by Calculated Risk on 5/24/2015 10:01:00 PM

Sunday, May 24, 2015

Hotels: RevPAR up almost 50% since 2009

Revenue per available room (RevPAR) is now at $85.50. In May 2009, RevPAR had fallen to $58.39. So, RevPAR is up 46.9% over the last 6 years - and the occupancy rate will probably be at a new record high this year. A great year for hotels!

From HotelNewsNow.com: STR: US hotel results for week ending 16 May

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 10-16 May 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year measurements, the industry’s occupancy increased 0.5 percent to 70.3 percent. Average daily rate increased 5.2 percent to finish the week at US$122.10. Revenue per available room for the week was up 5.7 percent to finish at US$85.80.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above last year.

Right now 2015 is even above 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Report: Greece will not make June IMF Payment

by Calculated Risk on 5/24/2015 11:30:00 AM

From the WSJ: Greece Won’t Meet IMF Repayments in June, Interior Minister Says

Greece said Sunday that it won’t have the money it is due to repay to the International Monetary Fund next month unless it strikes a deal with international creditors over further rescue funding.

Interior Minister Nikos Voutsis told privately owned television station Mega that Greece is scheduled to repay €1.6 billion ($1.76 billion) to the IMF between June 5-19, but the payments cannot be met.

“This money will not be given,” he said. “It does not exist.”

Saturday, May 23, 2015

Schedule for Week of May 24, 2015

by Calculated Risk on 5/23/2015 08:31:00 AM

The key reports this week are April New Home sales on Tuesday, the 2nd estimate of Q1 GDP on Friday, and March Case-Shiller house prices on Tuesday.

For manufacturing, the May Richmond and Dallas Fed surveys will be released this week.

All US markets will be closed in observance of Memorial Day.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

9:00 AM: FHFA House Price Index for March 2015. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March prices.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the February 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the Comp 20 index for March. The Zillow forecast is for the National Index to increase 4.2% year-over-year in March, and for prices to increase 1.0% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an increase in sales to 509 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 481 thousand in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

10:30 AM: Dallas Fed Manufacturing Survey for May.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Regional and State Employment and Unemployment (Monthly), April 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 274 thousand.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.8% increase in the index.

8:30 AM: Gross Domestic Product, 1st quarter 2015 (second estimate). The consensus is that real GDP decreased 0.9% annualized in Q1, revised down from the 0.2% advance estimate.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 53.0, up from 52.3 in April.

10:00 AM: University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 90.0, up from the preliminary reading of 88.6, and down from the April reading of 95.9.

Friday, May 22, 2015

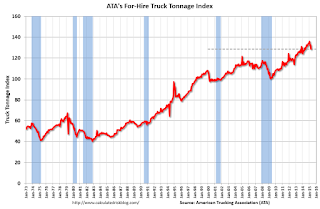

ATA Trucking Index decreased 3% in April

by Calculated Risk on 5/22/2015 04:01:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Fell 3% in April

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index fell 3% in April, following a revised gain of 0.4% during the previous month. In April, the index equaled 128.6 (2000=100), which was the lowest level since April 2014. The all-time high is 135.8, reached in January 2015.

Compared with April 2014, the SA index increased just 1%, which was well below the 4.2% gain in March and the smallest year-over-year gain since February 2013. ...

“Like most economic indicators, truck tonnage was soft in April,” said ATA Chief Economist Bob Costello. “Unless tonnage snaps back in May and June, GDP growth will likely be suppressed in the second quarter.”

Costello added that truck tonnage is off 5.3% from the high in January.

“The next couple of months will be telling for both truck freight and the broader economy. Any significant jump from the first quarter is looking more doubtful,” he said.

Trucking serves as a barometer of the U.S. economy, representing 68.8% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled just under 10 billion tons of freight in 2014. Motor carriers collected $700.4 billion, or 80.3% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 1.0% year-over-year.

Yellen: Expect Rate Hike in 2015, Several Years before Fed Funds Rate "back to normal" level

by Calculated Risk on 5/22/2015 01:18:00 PM

From Fed Chair Janet Yellen: The Outlook for the Economy

[I]f the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy. To support taking this step, however, I will need to see continued improvement in labor market conditions, and I will need to be reasonably confident that inflation will move back to 2 percent over the medium term.

