by Calculated Risk on 4/05/2021 10:05:00 AM

Monday, April 05, 2021

ISM® Services Index increased to "all-time high of 63.7%" in March

(Posted with permission). The March ISM® Services index was at 55.3%, up from 55.3% last month. The employment index increased to 57.2%, from 52.7%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in March for the 10th month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.The employment index increased to 57.2% from 52.7% in February.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI® registered an all-time high of 63.7 percent, 8.4 percentage points higher than the February reading of 55.3 percent. The previous high was in October 2018, when the Services PMI® registered 60.9 percent. The March reading indicates the 10th straight month of growth for the services sector, which has expanded for all but two of the last 134 months.”

Nieves continues, “For further historical context, the Services PMI® debuted as the Non-Manufacturing NMI® in 2008, although subindex data was collected for years in advance. In August 1997, the four subindexes — Business Activity, New Orders, Employment and Supplier Deliveries — that make up the Services PMI® would have calculated a composite-index reading of 62 percent.

“The Supplier Deliveries Index registered 61 percent, up 0.2 percentage point from February’s reading of 60.8 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

“The Prices Index figure of 74 percent is 2.2 percentage points higher than the February reading of 71.8 percent, indicating that prices increased in March, and at a faster rate. According to the Services PMI®, all 18 services industries reported growth. The composite index indicated growth for the 10th consecutive month after a two-month contraction in April and May. There was a substantial increase in the rate of growth in the services sector in March. Respondents’ comments indicate that the lifting of coronavirus (COVID-19) pandemic-related restrictions has released pent-up demand for many of their respective companies’ services. Production-capacity constraints, material shortages, weather and challenges in logistics and human resources continue to cause supply chain disruption,” says Nieves.

emphasis added

Seven High Frequency Indicators for the Economy

by Calculated Risk on 4/05/2021 08:28:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of April 4th.

The seven day average is down 37.7% from the same week in 2019 (62.3% of last year). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - and TSA data has picked up in 2021.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through April 3, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is picking up again - and is above 2019 in Texas and Florida.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $40 million last week, down about 78% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Even when occupancy increases to 2009 levels, hotels will still be hurting.

This data is through March 27th. Hotel occupancy is currently down 16.7% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of March 26th, gasoline supplied was off about 2.6% (about 974.4% of the same week in 2019).

Gasoline supplied was up year-over-year, since at one point, gasoline supplied was off almost 50% YoY in 2020.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through April 3rd for the United States and several selected cities.

This data is through April 3rd for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 63% of the January 2020 level. It is at 59% in Chicago, and 58% in Houston (the Houston dip was a weather related decline) - and moving up recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, April 2nd.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, April 04, 2021

Sunday Night Futures

by Calculated Risk on 4/04/2021 06:17:00 PM

Weekend:

• Schedule for Week of April 4, 2021

Monday:

• At 10:00 AM ET, the ISM Services Index for March.

• During the Day, NY Fed, SCE Housing Survey: Data update

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 15 and DOW futures are up 150 (fair value).

Oil prices were up over the last week with WTI futures at $61.45 per barrel and Brent at $64.86 per barrel. A year ago, WTI was at $28, and Brent was at $24 - so WTI oil prices are UP sharply year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.86 per gallon. A year ago prices were at $1.87 per gallon, so gasoline prices are up $0.99 per gallon year-over-year.

April 4th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/04/2021 04:11:00 PM

Note: I've been posting this data daily for over a year. I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 165.1 million doses have been administered. 23.2% of the population over 18 is fully vaccinated, and 40.2% of the population over 18 has had at least one dose (103.7 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

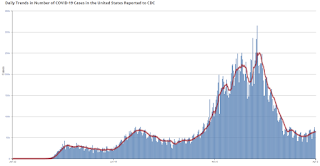

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Brief Discussion: The Impact of Rising Mortgage Rates on Home Sales and House Prices

by Calculated Risk on 4/04/2021 09:36:00 AM

CR Note: There is quite a bit of information (and charts) in this article by Matthew Graham at MortgageNewsDaily: Who's Lying About The Housing Market?. Here are a few excerpts on the impact of mortgage rates on home sales and house prices.

CR Note: There is much more in the article. As Graham notes, inventory is the key,Click on graph for larger image.

