by Calculated Risk on 9/09/2008 04:03:00 PM

Tuesday, September 09, 2008

$100 Oil

The NYMEX is showing Light Sweet Crude closed at $102.16 per barrel today.

Bloomberg is showing the dated Brent Spot price at $98.52 per barrel.

Barchart.com is showing ICE Brent Crude Oil for Oct at $99.37 per barrel.

Whatever price you use, oil prices have fallen by almost one third since the peak in July.

So far so good on oil prices.

Note: My comment "so far so good" was referring to the impact of oil prices on the economy. I've been pointing out for sometime that if we are to avoid a severe recession, we probably needed oil price to fall sharply. My prediction earlier this year for oil prices to decline in the 2nd half of 2008 was based on demand destruction, lower subsidies in certain Asian countries, weaker demand growth in China, and a few other reasons.

Whether this will be enough to keep the recession mild to moderate (in terms of unemployment staying below 8%), we still don't know - but it will definitely help. And this will also help with inflation too - and keep the Fed from raising rates.

Thursday, September 04, 2008

The Import Slowdown: Los Angeles Area Ports

by Calculated Risk on 9/04/2008 07:47:00 PM

This is an update to an earlier post in April. Click on graph for larger image in new window.

Click on graph for larger image in new window.

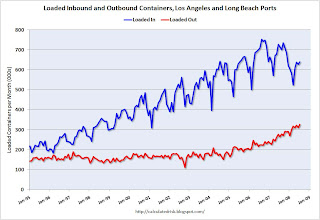

This graph shows the loaded containers per month - inbound and outbound - for the ports of Los Angeles and Long Beach combined.

Note: container traffic doesn't tell us about value, but it gives us a general idea on import and export volumes. We have to wait for the monthly trade deficit report for dollar values.

Imports have been surging for years, but import traffic started to decrease last year. For the last two month, import traffic averaged a decrease of 12.1% year-over-year.

Recently exports have picked up, and for the last two months export traffic has increased an average of 17.8% year-over-year.

Although this is just two Los Angeles area ports, this fits with the declining trade deficit (see 2nd graph). For export businesses in the U.S., these have been good times. However, as San Francisco Fed President Dr. Yellen noted this morning, the global slowdown might start to impact exports:

"[E]xport growth alone contributed one-half of the total real GDP growth registered in the second quarter. This element has been an important source of strength in our economy for over a year, being buoyed by strong growth abroad and by the weakening of the dollar. However ... in recent months the dollar has risen somewhat and economic growth in many of our industrialized trading partners has slowed or even turned negative, suggesting that we can no longer count on exports as an important source of strength."

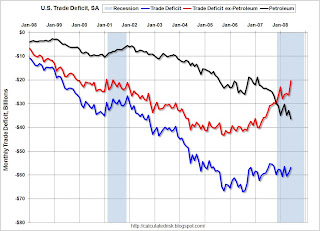

Here is a graph of the trade deficit (June is the most recent data).

Here is a graph of the trade deficit (June is the most recent data).The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit). The oil deficits in July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

The ex-petroleum deficit is already falling fairly rapidly with weak imports and strong exports.

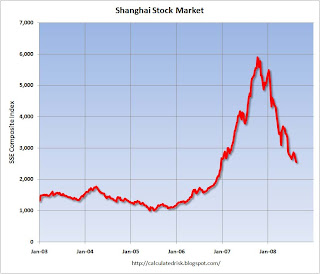

Back in April I asked what would be the impact of slowing imports on China and on oil prices? I noted the dramatic decline in the Shanghai index:

The Shanghai SSE composite index is now below 2,277, the lowest since the amazing run up started in 2006. The index is off over 61% from the peak. This suggests a slowdown in the Chinese economy, and probably less business investment in China.

The Shanghai SSE composite index is now below 2,277, the lowest since the amazing run up started in 2006. The index is off over 61% from the peak. This suggests a slowdown in the Chinese economy, and probably less business investment in China.And the SSE index will probably fall further tonight after the 344 decline in the DOW today.

And as far as oil prices, the decline has been sharp, with prices now down by about one third from the peak. This could have serious implications for OPEC, see the NY Times: As Oil Prices Fall, OPEC Faces a Balancing Act and my speculation back in March: Petroleum Prices and GCC Spending

There is no longer any discussion of decoupling of the U.S. and world economies (something that never made sense to me). Now the questions are: Will U.S. exports continue to grow as economic growth slows or turns negative for U.S. trading partners? And will a combination of some U.S. export growth and lower oil prices provide enough of a cushion to keep the U.S. out of a severe recession? I think so, but the next several quarters will be especially ugly in the U.S. with rising unemployment, less business investment, and probably negative Personal Consumption Expenditures (PCE), or in Dr. Yellen's words "decidedly subpar" (and she wasn't discussing golf).

