by Calculated Risk on 9/19/2009 10:47:00 PM

Saturday, September 19, 2009

Senator Dodd Pushing New Bank Regulatory Plan

From the NY Times: Leading Senator Pushes New Plan to Oversee Banks

[Sentator Dodd] is planning to propose the merger of four bank agencies into one super-regulator, an idea that is significantly different from what President Obama envisions.There is no question that the regulatory agencies reacted slowly to the obvious increase in risky loans in 2003 and 2004. I think any proposal should explain how a new "superagency" would have caught these problems earlier.

... the bill Mr. Dodd is preparing to make public in the coming weeks would be more ambitious and politically risky than the plan offered by the White House, which considered but then decided against combining the four banking agencies — the Federal Reserve, the Office of Thrift Supervision, the Federal Deposit Insurance Corporation and the Comptroller of the Currency — into one superagency.

...

In the House, Representative Barney Frank of Massachusetts, a Democrat and the chairman of the Financial Services Committee, has been working on legislation that is closer to the Obama plan on consolidation of the agencies.

...

Mr. Dodd has also rejected the administration’s proposal to have the Fed play the leading role as a so-called “systemic risk” regulator that examines the connections between regulated and unregulated companies for trouble spots that could disrupt the markets.

Need a hideout?

by Calculated Risk on 9/19/2009 06:51:00 PM

From the Chicago Sun Times: Capone lodge up for auction

Al Capone's "hideout retreat" in Wisconsin [is up for auction] minimum bid required: $2.5 million.A nice little hideaway ... maybe there is a secret vault ... hey, paging Geraldo!

"Located in the beautiful Northwoods of Wisconsin" near Couderay, the property includes 407 acres with a 37-acre private lake, according to an ad placed on the property announcing the foreclosure sale by Chippewa Valley Bank.

The buyer will get the original 1920s main lodge made of native fieldstone and featuring a massive split fieldstone fireplace. The sale also includes an eight-car garage renovated into a bar and restaurant, a bunkhouse, year-round caretaker's residence, guard tower and other outbuildings ...

Report: Strategic Defaults a "Growing Problem"

by Calculated Risk on 9/19/2009 11:55:00 AM

From Kenneth Harney at the LA Times: Homeowners who 'strategically default' on loans a growing problem

National credit bureau Experian teamed with consulting company Oliver Wyman to identify the characteristics and debt management behavior of the growing numbers of homeowners who bail out of their mortgages with none of the expected warning signs, such as nonpayments on other debts.This fits with recent research from Guiso, Sapienza and Zingales: See New Research on Walking Away and here is their paper: Moral and Social Constraints to Strategic Default on Mortgages

...

[Some results:]

...The number of strategic defaults is far beyond most industry estimates -- 588,000 nationwide during 2008, more than double the total in 2007. ... Strategic defaulters often go straight from perfect payment histories to no mortgage payments at all. ... Strategic defaults are heavily concentrated in negative-equity markets ...

Leonhardt: Wages Grow for Those With Jobs

by Calculated Risk on 9/19/2009 08:36:00 AM

I've been asked many times what people should do financially during a recession. My first answer has always been "Keep your job if you can!"

Earlier this week, David Leonhardt at the NY Times wrote: Wages Grow for Those With Jobs, New Figures Show

Even though unemployment has reached its highest level in 26 years, most workers have received a raise over the last year.From an earlier post, here is a graph of hires and separations from the BLS "Job Openings and Labor Turnover Survey" (JOLTS) survey. The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers.

That contrast highlights what I think is one of the more overlooked features of the Great Recession. In the job market, at least, the recession’s pain has been unusually concentrated.

...

People who have lost their jobs are struggling terribly to find new ones. Since the downturn began in 2007, companies have been extremely reluctant to hire new workers, and few new companies have started. The economy and the job market are churning very slowly.

...

Try thinking of it this way: All of the unemployed people in the country are gathered in a huge gymnasium that’s been turned into a job search center. The fact that this recession is the worst in a generation means that there are many, many people in the gym. The fact that the economy is churning so slowly means that there is not much traffic into and out of the gym.

If you’re inside, you will have a hard time getting out. Yet if you’re lucky enough to be outside the gym, you will probably be able to stay there. The consequences of a job loss are terribly high, but — given that the unemployment rate is almost 10 percent — the odds of job loss are surprisingly low.

Note: Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows hires (Green Line), Quits (blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and blue added together equals total separations. Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (green line) and separations (red and blue together) are pretty close each month. When the green line is above total separations, the economy is adding net jobs, when the green line is below total separations, the economy is losing net jobs.

Total separation and hires have both declined recently - the lower "churn" that Leonhardt discusses, and the reason so many people are stuck in the "gymnasium".

Friday, September 18, 2009

Problem Bank List (Unofficial) Sept 18, 2009

by Calculated Risk on 9/18/2009 09:15:00 PM

This is an unofficial list of Problem Banks.

