by Calculated Risk on 11/02/2005 12:37:00 AM

Wednesday, November 02, 2005

USA Today: Overheated housing market is cooling off

The USA Today reports: Overheated housing market is cooling off

...there's nervous chatter about the recent increase in the number of homes for sale, sellers cutting their asking prices and builders wooing buyers with incentives.The USA Today article covers familiar ground and adds these anecdotes:

The reason: There are signs that the overheated market might finally be cooling. The Commerce Department, for example, said sales of new homes in September fell shy of expectations, median prices declined 5.7%, and the number of new homes for sale shot up to a record 493,000. Freddie Mac also said October mortgage applications seem to be "tapering off."

• Ricardo Cortazar, a Realtor in Tempe, Ariz., says it now takes 35 days, on average, to sell a home. Six months ago, it took a week. Inventory in Arizona has swelled to 15,000 homes, vs. 6,000 in May.The housing market does appear to be slowing.

• Vaughn Bryan, a real estate agent in San Bernardino County, has spotted another ominous trend: a rise in the number of 90-day listing contracts that expire without a sale.

• Dan Elsea, a Detroit Realtor, says it's common for sellers in the job-starved Motor City to reduce asking prices two, three or four times before signing a deal.

• Kelly Haslam of Madison, Wis., hasn't been able to sell her bungalow-style home despite putting it up for sale "by owner" seven weeks ago, hosting four open houses and dropping her price once.

• Judi Keenholtz, CEO of Empire Realty, which serves San Francisco's East Bay, says desirable homes in good school districts that used to fetch eight to 10 bids now get three or four.

Tuesday, November 01, 2005

Fiscal 2006: A Record October

by Calculated Risk on 11/01/2005 02:57:00 PM

Fiscal 2006 is off to a poor start as the increase in the National Debt set a record for the month of October. The National Debt increased $94.4 Billion to $8.027 Trillion as of Oct 31, 2005.

Click on graph for larger image.

The previous record for October was in 2003 (fiscal 2004) when spending for the Iraq war lead to an increase in the National Debt of $89.4 Billion. This October was negatively impacted by spending related to hurricanes Katrina and Rita.

Each month I will plot the YTD increase in the National Debt and compare it to the proceeding years. Even without the hurricane spending, I expect fiscal 2006 to set a new record for National Debt accumulation.

Construction Spending Sets Record

by Calculated Risk on 11/01/2005 12:05:00 PM

The AP reports: Construction spending hit all-time high in September

Construction spending set another record in September as the building industry continued to enjoy boom times.New Home inventories are already at record levels, sales appear to be slowing, and residential construction activity is at record levels. Hmmm ...

The Commerce Department said construction activity rose 0.5 percent to an all-time high of $1.12 trillion at a seasonally adjusted annual rate in September...

...

Private construction rose by 0.6 percent to a seasonally adjusted annual rate of $871.5 billion with private residential building up an even stronger 1 percent, to $624.3 billion. Both the overall private construction figure and the residential activity were at all-time highs.

Both office construction and commercial buildings, a category that includes shopping centers, showed big gains in September.

Total government construction was unchanged in September at an annual rate of $248.5 billion after posting a 0.4 percent increase in August. Activity at the state and local level rose by 0.3 percent to a record high of $231.9 billion while federal building projects dipped by 4.5 percent to an annual rate of $16.7 billion.

Monday, October 31, 2005

Data and the Fed

by Calculated Risk on 10/31/2005 08:11:00 PM

Dr. Duy prepares us for another "measured pace" rate hike tomorrow: Fed Watch: Another Meeting, Another 25 Basis Points

"The above title makes the Fed sound just a little too predictable. But the hawkish rhetoric from Fed officials has been quite clear, and last week’s data adds to the case for additional tightening at what we have come to know as the measured pace.But after the next couple of hikes, Dr. Duy expects the FED to become more data dependent:

...

...incoming data suggests the economy remains on cruise control despite the series of speed bumps the Fed keeps laying down. Does this mean the Fed just keeps laying down more bumps? For the rest of this year, the answer appears to be yes. I think the Fed is comfortable chasing the 10 year bond. Indeed, the bond market has recently cleared the way for additional hikes, with the 10 year yield rising above 4.5%."