After we begin raising the federal funds rate, I anticipate that the pace of normalization is likely to be gradual. The various headwinds that are still restraining the economy, as I said, will likely take some time to fully abate, and the pace of that improvement is highly uncertain. If conditions develop as my colleagues and I expect, then the FOMC's objectives of maximum employment and price stability would best be achieved by proceeding cautiously, which I expect would mean that it will be several years before the federal funds rate would be back to its normal, longer-run level.

Having said that, I should stress that the actual course of policy will be determined by incoming data and what that reveals about the economy. We have no intention of embarking on a preset course of increases in the federal funds rate after the initial increase. Rather, we will adjust monetary policy in response to developments in economic activity and inflation as they occur. If conditions improve more rapidly than expected, it may be appropriate to raise interest rates more quickly; conversely, the pace of normalization may be slower if conditions turn out to be less favorable.

emphasis added

Key Measures Show Low Inflation in April

by Calculated Risk on 5/22/2015 11:54:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.2% annualized rate) in April. The CPI less food and energy rose 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.8%. Core PCE is for March and increased 1.35% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 3.1% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is slightly above 2%).

The key question for the Fed is if these key measures will move back towards 2%.

BLS: CPI increased 0.1% in April, Core CPI increased 0.3%

by Calculated Risk on 5/22/2015 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in April on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index declined 0.2 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.1% increase for CPI, and above the forecast of a 0.1% increase in core CPI.

The index for all items less food and energy rose 0.3 percent in April and led to the slight increase in the seasonally adjusted all items index.

emphasis added

Black Knight: Mortgage Delinquencies increased slightly in April

by Calculated Risk on 5/22/2015 07:01:00 AM

According to Black Knight's First Look report for April, the percent of loans delinquent increased 1% in April compared to March, and declined 15% year-over-year.

The percent of loans in the foreclosure process declined 2% in March and were down 25% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.77% in April, up from 4.70% in March.

The percent of loans in the foreclosure process declined in April to 1.51%. This was the lowest level of foreclosure inventory since January 2008.

The number of delinquent properties, but not in foreclosure, is down 406,000 properties year-over-year, and the number of properties in the foreclosure process is down 252,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for April in early June.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2015 | Mar 2015 | Apr 2014 | Apr 2013 | |

| Delinquent | 4.77% | 4.70% | 5.62% | 6.21% |

| In Foreclosure | 1.51% | 1.55% | 2.02% | 3.17% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,463,000 | 1,409,000 | 1,634,000 | 1,717,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 952,000 | 971,000 | 1,187,000 | 1,394,000 |

| Number of properties in foreclosure pre-sale inventory: | 764,000 | 782,000 | 1,016,000 | 1,588,000 |

| Total Properties | 3,179,000 | 3,162,000 | 3,837,000 | 4,699,000 |

Thursday, May 21, 2015

Friday: CPI, Yellen

by Calculated Risk on 5/21/2015 07:03:00 PM

Earlier from the Philly Fed: May Manufacturing Survey

Manufacturing activity in the region increased modestly in May, according to firms responding to this month’s Manufacturing Business Outlook Survey. Indicators for general activity, new orders, and shipments were positive but remain at low readings. Employment increased at the reporting firms, but the employment index moderated compared with April. Firms reported continued price reductions in May, with indicators for prices of inputs and the firms’ own products remaining negative. The survey’s indicators of future activity suggest that firms expect continuing growth in the manufacturing sector over the next six months.This was below the consensus forecast of a reading of 8.0 for May.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 7.5 in April to 6.7 in May. ...

Firms’ responses suggest some weakening in labor market conditions this month compared with April. ... The current employment index, however, fell 5 points, to 6.7.

emphasis added

Also the Kansas City Fed reported: Tenth District Manufacturing Activity Declined More Sharply

“Factories in our region saw an even sharper decline in May than in March or April, as exports fell further and energy-related producers saw another drop in orders,” said [Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City] “However, firms’ overall still plan a modest increase in employment over the next six to twelve months.”

