by Calculated Risk on 8/12/2005 02:32:00 PM

Friday, August 12, 2005

WSJ: Rise in Supply Suggests Housing Market Cooling

The WSJ reports:

Rise in Supply of Homes for SaleExcerpt:

Suggests Market Could Be Cooling

By JAMES R. HAGERTY and KEMBA DUNHAM

Staff Reporters of THE WALL STREET JOURNAL

August 12, 2005; Page A1

"The number of homes available for sale has increased sharply in some of the nation's hottest real-estate markets -- one of several recent signs suggesting that air may be seeping out of the frenzied U.S. housing market.

Home prices have surged an average of about 50% in the U.S. in the last five years, largely thanks to the lowest mortgage interest rates in more than four decades and what has been a shortage of available homes in many markets. But some economists and housing-industry analysts believe supply is catching up with demand -- a trend that could cause home-price appreciation to slow down in the months ahead.

In San Diego County, for instance, where the median home price has more than doubled in the last five years, the number of homes listed for sale totaled 12,149 on July 8, more than twice the 5,995 available a year earlier, according to the San Diego Association of Realtors.

In northern Virginia, an area dominated by the fast-growing suburbs of Washington, inventories are up 26% from a year earlier. "Sales have slowed down for sure," says Tip Powers, president of Realty Direct Inc., Sterling, Va. He says home prices have flattened out and speculators are starting to shy away from the market because they no longer can count on quickly unloading properties at a profit.

A similar rise is being seen in Massachusetts, where home inventories are up 31%, according to officials of real-estate organizations there. Real-estate brokers say inventories also are up in such markets as Chicago, Las Vegas and Orlando."

.

.

.

Several factors point to a possible cooling of the market. Mortgage interest rates have been edging higher in recent weeks, raising the cost of purchasing a new home and knocking some potential buyers out of the market. The average rate for a 30-year fixed mortgage is 5.89%, said Freddie Mac, a mortgage-finance company, this week. That's up from 5.53% in late June.

In some markets, such as California and Florida, prices have surged past the ability of many people to afford a home. Additionally, banking regulators have begun to raise questions about whether mortgage lenders are being prudent enough -- which eventually could prompt some lenders to tighten credit standards.

Virginia Housing: "It’s Changing"

by Calculated Risk on 8/12/2005 11:39:00 AM

UPDATE: More inventory data - GREATER NORTHERN VIRGINIA AREA

| Active Listings | 2005 | 2004 | Pct.Chg |

| Single Family Homes | 8,800 | 6,588 | 33.6% |

| Condos & Coops | 1,544 | 1,010 | 52.9% |

| TOTAL | 10,344 | 7,598 | 36.1% |

Leesburg Today reports the Virginia housing market is "changing". The story has many positive comments, but:

... there are definite signs of a slowdown and that the market is undergoing a correction ... reported an across-the-board slowing, a build up of inventories and a shift in power from the seller-dominated market of the past few years back to the buyer.The housing market is still strong, but the story is rising inventories:

Fischer noted that inventories have quadrupled in the resale market over the past two-and-a-half months. Although that trend has not extended yet to new home sales, Fischer predicted "it’s reasonable to expect that as those inventories build, that will have an impact on the new home frenzy."

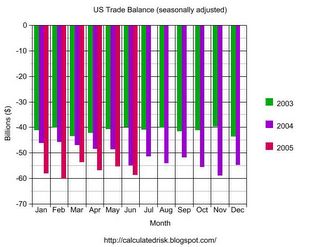

U.S. Trade Deficit: $58.8 Billion for June

by Calculated Risk on 8/12/2005 08:47:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for June:

"... total June exports of $106.8 billion and imports of $165.6 billion resulted in a goods and services deficit of $58.8 billion, $3.4 billionNote: all numbers are seasonally adjusted.

more than the $55.4 billion in May, revised.

June exports were virtually unchanged from May, and June imports were $3.4 billion more than May imports of $162.2 billion."

Click on graph for larger image.

