by Calculated Risk on 8/12/2008 08:54:00 AM

Tuesday, August 12, 2008

June Trade Deficit: $56.8 billion

The Census Bureau reports:

[T]otal June exports of $164.4 billion and imports of $221.2 billion resulted in a goods and services deficit of $56.8 billion, down from $59.2 billion in May, revised. June exports were $6.4 billion more than May exports of $158.0 billion. June imports were $3.9 billion more than May imports of $217.2 billion.Non-petroleum imports (corrected) are dropping sharply, although petroleum imports (in dollars) were up in June. Import oil prices hit a record $117.13 per barrel in June, and will increase further in July (when spot prices peaked).

Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

Click on table for larger image in new window.

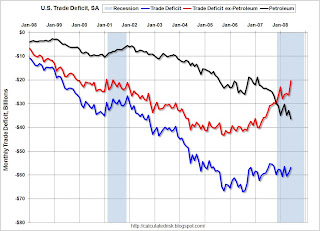

Click on table for larger image in new window.This graph shows the U.S. trade deficit through June. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current probable recession is marked on the graph.

The oil deficits in July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. As I noted last week, there are other factors that impact exchange rates, but this decline in oil prices will have a significant impact on the overall deficit, and this might mean the dollar has finally bottomed.

Friday, August 08, 2008

Oil and the Dollar

by Calculated Risk on 8/08/2008 01:09:00 PM

Oil continues to sell off, and is now below $114 per barrel (Brent Crude Oil nearest futures)

Meanwhile the dollar is rallying.

These are two important stories.

As I noted late last year, the dollar had fallen enough to make a significant dent in the ex-petroleum trade deficit. Unfortunately for the trade deficit, oil prices were surging. Click on table for larger image in new window.

Click on table for larger image in new window.

This graph shows the U.S. trade deficit through May. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current probable recession is marked on the graph.

The oil deficits in June, July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. Although there are other factors that impact exchange rates, this decline in oil prices will have a significant impact on the overall deficit, and might mean the dollar has finally bottomed (heresy to some I know!).

Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

Tuesday, August 05, 2008

The Slowdown in China

by Calculated Risk on 8/05/2008 06:50:00 PM

Note: Please don't miss Tanta's post this morning on the NY Times and Freddie Mac.

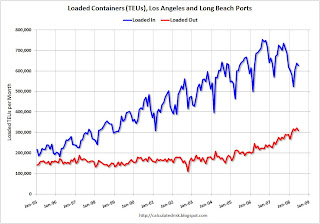

On China and trade: This first graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic grew quickly for a number of years, but appears to be declining (there is a strong seasonal component). Inbound traffic is off almost 14% from June 2007.

Outbound traffic was flat for years, but has been increasing the last few years. Outbound traffic is up 12% from June 2007.

A few key points: Imports have slowed, and U.S. exports are increasing fairly rapidly. This means the trade deficit (especially ex-petroleum) is also decreasing. This change in the trade balance is probably due to the weak dollar and the weak U.S. economy.

Trade has also boosted GDP (trade contributed 2.4% to the Q2 GDP growth), and has kept U.S. manufacturing employment from falling sharply as usually happens in a recession. This last point has been important in my forecast that headline unemployment wouldn't reach 8% in this cycle.

And from the NY Times: Booming China Suddenly Worries That a Slowdown Is Taking Hold

China's post-Olympics economic slowdown has started before the Games have even begun.

New orders at Chinese factories plunged last month. Exports are barely growing, after adjusting for inflation and currency fluctuations. The real estate market is weakening, with apartment prices sinking in southeastern China, the region hardest hit by economic troubles.

"China has slowed down a lot already, but it's going to slow down more," said Hong Liang, the senior China economist at Goldman Sachs.

...

Weak demand from the United States over the past year, and now from Europe as well, is part of China's emerging problem. On Sunday evening, the port here in Hong Kong was less full of containers than usual, part of a broader slowing of export growth.

