by Calculated Risk on 9/12/2012 09:47:00 PM

Wednesday, September 12, 2012

Thursday: FOMC Meeting, Unemployment Claims

From Tim Duy at EconomistsView: The Wait Should be Finally Over

With respect to the meeting tomorrow, I agree with Robin Harding at the FT on this point:From Jon Hilsenrath at the WSJ: Four Things to Watch at Fed Meeting. Some excerpts:

For me, the question of what the Fed will do is far less interesting – and far less in doubt – than how the Fed will do it. This will not be a pro forma repeat of previous actions. As Mr Bernanke’s speech shows, the Fed is trying to address grave concerns about the labour market. The crucial issue is whether and how they tie any action to the state of the economy.I don't anticipate a lump sum QE announcement. I anticipate an open-ended commitment to regular purchases of securities, Treasuries and/or MBS, that can be scaled up or down in response to the economy. Wall Street may be initially disappointed by the lack of a big number, but over time I think markets will come to appreciate the greater impact offered by a regular commitment based upon economic outcomes rather than the arbitrary amounts and time lines of previous QE efforts.

As Harding says, how they tie the policy to the economy is key.

–QE STRATEGY: Many investors expect the Federal Reserve to launch a new round of bond purchases, often called quantitative easing or QE. One big question is how the Fed would structure such a program.On Thursday:

...

–WHAT TO DO WITH TWIST: Officials must decide what to do about the “Operation Twist” program if they launch a new bond-buying program. The Fed is funding the Twist purchases with money it gets by selling short-term Treasury securities.

...

–COMMUNICATION: How the Fed describes its impetus for action, and its criteria for even more in the future, could matter a lot. Is it responding to a darkening outlook? Or has it decided to take more aggressive action because its patience with slow growth and high unemployment is running out and it has a new commitment to changing that?

...

–WHETHER TO LOWER ANOTHER RATE: The Fed now pays banks 0.25% interest on reserves they keep with the central bank. The Fed could reduce the rate it pays on reserves that aren’t required of banks (known as excess reserves) a little bit to try to give banks more impetus to lend.

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 365 thousand.

• Also at 8:30 AM, the Producer Price Index for August will be released. The consensus is for a 1.4% increase in producer prices (0.2% increase in core).

• At 12:30 PM, the FOMC Meeting Announcement will be released. Additional policy accommodation is very likely. The FOMC might lengthen their forward guidance for the first rate hike to mid-2015 or later, and / or also launch an open ended Large Scale Asset Purchases(LSAP) program (commonly called QE3).

• At 2:00 PM, The FOMC Forecasts will be released. These include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections. Earlier I posted a preview with the June projections for reference.

• At 2:15 PM: Fed Chairman Ben Bernanke will hold a press briefing and discuss the FOMC policy decisions.

.

FOMC Projections Preview

by Calculated Risk on 9/12/2012 07:01:00 PM

There is plenty of discussion about QE3 (will they or won't they), but another key piece of information released tomorrow is the projections of the FOMC participants. In advance of the meeting I thought I'd take a look back at the previous projections from the June meeting.

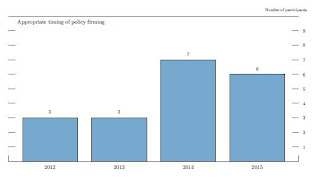

The first chart is when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate.

The key is to see if this shifts further to the right with more participants thinking the first rate increase will happen in 2015 or beyond. Many analysts expect that the FOMC will push out their forward guidance to 2015 (from 2014), and that suggests many more participants will view 2015 or beyond as appropriate.

This graph will probably be extended to 2015, and once again many participants will probably think the Fed Funds rate will be in the current range into 2015.

On the projections, GDP will probably be revised down again for 2012.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

GDP grew at a 1.8% annualized rate in the first half of 2012, and would have to increase at a 2.0% to 3.0% rate in the 2nd half to reach the previous range of projections.

The unemployment rate was at 8.1% in August. This is still in the June projection range, and the key will be to watch the projections for 2013 and 2014. Fed Chairman Ben Bernanke called unemployment a "grave concern" in his recent Jackson Hole speech.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

Overall PCE inflation has been on a 1.3% annualized pace this year through July (although this will probably increase with the increase in oil prices), and core PCE has been increasing at a 1.8% annualized pace. The core PCE rate has slowed further over the last few months. Right now inflation is tracking near the bottom of the previous FOMC projections.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.7 to 2.0 | 1.6 to 2.0 | 1.6 to 2.0 |

Here was the key sentence from the most recent FOMC minutes: "Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery."

There is nothing in the recent data pointing to a "substantial and sustainable strengthening in the pace of the economic recovery". So I expect QE3 to be announced tomorrow.

Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in August

by Calculated Risk on 9/12/2012 02:59:00 PM

CR Note: Yesterday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). There has been a clear shift to fewer distressed sales in Sacramento.

Economist Tom Lawler has been digging up similar data, and he sent me the following table today for several more distressed areas. For all of these areas the share of distressed sales is down from August 2011 - and for the areas that break out short sales, the share of short sales has increased (except Minneapolis) and the share of foreclosure sales are down - and down significantly in some areas.

