by Calculated Risk on 10/08/2005 05:33:00 PM

Saturday, October 08, 2005

Reduced! Anxious! Submit!

Click on photo for larger image.

From a brochure I picked up this afternoon:

Reduced! Anxious! Submit!

The brochure was from the "Calahan" listing shown here.

There are five For Sale signs in a row at this local condominium complex: two are turned the other way - the first one (dark purple) and the fourth one (white). The third sign reads "Sold".

Compare the above photo to this one taken on August 21st: Signs of the Times

The "Calahan" listing is now anxious. The "Trider" listing is now Sold. Two more units are now for sale.

Everywhere I looked, there are more listings now than in August.

Friday, October 07, 2005

Reuters: San Diego economy flat as housing market cools

by Calculated Risk on 10/07/2005 12:24:00 PM

Reuters reports: San Diego economy flat as housing market cools

An index that tracks economic activity in San Diego, California slipped in August from July, weighed down in part by fewer permits issued for building new homes, according to a report issued on Thursday.The San Diego economy might be showing the early effects of a slowing housing market. If San Diego follows the UK experience, the next step will be less equity extraction and lower retail sales, followed by lost jobs in the construction and retail fields.

San Diego County's housing market is one of the most closely watched in California because home prices, sales and building activity there had increased in advance of a statewide housing boom.

Many analysts believe California's broad housing market mirrors the San Diego market and expect the state's torrid market is poised to cool, with home prices that have more than doubled since late 2001 flattening and home building and sales slowing as they have in San Diego in recent months.

San Diego's homes market is "correcting," said Alan Gin, the University of San Diego professor who wrote the index report.

"It's going to take longer to sell houses and the number of sales overall will slow," said Gin, noting the university' economic index for San Diego County fell 0.1 percent in August from July, reversing an 0.1 percent rise in July from June.

The index has been essentially flat in recent months, pointing to "continued modest growth through the end of the year and into the first half of 2006" for the local economy, according to Gin.

September Jobs Report

by Calculated Risk on 10/07/2005 10:06:00 AM

The jobs report can be summarized: Construction hot, manufacturing not, Katrina impact unclear. As is usual, construction added jobs while the downward trend in manufacturing continued. In fact, manufacturing jobs (14.234 million) are at the lowest level since 1950.

UPDATE: Please see Dr. Altig's comments too. He points out that I was "incomplete" and writes that "outside of retail sales" and manufacturing "advances in employment were broad-based." See his graphs.

From the BLS:

Nonfarm payroll employment was little changed (-35,000) in September, and the unemployment rate rose to 5.1 percent ... The measures of employment and unemployment reported in this news release reflect both the impact of Hurricane Katrina, which struck the Gulf Coast in late August, and ongoing labor market trends.Did this report, with "negligible" impact from Katrina, accurately measure the employment impact of Katrina? The BLS is not sure:

For the September CES estimates, several modifications to the usual estimation procedures were adopted to better reflect employment in Katrina-affected areas. The changes included: a) modification of procedures to impute employment counts for survey nonrespondents in the most heavily impacted areas b) adjustments to sample weights for sample units in the more broadly defined disaster area to compensate for lower-than-average survey response rates, and c) modification of the adjustment procedure for the business net birth/death estimator to reflect likely changes in business birth/death patterns in the disaster areas.It will probably takes several months to accurate assess the impact of Katrina on jobs. Meanwhile, the relatively strong report (-150K jobs was the expectation) has led to a sell off in bonds with the 10 year yield above 4.4% (but bonds are rallying as I type).

Hurricane Rita made landfall during the September data collection period. As a result, response rates for both surveys were lower than normal in some areas. However, because the reference periods for both surveys occurred before Hurricane Rita struck, the impact of this storm on measures of employment and unemployment was negligible.

On overall employment: Bush's first term, with a net loss of 759K private sector jobs (a gain of 119K total jobs), was a disappointment. For Bush's 2nd term, anything less than 6.8 Million net jobs will have to be considered poor. And anything above 10 million net jobs as excellent. Of course, in additional to the number of jobs, the quality of the jobs and real wage increases are also important measures.

