by Calculated Risk on 6/27/2005 02:57:00 PM

Monday, June 27, 2005

Housing Misinformation

The LA Times publishes a small community newspaper for my neighborhood called the Daily Pilot. The business section of today's Pilot featured an article on housing. What caught my eye were some quotes from local real estate professionals.

"Much of the appreciation we're seeing is permanent."John Burns, president of Irvine-based John Burns Real Estate Consulting June, 2005

Compare to:

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."Irving Fisher, Ph.D. Economics, Oct. 17, 1929

But far more discouraging are the comments attributed to Bill Cote of the Cote Realty Group. He doesn't believe there is a bubble, but he also apparently wants to withhold information from the home buying public:

[Cote]...is bothered by the potential of academics forecasting real estate deflation to discourage the public. He said it's tough for general audiences to discern between the various forecasts that are out there."People start talking ..." We wouldn't want that to happen.

"It affects the confidence of the market -- people start talking," Cote said. "People can't tell unless they're sophisticated in economics."

Houses and Interest Rates

by Calculated Risk on 6/27/2005 12:22:00 AM

My latest post is up on Angry Bear: The Impact of Interest Rates on House Prices. Several people are arguing that housing prices are appropriate based on current interest rates. I argue that this is incorrect.

And from the NY Times: How Home Prices Can Be Hot but Inflation Cool. This article discusses a potential problem with the CPI calculation. When houses prices fall that might increase the reported CPI:

... when housing prices fall, a trend that most people would deem anti-inflationary, and renting becomes more attractive than owning, the index might process the information as evidence that inflation is on the rise. "We got a great deal of criticism that we were overstating inflation in the early 1990's, because housing prices were declining and rents were going up steadily," Mr. Jackman said.And my friend Mike Shedlock is hearing "Warning bells from homebuilder suppliers".

Best to all.

Friday, June 24, 2005

Buffett Examines living in Squanderville

by Calculated Risk on 6/24/2005 09:17:00 PM

Kash covered the political reaction to the announcement that China National Offshore Oil Corporation, or CNOOC, is bidding for Unocal. MaxSpeak and Dr. Setser work the numbers.

This event reminds me of the following cautionary tale from Warren Buffett (Oct, 2003).

[T]ake a wildly fanciful trip with me to two isolated, side-by-side islands of equal size, Squanderville and Thriftville. Land is the only capital asset on these islands, and their communities are primitive, needing only food and producing only food. Working eight hours a day, in fact, each inhabitant can produce enough food to sustain himself or herself. And for a long time that's how things go along. On each island everybody works the prescribed eight hours a day, which means that each society is self-sufficient.UPDATE: Buffett was on CNBC Thursday June 23rd. Here are his comments on China:

Eventually, though, the industrious citizens of Thriftville decide to do some serious saving and investing, and they start to work 16 hours a day. In this mode they continue to live off the food they produce in eight hours of work but begin exporting an equal amount to their one and only trading outlet, Squanderville.

The citizens of Squanderville are ecstatic about this turn of events, since they can now live their lives free from toil but eat as well as ever. Oh, yes, there's a quid pro quo-but to the Squanders, it seems harmless: All that the Thrifts want in exchange for their food is Squanderbonds (which are denominated, naturally, in Squanderbucks). Over time Thriftville accumulates an enormous amount of these bonds, which at their core represent claim checks on the future output of Squanderville. A few pundits in Squanderville smell trouble coming. They foresee that for the Squanders both to eat and to pay off-or simply service - the debt they're piling up will eventually require them to work more than eight hours a day. But the residents of squanderville are in no mood to listen to such doom saying.

Meanwhile, the citizens of Thriftville begin to get nervous. Just how good, they ask, are the IOUs of a shiftless island? So the Thrifts change strategy: Though they continue to hold some bonds, they sell most of them to Squanderville residents for Squanderbucks and use the proceeds to buy Squanderville land. And eventually the Thrifts own all of Squanderville. At that point, the Squanders are forced to deal with an ugly equation: They must now not only return to working eight hours a day in order to eat - they have nothing left to trade - but must also work additional hours to service their debt and pay Thriftville rent on the land so imprudently sold. In effect, Squanderville has been colonized by purchase rather than conquest. It can be argued, of course, that the present value of the future production that Squanderville must forever ship to Thriftville only equates to the production Thriftville initially gave up and that therefore both have received a fair deal. But since one generation of Squanders gets the free ride and future generations pay in perpetuity for it, there are - in economist talk - some pretty dramatic "intergenerational inequities."