"While policymakers might see the need for additional rate hikes, they realize a lot is also in the pipeline as well. With a considerable amount of accommodation removed, the Fed, I suspect, will soon start paying more attention to data that comes in on the weak side.Hey, hey, hey ... I think those housing bears are correct! Read Dr. Duy's entire post - it is excellent as always.

So what will the Fed be looking for in that respect? The Fed will be watching for additional evidence of a slowing housing market. Again, the point is not housing itself, but the expected negative impact of a housing slowdown on consumer spending. I doubt the early data and anecdotal evidence is enough to convince them that the housing ATM is closed, but if the housing bears are correct, we could see evidence in that direction pile up over the next couple of months.

Another red flag for the Fed would be sputtering investment spending. Greenspan’s speeches and the minutes suggest that policymakers expected investment spending to hold strong, and they were a little disappointed by what they were seeing..."

And a couple of comments on the "data". Dr. Kash is concerned about personal income growth and the negative savings rate: Slowing Growth?

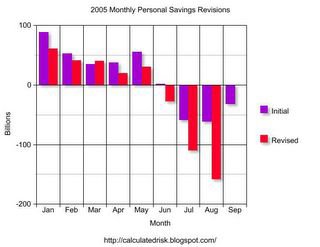

And to add to Kash's concerns, I've noticed that the data on personal savings has been steadily revised downward.

Click on graph for larger image.

Click on graph for larger image.The graph shows the monthly personal savings (Billions $ annual rate) from the BEA's monthly Personal Income and Outlays report.

The purple bar is the initial reported value, the red bar the most recent revision.

With the exception of March (minor upwards revision), all of the revisions have been negative. This might indicate a change in trend. I wonder if this concerns the FED?

Census Bureau Vacancy Report

by Calculated Risk on 10/31/2005 10:15:00 AM

The Census Bureau released the 3rd quarter Housing Vacancies and Homeownership (PDF) report today.

National vacancy rates in the third quarter 2005 were 9.9 percent for rental housing and 1.9 percent for homeowner housing ...The Home Ownership rates was 68.8%.

The housing survey is subject to large errors and readers must be careful evaluating quarter to quarter changes. But the report does show these trends:

1) Vacancy rates might have peaked for rental housing at the historically high rate of around 10%, and

2) The vacancy rate for homeowner housing is at a record level and might still be increasing.

This level of vacancies indicates significant excess housing capacity.

Here is the Census Bureau site for Housing Vacancies and Homeownership with definitions and historical tables.

Housing and More

by Calculated Risk on 10/31/2005 01:40:00 AM

My Angry Bear post is up: GDP and Housing.

Dr. Thoma excerpts Krugman's Ending the Fraudulence. I would like to echo Dr. Thoma's comments on the media.

Journalists need to ... ask themselves how to do a better job of presenting objective analysis on economic matters rather than the opinions of pundits from both sides. That’s a lot harder than grabbing the usual talking heads who say the usual things, it will require digging in and doing research, seeking out and talking to the real experts in the field, and understanding the issues before reporting on them.Of course the media tries to be "fair" and report both sides. When one side is spouting nonsense, reporting both sides equally is absurd. Dr. Krugman once joked that if President Bush said that the Earth was flat, the headlines of news articles would read, "Opinions Differ on Shape of the Earth."

And finally, I have suggested that the UK's current economic problems might be an example of what will happen in the US, after the housing market slows, since the BoE started raising rates sooner than the FED. Australia is another country to watch: Home sales stall on slowdown

SALES of new homes and units plummeted 16 per cent in September with no sight of a recovery in the housing market, figures released today show.Dilbert (Scott Adams) has started blogging: Enjoy!

The sale of new houses fell by 20 per cent while the sale of multi-units rose 9.4 per cent over the month, the Housing Industry Association (HIA) said.

New home sales are less than half their level two years ago before the property market had started to cool with higher interest rates.

Australia's peak building industry body said there was no sight of recovery in housing demand.