Friday, August 29, 2008

Oil and Gustav

by Calculated Risk on 8/29/2008 01:48:00 PM

It's way too early to tell if this will be a huge story or a "nothingburger" (hopefully), but Tropical Storm Gustav is a potential threat to the GOM and oil production.

Click on image for larger image in new window.

Here are some excellent sites to track hurricanes:

National Hurricane Center

Weather Underground Note: See Jeff Master's blog.

Wednesday, August 13, 2008

U.S. Miles Driven Declines 4.7% from June 2007

by Calculated Risk on 8/13/2008 01:04:00 PM

Please don't miss Tanta's Reset Vs. Recast, Or Why Charts Don't Match

More demand destruction for oil ...

From the DOT: American Driving Reaches Eighth Month of Steady Decline

New data released today by the U.S. Department of Transportation show that, since last November, Americans have driven 53.2 billion miles less than they did over the same period a year earlier – topping the 1970s’ total decline of 49.3 billion miles.

...

Americans drove 4.7 percent less, or 12.2 billion miles fewer, in June 2008 than June 2007. The decline is most evident in rural travel, which has fallen by 4 percent – compared to the 1.2 percent decline in urban miles traveled – since the trend began last November.

Click on graph for larger image in new window.

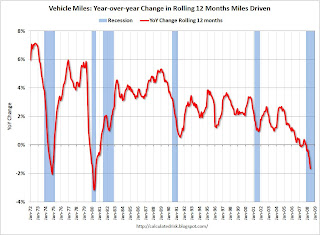

Click on graph for larger image in new window.This graph shows the YoY change in the rolling 12 month total miles driven. The rolling 12 months total is off 1.7% compared to a year ago, and with the June 2008 vs June 2007 change off 4.7%, this will probably fall significantly more.

The decline in miles driven is similar to the two oil crisis of the '70s.

Of course oil prices are falling (up a little today), and this will lead to lower gasoline prices and probably a few more miles driven.

Monday, August 11, 2008

Shanghai Cliff Diving

by Calculated Risk on 8/11/2008 12:03:00 AM

Friday, August 08, 2008

Oil and the Dollar

by Calculated Risk on 8/08/2008 01:09:00 PM

Oil continues to sell off, and is now below $114 per barrel (Brent Crude Oil nearest futures)

Meanwhile the dollar is rallying.

These are two important stories.

As I noted late last year, the dollar had fallen enough to make a significant dent in the ex-petroleum trade deficit. Unfortunately for the trade deficit, oil prices were surging. Click on table for larger image in new window.

Click on table for larger image in new window.

This graph shows the U.S. trade deficit through May. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current probable recession is marked on the graph.

The oil deficits in June, July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. Although there are other factors that impact exchange rates, this decline in oil prices will have a significant impact on the overall deficit, and might mean the dollar has finally bottomed (heresy to some I know!).

Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

Monday, August 04, 2008

Oil Futures Fall to $120 per Barrel

by Calculated Risk on 8/04/2008 01:21:00 PM

The following chart shows just how far oil prices have risen: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the monthly nearest futures price ranges for Brent Crude Oil since 1998. (sorry the image is blurred)

The recent pullback is pretty minor compared to the huge run up in oil prices since 2007.

If demand destruction is outweighing other supply and demand issues, I'd expect prices to fall much further.

Monday, July 28, 2008

Oil: Demand Destruction

by Calculated Risk on 7/28/2008 09:39:00 AM

From the DOT: Nearly 10 Billion Fewer Miles Driven in May 2008 than May 2007 Seven-Month Decline in Travel Reflected in Highway Trust Fund

Secretary Peters said that Americans drove 9.6 billion fewer vehicle-miles traveled (VMT) in May 2008 than in May 2007, according to the Federal Highway Administration data. This is the largest drop in VMT for any May ... and is the third-largest monthly drop in the 66 years such data have been recorded. Three of the largest single-month declines - each topping 9 billion miles - have occurred since December.