Click on graph for larger image.

For the quantity of jobs, this graph provides a measurement tool for job growth during Bush's 2nd term.

The blue line is for 10 million jobs created during Bush's 2nd term; the purple line for 6.8 million jobs. The insert shows net job creation for the first 8 months of the 2nd term - currently midway between the two lines.

Thursday, October 06, 2005

California Realtors: Affordability At Record Low

by Calculated Risk on 10/06/2005 08:24:00 PM

The California Association of Realtors reports: Housing Affordability Index fell four points to 14 percent in August; lowest on record since 1989

The percentage of households in California able to afford a median-priced home stood at 14 percent in August, a 4 percentage-point decrease compared with the same period a year ago when the Index was at 18 percent, according to a report released today by the California Association of REALTORS® (C.A.R.). The August Housing Affordability Index (HAI) declined 2 percentage points compared with July, when it stood at 16 percent.

C.A.R.’s monthly housing affordability index measures the percentage of households that can afford to purchase a median-priced home in California. C.A.R. also reports housing affordability indexes for regions and select counties within the state. The Index is the most fundamental measure of housing well-being in the state.

The minimum household income needed to purchase a median-priced home at $568,890 in California in August was $133,800, based on an average effective mortgage interest rate of 5.87 percent and assuming a 20 percent downpayment. The minimum household income needed to purchase a median-priced home was up from $110,980 in August 2004, when the median price of a home was $473,520 and the prevailing interest rate was 5.83 percent.

The minimum household income needed to purchase a median-priced home at $220,000 in the U.S. in August 2005 was $51,740.

Realtor Economist: 'Bubble Talk Overblown'

by Calculated Risk on 10/06/2005 12:33:00 PM

The Contra Costa Times reports:

The long-booming housing market is moderating, but fears of a bubble are overblown, according to the chief economist for the California Association of Realtors.Prices will increase a modest 6% to 12%? I think most homebuyers would be very happy with that "modest" return. The article also mentions the UCLA Anderson Forecast and Dr. Thronberg:

In a presentation in San Ramon before the Contra Costa Association of Realtors on Wednesday, Leslie Appleton-Young predicted that 2005 will represent the peak of the housing market, with state home sales likely to fall 2 percent next year.

Median home prices, however, will continue to rise, if at a slower pace. The CAR expects prices to increase 10 percent in California in 2006, compared with the estimated 16 percent increase this year. In the Bay Area, housing prices are likely to climb a more modest 6 percent to 12 percent.

"The forecast for California is mediocre at best, and at worst we are liable to slip into a recession," wrote study author Chris Thornberg. He said California homes are overvalued by as much as 40 percent to 45 percent.

Wednesday, October 05, 2005

US energy chief: High fuel prices to persist

by Calculated Risk on 10/05/2005 06:50:00 PM

The Financial Times reports: High fuel prices to persist says US energy chief:

Higher energy costs triggered by Hurricanes Katrina and Rita could persist for several years, leaving reduced consumption as the only short-term relief, Samuel Bodman, the US energy secretary, warned on Wednesday.The problem is twofold: In the short run there is a lack of refining capacity because 12 refineries are still shut down in the Gulf Coast area, and in the intermediate run, there is significant damage to oil producing facilities in the Gulf of Mexico. From the Energy Information Administration on refineries:

"Both oil and natural gas availability has been severely impaired and the effects of this will reverberate through the economy of this country for some time," he told a breakfast meeting of reporters. "The main thing that US citizens can do is conserve. We simply have to do it." He predicted conservation efforts would make "a major dent" in demand.

"...there are 4 refineries still shut down in the New Orleans area following Hurricane Katrina, 7 shut down in the Port Arthur and Lake Charles areas, and 1 shut down or attempting to restart in the Houston/Texas City/Galveston refining area, amounting to a total of over 3.0 million barrels per day of refining capacity that is currently offline. This accounts for over 1.3 million barrels per day of gasoline, over 700,000 barrels per day of distillate fuel, and nearly 400,000 barrels per day of jet fuel that is not being produced as long as these refineries remain shutdown."