June 2005 was only 7% worse than June 2004. For the first six months of 2005, the trade deficits is up 18% over the same period in 2004.

Imports from China were a record $20.988 Billion. And Imports from Japan rebounded to $11.989 Billion.

The average contract price for oil of $44.40 was just below the record of $44.76 in April.

Based on initial data, the trade deficit for July will be close to the seasonally adjusted record of $60.1 Billion set in February.

Krugman: Safe as Houses

by Calculated Risk on 8/12/2005 12:59:00 AM

Dr. Krugman writes in the NYTimes: Safe as Houses about the housing centric US economy:

Since December 2000 employment in U.S. manufacturing has fallen 17 percent, but membership in the National Association of Realtors has risen 58 percent.And Krugman is concerned about the impact on the economy when housing slows:

The housing boom has created jobs in two ways. Many jobs have been created, directly and indirectly, by a surge in housing construction. And rising home values have fueled a simultaneous surge in consumer spending.

Let's start with home building. Between 1980 and 2000, which was before the housing boom, spending on the construction of new homes averaged 4.25 percent of G.D.P. In the most recent quarter, however, the figure was 5.98 percent. That difference is equivalent to about $200 billion a year in additional spending, generating roughly two million extra jobs.

... the economy is expanding. But because that expansion depends so much on real estate - without the housing boom, the economic picture would look dismal indeed - you have to wonder how much to trust it.Krugman concludes:

I've written before about the reasons to believe that current house prices in much of the country represent a bubble. When that bubble begins to deflate, so will housing-related employment.

How solid, then, is America's economic recovery? The British have a phrase that applies: "safe as houses." Our economy is as safe as houses. Unfortunately, given current prices and our dependence on foreign lenders, houses aren't safe at all.

Thursday, August 11, 2005

California's Housing Affordability Index

by Calculated Risk on 8/11/2005 08:33:00 PM

The California Association of Realtors reports: California's Housing Affordability Index fell two points to 16 percent in June

The percentage of households in California able to afford a median-priced home stood at 16 percent in June, a 2 percentage-point decrease compared with the same period a year ago when the Index was at 18 percent, according to a report released today by the California Association of REALTORS® (C.A.R.). The June Housing Affordability Index (HAI) was unchanged from May, when it also stood at 16 percent.See article for table of affordability and prices by region.

...

The minimum household income needed to purchase a median-priced home at $542,720 in California in June was $125,870, based on an average effective mortgage interest rate of 5.71 percent and assuming a 20 percent downpayment. The minimum household income needed to purchase a median-priced home was up from $111,420 in June 2004, when the median price of a home was $468,050 and the prevailing interest rate was 6.01 percent.

FED: Monetary Policy and Asset Price Bubbles

by Calculated Risk on 8/11/2005 11:14:00 AM

The Federal Reserve's Glenn D. Rudebusch, Senior Vice President and Associate Director of Research has released an economic letter: Monetary Policy and Asset Price Bubbles.

In theory at least, an asset price can be separated into a component determined by underlying economic fundamentals and a nonfundamental bubble component that may reflect price speculation or irrational investor euphoria or depression. The expansion of an asset price bubble may lead to a debilitating misallocation of economic resources, and its collapse may cause severe strains on the financial system and destabilize the economy.

Despite these potential problems, the appropriate monetary policy response to an asset price bubble remains unclear and is one of the most contentious issues currently facing central banks. Some have argued that monetary policy should be used to contain or reduce an asset price bubble in order to alleviate its adverse consequences on the economy, while others have argued that such a policy would be both impractical and unproductive given real-world uncertainties about the nature or even existence of bubbles. This Economic Letter examines how policymakers might choose between alternative courses of action when confronted with a possible asset price bubble.

Click on Chart for larger image.

