by Calculated Risk on 9/22/2009 09:43:00 PM

Tuesday, September 22, 2009

WSJ: Delayed Foreclosures and "Shadow" Inventory

From Ruth Simon and James Hagerty at the WSJ: Delayed Foreclosures Stalk Market

... Legal snarls, bureaucracy and well-meaning efforts to keep families in their homes are slowing the flow of properties headed toward foreclosure sales, even when borrowers are in deep distress. ... some analysts believe the delays are ... creating a growing "shadow" inventory of pent-up supply that will eventually hit the market.The foreclosures are coming. How many and when is the question. But based on the comments from the BofA spokeswoman, it sounds like foreclosures will "spike" in Q4.

...

Ivy Zelman ... believes three million to four million foreclosed homes will be put up for sale in the next few years. The question is whether the flow of these homes onto the market will resemble "a fire hose or a garden hose or a drip," she says.

... "We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" for a loan modification or other alternatives, says a Bank of America Corp. spokeswoman. Foreclosure sales had dropped to "abnormally low" levels in response to government efforts to stem foreclosures, she adds.

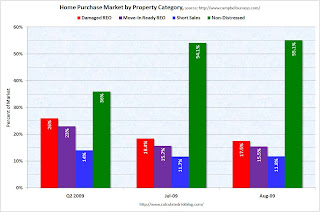

Home Purchase Market by Property Category

by Calculated Risk on 9/22/2009 06:28:00 PM

This is from a monthly survey by Campbell Communications (posted with permission).

Source: Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions, Campbell Communications, June 2009 Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Campbell survey broke REOs down into damaged and move-in ready. Distressed sales also include short sales.

Mark Hanson has pointed out that "organic" sales (non-distressed) have a seasonal pattern, and that distressed sales are basically steady all year. This new monthly data from Campbell Surveys should show that change in mix over the next few months.

A comment on Option ARMs

by Calculated Risk on 9/22/2009 04:11:00 PM

The impact of Option ARM recasts is a huge question mark.

Diana Olick at CNBC writes: ARM Payment Shock a Myth?

We've been talking a lot recently about the "next wave" of foreclosures that would be driven by adjustable rate mortgage resets. In a research note today, FBR's Paul miller is taking an interesting tack: "While we remain very concerned about the impact of continued job losses on default rates, our analysis suggests that payment shock from ARM resets should not be a problem, as long as the Federal Reserve can keep short-term rates at record lows."Stop right there. Resets are not a problem with low interest rates. The potential problems are from loan recasts.

From Tanta on resets and recasts:

"Reset" refers to a rate change. "Recast" refers to a payment change. ... "Recast" is really just a shorter word for "reamortize": you take the new interest rate, the current balance, and the remaining term of the loan, and recalculate a new payment that will fully amortize the loan over the remaining term.Since a large percentage of ARM borrowers chose the negatively amortizing option, their payments will jump when the loan is reamortized or recast. Of course the interest rate will still be low, and the recast will be at the low rate.

So it is really hard to tell what will happen.

We see cautionary articles all the time:

But I think the exact impact is uncertain. Many Option ARM borrowers are defaulting before the loan recasts, see: $134B of U.S. Option ARM RMBS To Recast by 2011 (note: Fitch is just looking at securitized Option ARMs, not loans in bank portfolios):

Of the $189 billion securitized Option ARM loans outstanding, 88% have yet to experience a recast event ... Of these loans that have not yet recast, 94% have utilized the minimum monthly payment to allow their loans to negatively amortize.For more on defaulting before recast, see: Option ARM Defaults Shrink Recast Wave, Barclays Says .

...

Further evidence of option ARM underperformance in the last year lies in the number of outstanding securitized Option ARMs either 90 days or more delinquent, in foreclosure or real estate-owned proceedings, which has increased from 16% to 37%. Total 30+ day delinquencies are now 46%, despite the fact that only 12% have recast and experienced an associated payment shock. Instead, negative and declining equity has presented a larger problem: due to high concentrations in California, Florida, and other states with rapidly declining home prices, average loan-to-value ratios have increased from 79% at origination to 126% today. 'Negative equity and payment shocks will continue as Option ARM loans recast in large numbers in the coming years,' said Somerville.

emphasis added

And it is important to remember that most of the Option ARM loans in the Wells Fargo portfolio (via Wachovia) recast in ten years, as noted by the Healdsburg Housing Bubble: Reset Chart from Credit Suisse has a Major Error From the Wells Fargo Q2 Conference Call:

[W]hile many other option ARM loans have recast periods as short as five years, our Pick-a-Pay loans generally have ten-year contractual recasts. As a result, we have virtually no loans where the terms recast over the next three years, allowing us more time to work with borrowers as they weather the current economic downturn.It is a little confusing. You can't just look at a chart of coming recasts and know when borrowers will default. The real problem for Option ARMs is negative equity, and the surge in defaults is happening before the loans recast.