Previous comments from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Aug | 11-Aug | 12-Aug | 11-Aug | 12-Aug | 11-Aug | |

| Las Vegas | 43.7% | 21.7% | 16.9% | 50.2% | 60.6% | 71.9% |

| Reno | 38.0% | 30.0% | 13.0% | 31.0% | 51.0% | 61.0% |

| Phoenix | 29.4% | 25.2% | 14.0% | 41.5% | 43.4% | 66.7% |

| Sacramento | 35.4% | 23.6% | 16.6% | 38.4% | 52.0% | 62.0% |

| Minneapolis | 10.8% | 11.6% | 26.0% | 33.4% | 36.8% | 45.0% |

| Mid-Atlantic (MRIS) | 11.8% | 11.2% | 8.7% | 14.7% | 20.6% | 25.9% |

| Hampton Roads VA | 24.4% | 29.3% | ||||

| Charlotte | 13.6% | 19.0% | ||||

| Memphis | 28.7% | 31.5% | ||||

| Birmingham AL | 27.8% | 30.3% | ||||

Shiller on House Prices

by Calculated Risk on 9/12/2012 12:39:00 PM

An interview with Professor Robert Shiller on NPR: The Housing Market: Have We Finally Hit Bottom? A brief excerpt:

Neil Conan, Host, NPR: And in the spring you were on the fence as those first reports came in giving three months of generally positive data. Do you think we're coming off the bottom?Robert Shiller makes a few key points:

Robert Shiller, economist, Yale University: Well, we definitely have positive data. The question is how strong is it, and will this fizzle - this rally fizzle or not? And I don't know the answer to that. But I point out that this is the fourth time we've had a rally since the crisis ended. It's coming in the summertime, right? Well, that's the normal time of strength in the market.

So if you look at the data, it doesn't jump out at you that we've reached the turning point. Now, we may have, but I think that seasonality seems to be getting stronger, and that's another contender.

CONAN: So how long do you think you would want to wait before you saw enough numbers to make a decision?

SHILLER: Well, I used to forecast home prices, and I thought a year - once you have a year - this is what I used to think, and whether it's still true, but ... But once you have a year of solid price increases, you are probably off to the races for some years. So yeah, but we're not into it that long yet.

CONAN: And there's other factors, because of all those foreclosures, because of all those mortgages underwater, a lot of people fear that there's a big backlog of housing stock that you're going to have to work through before you can start going again.

SHILLER: Right, there's a lot of people who are thinking, you know, if the prices would just come up a little bit, I'd sell.

• There is a seasonal pattern for house prices, and the seasonality has been much stronger in recent years. The reason is foreclosures and short sales happen all year, but there is a seasonal pattern for conventional sales. So distressed sales push down prices more than normal in the winter. Some of the recent increase in house prices was due to seasonal factors, and - as I noted last month - we should expect the NSA indexes to show month-over-month declines later this year. But the key will be to watch the year-over-year change.

• I've argued before that we will not really know if house prices have bottomed until at least a year after it happens (I think prices bottomed early this year). Robert Shiller makes the same argument: "once you have a year of solid price increases, you are probably off to the races for some years". I don't think prices will be "off to the races" because ...

• As Shiller notes, there are probably quite a few people waiting for a better market and somewhat higher prices: "there's a lot of people who are thinking, you know, if the prices would just come up a little bit, I'd sell". That is one reason why prices will probably not be "off to the races". Also there are still quite a few distressed sales in the pipeline - and that will keep prices from rising quickly.

Here is the radio interview:

CoreLogic: Negative Equity Decreases in Q2 2012

by Calculated Risk on 9/12/2012 09:31:00 AM

From CoreLogic: CORELOGIC® Reports Number of Residential Properties in Negative Equity Decreases Again in Second Quarter of 2012

CoreLogic ... today released new analysis showing that 10.8 million, or 22.3 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2012. This is down from 11.4 million properties, or 23.7 percent, at the end of the first quarter of 2012. An additional 2.3 million borrowers possessed less than 5 percent equity in their home, referred to as near-negative equity, at the end of the second quarter. Approximately 600,000 borrowers reached a state of positive equity at the end of the second quarter of 2012, adding to the more than 700,000 borrowers that moved into positive equity in the first quarter of this year.

Together, negative equity and near-negative equity mortgages accounted for 27.0 percent of all residential properties with a mortgage nationwide in the second quarter, down from 28.5 percent at the end of the first quarter in 2012. Nationally, negative equity decreased from $691 billion at the end of the first quarter in 2012 to $689 billion at the end of the second quarter, a decrease of $2 billion driven in large part by an improvement in house price levels.

“The level of negative equity continues to improve with more than 1.3 million housholds regaining a positive equity position since the beginning of the year,” said Mark Fleming, chief economist for CoreLogic. “Surging home prices this spring and summer, lower levels of inventory, and declining REO sale shares are all contributing to the nascent housing recovery and declining negative equity.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 59 percent, followed by Florida (43 percent), Arizona (40 percent), Georgia (36 percent) and Michigan (33 percent). These top five states combined account for 34.1 percent of the total amount of negative equity in the U.S."

The second graph shows the distribution of home equity. Close to 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But some borrowers are close.

The second graph shows the distribution of home equity. Close to 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But some borrowers are close.More from CoreLogic: "As of Q2 2012, there were 1.8 million borrowers who were only 5 percent underwater. If home prices continue increasing over the next year, these borrowers could move out of a negative equity position."

This is some improvement, but there are still 10.8 million residential properties with negative equity.