Buffett said he doesn't subscribe to the view that China is engaging in a trade war with the U.S. He said Chinese corporate takeovers, such as CNOOC Ltd's (CEO) recent bid for Unocal Corp. (UCL) were an "inevitable" consequence of the U.S. trade deficit. He noted that the U.S. imported far more goods from China than it sold to the nation.

"If we're going to consume more than we produce, we have to expect to give away a little bit of the country," said the "Oracle of Omaha."

May New Home Sales: 1.298 Million

by Calculated Risk on 6/24/2005 10:19:00 AM

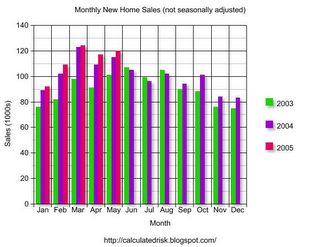

According to a Census Bureau report, New Home Sales in May were at a seasonally adjusted annual rate of 1.298 million vs. market expectations of 1.32 million. April sales were revised down significantly to 1.271 Million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

Sales of new one-family houses in May 2005 were at a seasonally adjusted annual rate of 1,298,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.1 percent above the revised April rate of 1,271,000 and is 4.4 percent above the May 2004 estimate of 1,243,000.

The Not Seasonally Adjusted monthly rate was 120,000 New Homes sold, up from a revised 117,000 in April.

The median sales price of new houses sold in May 2005 was $217,000; the average sales price was $281,400.

UPDATE: Add graph of median and average prices.

The average sales price is down slightly and the median price is the lowest since September of 2004.

The seasonally adjusted estimate of new houses for sale at the end of May was 442,000. This represents a supply of 4.2 months at the current sales rate.

The seasonally adjusted supply of New Homes was 4.2 months, about normal for the last few years. The supply for April was also 4.2 months, revised from 4.1 months.

New Home Sales were below Wall Street forecasts. The story is the downward revisions for March and April. Both months were originally reported as record sales, but they have been revised to be below the record of last October.

Thursday, June 23, 2005

Buffett on Housing: Some people may regret recent purchases

by Calculated Risk on 6/23/2005 10:24:00 PM

Warren Buffet was interviewed on CNBC today. Here are a few of his comments as reported by Dow Jones:

On The Real-Estate Bubble:

Lending practices, low interest rates, and "the psychology that ensues when an asset class moves year after year and people feel 'why didn't I get into it before?'" is creating a precarious situation in some of the real estate markets, Buffett said.On the Dollar and the Trade Deficit:

At the high end of the market, Buffett said people may regret recent purchases.

Buffett said the trade deficit was "a deeply embedded structural problem."On China:

The investor cited Federal Reserve Chairman Alan Greenspan in 2002, saying that countries who experience similar trade-deficit trends in the past, "invariably have run into problems."

"Eventually the current-account deficit will have to be restrained," Buffett said.

"We've gone from being a country that owned more of the rest of the world than they owned of us to a country probably $3 trillion in the hole right now in terms of our net worth position," Buffett said. "So it will have had a effect, it may be a month from now, it may be five years from now."

As a consequence of such imbalances, Buffett warned that the dollar will continue its downdraft "at some point," and indicated that he expects the dollar to be weaker five years from now.

Buffett said he doesn't subscribe to the view that China is engaging in a trade war with the U.S. He said Chinese corporate takeovers, such as CNOOC Ltd's (CEO) recent bid for Unocal Corp. (UCL) were an "inevitable" consequence of the U.S. trade deficit. He noted that the U.S. imported far more goods from China than it sold to the nation.

"If we're going to consume more than we produce, we have to expect to give away a little bit of the country," said the "Oracle of Omaha."

Fed Gov Olson: Housing Concerns

by Calculated Risk on 6/23/2005 11:16:00 AM

Federal Reserve Governor Mark Olson expressed concern today about "homebuying decisions premised on unrealistic rates of home appreciation":

Over the past several years, there has been an explosion of new and novel mortgage products, including mortgages that allow homeowners to skip mortgage payments (which results in increasing the size of their mortgage balance) and mortgages that allow homeowners to pay only the interest on a loan, and not the principal, for a preset period at the beginning of the life of their mortgage loan. Many of these products can be useful financial tools for homebuyers and, indeed, may have helped make homeownership more accessible for some households. But to the extent that these new mortgage products promote homebuying decisions that are premised on unrealistic rates of home appreciation, they raise concerns. Some borrowers may not be able to sustain such a loan over a long time horizon if the pace of home price growth moderates. In particular, when the payments on these novel mortgages adjust upward, the homebuyer may not be able to refinance such mortgages unless the home has increased in value.At the same conference, according to an MSNBC article, Cleveland Fed President Sandra Pianalto cited a study:

... that found 25 percent of Americans claim to have no spare cash after covering regular expenses, warned that tapping wealth stored in the family home carries risks.In a related commentary Double bubble trouble Danielle DiMartino points out that:

“Increasingly, home owners are using home equity as a source of ready cash ... this doesn’t bode well for the ownership society that we’re trying to build,”

Delinquency and foreclosure rates have been falling

The reason, said MBA chief economist Doug Duncan, is strong job creation.