But the recasts will matter too, since many of these borrowers used these mortgages as "affordability products", and bought the most expensive homes they could "afford" (based on monthly payments only). When the recasts arrive, these borrowers will have few options.

The Housing Tax Credit Debate is Heating Up

by Calculated Risk on 9/22/2009 02:36:00 PM

Really not much of a debate - most economists, left and right - oppose it.

Patrick Coolican has a great overview: Economists say extending tax credit for first-time homebuyers is bad policy

[I]t’s not surprising that Nevada’s congressional delegation has signed on to a plan to extend the credit and even make it more generous.And from economists:

“It’s working,” says Rep. Dina Titus, the 3rd District Democrat. “You can see the positive impact of it. It really is stimulating the economy, helping Realtors and developers and homebuilders and individual homebuyers.”

“It’s terrible policy,” says Mark Calabria of the libertarian Cato Institute.There is much much more in the article.

“It’s awful policy,” says Andrew Jakabovics, associate director for housing and economics at the liberal Center for American Progress. “It’s incredibly expensive. It’s not well targeted.”

...

“We paid $8,000 to at least 1.5 million people to do something they were going to do anyway,” Jakabovics says.

...

“A heck of a lot of people would have bought the house anyway,” says Ted Gayer, an economist at the Brookings Institution.

...

The tax break, due to expire at the end of November, is on track to cost $15 billion, twice what Congress had planned. In other words, it will cost $43,000 for every new homebuyer who would not have bought a house without the tax break.

Gayer also questions whether moving people from renting to owning is really all that useful ...

The tax credit is one, albeit very expensive, way to create more households, but rental vouchers to get people out of their parents’ basements should also be considered, economists say.

Here is a post estimating the cost of an additional housing unit sold.

Also, it seems the goal of any stimulus should be to create more households, not just move people from renting to owning.

Here is a quote from an economist who called the housing bubble (no link):

The housing tax credit is an enormously inefficient use of government resources, and it does not really focus on what the economy needs: more job creation, and a return to “normal” growth of households.

While I believe it is highly unlikely that it will be expanded – that’s just REALLY TOO DUMB, even for Congress – I do think that the current credit will be extended for a bit.

Thomas Lawler former Fannie Mae and Wall Street economist, Sept 18, 2009

Q2 2009: Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 9/22/2009 01:14:00 PM

Note: This is not data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other contributors for the pervious MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q2 2009, the Net Equity Extraction was minus $48 billion, or negative 1.8% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report shows the amount of mortgage debt outstanding is declining, and this is partially because of debt cancellation per foreclosure sales (and a little from modifications), and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

Clearly the Home ATM has now been closed for a few quarters.

Philly Fed State Coincident Indicators

by Calculated Risk on 9/22/2009 10:46:00 AM

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty states are showing declining three month activity. The index increased in 6 states, and was unchanged in 4.

Here is the Philadelphia Fed state coincident index release for August.

In the past month, the indexes increased in 11 states (Arkansas, Indiana, Montana, North Dakota, Nebraska, Rhode Island, South Carolina, South Dakota, Virginia, Vermont, and Wisconsin), decreased in 36, and remained unchanged in three (New Hampshire, Ohio, and Tennessee) for a one-month diffusion index of -50. Over the past three months, the indexes increased in six states (Arkansas, North Dakota, South Carolina, South Dakota, Vermont, and Wisconsin), decreased in 40, and remained unchanged in four (Mississippi, Montana, Nebraska, and Virginia) for a three-month diffusion index of -68.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

A large percentage of states still showed declining activity in August.

Bank Report: Asia Rebounding

by Calculated Risk on 9/22/2009 08:57:00 AM

From the NY Times: Asia Rebounding Rapidly, Bank Reports

The [Asian Development Bank] declared that economic growth in China would be 8.2 percent this year, 1.2 percentage points higher than the bank’s forecast in March, and 8.9 percent next year.This should help U.S. exporters.

