by Calculated Risk on 5/02/2014 01:55:00 PM

Friday, May 02, 2014

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

By request, here is an update on an earlier post through the April employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is just starting the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Fifteen months into Mr. Obama's second term, there are now 4,986,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 710,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level. Right now I'm expecting some increase in public employment in 2014.

Comments on Employment Report

by Calculated Risk on 5/02/2014 10:30:00 AM

First, as always, we shouldn't read too much into any one report. Also there was probably some weather related bounce back in this report (one of the reasons I took the "over" yesterday).

Through the first four months of 2014, the economy has added 857,000 payroll jobs - slightly better than during the same period in 2013 even with the severe weather early this year. (For comparison, there were 821,000 payroll jobs added during the first four months of 2013). My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year, and that still looks about right.

Here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

It is possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,177 | 2,716 |

| 2000 | 1,946 | 1,682 |

| 2001 | -1,735 | -2,286 |

| 2002 | -508 | -741 |

| 2003 | 105 | 147 |

| 2004 | 2,033 | 1,886 |

| 2005 | 2,506 | 2,320 |

| 2006 | 2,085 | 1,876 |

| 2007 | 1,140 | 852 |

| 2008 | -3,576 | -3,756 |

| 2009 | -5,087 | -5,013 |

| 2010 | 1,058 | 1,277 |

| 2011 | 2,083 | 2,400 |

| 2012 | 2,236 | 2,294 |

| 2013 | 2,331 | 2,365 |

| 20141 | 2,571 | 2,526 |

| 1 2014 is current pace annualized (through April). | ||

And we are almost to another milestone: total employment is now only 113,000 below the previous peak, and I expect total employment will be at a new high in May. Of course the labor force has continued to increase over the last 6+ years, and there are still millions of workers unemployed - so the economy still has a long way to go.

Note: Private payroll employment increased 273 thousand in April and private employment is now 406,000 above the previous peak (the unprecedented large number of government layoffs has held back total employment).

Overall this was a solid employment report.

Earlier: April Employment Report: 288,000 Jobs, 6.3% Unemployment Rate

Employment-Population Ratio, 25 to 54 years old

Since the overall participation rate declined recently due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate declined recently due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The 25 to 54 participation rate declined in April to 80.8% from 81.2% in March, and the 25 to 54 employment population ratio decreased to 76.5% from 76.7%. As the recovery continues, I expect the participation rate for this group to increase.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next month (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 7.5 million in April. These individuals were working part time because their hours had been cut back or because they were unable to find full-time work.This suggests significantly slack in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 12.3% in April from 12.7% in March.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.452 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 3.739 in March. This is trending down, but is still very high.

Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In April 2014, state and local governments added 18,000 jobs. State and local government employment is now up 104,000 from the bottom, but still 640,000 below the peak.

It appears state and local employment employment has bottomed. Of course Federal government layoffs are ongoing.

April Employment Report: 288,000 Jobs, 6.3% Unemployment Rate

by Calculated Risk on 5/02/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 288,000, and the unemployment rate fell by 0.4 percentage point to 6.3 percent in April, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for February was revised from +197,000 to +222,000, and the change for March was revised from +192,000 to +203,000. With these revisions, employment gains in February and March were 36,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.The headline number was well above expectations of 215,000 payroll jobs added.

The first graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Employment is 0.1% below the pre-recession peak (113 thousand fewer total jobs - almost back). Private employment is now solidly above the pre-recession peak by 406 thousand.

NOTE: The second graph is the change in payroll jobs ex-Census - meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was decreased in April to 62.8%. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The Employment-Population ratio was unchanged in April at 58.9% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was declined sharply in April at 6.3%.

This was a solid employment report, and including revisions, was well above expectations.

I'll have much more later ...

Thursday, May 01, 2014

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 5/01/2014 08:01:00 PM

Speaking of jobs, the Office of Inspector General released their report on the claims that the unemployment rate was manipulated prior to the 2012 election: Unsubstantiated Allegations that the Philadelphia Regional Office Manipulated the Unemployment Survey Leading up to the 2012 Presidential Election to Cause a Decrease in the National Unemployment Rate

In October 2013, OIG received information alleging that management in the U.S. Census Bureau’s Philadelphia Regional Office instructed staff to falsify survey responses on the AHS and the CPS. Following this complaint, additional allegations were presented in various media publications, which reported widespread data falsification in the Census Bureau’s Philadelphia Regional Office.Jack Welch should not only apologize for his false accusations, but he should pay the cost of the investigation!

OIG thoroughly investigated these allegations, and found no evidence that management in the Philadelphia Regional Office instructed staff to falsify data at any time for any reason. Further, we found no evidence of systemic data falsification in the Philadelphia Regional Office. Addressing allegations raised in the media, we found no evidence that the national unemployment rate was manipulated by staff in the Philadelphia Regional Office in the months leading up to the 2012 presidential election.