VMT on all public roads for May 2008 fell 3.7 percent as compared with May 2007 travel, the Secretary added, marking a decline of 29.8 billion miles traveled in the first five months of 2008 than the same period a year earlier. This continues a seven-month trend that amounts to 40.5 billion fewer miles traveled between November 2007 and May 2008 than the same period a year before, she said.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the the moving 12 month total for vehicle miles driven.

The miles driven (on a rolling 12 month basis) is just starting to decrease - similar to what happened during the oil crisis of the '70s.

And from the NY Times: Fuel Subsidies Overseas Take a Toll on U.S.

The oil company BP, known for thorough statistical analysis of energy markets, estimates that countries with subsidies accounted for 96 percent of the world’s increase in oil use last year — growth that has helped drive prices to record levels.Further reductions in these subsidies would reduce demand, and lower world oil prices.

...

China raised gasoline and diesel prices on June 21, though still keeping them below world levels. World oil prices plunged more than $4 a barrel within minutes on the expectation that Chinese demand would slow.

...

Indonesia spends more on fuel subsidies, $20 billion this year, than any country except China. Some economists estimate that fuel use in Indonesia would fall by as much as a fifth if the government were to eliminate subsidies entirely.

...

Malaysia’s government incited public anger on June 4 when it raised gasoline prices by 40 percent. ... Before adjusting the prices, Malaysia was spending 7.5 percent of its entire economic output on fuel subsidies, a greater share than any other nation. Indonesia follows with 4 percent.

Miles Driven Off 3.7% in May

by Calculated Risk on 7/28/2008 02:05:00 AM

The WSJ has some details from the DOT report due tomorrow: Funds for Highways Plummet As Drivers Cut Gasoline Use

A report to be released Monday by the Transportation Department shows that over the past seven months, Americans have reduced their driving by more than 40 billion miles. Because of high gasoline prices, they drove 3.7% fewer miles in May than they did a year earlier, the report says, more than double the 1.8% drop-off seen in April.More demand destruction for oil.

Sunday, July 20, 2008

Setser: The Oil Shock of 2008

by Calculated Risk on 7/20/2008 11:25:00 AM

Brad Setser, at Follow the Money, presents a couple of graphs on changes in oil export revenue: The Oil Shock of 2008.

The following graph shows the Year-over-year change in oil exports as a percent of world GDP (and in billions of dollars).

This calculation assumes that the oil exporters will export about 45 million barrels a day of oil.Assuming oil prices average $120 per barrel for 2008, the increase in 2008 will be similar to the oil shocks of the '70s.

Each $5 increase in the average price of oil increases the oil exporters’ revenues by about $80 billion, so if oil ends up averaging $125 a barrel this year rather than $120 a barrel, the increase in the oil exporters revenues would be close to a trillion dollars.

Wednesday, July 16, 2008

Falling Oil Prices and CPI

by Calculated Risk on 7/16/2008 10:57:00 AM

From MarketWatch: Crude falls over $6 as inventories show surprise increase

U.S. crude inventories gained surprisingly in the week ending July 11, up 3 million barrels to 296.9 million, the U.S. Energy Information Administration reported on Wednesday.As I noted yesterday, the difference between a moderate and severe recession might be what happens with oil prices:

One of the keys to the base case is that oil prices decline in the 2nd half of 2008 (something I've been predicting for some time). This prediction is based on demand destruction, lower subsidies in certain Asian countries, weaker demand growth in China, and a few other reasons. The fundamentals of supply and demand for oil suggests a small decrease in demand could led to a fairly large decrease in price. If this happens, then that will hopefully lead to Kasriel's "sharp deceleration in inflation".Usually the headline measure of inflation (CPI) and the core inflation measure (CPI less food and energy) track pretty well with just short periods of divergence due primarily to changes in oil prices. But for the last few years oil prices have risen relentlessly, and CPI has been substantially above Core for an extended period as shown on the following graph.

Falling oil prices would move CPI below Core inflation and might keep the economy out of a severe recession (although the period of economic weakness would still linger for some time).

Saturday, July 05, 2008

U.S. Energy Consumption as Percent of GDP

by Calculated Risk on 7/05/2008 01:28:00 PM

I found this story puzzling ...

From MarketWatch: S&P says energy spending has fallen to 1971 pace

[A] Standard & Poor's report said Wednesday it expects Americans to spend the same portion of their household income on energy as they did the year the Ed Sullivan Show went off the air.These numbers don't make sense to me, so instead I looked at U.S. energy consumption as a percent of GDP. The EIA provides this percentage from 1970 through 2005 (most recent estimate).