Click on graph for larger image.

In the short run, the supply of gasoline and other refined products is critically important. The graph from the DOE shows that gasoline stocks are near the bottom of the normal range and falling. This despite record imports of refined products, as reported in the Financial Times:

US petrol imports last week hit a record 1.4m barrels a day, the Energy Information Administration said on Wednesday.Once again the financial media is confused on the oil and gasoline supply and demand dynamics. The AP is reporting:

"The price of oil fell to its lowest level in two months on Wednesday as evidence builds that the high cost of gasoline and other fuels is sapping demand."The AP report is incorrect. The price of oil is falling because the demand for oil is falling. The demand for oil is falling because the 12 refineries are shut down.

This graph compares the 2004 and 2005 demand for gasoline for each week from the beginning of June. For 2005, the demand for gasoline was strong even with the much higher price, until hurricane Katrina struck the Gulf Coast. When prices spiked to over $3 per gallon, demand fell sharply. But demand is now just below the same period in 2004. Note: weekly demand can vary considerably.

This graph compares the 2004 and 2005 demand for gasoline for each week from the beginning of June. For 2005, the demand for gasoline was strong even with the much higher price, until hurricane Katrina struck the Gulf Coast. When prices spiked to over $3 per gallon, demand fell sharply. But demand is now just below the same period in 2004. Note: weekly demand can vary considerably.So in the short run, there will continue to be upward pressure on the prices of refined products. In the intermediate term, when the refineries are restored to full operation, there will be pressure on oil prices - if the economy stays reasonably healthy.

Therefore it is not unexpected to see oil prices fall - and they may fall some more. However there is a danger of much higher gasoline prices (and heating oil prices) if demand stays strong.

In the long run, the policy of encouraging oil consumption and relying on ever more oil production is probably doomed. The Financial Times touches on that topic:

"The US has not measurably increased fuel efficiency standards for vehicles in a generation and so we now lag behind China in these standards," said Paul Bledsoe of the National Commission on Energy Policy, a bipartisan body comprising industry executives and former policymakers.RESOURCES:

Here is the current Hurricane Katrina/Hurricane Rita Evacuation and Production Shut-in Statistics Report from the Minerals Management Service.

And here is the Energy Information Administration's daily report.

And the Department of Energy's This Week in Petroleum.

MBA: Mortgage Rates Increase

by Calculated Risk on 10/05/2005 11:00:00 AM

The Mortgage Bankers Association reports a slight decline in mortgage applications:

The Market Composite Index — a measure of mortgage loan application volume – was 713.5, a decrease of 1.1 percent on a seasonally adjusted basis from 721.2 one week earlier. On an unadjusted basis, the Index decreased 1.2 percent compared with the previous week and was down 1.8 percent compared with the same week one year earlier.The interest rate for 30-year fixed-rate mortgages increased to 5.94% and the interest rate for a 1 year ARM to 5.13 percent from 5.02 percent one week earlier. This is the 2nd week since early '02 that the 1 year ARM has been above 5%. (See graph on Angry Bear)

Refinance activity remains strong:

The refinance share of mortgage activity increased to 44.5 percent of total applications from 43.9 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 29.8 percent of total applications from 28.8 percent the previous week.With rising rates, I'm surprised at the level of refinance activity.

Tuesday, October 04, 2005

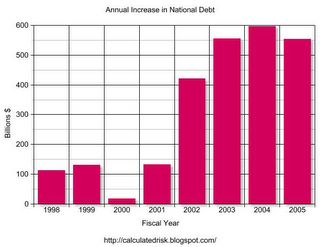

Fiscal 2005: National Debt Increases $553.7 Billion

by Calculated Risk on 10/04/2005 03:16:00 PM

The US Treasury Department reports that the US National Debt increased $553.7 Billion in fiscal 2005 (ends Sept 30, 2005).

The total National Debt is now $7,932,709,661,723.50.