The inventory situation may mean that prices remain more resilient in the current housing cycle despite the recent surge in interest rates. Even then, past examples of rate spikes have only had moderate impacts on housing.

Using the same home sales data from above, let's highlight previous rate spikes so we can see the impact...

There was a big rate spike at the end of 2016 that had no discernible effect on prices. This is notable because that rate spike was fueled by economic optimism as opposed to 2013's rate spike which happened after the Fed said they would begin decreasing their rate-friendly bond buying program. 2018 was somewhat similar as the Fed was continuing to tighten monetary policy and raise short term interest rates.

A case could be made that the current rate spike shares some similarities with 2016. The path of 10yr Treasury yields (a benchmark for longer term rates like mortgages) has largely traced pandemic progress and economic recovery hopes. Yields (aka rates) began rising late last summer as vaccine trials showed promising results and economic data began to improve.

Bottom line, it is a rising rate environment until further notice. If we don't see a negative turn of events for the economy, rates will eventually run out of steam for other reasons. But that could take time, and the overall rate spike could rival the worst past examples by the time it fully runs its course.

Saturday, April 03, 2021

April 3rd COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/03/2021 03:39:00 PM

Note: I've been posting this data daily for over a year. I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 161.7 million doses have been administered. 23.1% of the population over 18 is fully vaccinated, and 40.1% of the population over 18 has had at least one dose (103.5 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Schedule for Week of April 4, 2021

by Calculated Risk on 4/03/2021 08:11:00 AM

This will be a light week for economic data.

The key report this week is the Trade Deficit on Wednesday.

10:00 AM: the ISM Services Index for March.

During the Day: NY Fed, SCE Housing Survey: Data update

8:00 AM: Corelogic House Price index for February.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 6.917 million from 6.752 million in December.

The number of job openings (yellow) were down 3.3% year-over-year, and Quits were down 7.2% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $70.3 billion. The U.S. trade deficit was at $68.2 billion in January.

2:00 PM: FOMC Minutes, Minutes Meeting of March 16-17, 2021

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 700 thousand from 719 thousand last week.

12:00 PM: Discussion, Fed Chair Jerome Powell, The Global Economy, At the International Monetary Fund Debate on the Global Economy

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for a 0.5% increase in PPI, and a 0.2% increase in core PPI.

Friday, April 02, 2021

April 2nd COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/02/2021 03:44:00 PM

Note: I've been posting this data daily for over a year. I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 157.6 million doses have been administered. 22.4% of the population over 18 is fully vaccinated, and 39.2% of the population over 18 has had at least one dose (101.8 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

March Vehicles Sales increased to 17.75 Million SAAR

by Calculated Risk on 4/02/2021 01:19:00 PM

Wards released their estimate of light vehicle sales for March yesterday. Wards estimates sales of 17.75 million SAAR in March 2021 (Seasonally Adjusted Annual Rate), up 13.3% from the February sales rate, and up 56% from March 2020 (sales collapsed in March 2020).

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the Wards' estimate for March (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 17.75 million SAAR.

Note: dashed line is current estimated sales rate of 17.75 million SAAR.Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 4/02/2021 12:09:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of March 30th.

From Black Knight: Servicers Continue to Work Through Forbearance Plans as U.S. Enters Fifth Consecutive Week of Improvement

The country saw yet another week of forbearance improvement this week, with active plans falling by 33,000 (-1.3%). This marks the fifth consecutive week of improvement and the longest such stretch since September 2020.The number of loans in forbearance has slowly declined over the last few months.

Weekly declines were seen across investor classes, with GSE plans down 15,000, FHA/VA plans down 12,000, and plan volumes among portfolio/PLS mortgages falling by 6,000 for the week.

This week’s improvement has pushed the number of active plans down by 172,000 (-6.3%) from last month, the largest such M/M improvement since November 2020. As of March 30, there are now 2.54 million active forbearance plans, representing 4.8% of all active mortgages.

Click on graph for larger image.

As anticipated, these improvements were driven by the large volume of forbearance plan reviews taking place in recent weeks. Entering March, 1.2 million plans were scheduled for review for removal/extension during the month; as of March 30, some 300,000 such scheduled expirations remain, with another 655,000 on tap for April. These numbers suggest we could see continued improvement in coming weeks as servicers continue to review plans with scheduled expirations for removal or extension.

We’ll have another forbearance update published here on this blog next Friday, April 9.

emphasis added