Friday, October 28, 2005

UCLA's Dr. Thornberg: California Housing 35% overvalued

by Calculated Risk on 10/28/2005 08:48:00 PM

The Economic Alliance for Business (EDAB) just released their October 2005 East Bay Quarterly Forecast, authored by Christopher Thornberg, Senior Economist for UCLA Anderson Forecast (thanks to Robert Sakai). The report is fairly positive on the economy over the next few quarters, but is cautionary on real estate. Dr. Thornberg writes:

The good news is likely to continue for the next few quarters. Katrina and Rita may have monopolized the newspapers, but they will have little impact positive or negative on the California economy. Gas prices are already on their way back down. Demand is softening as the year moves into the winter season and refining capacity is coming back online. With pockets flush again, expect a solid holiday season for retailers in the area.From the section on Real Estate: Is the party coming to an end?

But there are storm clouds on the horizon that are being generated by yet another low-pressure system building up -- our housing markets. Prices have continued their truly meteoric rise, as has the pace of building. But there are signs the market is starting to lose its oomph. Market activity in the Bay Area has started to slow sharply, and inventories are on the rise.

As has been discussed in this and past reports, the primary driver of the California economy, including the Bay Area and the East Bay, has been the residential real estate boom. ... All this new construction has been creating many of the new jobs in the state including those in finance companies working to extend credit. And while we lack direct evidence, it appears that consumer spending is being fueled largely by the wealth being generated within the economy by the massive rate of appreciation.After a discussion of housing fundamentals, Thornberg states:

... housing prices should have basically gone flat as of Q4 2002, and instead they have grown at an unprecedented pace. While there is some room for debate on this issue, I put the starting date of the downturn in ‘per worker income’ at Q4 2002. On this basis, we can guesstimate that property in California is now overvalued by something close to 35 or 40%.(emphasis added)Thornberg concludes:

The market is still red hot of course. Price appreciation and market activity continue at a record pace. Nevertheless, right now the bubble is clearly starting to lose steam.

...

The best indicator that the party is starting to end will be a decline in overall market activity—slowing of total unit sales and build up of inventories. When inventories rise and sales start to fall this will spill over into price appreciation and construction within three to six quarters, and this is when the overall economy will begin to feel the pinch. Right now the market appears to be at a crossroads. According to the latest numbers available, market inventories in the state have almost doubled over the past six months and overall market activity has been flat albeit at a very high pace.

...

... things are clearly at a tipping point. And remember, while it is unlikely that nominal home prices will fall rapidly, that does not mean a cooling market will do little damage to the economy. A cooling market is characterized by a large drop in new building units, market activity, and refinancing activity, not to mention heightened foreclosure activity. A lot of the new jobs in those areas will suddenly start to disappear. And don’t forget those wealth effects. When consumers realize they can no longer expect that appreciation bonus to subsidize their consumption habits, they will very likely pull back on spending. Keep an eye out.

The LOUD 'No Bubble' Crowd

by Calculated Risk on 10/28/2005 11:56:00 AM

Krugman on Bernanke

by Calculated Risk on 10/28/2005 01:27:00 AM

Dr. Thoma excerpts from Dr. Krugman's most recent column: New Fed Chairman Bernanke and the Bubble

Krugman on Bernanke's recent comments: "...soothing words are expected from a Fed chairman. He must know that he may be wrong."

Excerpt (italics Krugman, other Dr. Thoma):

... my main concern is that the economy may well face a day of reckoning soon after Mr. Bernanke takes office. And ... coping with that day of reckoning without some nasty shocks may be beyond anyone's talents. The fact is that the U.S. economy's growth over the past few years has depended on two unsustainable trends: a huge surge in house prices and a vast inflow of funds from Asia. Sooner or later, both trends will end, possibly abruptly.

But hasn't Bernanke said there is no housing bubble, and that the global savings glut explains the international trade imbalance and the dangers there aren't as large as many believe?

...Well, soothing words are expected from a Fed chairman. He must know that he may be wrong.

If he is wrong, what should he do? Does he have what it takes to handle such events?

If he is, the U.S. economy will find itself in need of the "Rooseveltian resolve" Mr. Bernanke advocated for Japan. We can safely predict that Mr. Bernanke will show that resolve. ...

It's reassuring to hear such praise for Bernanke. It sounds like monetary policy is in good hands.

But that may not be enough. When all is said and done, the Fed controls only one thing: the short-term interest rate. And it will be a long time before we have competent, public-spirited people controlling taxes, spending and other instruments of economic policy."

That's not quite as reassuring.

