by Calculated Risk on 1/25/2013 05:46:00 PM

Friday, January 25, 2013

WSJ: "Six Housing Forecasters Who Got Things Right in 2012"

From Nick Timiraos at the WSJ: Six Housing Forecasters Who Got Things Right in 2012

A few analysts, of course, did offer housing forecasts at the beginning of the past year that turned out to be largely correct. What’s more: some of these analysts had also accurately forecast the housing sector’s slowdown as the market neared its peak in 2005 and 2006.Here are the six forecasters.

On Tom Lawler:

Last year, he began writing about how Phoenix had hit a “bottom” in real estate, a prediction that became the genesis of this Page One story in the Journal last year. Nationally, Mr. Lawler called for gains of nearly 20% in new home sales to an annual rate of 365,000 [the Census Bureau reported 367,000 this morning] and gains of around 24% in total housing starts (preliminary estimates show they were up around 28%).Thanks to Nick - I appreciate the mention! (others mentioned include Ivy Zelman, Glenn Kelman, Joseph LaVorgna and John R. Talbott).

Hotels: RevPAR increases 12% compared to same week in 2012

by Calculated Risk on 1/25/2013 03:43:00 PM

From HotelNewsNow.com: STR: US results for week ending 19 January

In year-over-year comparisons, occupancy was up 6.1 percent to 54.5 percent, average daily rate rose 5.6 percent to US$105.73 and revenue per available room increased 12.1 percent to US$57.57.The 4-week average of the occupancy rate is back to normal levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

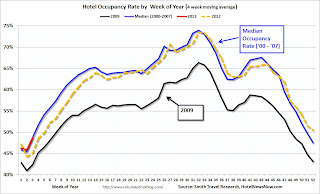

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

The occupancy rate will continue to increase over the next few months as business travel picks up in the Spring. This is a key period for the hotel industry and the occupancy rate was still weak early in 2012 (the Summer and Fall occupancy rate was close to normal in 2012).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

New Home Sales and Distressing Gap

by Calculated Risk on 1/25/2013 11:58:00 AM

The Census Bureau reported a month-to-month decline in new home sales in December, but sales for the three previous months were revised up - so 2012 annual sales were at the expected level of 367 thousand (before further revisions). This was an increase of 19.9% from 2011.

Note: I also expect sales for December will be revised up (almost all the recent revisions have been up).

This table shows the annual sales rate for the last eight years.

| Annual New Home Sales | ||

|---|---|---|

| Year | Sales (000s) | Change in Sales |

| 2005 | 1,283 | 6.7% |

| 2006 | 1,051 | -18.1% |

| 2007 | 776 | -26.2% |

| 2008 | 485 | -37.5% |

| 2009 | 375 | -22.7% |

| 2010 | 323 | -13.9% |

| 2011 | 306 | -5.3% |

| 2012 | 367 | 19.9% |

Even with the sharp increase in sales, 2012 was the third lowest year for new home sales since the Census Bureau started tracking sales in 1963. The two lowest years were 2010 and 2011.

Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or another 22% to 25% on an annual basis.

My guess is sales will rise to around 800 thousand per year in a few years, but others think the next peak may be lower, perhaps closer to 700 thousand. I think the demographics support close to 800 thousand per year, but even if sales only rise to the average of 664 thousand for the '80s and '90s, sales would still increase over 80% from the 2012 level.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to start to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Click on graph for larger image.

Click on graph for larger image.Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 369,000 SAAR in December

• New Home Sales graphs

New Home Sales at 369,000 SAAR in December

by Calculated Risk on 1/25/2013 10:00:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 369 thousand. This was down from a revised 398 thousand SAAR in November (revised up from 377 thousand). Sales for September and October were revised up too.

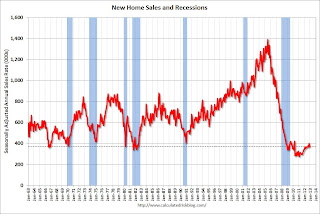

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in December 2012 were at a seasonally adjusted annual rate of 369,000 ... This is 7.3 percent below the revised November rate of 398,000, but is 8.8 percent above the December 2011 estimate of 339,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Annual 2012 sales were up almost 20% compared to 2011:

"An estimated 367,000 new homes were sold in 2012. This is 19.9 percent above the 2011 figure of 306,000."The second graph shows New Home Months of Supply.

The months of supply increased in December to 4.9 months from 4.5 months in November.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of December was 151,000. This represents a supply of 4.9 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was just above the record low in December. The combined total of completed and under construction is also just above the record low since "under construction" is starting to increase.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In December 2012 (red column), 26 thousand new homes were sold (NSA). Last year only 24 thousand homes were sold in December. This was the sixth weakest December since this data has been tracked. The high for December was 87 thousand in 2005.

New home sales were at 367 thousand in 2012, up almost 20% from 307 thousand in 2011. Also sales are finally near the lows for previous recessions too.

New home sales were at 367 thousand in 2012, up almost 20% from 307 thousand in 2011. Also sales are finally near the lows for previous recessions too.This was below expectations of 388,000 sales in December, but with the strong upward revision to November sales (and smaller upward revisions to September and October) this was another solid report. I'll have more soon ...

U.K. Economy Shrinks Again

by Calculated Risk on 1/25/2013 08:57:00 AM

From the WSJ: U.K. Economy Shrinks

The U.K. economy shrank in the final quarter of 2012, leaving Britain at risk of entering its third recession since 2008.A triple dip?

In its preliminary estimate, the Office for National Statistics said gross domestic product contracted 0.3% between October and December compared with the third quarter. On an annual basis economic output was flat.

"At the moment it remains too early to tell if the economy will triple-dip, but today's numbers have greatly increased the risk of a new recession and a downgrading of the U.K.'s triple-A credit rating," said Chris Williamson, chief economist at data providers Markit.

However it appears employment is doing better than GDP in the U.K., from Izabella Kaminska at FT Alphaville: Mismeasuring UK GDP