Friday:

• At 8:30 AM ET, the Employment Report for April. The consensus is for an increase of 215,000 non-farm payroll jobs in April, up from the 192,000 non-farm payroll jobs added in March. The consensus is for the unemployment rate to decline to 6.6% in April

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is for a 1.3% increase in March orders.

Employment Report Preview for April

by Calculated Risk on 5/01/2014 05:45:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus, according to Bloomberg, is for an increase of 215,000 non-farm payroll jobs in April (range of estimates between 190,000 and 279,000), and for the unemployment rate to decline to 6.6%.

Note: The BLS reported 192,000 payroll jobs added in March with the unemployment rate at 6.7%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 220,000 private sector payroll jobs in April. This was close to expectations of 210,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index increased in April to 54.7%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 6,000 in April. The ADP report indicated a 1,000 increase for manufacturing jobs in April.

This month the ISM non-manufacturing (service) report will be released on Monday, May 5th - after the release of the BLS employment report.

• Initial weekly unemployment claims averaged close to 320,000 in April. This was essentially unchanged from March. For the BLS reference week (includes the 12th of the month), initial claims were at 304,000; this was down from 323,000 during the reference week in March.

This suggests some upside to the consensus forecast.

• The final April Reuters / University of Michigan consumer sentiment index increased to 84.1 from the March reading of 80.0. This is frequently coincident with changes in the labor market, but there are other factors too.

• The small business index from Intuit showed a 25,000 increase in small business employment in April - the largest gain in a year:

“This month’s employment increase comes after three successive months with little-to-no small business employment growth. In fact, it’s the fastest rate we’ve seen over the past year,” said Susan Woodward, the economist who works with Intuit to create the indexes. “Despite this growth, these figures do not paint an optimistic picture. We still have an economy with high unemployment."• Conclusion: The ADP report was higher in April compared to the March report - and in line with most forecasts, weekly unemployment claims were low during the reference period, the Intuit small business index showed the most hiring in a year, and the ISM manufacturing survey suggests an increase in hiring (but the the service sector report isn't available). Most of the indicators suggest a solid employment report.

Also - it is possible that there will be some additional bounce back from the below trend employment reports over the winter (weather related).

There is always some randomness to the employment report, but the I'll take the over on the consensus forecast of 215,000 nonfarm payrolls jobs added in April.

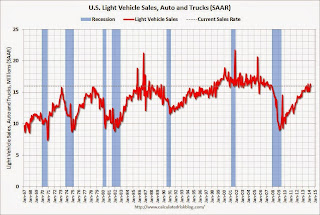

U.S. Light Vehicle Sales decrease to 16.0 million annual rate in April

by Calculated Risk on 5/01/2014 03:14:00 PM

Based on an AutoData estimate, light vehicle sales were at a 16.04 million SAAR in April. That is up 5.5% from April 2013, and down 2% from the sales rate last month.

This was below the consensus forecast of 16.2 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for April (red, light vehicle sales of 16.04 million SAAR from AutoData).

Severe weather clearly impacted sales in January and February, and some of the increase in March was probably a bounce back due to better weather. Sales in April were probably a return to trend.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales, and most forecasts are for around a small gain in 2014 to around 16.1 million light vehicles.

Lawler: Large home builders net orders last quarter "vitually flat" from year ago

by Calculated Risk on 5/01/2014 12:17:00 PM

M.D.C. Holdings reported that net home orders in the quarter ended March 31, 2014 totaled 1,236, down 4.9% from the comparable quarter of 2013. Net orders per active community were down 9.6% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 19% last quarter, up slightly from 18% a year earlier. Home deliveries last quarter totaled 873, down 14.2% from the comparable quarter of 2013, at an average sale price of $377,000, up 11.1% from a year ago. The company’s order backlog at the end of March was 1,625, down 15.7% from last March. M.D.C. owned or controlled 16,043 lots at the end of March, up 25.9% from a year ago, and the company’s active community count at the end of March was 157, up 13% from last March.

M.D.C. attributed the increase in its average sales price both to price appreciation in “many” of its markets and to a shift in the mix of homes closed. The biggest YOY declines in net orders per active community were in Nevada, Virginia, Maryland, and Arizona.

Beazer Homes reported that net home orders in the quarter ended March 31, 2014 totaled 1,390, down 8.6% from the comparable quarter of 2013. Beazer’s net orders per community last quarter were down 2.9% from a year earlier. The company’s sales cancellation rate, expressed as a % of gross orders, was 19.4% last quarter, up slightly from 18.7% a year ago. Home deliveries totaled 977 last quarter, down 13.3% from the comparable quarter of 2013, at an average sales price of $272,400, up 7.5% from a year ago. The company’s order backlog at the end of March was 2,163, down 2.2% from last March. Beazer owned or controlled 29,331 lots at the end of March, up 18.8% from last March.