Thursday, October 27, 2005

MBA: Increased use of 'creative' mortgages

by Calculated Risk on 10/27/2005 04:57:00 PM

IBD reports: Data confirm increased use of 'creative' mortgages

Faced with rising interest rates, more U.S. home buyers sought savings by opting for riskier nontraditional mortgages in the early part of this year compared with late last year, more evidence of a trend that has caught the attention of regulators and the mortgage industry at large, Mortgage Bankers Association data released Tuesday showed.Here is the MBA release: Mortgage Originations Rise in First Half of 2005; Demand for Interest Only, Option ARM and Alt-A Products Increases

...

Mortgage activity overall expanded in the early part of this year: the dollar volume of first-mortgage originations on single-family homes increased 10%, while volume for second mortgages rose 12%, the trade group said as part of its annual conference, held in Orlando, Fla.

...

"With the difference in ARM rates and fixed rates narrowing, consumers have shifted from traditional ARMs to nontraditional products," said Doug Duncan, MBA's chief economist.

...

The increase in nontraditional lending prompted the Federal Reserve earlier this year to urge greater vigilance on the part of mortgage lenders too.

The Fed's attention highlighted the growing risk in this area, although some of that risk is countered by the large amount, more than half, of loans locked in at fixed interest rates.

The most popular of the "creative" financing now being undertaken by some households include interest-only loans and option ARMs, a relatively new product that allows borrowers to choose each month to pay interest only, interest plus some principal, or even less than the interest due, with the remaining portion of the interest payment tacked on to the principal.

A Wells Fargo survey released this week showed most holders of these loans were paying toward principal. But some experts said the real test will come in just over a year, when higher interest rates kick in for these loans. See related story.

Interest-only loans increased to a 23% share in the first part of this year from a 17% share late last year, the MBA poll showed.

Option ARM originations rose to 7% of the dollar value of originations and 4% of the loan count during the first half of 2005.

"These percentages are likely understated as many survey respondents did not report their option ARM volume," the group said.

Originations of loans to consumers with riskier credit ratings also increased, the survey found. The share of originations that were so-called Alt-A loans, or those that fall somewhere on the risk spectrum between prime and subprime, increased to 11% from 8%.

The survey also found that the majority of loans, 88% in the first half, were for owner-occupied homes. But a rising share was taken up by loans for non-owner-occupied properties, at a "significant" 12%, MBA said.

Some market observers have said that mortgage risk overall has risen in step with an increase of mortgages on investment property. Traditionally, homeowners are viewed as more likely to keep up with payments on their own residence, less so on the roof not over their head.

*More than 9 of 10 interest only loans originated during the first half of 2005 are adjustable rate products, the remaining loans were fixed rate products.

*Among all survey respondents, option ARM originations were 7 percent of dollar originations and 4 percent of the loan count during the first half of 2005. These percentages are likely understated as many survey respondents did not report their option ARM volume. Among survey respondents that did report option ARM data, option ARM loans comprised 16 percent of their dollar originations and 10 percent of their loan count.

*The vast majority of loans (88 percent) in the first half were for owner occupied homes, but the percentage of loans for non-owner occupied properties was significant (12 percent). This finding is consistent with the 2004 Home Mortgage Disclosure Act data which revealed that more than 11 percent of 2004 originations were for non-owner occupied properties.

*While nearly half (48 percent) of all loans originated were agency eligible, they represented only 38 percent of the origination dollar volume. Agency eligible loans are mortgage loans which conform to the size and credit quality guidelines and would be available for sale to Fannie Mae and Freddie Mac under any of their loan programs.

*From the second half of 2004 to the first half of 2005, reverse mortgage originations increased 28 percent, with FHA’s Home Equity Conversion Mortgages (HECMs) increasing by 31 percent and other reverse mortgages up 8 percent.

*Compared with the last half of 2004, the first half of 2005 origination volume of all second mortgages increased 12 percent, closed-end seconds increased 37 percent and open-end seconds or home equity lines of credit (HELOCs) increased 20 percent (based on companies submitting data for both time periods).

*In the first half of 2005, 82 percent of second mortgage originations were HELOC loans compared with 18 percent for closed-end loans. HELOC origination volume refers to the size of the line, not the drawn amount.