Click on graph for larger image.

The increase in the National Debt was slightly less than the record set in fiscal 2004 of $595.8 Billion in additional debt.

The initial estimates for fiscal 2006 are for a new record of approximately $650 Billion in new debt. On the positive side, tax revenues from the housing boom will help in fiscal '06. On the negative side are the additional expenditures for hurricane recovery.

In addition, if the economy weakens significantly, as the housing market slows, the increase in the debt could be substantially higher.

Mercury News: Unreal Estate Series

by Calculated Risk on 10/04/2005 11:54:00 AM

The Mercury News has an excellent series of articles called "Unreal Estate". Today's article is Part III: Loan landslide on shaky soil

The previous articles in the series:

Part I: Housing boom showing its age

Part II: How the boom has hit home

Also see the companion articles in the side bar.

Excerpt from Part III:

Almost overnight, a transformed mortgage industry has rewritten the rules for home-buying. Relying on improved credit scoring, better risk-analysis tools and abundant cheap capital from around the globe, lenders have flooded the market in the past two years with exotic loans that allow consumers to take on more debt and more risk. People who once would have been denied mortgages now get the chance to join the auction and bid up home prices.And for a description of some of the risky mortgage products available today, see Schwanhausser's companion article: The lowdown on loans

Such loans are particularly popular in Silicon Valley, helping to push prices at a double-digit pace that many experts worry is unsustainable.

Interest-only loans, for example, accounted for more than half the purchase loans in the Bay Area in the first quarter of the year. That's nearly five times higher than in 2002, says LoanPerformance, a San Francisco firm that analyzes mortgage trends. And piggy-back loans -- which package two loans for borrowers putting less than 20 percent down -- accounted for about 60 percent of the loan volume in the Bay Area in the first half of 2005, according to SMR Research, a financial-services market research firm in Hackettstown, N.J.

But while exotic loans have swelled the ranks of potential buyers, slowing homes sales this summer are fueling worries about the economic aftershocks if the real estate market cools or slumps.

• Adjustable-rate loans with tantalizing "teaser" rates: Some ARMs dangle introductory interest rates as low as 1 percent. But beware: Some ARMs begin to adjust within as little as a month and can ratchet higher rapidly. That can lead to "payment shock."Also the NY Times continues their reporting on the housing market: Slowing Is Seen in Housing Prices in Hot Markets and Home Builders' Stock Sales: Diversifying or Bailing Out?

• Hybrid ARMs: They start out like fixed-rate loans, charging the same flat monthly payment of principal and interest. After three to seven years, typically, they turn into adjustable-rate loans. The payment shock can be substantial if interest rates rise.

• Interest-only loans: Borrowers may pay only the interest portion of the monthly payment, typically for three to five years but sometimes up to 10 years. After that, the monthly payments can vault higher to pay off the principal over the remainder of the loan.

• Option ARMs: Every month borrowers get to choose from a handful of payment options. When times are flush, they can pay what they would owe under a standard 15- or 30-year fixed-rate mortgage. Or they can just pay the interest. But if cash is tight, they can make a minimum payment that is less than the interest charge.

The last option can result in "negative amortization" that leaves homeowners owing more than they borrowed in the first place. Also, monthly payments can jump after a number of years or if the negative amortization exceeds the "cap" allowed by the loan.

• "Piggyback" loans: This is an increasingly popular tactic that involves packaging two loans to avoid the hefty monthly bills for private mortgage insurance, or PMI, that is required when borrowers make a down payment of less than 20 percent. For example, lenders often package one mortgage for 80 percent of the home's value with a home-equity loan or line of credit for the remaining 20 percent.

Monday, October 03, 2005

The 2006 Economy: Soft or Hard Landing?

by Calculated Risk on 10/03/2005 04:39:00 PM

"...make no mistake about it, the froth in the U.S. housing market is about to lose its effervescence; the bubble is about to become less bubbly. If real housing prices decline in the U.S. in 2006 or 2007, a recession is nearly inevitable." Bill Gross, PIMCO, October 2005Here are two interesting perspectives on the economy going forward. The first is from Dr. Duy who ventures inside Greenspan's head: How Does the Fed See the Economy Evolving? And the second is from PIMCO's Bill Gross: Deliberate Acts Of Kindness.