Housing is a chief driver of job creation.

Housing is being driven by "creative loans". (see Olson's comments above)

And she concludes:

The debate reminds us that falling prices not only will coincide with higher foreclosures, they also will be accompanied by millions of pink slips.

Wednesday, June 22, 2005

Option ARMs

by Calculated Risk on 6/22/2005 05:54:00 PM

In the comments to an earlier post, malabar asked if "something like the PIK (payment in kind) bonds used during the 80s LBO days" were being used in the housing market. I suggested that Option ARMs might be similar in that one of the options is a minimum monthly payment that allows for negative amortization.

And reading our minds, The Housing Bubble featured a post today on option ARMs:

S&P Warns On Option ARMs

The alarms about option ARM loans couldn't be any louder. "Recently, option ARMs have become increasingly prevalent in the market. After extensive research, Standard & Poor's has determined that additional credit enhancement is required to account for the increased risk of default resulting from the payment shock inherent in these loans."

"The ratings company said the tightening applies to loans that are bundled into mortgage-backed securities for sale to investors as well as option adjustable-rate mortgage loans, or option ARMs, The Wall Street Journal said."

"Some economists fear that option ARMs and other loans that reduce initial payments are fueling house-price inflation by enabling people to bid more for homes than they could if they were taking out conventional loans, said the Journal."

"Option ARMs and similar loans are among 'the only things left that are keeping home prices rising,' Stuart Feldstein, of (a) financial-services market-research firm."

This link reveals the problem may be bigger than previously reported. "According to UBS AG, option ARMs now account for 40 percent of prime-rated mortgages packaged into securities, compared to just 1 percent in 2003."

The widespread use of Option ARMs is clear evidence of excessive leverage in the housing market.

Thanks to malabar. Hat tip to Ben Jones.

The Refinery Myth

by Calculated Risk on 6/22/2005 03:15:00 PM

Bloomberg reports that Chevron is expanding their Pascagoula, Miss. refinery to boost gasoline output:

The expansion will raise daily gasoline output by 11,900 barrels, or 500,000 gallons, to about 131,000 barrels, [Steve Renfroe, Chevron Spokesperson] said. The $150 million project is expected to begin in July and be finished in late 2006.I don't doubt that additional refining capacity will be needed. But the following sentence in the article perpetuates the myth that the lack of refining capacity is contributing to the high price of oil:

The shortage of refining capacity worldwide has contributed to the 57 percent rise in oil prices in the past year.This is similar to a recent comment by Saudi oil minister Ali al-Naimi:

"There is no shortage of oil. It's there. What is driving the price is the inability to make the oil into products."The BBC article continues:

Some analysts say there are insufficient oil refineries, both in the US, where no new refineries have been built since 1976, and worldwide.Here is a simple diagram of a bottleneck:

This shortage could help keep oil prices high.

Raw Material --->> bottleneck --->> Finished Good

What happens with a bottleneck? If the process is running at full capacity, there is a fixed supply of finished goods, so the price of the Finished Good will rise rapidly with any increase in demand.

But what happens to the price of the raw material? Since the process is running at full capacity (a bottleneck), the demand is fixed, and any additional supply of raw material will cause the price of the raw material to drop!

For the Oil industry: Crude oil is the raw material, the potential bottleneck is the refining process and the finished good is gasoline (also other products, but I'll use gasoline in this example). If refining is at or near full capacity, any additional demand for gasoline would increase the price of the finished good (gasoline) but would not change the demand for crude oil (demand is fixed by the refining bottleneck).

Since demand for crude would be fixed with a bottleneck, any additional supply of crude would depress the price of the raw material (crude oil). Therefore the lack of refining capacity could only depress the price of crude and would not contribute to the rise in the price of crude - the opposite of what is being reported. Adding more refining capacity would increase the demand for crude oil and could lead to higher crude oil prices, unless additional supply of crude is brought online.

Perhaps the Saudi oil minister has ulterior motives for blaming refining for the high price of crude oil, but that doesn't mean the financial press should perpetuate the myth.