S&P Chief Economist David Wyss said the ratings agency expects an average U.S. household to spend 6.7% of its income on energy this year - the same portion spent on average in 1971, before the creation of the Organization of the Petroleum Exporting Countries oil cartel. In the early 1980s, in contrast, energy costs accounted for 7.9% of U.S. household income.

The EIA estimate shows that energy consumption as a percent of GDP was 8.4% in 2005, slightly higher than the 8.0% in 1971. However, in case no one noticed, energy prices have increased since 2005.

In 2005, petroleum prices were in the $50 per barrel range, now spot prices are over $140 per barrel. In 2005, the average well head price for natural gas prices spiked to over $7.00 per million Btu because of the hurricanes in the gulf, and then declined slightly in 2006. However wellhead prices have spiked again to over $10.00 per MMBtu.

Even coal prices, after years of comparatively minor price changes, have risen significantly in 2008.

Using the EIA price data, and making a few assumptions (no increase in energy consumption in 2008, and an energy mix of 40% petroleum, 23% coal, 23% natural gas, and 14% nuclear and renewables), we can estimate that energy consumption as a percent of U.S. GDP will set a record in 2008 of over 14%.

This estimate could be too high. Prices might fall, and the energy mix in 2008 might change, but clearly energy as percent of GDP will be close to the record high this year.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the EIA estimates of energy consumption as a percent of GDP (blue), and my estimates for 2006 through 2008 (red).

In 2006, Wyss was quoted in The Christian Science Monitor: Oil spike: a surmountable challenge?

However, back in 1981, energy was a much larger part of the US economy, representing 14 percent of the gross domestic product, Wyss says. Because energy was so crucial back then, the Federal Reserve pushed interest rates sharply higher to curtail inflation.In 2006, Wyss apparently was using the most recent data (energy consumption was 7.0% and 6.9% in 2000 and 2001 respectively - the data available in 2006). However, as this graph shows, energy consumption was probably already approaching 10% of GDP in 2006.

Today, energy represents 7 percent of GDP.

Saturday, June 28, 2008

You know Gas is Expensive when Teenagers Stop Cruising!

by Calculated Risk on 6/28/2008 09:14:00 PM

From the NY Times: Cruise Night, Without the Car

For car-loving American teenagers, this is turning out to be the summer the cruising died.

...

From coast to coast, American teenagers appear to be driving less this summer. Police officers who keep watch on weekend cruising zones say fewer youths are spending their time driving around in circles, with more of them hanging out in parking lots, malls or movie theaters.

Thursday, June 26, 2008

Oil hits $140, Dow Off 300

by Calculated Risk on 6/26/2008 02:53:00 PM

From MarketWatch: Oil prices tops $140

TED spread rising sharply. Is this the 4th wave of the credit crisis?

Sunday, June 22, 2008

Saudi Arabia Plans to Increase Oil Production

by Calculated Risk on 6/22/2008 10:53:00 AM

Here is a story from Bloomberg on the "Oil Summit" in Saudi Arabia: Saudi Arabia Boosts Oil Supply, May Pump More Later

``Saudi Arabia is prepared and willing to produce additional barrels of crude above and beyond the 9.7 million barrels per day, which we plan to produce during the month of July, if demand for such quantities materializes and our customers tell us they are needed,'' [Saudi Oil Minister Ali al- Naimi] said.

Saudi Arabia's capacity will be 12.5 million barrels a day by the end of 2009 and may rise to 15 million after that if necessary, he said.

Thursday, June 19, 2008

DOT: Americans Drove Fewer Highway Miles in April

by Calculated Risk on 6/19/2008 12:50:00 PM

From the Department of Transportation: Americans Drove 1.4 Billion Fewer Highway Miles in April of 2008 than in April 2007 While Fuel Prices and Transit Ridership Are Both on the Rise

[U.S. Transportation Secretary Mary E. Peters] said that Americans drove 1.4 billion fewer highway miles in April 2008 than at the same time a year earlier and 400 million miles less than in March of this year. She added that vehicle miles traveled (VMT) on all public roads for April 2008 fell 1.8 percent as compared with April 2007 travel. This marks a decline of nearly 20 billion miles traveled this year, and nearly 30 billion miles traveled since November.This is the fewest miles driven in April since 2003.