Note: Bank failures today, Irwin Union Bank, F.S.B., Louisville, KY, and Irwin Union Bank and Trust Company, Columbus, IN, were on this list.

Changes and comments from surferdude808:

There were large changes to Unofficial Problem Bank List as the OCC released some of its newly issued actions for late July and early August.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The list increased by a net of 12 institutions to 436 from 424 last week. Assets increased by $7.4 billion to $294 billion. There were five removals with assets of $8.5 including three failures -- Corus Bank, N.A. ($7 billion), Venture Bank ($991 million), and Brickwell Community Bank ($72.5 million); and two action terminations (First National Bank of Colorado City and Cumberland Valley National Bank).

Interestingly, last week Hometown National Bank, Longview, WA was removed as the OCC terminated a Formal Agreement only for them to be added back to this week’s list as the OCC subsequently placed Hometown under a Cease & Desist Order.

Of the 17 additions this week are several subsidiary banks of the privately controlled bank holding company FBOB Corporation based in Chicago, IL. These include the Park National Bank, Chicago, IL ($4.8 billion), San Diego National Bank, San Diego, CA ($3.4 billion), and Pacific National Bank, San Francisco, CA ($2.1 billion). The Federal Reserve issued a Written Agreement against FBOB Corporation on Sept 14, 2009. FBOB Corporation has assets of $18.3 billion and controls nine institutions supervised by either the OCC or FDIC with five subject to a formal enforcement action.

Other sizable additions to the list this week include the $1.2 billion asset Metrobank, National Association, Houston, TX, and the $1.1 billion asset Atlantic Southern Bank, Macon, GA.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures #93 & 94: Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana

by Calculated Risk on 9/18/2009 05:15:00 PM

Two Irwin Banks burn away

Incandescent heat

by Soylent Green is People

From the FDIC: First Financial Bank, National Association, Hamilton, Ohio, Assumes All of the Deposits of Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana

Federal and state regulators today closed Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana, respectively. The institutions are banking subsidiaries of Irwin Financial Corporation, Columbus, Indiana. The regulators immediately named the Federal Deposit Insurance Corporation (FDIC) as the receiver for the banks. ...A two-fer to start BFF.

Irwin Union Bank and Trust Company, Columbus, Indiana, was closed by the Indiana Department of Financial Institutions. As of August 31, 2009, it had total assets of $2.7 billion and total deposits of approximately $2.1 billion. Irwin Union Bank, F.S.B., Louisville, Kentucky, was closed by the Office of Thrift Supervision. As of August 31, 2009, it had total assets of $493 million and total deposits of approximately $441 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for both institutions will be $850 million. ... The failure of the two institutions brings the nation's total number this year to 94. This was the first failure of the year in Indiana and Kentucky. The last FDIC-insured institutions closed in the respective states were The Rushville National Bank, Rushville, Indiana, on December 18, 1992, and Future Federal Savings Bank, Louisville, Kentucky, on August 30, 1991.

Market, “I.B.G. - Y.B.G.” and Fed MBS and Treasury Purchases

by Calculated Risk on 9/18/2009 04:11:00 PM

While we wait for the FDIC (HomeGnome has a poll each week in the comments!): Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And from Eric Dash at NY Times Economix: What’s Really Wrong With Wall Street Pay?

Note: “I.B.G. - Y.B.G.” stands for what happens - from a trader's perspective - if a huge trade goes South: "I’ll Be Gone and You’ll Be Gone"

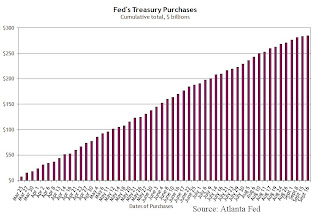

And since we've been discussing the possible impact of Fed purchases on mortgage rates, from the Atlanta Fed weekly Financial Highlights:  From the Atlanta Fed:

From the Atlanta Fed:

On September 15, the Fed purchased $2.05 billion in Treasuries, roughly in the 10-17 year sector; on September 16, it purchased $1.799 billion in the one-to-two year sector. It has purchased a total of $285.2 billion of Treasury securities through September 16. The Fed plans to purchase $300 billion by the end of October, or about six weeks from now, which makes for a pace of about $2.5 billion in purchases per week.

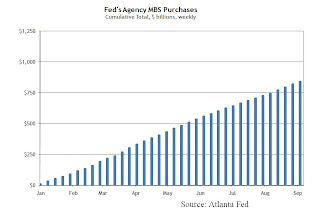

And from the Atlanta Fed:

And from the Atlanta Fed: The Treasury purchases have slowed and will end in six weeks. The MBS purchases are ongoing.The Fed has purchased a net total of $18.8 billion of agency MBS between September 3 and 9. It bought $3.6 billion of Freddie Mac, $12.4 billion of Fannie Mae, and $2.9 billion of Ginnie Mae. The Fed’s cumulative MBS purchases have reached $840.1 billion, and it has announced plans to purchase up to $1.25 trillion by the end of the year.