UPDATE: In the comments, darffot suggests that he interprets al-Naimi's comments as: The lack of refining capacity for sour crude is pushing up the price of sweet crude. Here is darffot's comment:

i would like to offer an alternative interpretation, which is the way i have always taken al-Naimi's comments on this issue: the incremental production adds coming out of SA and elsewhere is primarily high-sulfur "sour" oil. this is oil which most refineries cannot process, especially thanks to recent enactment of emissions legislation in various parts of the world. just as American electricity producers created a glut of NG-based power plants in keeping with the clean air theme, refinery capacity additions have been skewed toward light sweet oil, which is easier to process with lower pollutants. and, just like the NG-turbine additions, these geniuses did not stop to think beforehand whether the supply would be there when the capacity came on.

the result today is that there is high competition for light sweet crude (the widely followed WTI) while the excess sour production goes begging for buyers. this can be clearly seen in the historically large spreads between sweet and sour crude products, and is also very apparent in the chart of Valero (VLO), the US based refiner most heavily focused on sour crude. just listen to a VLO conference call and you will learn how they are printing money thanks to the record spreads between sweet and sour. this, i believe, is what al-Naimi is alluding to when he says there is not enough refining capacity--there's not enough sour refining capacity to keep in alignment with the composition of crude coming online at the margin. meanwhile, there is high competition for the sweet crude.

UPDATE 2: According to a recent Forbes article, the spread between light and sour has increased from $2.50/ bbl to almost $9/bbl over the last 2 years. This is darffot's point and he is clearly correct about more demand for light sweet crude.

However, this still means there has been a substantial price increase for sour crude (from around $27 to almost $50 today spot prices). Perhaps a few dollars of the WTI prices are related to refinery mix (but that isn't what the financial press claimed), but blaming the doubling of oil prices on lack of sour crude refining capacity is also incorrect.

Tuesday, June 21, 2005

UCLA Anderson Preview: Bubble Burst could lead to Recession

by Calculated Risk on 6/21/2005 02:41:00 AM

The UCLA Anderson Forecast will be released today. According to a preview in the LA Times:

... the UCLA forecasters once again predict that a housing slowdown could push California into recession, while causing a noticeable slowing in U.S. economic growth.

UPDATE: Another preview article: Home bubble could weaken

the residential real estate market could soften in the latter half of this year, slowing the state and national economies.ORIGINAL POST:

Still, Edward Leamer, an author of the quarterly outlook from the university's Anderson School of Business, stopped well short of forecasting a recession this year. "The probability remains essentially zero ... before April 2006."

Leamer said the first indication of a turn for the economy will be fewer home sales with properties sitting longer on the market. Then builders will retreat and pull fewer permits, and jobs that depend on home sales will be lost. While a price softening and not a collapse is expected, this series of events will trickle down through the overall economy.

He noted a drop in spending on homes played a major role in nine of the past 10 economic downturns since World War II.

While the outlook for the economy over the next 12 months is positive, predicting after that gets dicey, but real estate will play a large role in what happens.

"The bad news is that we have real problems in the housing sector that will cause the economy a good deal of stress soon enough," Leamer said in his report, referring to home prices that have reached unsustainable levels in some markets.

Others are expressing similar concerns:

On Monday, Merrill Lynch added to the bubble concerns, releasing a report that said U.S. economic growth could slow by a full percentage point next year if home prices were to stagnate in the biggest cities.And on California:

Merrill Lynch senior economists found that six California markets — San Diego, Inland Empire, Los Angeles, San Francisco, San Jose and Sacramento — were "well in bubble territory" with above-normal ratios of home prices to household incomes.

Federal Deposit Insurance Corp. data, provided to The Times on Monday, further underscored such concerns that declines in the nation's biggest housing markets could throttle the entire U.S. economy.

... to the UCLA economists, the sizzling housing market has masked a number of weaknesses in California's economy, including job growth that is not as good as it looks. Employment and personal incomes in California have gained only modestly in the last year, UCLA's Thornberg said. Yet, many Californians "feel" wealthier because they perceive their homes to be worth a lot more.They could say the same thing about much of the US: the housing boom has masked otherwise weak job growth. Look for more comments later today.

Monday, June 20, 2005

Port of Los Angeles: Less traffic in May

by Calculated Risk on 6/20/2005 02:49:00 PM

The Port of Los Angeles released their May statistics today. Inbound (loaded containers) was 313 thousand compared to 329 thousand in April - a decline of 5%.

Outbound volume was 105 thousand loaded containers vs. 107 thousand for April. This is similar to the 1% decline for the Port of Long Beach.

Port of Long Beach statistics correlate better with imports from China, but I can't overlook the weak imports for the Port of LA.