This slowdown is reflected in the Shanghai SSE composite index that is off about 54% from the peak.

This slowdown is reflected in the Shanghai SSE composite index that is off about 54% from the peak.And this slowdown is probably impacting oil prices. And that will also help the U.S. trade deficit.

The danger is that China - and the rest of the global economy - will slow down too quickly, and U.S. exports will be negatively impacted. That could lead to more unemployment in the U.S. than I'm currently forecasting, and also a deeper recession.

Tuesday, June 17, 2008

The Coming Slowdown in China?

by Calculated Risk on 6/17/2008 06:21:00 PM

From Bloomberg: Yuan Extends Gains to 20% Since End of Peg Before Paulson Talks

The yuan extended gains to 20 percent since China ended a fixed exchange rate to the dollar in July 2005 ... The currency climbed for a fifth day, reaching 6.8909 per dollar. The yuan's advance since the peg was scrapped compares with a 29 percent gain for the euro against the dollar, 13.2 percent for the British pound and 4.7 percent for the Japanese yen.From Professor Krugman: The world gets bigger

Many people have noticed that higher fuel prices are putting the brakes on globalization: if it costs more to ship stuff, there will be less shipping.And from the NY Times: Labor Costs Rise, and Manufacturers Look Beyond China

How big is this effect? ...

[A] very back-of-the envelope calculation using CIBC estimates of the fuel cost effect gives me a 17 percent contraction in trade if oil prices stay at current levels for a long time.

China remains the most popular destination for foreign industrial investment in the world, attracting almost $83 billion last year. But ... [there are a] long list of concerns about China ... inflation, shortages of workers and energy, a strengthening currency, changing government policies, even the possibility of civil unrest someday. But most important, wages in China are rising close to 25 percent a year in many industries, in dollar terms, and China is no longer such a bargain.Just some food for thought ...

Tuesday, June 10, 2008

Trade Deficit Increases

by Calculated Risk on 6/10/2008 09:13:00 AM

From the WSJ: Oil Prices Push Trade Gap Wider

The U.S. deficit in international trade of goods and services increased by 7.8% to $60.90 billion from March's revised $56.49 billion, the Commerce Department said Tuesday.The average price per barrel of oil was $96.81 in April - and the current world spot price is around $136 per barrel - so oil import prices will increase over the next few months.

...

The U.S. bill for crude oil imports in April increased. It totaled $29.34 billion, up from $25.03 billion in March. The average price per barrel increased by $6.96 to a record $96.81 from $89.85.

...

The U.S. paid $38.19 billion for all types of energy-related imports, up from $33.15 billion in March.

...

The U.S. trade deficit with China expanded to $20.24 billion from March's $16.08 billion.

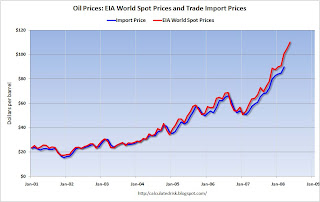

The following graph shows import prices vs. U.S. spot prices (shifted one month into the future).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Since import prices lag spot prices by about one month, import prices will probably jump to around $102 per barrel for May - and $116 per barrel in June (based on May spot prices).

Any progress on reducing the trade deficit, due to the weak dollar, is now being offset by rising oil prices.

Friday, May 09, 2008

March Trade Deficit

by Calculated Risk on 5/09/2008 11:30:00 AM

The Census Bureau reported a goods and services deficit of $58.2 billion for March 2008. Exports, in March, decreased $2.6 billion to $148.5 billion, but are up almost 16% year-over-year. Imports decreased by over $6 billion to $206.7 billion, and excluding petroleum, are up only 4% year-over-year.

So ignoring monthly fluctuations, the story remains the same: exports are surging and imports (ex-petroleum) have slowed. A few years ago the story was how the ports could increase import capacity. Now the problem is finding enough containers for exports - see from the WSJ: Container Shortage Frustrates U.S. Exporters Click on graph for larger image.

Click on graph for larger image.

The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit). The current probable recession is marked on the graph.

Unfortunately the dollar amount of petroleum imports is surging, and this increase in petroleum imports (because of price, not quantity) is mostly offsetting the improvement in the non-petroleum trade deficit.

And the petroleum deficit will worsen in April and May. The second graph compares petroleum import prices with the EIA World Spot Price. This shows that import prices in April and May will be significantly higher than for March. Note that the May prices are for last week - and oil prices are setting new records again

The second graph compares petroleum import prices with the EIA World Spot Price. This shows that import prices in April and May will be significantly higher than for March. Note that the May prices are for last week - and oil prices are setting new records again every day every hour!

Thursday, April 10, 2008

February Trade Deficit

by Calculated Risk on 4/10/2008 10:15:00 AM

The Census Bureau reported a goods and services deficit of $62.3 billion for February 2008. Exports, in February, increased almost $3 billion to $151.3 billion, but imports increased by over $6 billion to $213.7 billion - despite petroleum imports being off slightly in February.

Export growth was still strong, but the rise in imports is very disappointing - especially if the increase in imports was due to rising prices (export and import prices will be released tomorrow). Note: we have to be careful to not read too much into one month's data.

This also suggests Q1 GDP will be weaker than currently expected. Click on graph for larger image.

Click on graph for larger image.

The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit). The current probably recession is marked on the graph.

The ex-petroleum deficit has been falling fairly rapidly, almost entirely because of weak imports. Hopefully the increase in February was just monthly noise.

Tuesday, April 08, 2008

The Import Slowdown: Los Angeles Area Ports

by Calculated Risk on 4/08/2008 12:45:00 PM

Click on graph for larger image.

Click on graph for larger image.

This graph shows the loaded containers per month - inbound and outbound - for the ports of Los Angeles and Long Beach combined.

Imports have been surging for years (not exactly new news), but have slowed recently. For the last two month, imports averaged a decrease of 8.8% year-over-year.

Recently exports have picked up (because of the weak dollar), and for the last two months imports have increased an average of 24.3% year-over-year.

Although this is just two Los Angeles area ports, this fits with the declining trade deficit (see 2nd graph). For export businesses in the U.S. these are good times - and a big part of the reason the U.S. has seen less manufacturing employment weakness than in earlier recessions.

Of course this is having a negative impact on Asian exporting companies.  Here is a graph of the trade deficit (January is the most recent data).

Here is a graph of the trade deficit (January is the most recent data).

The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

The ex-petroleum deficit is falling fairly rapidly, almost entirely because of weak imports (export growth is still strong).

And from the AP: Idle cars signal a downturn

This brings up several important topics: What will happen in China as their export economy slows? Just look at the dramatic decline in the Shanghai index. What will happen to petroleum prices as the global economy slows? Will the U.S. import inflation from China and Asia as they raise prices? And I'm sure there are more issues too.

Friday, March 21, 2008

Petroleum Prices and GCC Spending

by Calculated Risk on 3/21/2008 01:17:00 PM

Note: this post is highly speculative and only a possibility that may be worth considering - something for a holiday. Best wishes to all.

Rachel Ziemba (filling in for Brad Setser) at RGE Monitor discusses how petrodollars are being spent by the GCC (Gulf Cooperation Council) countries in Petrodollars: How to Spend It

The following graph is interesting. This reminds me of how the surge in California state government revenues in the late '90s (due to the tech stock bubble), led to a concurrent surge in government spending. When the tech bubble burst, the state budget went bust.

The same pattern has been repeated across the U.S. recently with surging government spending based on revenues from the housing bubble. Now, almost every week, we see a story about some state or local government laying off workers and cutting their budget as revenues from housing decline.

So when I saw this graph, my first thought was: What happens if oil prices fall? Click on graph for larger image.

Click on graph for larger image.

Rachel Ziemba writes:

2007 was the first year that spending growth outstripped revenues [growth] in the GCC and many other oil exporters. 2008 budget plans imply even higher current (especially wages and subsidies) and capital expenditures. Even countries that have traditionally saved more (Kuwait) are ramping up spending especially on capital projects and in some cases transfers to the population or pension funds. ... With megaprojects in the works in a variety of sectors including energy and other infrastructure, capital spending will likely continue to rise.Further Ziemba argues - based on spending growth - that "many GCC countries might have very small current account surpluses" within 5 year, if oil prices hold steady. It appears the GCC spending plans depend on fairly high oil revenues.

But could oil prices fall sharply?

Setting aside peak oil arguments for now, it's important to realize that both the supply and demand curves for oil are, in general, very steep. If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; people stay with their routines and keep their same vehicle. With two steep curves (supply and demand), a small increase in quantity demanded will lead to a large increase in prices.

And, of course, the opposite is also true. A relatively small decrease in demand (or increase in supply) would cause a significant drop in price.

As the U.S. economy weakens, there is waning demand for oil in the U.S.:

According to the US Energy Information Administration's weekly inventory report, the overall consumption of oil and crude products dropped 3.2 percent in the last four weeks compared to the same period last year.Perhaps the growth in demand in China and India (and elsewhere) will more than offset the small decline in U.S. demand. But there may be another important factor - the behavior of the GCC countries.

What if the supply-demand curve for oil has multiple equilibrium points? And what if the GCC countries have been limiting production because of the lack of other investment opportunities? The following is from a paper by Professor Krugman several years ago: The Energy Crisis Revisited

The fact that oil is an exhaustible resource means that not extracting it is a form of investment. And it is an investment that might look attractive to a national government when oil prices are high. If a country does not want to spend all of the massive flow of cash generated by a sudden price increase on consumption, it must do one of three things: engage in real investment at home, which is subject to diminishing returns; invest abroad; or "invest" by cutting oil extraction, and hence reducing supply.

Krugman: Figure 1.

Krugman: Figure 1.So there is a definite possibility that over some range higher oil prices will lead to lower output. And given highly inelastic demand, as Cremer et al showed, that means that you can have multiple equilibria. Figure 1 illustrates the point: given the backward-bending supply curve and a steep demand curve, there are stable equilibria at both the low price PL and the high price PH.So there is a possibility that what has looked like peak oil to some observers (something I believe is coming), was actually GCC countries investing by not extracting oil. If oil prices start to fall, and with rising expenditures (see first graph again), the GCC countries might increase production - causing prices to fall further.

And falling oil prices would have a significant impact on the U.S. trade deficit:

This graph shows the total trade deficit (in blue) over the last 10 years. The red line is the trade deficit excluding petroleum products, and black is the petroleum deficit.

This graph shows the total trade deficit (in blue) over the last 10 years. The red line is the trade deficit excluding petroleum products, and black is the petroleum deficit. The ex-petroleum deficit is falling fairly rapidly, but the overall trade deficit is declining slowly, because of the surge in oil imports (in dollars, not quantity).

There are many potential impacts of falling oil prices - such as geopolitical issues with oil producing nations - but from a U.S. perspective this would help with the trade deficit, possibly the dollar, and cushion the impact of the current U.S. recession.

This is just something I've been musing about ... best to all.

Saturday, March 15, 2008

Trade Deficit and Mortgage Equity Withdrawal

by Calculated Risk on 3/15/2008 05:07:00 PM

The following graph shows an interesting relationship (Caution: correlation doesn't imply causation!). As Mortgage Equity Withdrawal (MEW) rose, so did the trade deficit. Note: both are shown as a percent of GDP.

Now that MEW is falling, the trade deficit is also falling - especially if we exclude petroleum imports. Click on graph for larger image.

Click on graph for larger image.

The dashed green line is the Kennedy-Greenspan MEW estimates as a percent of GDP.

Clearly the housing bust led to less MEW, and less MEW might have contributed to the declining trade deficit. (Something I predicted in 2005).

Looking forward, it appears MEW will decline sharply in 2008, as housing prices decline further, lending standards are tightened, especially for HELOCs, and since homeowner percent equity is already at record lows. In other words, the Home ATM is closing.

This suggests that the trade deficit (especially ex-petroleum) might decline sharply too. Part of the decline in the trade deficit is related to the falling dollar and higher U.S. exports (See Krugman's Good news on the dollar)

However, to complete the global rebalancing, two things must happen: both petroleum imports (in dollars) and the deficit with China must decline. The good news is the January trade deficit with China - although still huge at $20.3 billion - was actually less than the $21.3 billion in January 2007. The bad news is oil imports (in dollars) were at record levels.

Unless we see these key components of the trade deficit start to decline (oil and China), other exporters to the U.S. will have to bear the burden of the possibly sharp rebalancing of global trade.

Added: On oil, here is a KAL's cartoon from the Economist:

Click on image to see cartoon at The Economist.

Tuesday, March 11, 2008

January Trade Deficit

by Calculated Risk on 3/11/2008 09:49:00 AM

The Census Bureau reported today for January 2008:

"a goods and services deficit of $58.2 billion, up from $57.9 billion in December, revised. January exports were $2.4 billion more than December exports of $145.9 billion. January imports were $2.7 billion more than December imports of $203.7 billion."

Click on graph for larger image.

Click on graph for larger image.The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

The ex-petroleum deficit is falling fairly rapidly, almost entirely because of weak imports (export growth is still strong).

Unlike the previous decline in the trade deficit (during the '01 recession), the value of petroleum imports - in dollar terms - are still strong. In barrels, imports appear to be flat year over year.

The trade deficit is mostly from oil imports and China. This now reminds me somewhat of the early '80s when the deficit was mostly oil and Japan.

Wednesday, December 12, 2007

October Trade Deficit

by Calculated Risk on 12/12/2007 11:19:00 AM

The Census Bureau reported today for October 2007:

"a goods and services deficit of $57.8 billion, $0.7 billion more than the $57.1 billion in September"

The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

The ex-petroleum deficit is falling fairly rapidly, almost entirely because of weak imports (export growth is still strong). The ex-petroleum deficit is now almost all China! From Greg Robb at MarketWatch: Trade gap widens in October on high oil prices

The U.S. trade deficit with China widened to a record $25.9 billion in October from $24.4 billion in the same month last year and $23.8 billion in September. The trade gap with China rose to $213.5 billion in the first 10 months of the year, up from $190.7 billion in the same period last year.Unlike the previous decline in the trade deficit (during the '01 recession), the value of petroleum imports - in dollar terms - are still strong. In barrels, imports appear to be flat or declining slightly year over year.

Note also that not only oil import prices are surging. From Rex Nutting at MarketWatch: Import prices rise 2.7%, the most in 17 years

Driven by a weaker dollar and much higher prices for petroleum and natural gas, import prices surged 2.7% in November, the largest monthly increase in 17 years, the Labor Department reported Wednesday.

Even excluding fuels, import prices rose 0.5%.

Import prices have now risen 11.4% in the past year, the largest gain in the 25-year history of the import price index.

Friday, November 23, 2007

Roubini on Recoupling

by Calculated Risk on 11/23/2007 06:25:00 PM

Nouriel Roubini writes: Recoupling rather than Decoupling: the Forthcoming Contagion to China, East Asia and Emerging Markets

Paradoxically China is the one country that has, so far, decouple the most – both in real and financial terms from the U.S. but it will also be the first and most serious victim of a U.S. led recession. The decoupling of China is clear as its growth rate has not decelerated, in spite of the U.S. slowdown, and its financial markets have – so far – blissfully avoided (thanks in part to its financial system partially isolated via capital controls from the global one) the turmoil and volatility that hit the US and Europe since the summer. But the reason for the Chinese growth decoupling is that, until recently the US slowdown was still modest (short of the coming hard landing) and it was not concentrated in private consumption but rather housing: China is mostly exporting low-priced consumer goods to the U.S. and the recoupling of China will occur soon once the US consumer recession is in full swing. Thus, the biggest victim of a US consumer led recession will be the country – China - that, so far, has decoupled the most from the US.Let me add a couple of graphs:

...

No wonder that Chinese officials have started to express serious concerns about the current sharp slowdown in Chinese exports to the US, from an annualized growth rate of over 20% in Q1 to a rate of 12.4% in Q3 of this year ("If demand in the US drops further, Chinese exporters will be devastated by a rapid and continuous fall in orders," a Chinese official report said).

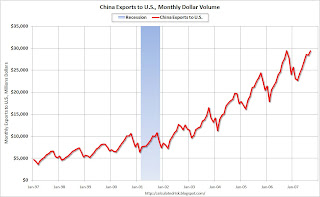

Click on graph for larger image.

Click on graph for larger image.The first graph shows the growth in China's exports to the U.S. over the last ten years. There is a clear seasonal pattern, and October is the peak month for Chinese exports to the U.S.

The second graph shows the Year-over-year change in Chinese exports to the U.S. Note: this graph uses a 3 month centered average to calculate the YoY change.

Since the last data point (trade data) is for September, and I'm using a 3 month centered average, the last plotted point is for August (9.5% YoY change).

Since the last data point (trade data) is for September, and I'm using a 3 month centered average, the last plotted point is for August (9.5% YoY change).Looking at data from the Ports of LA and Long Beach, the YoY change might be close to zero soon - something that hasn't happened since the 2001 recession.

Roubini argues for recoupling:

And once there is a sharp growth slowdown in China the next victims of this recoupling will be East Asia and commodity exporters.

Friday, November 09, 2007

September Trade Deficit

by Calculated Risk on 11/09/2007 12:51:00 PM

The Census Bureau reported today for September 2007:

"a goods and services deficit of $56.5 billion, compared

with $56.8 billion in August"

Click on graph for larger image.

Click on graph for larger image.The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

The ex-petroleum deficit is falling fairly rapidly, almost entirely because of weak imports (export growth is still strong). But unlike the previous decline in the trade deficit (during the '01 recession), petroleum imports are still strong.

UPDATE: Petroleum imports are strong in dollar terms, but they appear to be declining in BBLs, see exhibit 17. Imports are noisy month to month, but BBLs imported has declined year over year for the last several months. Also note the price per barrel. This will increase sharply over the next few months (but not to the spot level). Hat tip dryfly.

Normally oil prices would now be falling as the U.S. economy weakens - instead we are seeing margins shrinks for U.S. refiners and record high oil prices. This would imply that global demand for oil is strong, while domestic consumption is weak. This evidence supports the "decoupling" argument: that the U.S. economy could slow, but economic growth in the rest of the World would stay strong. I'm not convinced by the decoupling argument, and my view is that there is simply a lag between a slowing U.S. economy and a slowdown for the rest of the world.

Looking at the trade balance, excluding petroleum products, it appears the deficit peaked at about the same time as the housing market / mortgage equity withdrawal in the U.S. This is an interesting correlation (but not does imply causation).

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."

Alan Greenspan, Feb, 2005

The second graph shows the trade deficit and mortgage equity withdrawal as a percent of GDP.

The second graph shows the trade deficit and mortgage equity withdrawal as a percent of GDP.Declining MEW is one of the reasons I forecast the trade deficit to decline in '07. And a declining trade deficit also has possible implications for U.S. interest rates; as the trade deficit declines, rates may rise in the U.S. because foreign CBs will have less to invest in the U.S..

Note also that import prices are surging. From Greg Ip at the WSJ:

Import prices jumped 1.8% in October from September and are up 9.6% from the previous year. To be sure, most of that was due to rising oil and natural-gas prices. But even excluding fuels, prices were 0.3% higher from September and up 2.4% from a year earlier.The import prices problem will only get worse in October and November with surging oil prices and the falling dollar.

Thursday, October 11, 2007

August Trade Deficit

by Calculated Risk on 10/11/2007 03:19:00 PM

The Census Bureau reported today for August 2007:

"a goods and services deficit of $57.6 billion, $1.4 billion less than

the $59.0 billion in July"

Click on graph for larger image.

Click on graph for larger image.The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

Looking at the trade balance, excluding petroleum products, it appears the deficit peaked at about the same time as the housing market / mortgage equity withdrawal in the U.S. This is an interesting correlation (but not does imply causation). I had more on MEW vs. the trade deficit a few months ago.

The ex-petroleum deficit is falling fairly rapidly, almost entirely because of weak imports (export growth is still strong). But unlike the previous decline in the trade deficit (during the '01 recession), petroleum imports are still strong.

Normally oil prices would now be falling as the U.S. economy weakens - instead we are seeing margins shrinks for U.S. refiners and record high oil prices. This would seem to imply that global demand for oil is strong, while domestic consumption is weak. This evidence supports the "decoupling" argument: that the U.S. economy could slow, but economic growth in the rest of the World would stay strong (added: I'm not buying into the decoupling argument - I think it is unlikely).

As I've mentioned before, I need to spend some time looking at oil.

Tuesday, October 09, 2007

LA Times: Slipping imports reflect slowing economy

by Calculated Risk on 10/09/2007 02:08:00 AM

From the LA Times: Slipping imports reflect slowing economy

Cargo containers crammed with foreign-made goods that were supposed to set a record in August at major U.S. ports took an unexpected turn, with imports sinking 1.4% in another sign of the slowing of the economy.

...

The slump in oceangoing imports unloaded at the 10 largest U.S. container ports in August was the first drop since Global Insight began its monthly Port Tracker report in 2005. The number stunned some port watchers.

"When I first saw these numbers, I called the researchers and asked them if they had left a column out of the spreadsheet. I thought it was a typo," said Craig Shearman, vice president of the National Retail Federation, which pays Global Insight to conduct the trade research.

Thursday, September 20, 2007

The Dollar and the Trade Deficit

by Calculated Risk on 9/20/2007 03:07:00 PM

The following graph shows the U.S. trade deficit as a percent of GDP compared to the Fed Nominal Major Currencies Dollar Index.

NOTE: The trade deficit as a percent of GDP is presented as a positive number (for easier comparison to the dollar index). The 2007 trade deficit is estimated at 5.1% of GDP. The 2007 currency index is set to the Sept value. Click on graph for larger image.

Click on graph for larger image.

The common pattern is a currency strengthens and the trade deficit increases. Some time after the currency peaks, the trade deficit peaks. And that is followed by a bottom in the currency. There are other factors, but that is the common pattern.

The recent increase, and extraordinary size of the U.S. trade deficit, was probably related to the housing bubble and mortgage equity withdrawal (MEW). Now that MEW is generally declining, and the U.S. economy weakening, the U.S. trade deficit will probably continue to decline.

If the trade deficit has peaked, the dollar is probably much closer to the bottom than the top. I know this may seem like heresy, especially given recent events.

The biggest short term concern is that MEW will collapse, and the trade imbalance will unwind faster than expected. A "Wile E. Coyote moment"! (see Krugman: Will There be a Dollar Crisis? )

Also, from the WSJ: World Economy in Flux As America Downshifts

"We're definitely poised to have some significant rebalancing" of trade, says Harvard University economist Kenneth Rogoff, a former chief economist for the International Monetary Fund. He had been expecting the account deficit to shrink "by maybe half a percentage point of GDP over the next twelve months. Now it seems likely it will go down by 1.5 percentage points." And, he adds, "We could see something more rapid."

Something "more rapid" could be painful. Since Americans have financed their prosperity with borrowed money, reversing that habit means a period of living less opulently.

If foreign money turns scarce and the trade deficit narrows suddenly, Americans could face a tumbling dollar, soaring interest rates and an economic downturn. That could send shock waves back through Europe and Asia if their own consumers don't make up for lost demand from the U.S., the world's largest national economy.

If it happens more gradually, the recent run of American prosperity may continue, in a more subdued way.