A decision tree for choosing between the Standard and Bubble Policies is shown ... In brief, it poses three questions: (1) Can policymakers identify a bubble? (2) Will fallout from a bubble be significant and hard to rectify after the fact? and (3) Is monetary policy the best tool to deflate the bubble?The problem is each of these hurdles is difficult to negotiate. Rudebusch concludes:

The first hurdle—Can policymakers identify a bubble?—considers whether the particular asset price appears aligned with fundamentals. Some have argued that either bubbles don't exist because asset prices reflect the collective information and wisdom of traders in organized markets or, even if they do exist, they cannot be identified because the requisite estimates of the underlying fundamentals are so imprecise. If policymakers cannot discern a bubble, then the Standard Policy is the only feasible response.

But suppose an asset price bubble is identified. Then the second hurdle is whether bubble fluctuations have significant macroeconomic fallout that monetary policy cannot readily offset after the fact ...

...

The final hurdle before invoking a Bubble Policy involves assessing whether monetary policy is the best way to deflate the asset price bubble. Ideally, for the Bubble Policy, a moderate adjustment of interest rates could constrain the bubble and greatly reduce the risk of severe future macroeconomic dislocations. However, bubbles, even if identified, may not be influenced in a predictable fashion by monetary policy actions. Furthermore, even if changing interest rates could alter the bubble path, such a strategy may involve substantial costs, including near-term deviations from the central bank's macroeconomic goals as well as potential political and moral hazard complications. Finally, even if monetary policy can affect the bubble, alternative strategies to deflate it, such as changes in financial regulation or supervision, may be more targeted and have a lower cost.

The decision tree for choosing a Bubble Policy poses a daunting triple jump. For example, consider the run-up in the stock market in 1999 and 2000, when there was widespread suspicion that an equity price bubble existed and people worried that it could result in capital misallocation and financial instability. Still, those worries did not spur a Bubble Policy, in large part because it appeared unlikely that monetary policy could have deflated the equity price bubble without substantial costs to the economy. After the fact, of course, the macroeconomic consequences from the apparent boom and bust in equity prices arguably have been manageable.My view is regulatory substitutes are the answer, not monetary policy. For the housing bubble, more stringent lending requirements and oversight probably would have prevented much of the speculation.

However, the decision tree does not provide a blanket prohibition on bubble reduction, and as yet, there is no bottom line on the appropriate policy response to asset price bubbles. Those who oppose a Bubble Policy stress the steep informational prerequisites for success, while those who favor it note that policymakers often must act on the basis of incomplete knowledge.

Wednesday, August 10, 2005

Mortgage Lenders: Good and Bad

by Calculated Risk on 8/10/2005 10:33:00 PM

Here are two stories on mortgage lenders. The first story, from the WSJ, explores the financials of Downey Financial.

As of June 30, $12 billion, or 87 percent of Downey's ARMs are option ARMs. Its customers have racked up $72 million in additional balances on those mortgages by choosing to make minimum monthly payments. That's called negative amortization.This is the "good" story. It doesn't appear that the risk from option ARMs puts Downey at risk, but it does show the speculation using leverage in the California housing market. As the story points out:

Right now, Downey's negative amortization is a mere 0.6 percent of its ARM portfolio. But that measure understates its significance. Its negative amortization balance is accelerating, from $51 million in the first quarter and $37 million in the fourth quarter of 2004.

These noncash earnings were 20 percent of Downey's earnings per share in the second quarter. If that trend continues, more than 40 percent of Downey's current-quarter earnings would be noncash. Analysts already expect earnings to decline to $1.79 a share in this quarter, so it would be a bigger slice of a smaller pie.

In other words, the bank's earnings are being increasingly driven by sales of a product to inherently risky customers. Downey Finance Chief Tom Prince says concerns about option ARMs are exaggerated and that his bank previously has had even more exposure to them without problems. "I'm not particularly concerned about it," he says.

At Downey, disclosure is good; it's the exposure that's bad.The second story, Wolves in Small Print, details the predatory practices of some apparently unsavory lenders.

Garcia went with the bigger loan, one he thought was going to be for about $70,000 with about the same interest rate. But when closing day arrived, the figures had changed, he said.This story gets even more bizarre. Apparently Garcia only received $2800 from the proceeds of the new $100K loan, even though his previous loan balance was just over $60K.

"The final figures came out to around $100,000 with all the fees and closing costs, and when I read the papers a few days later, I said ‘Goll-ee,’ " Garcia said this week. "The new loan payments were about $900 a month. With my original loan I was paying insurance and taxes in the loan, but with the new loan I found out that that stuff wasn’t included. They told me it was a fixed interest rate, but I found out later it was variable. So every few years my interest rate was going to go higher. I found out I was going to be pricing myself out of my own home."

Garcia never got the $7,200 in the new loan to fix his foundation; according to the court documents, he got only $2,800. He thought he was getting a fixed interest rate of 8.7 percent, but the fine print said it was a variable loan that’s now up to 12.4 percent. What is even more amazing is the bottom-line amount that Ameriquest loaned, compared to the value on his house and his equity in it. Texas law limits home equity loans to 80 percent of the appraised value of a home. For him to get a loan of $100,000, Garcia’s house would have to be worth around $140,000 — more than double what Garcia paid for the house just eight years earlier.The second story sounds like fraud and I doubt it is widespread, although the story has some alarming numbers and other anecdotes. And it does show the naivete of some borrowers. There is also an interesting section on the "charities" that donate money to FHA buyers (really the money comes from the seller with a higher selling prices). I've written about these DAPs earlier with a chart on their growth. It appears to be getting worse:

...the increased use of "down payment assistance" programs that give mostly first-time buyers a "charitable" gift of the down payment money needed to close the loan under Federal Housing Administration loan rules.The DAP story is worrisome. And the first story on options ARMs is concerning since that appears to be a systemic problem.

Here is how it worked on a recent loan deal, coincidentally, just down the street from Felipe Garcia’s house in Edgecliff Village. According to documents sent to the buyer and obtained by the Weekly, the asking price on the home was $85,000. But the proposed buyer had bad credit, and the lender wanted a hefty down payment. So the Genesis Foundation, based in Indiana, was brought in to "give" the buyer the $7,200 down payment in return for a $595 fee that was rolled into the loan. In return, the company selling the house gave Genesis a tax-deductible "gift" of equal value and paid Genesis a $750 transaction fee.

It’s illegal for a home seller to give down payment money to a buyer, under federal lending rules. But in this case, the down payment technically came from a charity. In reality, it was just a way to move the money from one pocket to another. The new purchase price for the house was $93,000. So, in the end, the FHA (which requires at least a 3 percent down payment) was backing a higher loan with no real down payment. And instead of an $85,000 loan, the buyer now had a $93,000 loan.

June Trade Deficit Prediction

by Calculated Risk on 8/10/2005 11:10:00 AM

According to Briefing.com the market expects the trade deficit in June to be $57.2 Billion. The deficit for May was $55.3 Billion. My guess for June is $57.7 Billion.

PROJECTIONS:

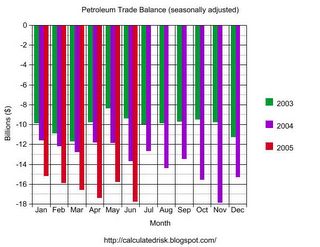

I. Petroleum Prediction. I made an earlier prediction but I'm not happy with the BLS estimates. I'm going to lower the projection slightly to reflect the DOE estimates.

Forecast: Total NSA ERRP Imports: $19.46 Billion

Total SA ERPP FORECAST:

Imports SA: $19.3 Billion (seasonal factor estimated at 0.9925 for June)

Exports SA: $2.3 Billion

Balance ERPP: $17.0 Billion

Including petroleum exports and adjusting for seasonal effects, the SA oil balance for June is projected at $17.0 Billion. This compares to $15.8 Billion for May - an increase of $1.2 Billion.

II: For China, I project (see bottom) a NSA deficit of $16.3 Billion for June compared to $15.75 Billion in May. SA this is $16.3 Billion vs. $16.3 Billion for May (no change).

III. Japan. I haven't figured out how to estimate trade with Japan yet, but I suspect we will see a larger deficit in June than May for two reasons:

A) inbound port traffic at Los Angeles was up 7% over May and outbound traffic was down 9%. It appears that Long Beach trade fluctuates more with China and Los Angeles with Japan and other Asian countries. Based on these numbers I expect the deficit with Japan to grow by about $1 Billion in June.

B) Bloomberg: Japan's June Exports Rise 3.6%, More Than Expected

IV. OVERALL: I haven't developed a method for predicting the deficit for other countries, but based on Oil and China I think the deficit in June will be slightly higher than May's deficit of $55.3 Billion. Oil will be about $1.2 Billion more in June (than May), SA China will be approximately the same and Japan/Asia will add another $1 Billion.

My Guess (not enough work to call it a projection / estimate): $57.7 Billion Deficit.

NOTE: I expect July to be worse than June.

CHINA: The following is the estimate for trade with China based on this methodology.

CHINA TRADE BALANCE: Table numbers in Billions $

NOT SEASONALLY ADJUSTED

| MONTH | NSA Balance | NSA Exports | NSA Imports |

| February | -$13.9 | $3.08 | $16.95 |

| March | -$12.9 | $3.3 | $16.21 |

| April | -$14.7 | $3.4 | $18.12 |

| May | -$15.75 | $3.3 | $19.05 |

| June | -$16.3(est) | $3.2(est) | $19.5(est) |

SEASONALLY ADJUSTED (all estimates)

| MONTH | SA Balance | SA Exports | SA Imports |

| February | -$18.1 | $3.08 | $21.19 |

| March | -$15.1 | $3.3 | $18.42 |

| April | -$15.5 | $3.4 | $18.88 |

| May | -$16.3 | $3.3 | $19.6 |

| May | -$16.3 | $3.2 | $19.5 |

Mortgage Applications Fall Slightly

by Calculated Risk on 8/10/2005 09:53:00 AM

Reuters reports:

Applications for U.S. home mortgages fell last week, its third consecutive drop, as refinancing activity waned and interest rates reached four-month highs, industry group figures showed on Wednesday.What is puzzling is the high percentage of borrowers still using ARMs:

The Mortgage Bankers Association said its seasonally adjusted index of mortgage application activity fell 0.9 percent to 745.0 in the week ended Aug. 5, adding to the previous week's 0.3 percent loss. The four-week moving average is down 1.5 percent to 763.1 from 774.9.

After falling during the previous week, demand for adjustable-rate mortgages (ARMs) rose in the week ended Aug 5, the MBS said.Of course I was puzzled last month too:

The ARM share of activity stood at 29.7 percent of total applications last week, up from 28.5 percent the previous week.

Given the spread between the various mortgage products, I'm surprised anyone is using an ARM. The breakeven point for a 30 year fixed rate mortgage vs. a 1 year ARM is less than 3 years. For those using a 5/1 year ARM (fixed for 5 years), the rate is the same as a 15 year fixed!

Since 28% of all application are for ARMs, this probably means:

1) Buyers think interest rates will decline in the future, or

2) Buyers are planning on moving within 3 years, or

3) Buyers can only qualify with a reduced payment.

None of these reasons seem compelling. I think this is more evidence of speculation / excessive leverage.

Tuesday, August 09, 2005

Realtor President: Sell Now, Buy Later.

by Calculated Risk on 8/09/2005 03:58:00 PM

The National Association of Realtors (NAR) President Al Mansell made some interesting comments today:

"It's a great time to sell, but it may be a better time to buy about a year from now when the market should come closer to balance,”I'm sure he meant that there are still below normal inventories and that he expects the housing market to be more balanced between supply and demand next year. But it sure sounded like a "Sell now, buy later" recommendation. Also from NAR chief economist David Lereah:

“The housing market is probably close to a peak right now in terms of sales activity, but there is tremendous momentum. Sales are expected to coast at historically high levels into next year, but they will trend slightly downward."Falling sales and rising inventories followed by declining prices is what I expect.