...

Tenth District manufacturing activity declined more sharply in May than in previous months and producers’ expectations also fell, with both reaching their lowest levels since mid-2009. ... The month-over-month composite index was -13 in May, down from -7 in April and -4 in March ... Production fell most sharply in energy-producing states like Oklahoma and New Mexico, but it was also down in most other District states.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys increased slightly in May, and this suggests a another weak ISM report for May.

Friday:

• At 8:30 AM ET, the Consumer Price Index for April from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core CPI.

• At 1:00 PM, Speech by Fed Chair Janet L. Yellen, U.S. Economic Outlook, At the Greater Providence Chamber of Commerce Economic Outlook Luncheon, Providence, Rhode Island

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/21/2015 03:26:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in April.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase in foreclosures in Baltimore).

Short sales are down in these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers has been declining.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Apr-15 | Apr-14 | Apr-15 | Apr-14 | Apr-15 | Apr-14 | Apr-15 | Apr-14 | |

| Las Vegas | 7.2% | 12.4% | 8.3% | 11.4% | 15.5% | 23.8% | 30.4% | 41.4% |

| Reno** | 6.0% | 15.0% | 5.0% | 6.0% | 11.0% | 21.0% | ||

| Phoenix | 2.5% | 4.0% | 3.8% | 6.5% | 6.3% | 10.5% | 25.3% | 32.2% |

| Sacramento | 5.6% | 9.5% | 6.6% | 7.5% | 12.2% | 17.0% | 18.4% | 21.9% |

| Minneapolis | 2.9% | 5.1% | 9.2% | 16.0% | 12.0% | 21.1% | ||

| Mid-Atlantic | 4.5% | 5.9% | 12.9% | 10.0% | 17.3% | 15.9% | 17.2% | 19.5% |

| Orlando | 4.8% | 9.1% | 24.7% | 23.7% | 29.5% | 32.8% | 37.4% | 42.4% |

| Florida SF | 4.0% | 6.9% | 19.1% | 21.1% | 23.1% | 28.0% | 37.2% | 43.4% |

| Florida C/TH | 2.0% | 4.5% | 14.6% | 15.6% | 16.6% | 20.1% | 65.4% | 70.9% |

| Miami MSA SF | 6.2% | 10.5% | 18.4% | 16.5% | 24.7% | 27.0% | 37.8% | 44.4% |

| Miami MSA C/TH | 2.3% | 5.5% | 18.2% | 17.5% | 20.6% | 23.0% | 68.9% | 73.4% |

| Tampa MSA SF | 4.5% | 7.0% | 20.3% | 23.2% | 24.8% | 30.1% | 34.5% | 41.6% |

| Tampa MSA C/TH | 2.9% | 4.6% | 15.5% | 18.8% | 18.4% | 23.3% | 60.8% | 66.7% |

| So. California* | 4.4% | 5.0% | 4.5% | 5.2% | 8.9% | 10.2% | ||

| Chicago (city) | 20.3% | 27.3% | ||||||

| Hampton Roads | 22.2% | 24.4% | ||||||

| Northeast Florida | 28.9% | 38.0% | ||||||

| Hampton Roads | 22.2% | 24.4% | ||||||

| Tucson | 27.1% | 30.5% | ||||||

| Toledo | 30.2% | 33.4% | ||||||

| Wichita | 19.8% | 25.1% | ||||||

| Des Moines | 13.8% | 17.1% | ||||||

| Peoria | 17.3% | 21.2% | ||||||

| Georgia*** | 21.6% | 34.3% | ||||||

| Omaha | 16.4% | 22.3% | ||||||

| Pensacola | 32.3% | 35.6% | ||||||

| Knoxville | 23.1% | 25.3% | ||||||

| Richmond VA MSA | 11.5% | 15.4% | 18.2% | 22.5% | ||||

| Memphis | 16.1% | 17.3% | ||||||

| Springfield IL** | 10.3% | 13.2% | 17.9% | N/A | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||