Hamilton on Regulating Banking Sector Compensation

by Calculated Risk on 9/18/2009 02:09:00 PM

Professor Hamilton, at Econbrowser, excerpts from the WSJ on curbing bankers' pay, and adds some important comments: Regulating compensation in the banking sector

One of the key questions for understanding the causes of our current problems is the following. Suppose that in 2005, the individuals who were putting together securities derived from subprime and alt-A mortgage loans could have known, with perfect foresight, events that were going to unfold in 2008. Would they have still done the same things they did in 2005? My concern is that, for many individuals, the answer might be "yes", insofar as they were richly rewarded personally in 2005 for making exactly the decisions they did. It was other parties (namely you and me) who later down the road were forced to absorb the downside of their gambles. Capitalism functions well when individuals are rewarded for making socially productive decisions. It is a disaster when individuals are rewarded for making socially destructive decisions. For this reason, I am quite supportive of the broad idea of the above proposal.For some people I don't think there is any question the answer would have been "yes". For many others, they would have ignored the "perfect foresight", and rationalized away the risks. The result is the same, but the second group can feel better about themselves while living large.

Hamilton also adds some comments on regulatory capture - another important issue.

Unemployment Rates: California, Nevada, and Rhode Island set new series highs

by Calculated Risk on 9/18/2009 11:26:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Twenty-seven states and the District of Columbia reported over-the-month unemployment rate increases, 16 states registered rate decreases, and 7 states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia.

...

Fourteen states and the District of Columbia reported jobless rates of at least 10.0 percent in August. Michigan continued to have the highest unemployment rate among the states, 15.2 percent. Nevada recorded the next highest rate, 13.2 percent, followed by Rhode Island, 12.8 percent, and California and Oregon, 12.2 percent each. The rates in California, Nevada, and Rhode Island set new series highs.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Fourteen states and D.C. now have double digit unemployment rates.

Illinois, Indiana, and Georgia are all close.

Four states are at record unemployment rates: Rhode Island, Oregon, Nevada, and California. Several others - like Florida and Georgia - are close.

FDIC's Bair: DIF May Borrow from Treasury

by Calculated Risk on 9/18/2009 10:26:00 AM

From the WSJ: FDIC Considers Borrowing From Treasury to Shore Up Deposit Insurance

Federal Deposit Insurance Corp. Chairman Sheila Bair said her agency is considering borrowing from the U.S. Treasury to replenish its deposit insurance fund.UPDATE: Bair is responding to comments by Barney Frank (see this speech at 25 mins, ht Kevin)

"We are carefully considering all options" including borrowing from the Treasury, Ms. Bair said Friday after a speech in Washington.

Here is a reference to a recent letter from Sen Levin, via Dow Jones: FDIC Should Borrow From Tsy, Not Charge Banks Fee

Sen. Carl Levin, D-Mich. ... said in a letter to FDIC Chair Sheila Bair that he was concerned about the possibility of the agency charging banks a second special assessment this year. ... Such fees could hurt smaller banks, Levin wrote.The Deposit Insurance Fund (DIF) had $10.4 billion in assets at the end of Q2, but the total reserves were $42 billion. Note that accounting for the DIF includes reserves against estimate future losses, so that is the difference between the total reserves and the reported assets. Total reserves of the Deposit Insurance Fund (DIF) stood at $42 billion. From the FDIC:

"Adding yet another major financial obligation during this crisis could further deplete the capital of these small financial institutions, making it difficult for them to extend the credit needed to turn our economy around," Levin said in the letter.

Just as insured institutions reserve for loan losses, the FDIC has to provide for a contingent loss reserve for future failures. To the extent that the FDIC has already reserved for an anticipated closing, the failure of an institution does not reduce the DIF balance. The contingent loss reserve, which totaled $28.5 billion on March 31, rose to $32.0 billion as of June 30, reflecting higher actual and anticipated losses from failed institutions. Additions to the contingent loss reserve during the second quarter caused the fund balance to decline from $13.0 billion to $10.4 billion. Combined, the total reserves of the DIF equaled $42.4 billion at the end of the quarter.Of course the FDIC cut a check to MB Financial Bank last week for approximately $4 billion as part of the Corus Bank seizure. For the Corus deal, MB Financial Bank assumed all of the deposits of Corus Bank (approximately $7 billion) and agreed to purchase approximately $3 billion of the assets (mostly cash and marketable securities). The FDIC wrote a check for the difference. The FDIC retained the remaining $4 billion in assets for later disposal, and estimated the losses would be $1.7 billion. But writing a $4 billion check was a significant hit to the cash reserves of the DIF.