose two points to 37 and posted a two-point gain in the South, to 40. The HMI for builders in the Midwest and West declined by two points to 16, and by one point to 34, respectively.

Inflation

by Calculated Risk on 11/16/2006 12:28:00 PM

The following graph shows monthly CPI, Core CPI (CPI less food and energy) and median CPI from the Cleveland Fed. Click on graph for larger image.

Click on graph for larger image.

Monthly CPI is a very noisy series and that is why many people use Core CPI. Personally I prefer the Cleveland Fed's median CPI. For October, the median CPI increased 0.3% or at an annualized rate of 3.65%.

Over the last 12 months, the median CPI has increased 3.6%, and over the last 6 months, median CPI has increased at a 4.0% annualized rate. Although the inflation news is welcome, I don't think the CPI or PPI numbers will change the Fed's view.

For more, see Kash's Inflation Update, October 2006

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |