by Calculated Risk on 7/07/2005 06:04:00 PM

Thursday, July 07, 2005

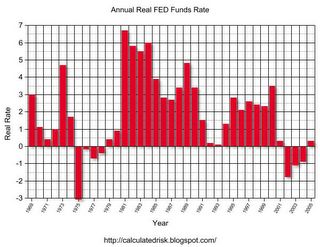

The Real FED Funds Rate

Dr. Hamilton of Econbrowser asks: "How high will the Fed push interest rates?"

First, how high is the Fed Funds Rate now? In nominal terms, the FED Funds Rate is 3.25%. But in real terms it is barely positive.

Click on graph for larger image.

For this graph, I subtracted the averaged trailing 12 months median CPI (SOURCE: Cleveland Fed) from the average of the monthly Fed Funds rate (SOURCE: Federal Reserve).

After the '73-75 recession, the FED Funds Rate chased the inflation rate. This led to ever higher inflation until the Volcker FED put the brakes on in the early '80s. The Real FED Funds Rate has declined since the early '80s, with a low in the early '90s as the FED provided stimulus in reaction to the '90/'91 recession.

A neutral Real FED Funds Rate is probably 2% or higher. If the economy is as healthy as the FED claims "... the expansion remains firm and labor market conditions continue to improve gradually.", then the FED will raise the FED Funds Rate to over 4% unless inflation diminishes.

Like many others, I believe the economy has serious and intractable imbalances: the current account deficit, the structural budget deficits and the housing bubble. These are the result of global shifts and poor public and fiscal policies.

Wednesday, July 06, 2005

Bank of England to Lower Rates?

by Calculated Risk on 7/06/2005 07:39:00 PM

UPDATE: We are all British today ...

The Bank of England's Monetary Policy Committee will conclude a two day meeting tomorrow and will announce monetary policy at 12 noon immediately following the Thursday meeting. The London Times has called for a rate cut.

THE Bank of England should move to bolster the economy today with a cut in interest rates, four out of nine members of The Times Monetary Policy Committee (MPC) said yesterday amid anxiety over faltering growth.The calls for a rate cut come as more evidence of economic weakness has emerged:

As worries were fuelled by figures showing manufacturing stagnating and homeowners further scaling back borrowing against their properties, pressure on the Bank to act was emphasised by the close vote among the independent experts.

Fears that the consumer downturn will be prolonged were heightened by the Bank’s latest figures for mortgage equity withdrawal, when homeowners borrow against increased property values for reasons other than moving home. The amount of cash raised in this way fell to £6.4 billion in the first quarter from a revised £8.3 billion in the previous three months and a peak of £17.7 billion in late 2003.The Confederation of British Industry has also called for a rate cut:

In The Times MPC vote, Martin Weale, NIESR’s director, and Sir Steve Robson, former Treasury Second Permanent Secretary, added their voices to call for an immediate rate cut. They were joined by The Times’s Anatole Kaletsky and Sushil Wadhwani, a former member of the Bank’s MPC, who also voted for a cut in June.

Sir Steve said that last week’s overhauled GDP data “suggested that the economy has been losing momentum for a good deal longer than previously thought”. “There are no new factors in prospect which would give it new momentum,” he said. Inflation remained subdued, he added. Mr Weale echoed this, arguing that growth was likely to have been below its long-term trend for a year.

``As there still seems little risk of inflation, the time for action is now,'' said CBI Director-General Digby Jones in the text of speech to be given in northern England this evening. There are ``troubling signs of decline in the housing market where confidence is everything. Such a loss of confidence is something the U.K. economy cannot afford.''

U.K. growth lagged behind the euro region for the first time in more than four years during the first quarter as the increase in consumer spending slowed and manufacturing contracted, government statistics showed last week. Inflation in May stayed at a seven-year high of 1.9 percent for the third month running.

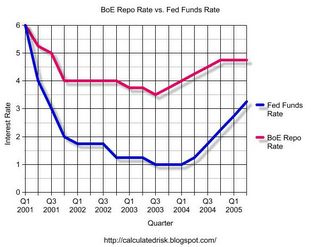

Click on graph for larger image.

Click on graph for larger image.It is possible that the UK housing slowdown is a leading indicator for the US housing market. The BoE didn't lower rates as far as the FED and they started raising rates sooner. Now, with the UK housing market faltering and high street sales slumping, it looks like the peak of the BoE interest rate cycle will be the lowest in fifty years.

What does this mean for the FED? Probably nothing. As Dr. Altig points out, the futures market is indicating at least two more 25 bps point rate increases from the FED at the next two meetings.

UPDATE: Financial Times: Grim outlook for UK manufacturing sector

David Page at Investec said: “Although manufacturing appeared firmer than markets were expecting in May, wholesale revisions in line with last week’s National Accounts revealed a weaker recent past for manufacturing and firmly pointed to a manufacturing recession.”Scotsman: Manufacturing recession rears its ugly head

"UK manufacturers are finding it difficult to pass on cost increases, particularly given the scale of the increase in oil,'' said George Buckley, an economist at Deutsche Bank. "In addition, weakening consumption makes it difficult to sell their products."

Tuesday, July 05, 2005

$1 Million Trailer: Land not included

by Calculated Risk on 7/05/2005 11:22:00 PM

The USA Today reports Mobile home madness: Prices top $1 million

A two-bedroom, two-bathroom mobile home perched on a lot in Malibu is selling for $1.4 million. This isn't a greedy seller asking a ridiculous amount no one will pay. (Photo gallery: Mobile home boasts of spectacular views)Uh, OK.

Two others sold in the area recently for $1.3 million and $1.1 million. Another, at $1.8 million, is in escrow. Nearby, another lists for $2.7 million.

"Those are the hottest (prices) I've ever heard," says Bruce Savage, spokesman for the Manufactured Housing Institute. He says prices in another hot spot, Key West, Fla., top $500,000. As if the price isn't tough enough to swallow, trailer buyers:

•Don't own the land. As with most mobile homes sold in Malibu, the land is owned by the proprietor of the trailer park, in this case, Point Dume Club.

•Still pay rent. Not owning the land means paying what's called "space rent" that is as high as or higher than many mortgages in other parts of the USA. On the $1.4 million trailer, space rent is $2,700 a month.

•Can't get mortgages. Since the buyers don't own the land, most of the mobile homes are paid for in cash or with a personal property loan that usually amounts to $100,000 or less, says Clay Dickens, mortgage loan agent at Community West Bank.

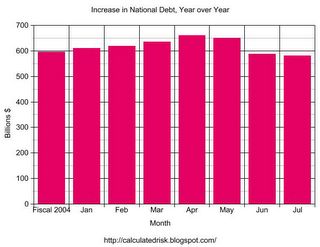

Budget Deficit: $581 Billion Year over Year

by Calculated Risk on 7/05/2005 03:58:00 PM

As of July 1, 2005 our National Debt is:

$7,827,306,264,287.53 (Over $7.8 Trillion)

As of July 1, 2004, our National Debt was:

$7,246,142,474,951.77

SOURCE: US Treasury.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

For Jul 1, 2004 to Jul 1, 2005: $581.2 Billion

I still expect fiscal 2005 to set a new nominal budget deficit record although it might be close. The current record annual increase in the National Debt is $596 Billion for fiscal '04.

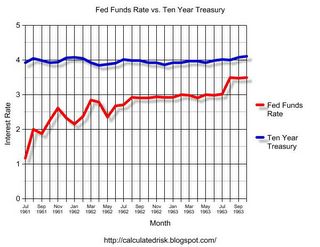

A Unique Conundrum?

by Calculated Risk on 7/05/2005 12:03:00 AM

The Federal Reserve has been steadily raising rates from a low of 1% to over 3%. And the yield on the Ten Year Treasury stubbornly refuses to budge.

Click on graph for larger image.

That is what happened in the early '60s. The Fed Funds rate moved from 1.1% in July 1961 to 3.5% in late 1963 and the Ten Year yield stayed steady at 4%.

All data from the Federal Reserve.

The yield curve narrowed and then what happened to the economy? It continued to grow and the stock market rallied.

There are many differences from forty years ago and today. But, with the constant drum beat in the financial press about the yield curve, I decided to check if the current situation was unique. It isn't. Nothing profound, I was just curious.

Also, my most recent post is up on Angry Bear: Housing Update.

Saturday, July 02, 2005

Housing: Boston is Looking Peaked

by Calculated Risk on 7/02/2005 12:00:00 AM

Many housing commentators have been looking to the UK and Australia housing markets as leading indicators for the US housing market. Now the housing bust may have reached the US shores: Boston is looking peaked.

In Massachusetts, the number of home sales dropped last month: Mass. home sales plunge 11.1 percent

There were about 36,259 homes on the market last month, or a supply of 8.8 months, a figure generally thought to be favorable to buyers, experts said.That is worth repeating; the supply of existing homes is now 8.8 months in Massachusetts. And that is exactly how many commentators felt the bubble would end:

Economists say this combination - higher prices amid lower sales volume - is precisely what you'd see in a bubble that's dying.And what happens when buyers use excessive leverage and can't sell? Massachusetts Foreclosure Filings Jump As Values Soar

Because of high housing prices, many first-time homebuyers have been using new, risky mortgage products that hold down costs in the early years of a loan, but they can face difficulties if payments rise later. In addition, people who already own homes have been tapping into rising property values to borrow money at historically low interest rates for college tuition, home improvements, credit-card debt, or other financial needs.And finally a quote from Bill Gross from Saturday's New York Times:

"When you tie all these factors together - the bubble in the real estate market, the popularity of interest-only loans, the willingness of lenders to give loans without a significant down payment, the lowering of standards for lenders, and the deep desire of people to own something priced beyond their means - you have a recipe for disaster," said Secretary of State William F. Galvin, whose office oversees the registries of deeds in a majority of the state's 14 counties. "That's what you're seeing in the Land Court."

"... if housing prices stop going up, which would be my forecast, that makes a substantial difference. Individuals have banked on that appreciation every year. You should come to a point where owners of houses realize we're in never-never land and stop buying on a speculative basis. Markets many times fall of their own weight. That's what happened with the Nasdaq in 2000."And maybe that's what is happening in Boston. Should we sound the alarm? The British Bust is coming!

Friday, July 01, 2005

Wells Fargo: Decade of Flat Home Prices

by Calculated Risk on 7/01/2005 01:19:00 AM

The Orange County Register reports on a presentation by Wells Fargo's chief economist Scott Anderson at the Westin South Coast Plaza on Wednesday. The Register quotes Anderson:

"We're talking about a decade at least – if not more – of (housing price) stagnation,"

"There will be a slow fizzle (in prices), not a pop,"Still Anderson is fairly positive:

There's a little oomph left in the market, he said. Anderson predicts that 30-year, fixed mortgage rates will remain around 5.8 percent over the next six months, which could help boost home prices about 5 percent this year. Next year, homeowners might see a 1 percent to 2 percent increase in appreciation, then Anderson expects prices will level off indefinitely until incomes can catch up.Previous housing booms also fizzled. But ten years of nominal price stagnation would be a 30% decline in real terms.

Even though much of Orange County's economic recovery can be attributed to the housing boom, Anderson doesn't think stagnant housing prices spell recession, because strength will remain in other sectors like technology and tourism.

I'm less confident than Mr. Anderson about avoiding a recession.

Thursday, June 30, 2005

CNN Newsnight: Aaron Brown Discusses the Housing Bubble

by Calculated Risk on 6/30/2005 11:37:00 PM

On Tuesday night, CNN's Newsnight with Aaron Brown had a segment on the housing bubble. Here are excerpts from the transcript:

BROWN: Back in the mid '90s, when we were all thinking of early retirement after our Internet stocks tacked on another 10 or 15 points, there were naysayers who said it wouldn't last, who said rationality always returns eventually, who said it was a bubble and a dangerous one at that. Oh, those naysayers.There is more, but that was the most in-depth part of the discussion. Dean Baker didn't get much face time!

By the way, are you counting on home equity to fund your retirement? Like the fact that your home doubled in the last decade or so? Feeling rich again? So is this deja vu with a mortgage? Here's CNN's Andy Serwer.

(BEGIN VIDEOTAPE)

ANDY SERWER, CNN CORRESPONDENT (voice-over): Is there a housing bubble? It depends who you ask and where you ask.

DEAN BAKER, CTR FOR ECONOMIC POLICY RESEARCH: Well, there's absolutely a housing bubble. In the last seven or eight years, we've seen an unprecedented run-up in home prices nationwide.

SERWER: No question, certain markets are red hot. Since 2000, the price of a single family home has jumped 77 percent in New York City, 92 percent in Miami, and 105 percent in San Diego. And there are other signs besides just home prices, 86 books on real estate investing were published last year, nearly three times as many as 1998.

Speculators have added fuel to overheated markets. In Los Angeles, for example, the number of homes sold that have been owned for less than six months jumped 47 percent in a year.

Prices are so high in some areas that renting a home has become dirt cheap by comparison. In San Francisco, for example, rent on a median price house runs $1,532 a month. Owning the same house with a typical mortgage would cost $3,424 a month.

But not every market is on fire. Some experts say that bubbles are mostly in cities on the east and west coasts. If those bubbles were to burst, it would shock the entire economy. But some say prices won't collapse, they'll just ease up.

FRANK NOTHAFT, CHIEF ECONOMIST, FREDDIE MAC: As long as the local economy remains strong and there is good job creation, then we're not going to see a drop in home values.

SERWER: In cities such as Dallas or Salt Lake or Pittsburgh, prices haven't risen nearly so much. Radical differences in prices can make moving from a hot zone like LA to a colder one like Syracuse either a windfall or a slap in the face, depending on which way you're going.

So what does all this mean for the prospective buyer?

FRANK NOTHAFT: It's a very personal decision whether or not they should sell now and choose to rent. If you're happy with your home and you enjoy the home that you're in and the neighborhood you're in, there's no point to sell it right now and switch to renting.

SERWER: In other words, don't just buy a home because you think you'll make a ton of money on it in two years. And don't sell your home just because it's appreciated wildly either. Because in real estate, as in everything else in life, you can't count on getting a better deal down the road.

Andy Serwer, CNN, New York.

(END VIDEOTAPE)

BROWN: Taking the global view for a moment, globalization being the rage these days, in 2004, housing prices in Spain and France went up even faster than they did here in the United States, 15 percent up for the year. Compared to 9 percent nationwide in the U.S.

But before you bet the farm, or the house, consider this. In Japan, house prices have dropped for the last 14 years. And they are now down 40 percent from their peak back in 1991. Here at home again, the median price of a house is $207,000. That means half the houses cost more, half the houses cost less.

Any economic topic is difficult for TV News. No pictures. I can imagine the viewers reaching for the remote ... hmmm, any shark attacks today?

Real Estate "Summit" Comments

by Calculated Risk on 6/30/2005 09:21:00 PM

Following are some comments and stories from the Reuters Real Estate Summit in New York.

Property guru says U.S. market nearing peak Peter Korpacz, the head of real estate business advisory services for PriceWaterhouseCoopers told reporters:

"The thing the industry is focusing on now is jobs growth. For the most part its running at about 175,000 a month. It's a healthy economy, but it's not robust. During this point in the last recovery (in the early 1990s) jobs were growing at about 217,000 a month."Toll Bros sees possible correction in hot markets

Korpacz said real estate lenders and developers are far more disciplined now than in the past and so there was little threat to the market from speculative development, although the red-hot residential sector was giving rise to concerns among investors.

He added that if there is a major drop in prices for condos or single-family housing, it could hurt "real estate as a whole and just wash (away) the whole industry."

"In the hot markets, I wouldn't be surprised to see a 20 percent decline," [Robert Toll Brothers Inc.'s chief executive] said at the Reuters Real Estate Summit in New York. "You've got a price going from $1 million to $800,000, I don't have a problem with that.For more stories see the Reuters Summit site.

"I don't think you're going to have a pop, which means I don't think you've got a bubble," added the head of the luxury home builder at the summit held at Reuters U.S. headquarters in New York. "But I do think you're going to have a correction as the markets unnaturally overheat because of speculation."

Environmental Economics

by Calculated Risk on 6/30/2005 01:31:00 PM

An an undergrad, I was incredibly fortunate to take Chemistry from Drs.Sherwood Rowland and Mario Molina. At that time, the future Nobel Laureates (1995 Nobel Prize in Chemistry) Rowland and Molina were working on their ground breaking discoveries into how chlorofluorocarbons (CFCs) were impacting the ozone.

But Rowland and Molina's work was just the start. To correct the CFC caused ozone depletion problem it took a combination of great science, an open discussion of the environmental impact of various policy options, government action and international cooperation. Not only was the chemistry fascinating, but that was my introduction into market failures and externalities. When I spoke with Dr. Rowland a few months ago, he modestly told me the science might have been the easy part!

With that prelude, here is a new Environmental Economics blog with 17 contributing economists addressing many of the economic and political issues that are required to transform good science into good policy. Enjoy!