Below are some summary stats for 8 large publicly-traded home builders.

As the table indicates, net orders at these eight builders combined last quarter were virtually flat from the comparable quarter of last year. While not all of these builders released active community count numbers, based on conference call comments I estimate that net orders per community for the eight builders as a whole last quarter were down about 6% from a year ago.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 3/14 | 3/13 | % Chg | 3/14 | 3/13 | % Chg | 3/14 | 3/13 | % Chg |

| D.R. Horton | 8,569 | 7,879 | 8.8% | 6,194 | 5,463 | 13.4% | $271,230 | $242,548 | 11.8% |

| Pulte Group | 4,863 | 5,200 | -6.5% | 3,436 | 3,833 | -10.4% | $317,000 | $287,000 | 10.5% |

| NVR | 3,325 | 3,510 | -5.3% | 2,211 | 2,272 | -2.7% | $361,400 | $330,400 | 9.4% |

| The Ryland Group | 2,186 | 2,052 | 6.5% | 1,470 | 1,315 | 11.8% | $327,000 | $277,000 | 18.1% |

| Meritage Homes | 1,525 | 1,547 | -1.4% | 1,109 | 1,052 | 5.4% | $365,896 | $314,363 | 16.4% |

| M/I Homes | 982 | 1,047 | -6.2% | 737 | 627 | 17.5% | $299,000 | $284,000 | 5.3% |

| Total | 21,450 | 21,235 | 1.0% | 15,157 | 14,562 | 4.1% | $308,445 | $278,040 | 10.9% |

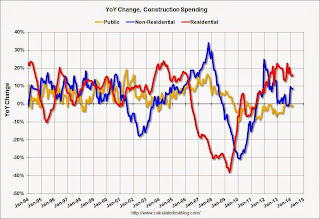

Construction Spending increased 0.2% in March, Public Construction Spending Lowest since 2006

by Calculated Risk on 5/01/2014 10:29:00 AM

The Census Bureau reported that overall construction spending increased in March:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during March 2014 was estimated at a seasonally adjusted annual rate of $942.5 billion, 0.2 percent above the revised February estimate of $940.8 billion. The March figure is 8.4 percent above the March 2013 estimate of $869.2 billion.Private spending increased and public spending decreased in March:

Spending on private construction was at a seasonally adjusted annual rate of $679.6 billion, 0.5 percent above the revised February estimate of $676.3 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $262.9 billion, 0.6 percent below the revised February estimate of $264.5 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 45% below the peak in early 2006, and up 62% from the post-bubble low.

Non-residential spending is 25% below the peak in January 2008, and up about 38% from the recent low.

Public construction spending is now 19% below the peak in March 2009 and at a new post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 16%. Non-residential spending is up 8 year-over-year. Public spending is down 1% year-over-year.

Looking forward, all categories of construction spending should increase in 2014. Residential spending is still very low, non-residential is starting to pickup, and public spending is probably near a bottom.

Note: Public construction spending is at the lowest level since 2006 (lowest since 2001 adjusted for inflation). Not investing more in infrastructure is probably one of the major policy failures of the last 5+ years.

ISM Manufacturing index increased in April to 54.9

by Calculated Risk on 5/01/2014 10:00:00 AM

The ISM manufacturing index suggests faster expansion in April than in March. The PMI was at 54.9% in April, up from 53.7% in March. The employment index was at 54.7%, up from 51.1% in March, and the new orders index was at 55.1%, unchanged from 55.1% in March.

From the Institute for Supply Management: April 2014 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in April for the 11th consecutive month, and the overall economy grew for the 59th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The April PMI® registered 54.9 percent, an increase of 1.2 percentage points from March's reading of 53.7 percent, indicating expansion in manufacturing for the 11th consecutive month. The New Orders Index registered 55.1 percent, equal to the reading in March, indicating growth in new orders for the 11th consecutive month. The Production Index registered 55.7 percent, slightly below the March reading of 55.9 percent. Employment grew for the 10th consecutive month, registering 54.7 percent, an increase of 3.6 percentage points over March's reading of 51.1 percent. Comments from the panel generally remain positive; however, some expressed concern about international economic and political issues potentially impacting demand."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 54.2%.

Weekly Initial Unemployment Claims increase to 344,000

by Calculated Risk on 5/01/2014 08:34:00 AM

The DOL reports:

In the week ending April 26, the advance figure for seasonally adjusted initial claims was 344,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 329,000 to 330,000. The 4-week moving average was 320,000, an increase of 3,000 from the previous week's revised average. The previous week's average was revised up by 250 from 316,750 to 317,000.The previous week was revised up from 329,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 320,000.

This was above the consensus forecast of 320,000. Even with the increase, the 4-week average is close to normal levels for an expansion.