Dr. Duy writes:

"... the Fed has shown concern that economic slack has evaporated, and, with rising energy prices in the background, inflationary pressures are building. To stem these pressures, they have tightened policy to reduce growth. They are not targeting the housing market directly, but recognize that since housing has been a driving force in the expansion, it will likely be the recipient of the brunt of their policy efforts.Of course this will lead to a slowdown in consumption, but Dr. Duy believes the Fed is looking for investment to fill the gap. The Fed's soft landing:

A cooling of the housing market, however, is not undesirable, and a major decline in values is unlikely. ... And, under the Greenspan scenario, a housing slowdown is necessary to trigger a needed rebalancing of economic activity. Moreover, with excess slack drying up, some sector needs to pull back, especially with any sense of fiscal discipline long gone."

"The upshot it that the economy evolves in such a way that consumption slows, savings rises, and, as long as investment spending continues to grow, we avoid a recession."Bill Gross is not quite as optimistic and summarizes his "sequence for house bubble popping or froth skimming" as:

1) Housing prices will cool/stop going up very much/even go down in some cities, WHEN...Mr Gross sees a recession as likely:

a. Interest rates rise to a high enough level to make the purchase of a new home a burden instead of a boon for first time buyers.

b. Mild regulatory pressure begins to reduce the amount of funny-money lending.

c. Speculators sniff the beginning of the end.

2) Home equitization should retreat shortly thereafter.

3) Consumption/the U.S. economy will then weaken when the house ATM starts running out of fresh new $25,000/$50,000/$100,000 home equity loan dollar bills.

4) The Fed will cut interest rates in order to start the game all over again.

Let me state categorically that the above sequence is barely questionable, almost inevitable, 99% unavoidable, and in modern parlance - "slam-dunk." In so saying, I hope I am not being unkind to those of you who think otherwise - IÂ’m trying to do you a favor!

How weak the U.S. economy gets will depend on numerous factors: oil/natural gas prices, China's continuing growth miracle, and of course the level of U.S. interest rates - themselves a function of the Fed and foreign willingness to buy our Treasury and corporate bonds. But make no mistake about it, the froth in the U.S. housing market is about to lose its effervescence; the bubble is about to become less bubbly. If real housing prices decline in the U.S. in 2006 or 2007, a recession is nearly inevitable. If higher yields simply slow the pace of appreciation to a more rational single digit number, then we could escape with a 1-2% GDP economy.The consistent theme is a slowing housing market and the questions are: What will the housing slowdown look like? And how large an impact will that have on US economic growth?

If the housing slowdown is gradual, and investment can replace the lost consumption associated with equity extraction, GDP growth will slow but the economy will stay healthy. Savings will rise, the current account deficit will fall and Americans will all hold hands and sing Kumbaya. Very unlikely in my view for several reasons:

1) The excessive leverage and speculation in the housing market means achieving a soft landing is very difficult. Many recent buyers will be hurt if house prices just flatten, making the FED's job very difficult.

2) The transition from a housing centric economy to a more balanced economy will involve significant dislocations. Many jobs in the housing related industries have non-transferable skills, require low levels of education, and are relatively well paying. These jobs will be difficult to replace.

3) The lowering of US consumption will have a worldwide ripple effect and especially impact China and other countries currently running trade surpluses with the US. These countries will probably sell US assets for domestic purposes (to minimize economic weakness) leading to higher rates in the US - exacerbating the US housing slowdown.

I'm sure I've left off several other problems (I need to read Dr. Setser and Dr. Kash Mansori). As much as I would like to see a soft landing, I think a hard landing is very likely.

NOTE: Please read Dr. Duy's piece - it is excellent. Also, Gross' piece starts with a nice tribute to his wife and the wonders of kindness in our everyday life.

Best to all.