The bank raised its 2009 growth forecast for India to 6 percent, from 5 percent predicted in March, and for developing Asian countries as a group to 3.9 percent, from 3.4 percent.

“Developing Asia is proving to be more resilient to the global downturn than was initially thought,” the bank said in a statement accompanying its semiyearly assessment.

A common factor among countries doing better than expected is that they have been able to offset weak exports by stimulating domestic demand more than anyone expected. ...

Note: The August west coast port traffic shows a clear pickup in exports.

Monday, September 21, 2009

Inspector General: FDIC saw risks at IndyMac in 2002

by Calculated Risk on 9/21/2009 11:59:00 PM

From the Inspector General Report:

Between 2001 and 2003, [Division of Insurance and Research] DIR risk assessments and quarterly banking profiles identified concerns about a number of issues, including:Matt Padilla at the O.C. Register has the story: FDIC saw risks at IndyMac in 2002 but failed to act• consumers’ ever-increasing debt load, the expansion of adjustable rate mortgages, and a potential housing bubble;In January 2002, DIR noted that non-recession-tested lending programs such as subprime lending and HLTV lending may pose the biggest threat to consumer loan portfolio credit quality in a slowing economy. In May 2003, DIR reported that there was a concern about the extent to which lenders’ scoring models under-predicted losses during the 2001 recession. DIR noted that many subprime lenders experienced loss rates higher than their models predicted and that some consumer lending business models had been found to be inadequate, including those that relied on the securitization market for funding and were, therefore, sensitive to market pricing changes.

• subprime and high loan-to-value (HLTV) lending as a risk in the event that the United States economy suffered a significant recession; and

• pricing and modeling charge-off risk with respect to the originate-to-sell model of the mortgage business.

The FDIC noted issues at IndyMac as early as 2002, but did not stop the bank’s risk taking, the report says.Clearly the FDIC DIR was on the right track in 2001 to 2003. Just like with the Federal Reserve failure of oversight, we need a clear explanation why no significant action was taken.

“It was not until August 2007 that the FDIC began to understand the implications that the historic collapse of the credit market and housing slowdown could have on IMB and took additional actions to evaluate IMB’s viability,” the report says.

...

Despite these risks, the FDIC switched to relying on examinations from the OTS from 2004 to mid 2007, a period in which Indymac “continued to rely heavily on volatile funding sources such as brokered deposits and (Federal Home Loan Bank) advances to fund its growth.”

...

IndyMac’s failure is expected to cost the FDIC’s insurance fund $10.7 billion.

Banks to Make Loans to FDIC?

by Calculated Risk on 9/21/2009 10:24:00 PM

From the NY Times: F.D.I.C. May Borrow Funds From Banks (ht RJ)

Senior regulators say they are seriously considering a plan to have the nation’s healthy banks lend billions of dollars to rescue the insurance fund that protects bank depositors. ...Of course healthy banks would be happy to lend money to the FDIC; it is completely risk free and backed by the Treasury (and taxpayers).

Bankers and their lobbyists like the idea ... The Federal Deposit Insurance Corporation, which oversees the fund, is said to be reluctant to use its authority to borrow from the Treasury.

...

Bankers worry that a special assessment of $5 billion to $10 billion over the next six months would crimp their profits and could push a handful of banks into deeper financial trouble or even receivership. And any new borrowing from the Treasury would be construed as a taxpayer bailout ...

Officials say that the F.D.I.C. will issue a proposed plan next week to begin to restore the financial health of the ailing fund.

Fed Funds and Unemployment Rate

by Calculated Risk on 9/21/2009 07:04:00 PM

The Real Time Economics blog at the WSJ discusses expectations for the Fed two day meeting that starts tomorrow: Expect Patience From the Fed (note: the statement will be released on Wednesday).

No one expects a rate hike, and the main focus will be on the economic outlook and whether MBS purchases will slow. Last month, the FOMC statement noted "economic activity is leveling out", and the statement this month might be slightly more positive.

The Fed also announced last month: "To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions ..."

And this month the committee might announce a "smooth transition" for the purchases of agency mortgage-backed securities - and extend the deadline a few months into 2010.

As far as "patience", the Fed's mission is to conduct "monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates". So unless inflation picks up significantly (unlikely in the near term with so much slack in the system), it is unlikely that the Fed will increase the Fed's Fund rate until sometime after the unemployment rate peaks. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.