China to raise gasoline, diesel prices

by Calculated Risk on 6/19/2008 10:18:00 AM

From Reuters: China to raise gasoline, diesel prices

China, the world's second largest oil consumer, will increase retail gasoline and diesel prices by 1,000 yuan ($145.50) per tonne from Friday, according to industry sources.See the analyst comments in the story.

Meanwhile, the Shanghai cliff diving continues with the SSE Composite Index off 6.5% last night.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This is a spectacular sell off.

I suspect this stock sell off could be in anticipation of a slowing Chinese economy, and a combination of a Chinese slowdown and lower oil and gasoline subsidies could lead to lower world oil prices later this year.

Tuesday, June 17, 2008

Loews CEO Tisch: Buying Financials like "catching a falling knife"

by Calculated Risk on 6/17/2008 07:36:00 PM

From Dennis Berman at the WSJ: Tisch Hews to the Prudent Approach

"No. 1, don't bet the company," [Loews CEO James Tisch] says. "First and foremost, everything we have is fully protected. Second, watch out for the downside. The businesses we like are ones with long-term assets, that are going to be here for a long time and aren't dependent on management. Our day will come."And on oil:

That means avoiding financials, which, a year into the credit crisis, are still "like catching a falling knife," he says.

"Overpriced," he says. "It's a demand issue, not a supply issue." He cites a decline in the amount of driving by U.S. motorists in March. "We're seeing fast adjustment, and we're going to see that world-wide."

Monday, June 09, 2008

Oil, House Prices and the Exurban Lifestyle

by Calculated Risk on 6/09/2008 09:04:00 AM

Last week I mentioned that 15% of the homes in Temecula, CA were REO or in foreclosure. Temecula is a fairly isolated town (see map), and the city is very dependent on construction and/or long commutes. The combination of the housing bust, plus high oil prices, is hitting exurban towns like Temecula very hard.

From Bloomberg: Wealth Evaporates as Gas Prices Clobber McMansions, SUV Makers

``At $4 per gallon gas, $125 per barrel oil and $10 per million Btu natural gas, a lot of activity becomes uneconomical,'' says Mark Zandi, chief economist at Moody's Economy.com ...Of course rural areas are getting hit hard too, from the NY Times: Rural U.S. Takes Worst Hit as Gas Tops $4 Average

The lifestyle of the exurban commuter may be one casualty.

Emerging suburbs and exurbs -- commuter towns that lie beyond cities and their traditional suburbs -- grew about 15 percent from 2000 to 2006, nearly three times as fast as the U.S. population, as Americans moved further out in search of more affordable houses or the bigger ones that are sometimes derided as McMansions.

``It was drive until you qualify'' for a mortgage, says Robert Lang, director of the Metropolitan Institute at Virginia Tech in Alexandria, Virginia. ``You can't do that anymore. Your cost of transportation will spike too much.''

[T]he pain [of $4 gasoline] is not being felt uniformly. Across broad swaths of the South, Southwest and the upper Great Plains, the combination of low incomes, high gas prices and heavy dependence on pickup trucks and vans is putting an even tighter squeeze on family budgets.Any lifestyle dependent on low gas prices - and low gas mileage vehicles - is becoming uneconomical. For those that own a home in a remote location, work in construction, and drive a low gas mileage vehicle, this must feel like a depression.

...

Here in the Mississippi Delta, some farm workers are borrowing money from their bosses so they can fill their tanks and get to work. Some are switching jobs for shorter commutes.

Saturday, June 07, 2008

Asian Countries Reduce Fuel Subsidies

by Calculated Risk on 6/07/2008 09:23:00 PM

From Bloomberg: U.S., Asia Express `Serious Concern' Over Oil Prices

The U.S. and Asia expressed ``serious concern'' over record oil prices, ... in a joint statement issued [by officials from Japan, China, India, South Korea and the U.S.] after a meeting in Aomori in northern Japan today.Reducing subsidies is an important step for the Asian countries. With market prices, Asian fuel demand will probably slow or even decline.

...

The governments of China and India, which sell fuels to domestic users below cost, were in agreement with the U.S., Japan and South Korea that ``a gradual withdrawal of fuel subsidies is desirable,'' the statement said.

India, Malaysia, Indonesia and Taiwan over the past month raised fuel prices and cut subsidies, in a move that may reduce Asian demand and slow global oil-consumption growth.

``This is the first time that we can agree on the necessity of abolishing fuel subsidies by steps,'' Japan's Trade Minister Akira Amari told reporters today. ``Each country has different reasons and contexts, so they cannot do that immediately.''