by Calculated Risk on 6/01/2008 07:35:00 PM

Sunday, June 01, 2008

WSJ: Number of Foreclosed Homes Keeps Rising

From the WSJ: Number of Foreclosed Homes Keeps Rising

Lenders and investors in mortgages owned about 660,000 foreclosed homes in April, up from 493,000 in January and 231,000 in January 2007, according to First American CoreLogic ... The April total works out to about one in seven previously occupied homes available for sale nationwide.The lenders were slow to reduce prices at first, apparently hoping for "better market conditions". Now some lenders are getting aggressive as they realize that holding REOs means even greater losses as prices continue to fall.

... By cutting prices, lenders have managed to increase sales of such homes sharply in recent months in some cities hit hard by foreclosures ... Mark Zandi, chief economist at Moody's Economy.com, forecasts that the inventory of REO homes won't peak before the end of 2009.

...

The REO glut is weighing on house prices in many areas, as banks tend to cut prices faster than other sellers.

From anecdotal evidence, it appears the lenders are being aggressive on pricing at the low end, but are still reluctant to discount mid to higher priced homes. This will probably change as the REOs continue to pile up at the banks.

REO Market Picking Up

by Calculated Risk on 6/01/2008 09:37:00 AM

From the LA Times: Sales of foreclosures are on the rise

THE MARKET may be down, but sales of bank-owned properties are picking up, with multiple offers being made in many cases as lenders drop their prices to move foreclosed homes off the books.Yes, some REO lenders are finally getting realistic with their pricing, and in areas with significant REO activity (and aggressive lenders) prices may be close to the eventual nominal bottom. This is one of the key points I made in House Price Mosaic.

...

"A $650,000 to $700,000 appraisal a year ago in some areas is now worth about $350,000. It took a while for the banks to adjust their mentality to that." [said Earl Bonawitz, general manager for Century 21 Wright in Temecula]

...

John Karevoll, an analyst with DataQuick Information Systems, also is seeing that REO prices have come down and more homes are closing escrow than a few months ago.

"The big question is whether we're in a recession," he said. "If we are, we're in for some more downturn. If we're not in a recession, it's likely that prices have found their bottom and that most of the declines are behind us. That's true for REOs and the market as a whole."

But this article misses a far more important point: house price changes vary widely by area, not just by state, but even within cities. Over time the equilibrium between different price ranges will return, but the price dynamics will be different. Areas with a large number of REOs have seen much faster price declines - and are probably closer to the price bottom. Areas with fewer REOs will exhibit "sticky prices" and the prices will probably decline for some time.

Tuesday, May 20, 2008

On the REO Trail

by Calculated Risk on 5/20/2008 06:29:00 PM

Here are a couple of recent videos from Realtor Jim in San Diego. The first video is in a run down area of Oceanside with REO after REO (2 min 19 sec).

The second video is in Valley Center (near Escondido). (2 min 21 sec) Jim mentions the Cash for Keys program (he is offering the previous owners $2500 for their keys). This house sold for $927,500 in 2005.

Trash Outs and Cash For Keys

by Tanta on 5/20/2008 08:19:00 AM

Here's a wee bit of cognitive dissonance with your coffee, courtesy of TheStreet.com:

Neighborhoods across the U.S. are being ransacked.I have been wanting some real numbers--not just a few splashy anecdotes--about the "trash out" thing. This is because it's exactly the sort of car-crash story the press loves, so it's the sort of thing always in danger of getting overstated (like the "burn outs").

In fact, about 50% of homes have substantial damage following foreclosure, according to a survey of 1,500 real estate agents by Campbell Communications in Washington, D.C. (This is not just due to homeowners looting their foreclosing properties; some do not have the financial capabilities for the home's upkeep, and other times vandals are responsible.)

To keep real estate agents from being left to sell homes with floor and carpet damages, holes in the wall, and removed appliances, a preventive measure is being offered to homeowners facing foreclosure known as "cash for keys."

The thing is, "trash outs" have as far as I know existed ever since the invention of foreclosure; they were simply rather rare. Not that most foreclosed homes were ever in pristine condition. But that's the thing: for most of my experience in this business the vast majority of REO damage was in fact due to the mortgagor's inability to afford repairs (indeed, the exploding water heater that damaged several hundred square feet of carpet might well have been the financial catastrophe that sent a struggling household into foreclosure in the first place). The rest was a function of vacancy: either vandalism or simply weather damage like frozen pipes, green pools, brown lawns, etc.

So I'm a touch skeptical about the claim that 50% of REO has "substantial damage" and most of that is willful trashing of the property. It would have been nice for the reporter to supply the details here. I became even more skeptical when I read this:

Lenders see cash for keys as a small price to pay when compared with the cost of repairs. Indeed, the price impact when people damage their houses can be up to 25% of what the home is worth, according to Campbell Communications. (That means a $400,000 home's repairs might cost around $100,000.)I freely admit it has been a while since my wrinkled reptilian snout has had to read a lot of detailed repair estimates. However, I think I need someone to explain to me how anyone can do $100,000 worth of damage to a three-bedroom two-and-a-half bathroom home with doors that are not wide enough to admit a backhoe. I suppose it's possible, but can the average repair bill be even close to that?

Then there's this:

How many people are biting?Having been assured by all kinds of people that homeowners are just ruthlessly walking away, I'm struggling with the idea that they're too pissed to collect an extra couple grand for the keys. They'd rather "mail them in" and get nothing? Because this might have something to do with their credit ratings? They really think they can make more than $3,000 net ripping out the furnace and selling it on eBay? That's easier than taking a check from the servicer?

It depends. Cash for keys is not always considered a bargain by homeowners. Losing their home and credit is a heavy burden.

"Most people don't want cash for keys," says the researcher Popik. "They want their credit ratings to stay intact."

My theory is that whenever the emerging popular narratives are this contradictory--homeowners are cold and calculating enough to just walk away from an upside-down investment, but they are also emotional and irrational enough to prefer the revenge of knocking holes in the drywall to getting a check to cover moving expenses; they can afford their mortgages but choose not to pay them, but they also can't afford basic maintenance before the foreclosure; they care about their credit ratings except they don't care about their credit ratings; they are the victims of servicers who won't answer the phone, but they are also bitter people who thumb their noses at a generous check the servicer is offering--we have an excellent opportunity to recognize that:

1. The category "homeowner" is extremely diverse.

2. All kinds of people do all kinds of things for all kinds of reasons, not all of which are obvious to anyone including the people who do these things.

3. Any discussion of "psychology" that assumes a universal, perfectly consistent and easily-predictable human response to falling home values or foreclosures is not a very sophisticated understanding of human psychology (Hi, Dr. Shiller!).

4. Any argument about "bailouts" that seems to depend on characterizing all homeowners in the same way, and imputing to them all the same experiences and motives and the same responses to incentives or disincentives, is not worth listening to.

5. I wouldn't hang a dog on the basis of a survey of real estate agents at this point.

Thursday, May 08, 2008

Another REO Slide Show

by Calculated Risk on 5/08/2008 11:00:00 PM

Peter Viles at LA Times brings us another gallery of foreclosed properties in LA.

Peter features one on his blog L.A. Land: A foreclosure bargain: The tires are free!. Check it out.

Here is another example - yeah, bars on the windows is a "family neighborhood"! Someone paid $485,000 for this home?

734 Aragon Ave., Los Angeles 90065

Agent's description: "Bank owned. This is a charming little home in a famly neighborhood. Garage was converted. SUBMIT ALL REASONABLE OFFERS."

• Sales history (from Redfin.com): Sold for $485,000 in February 2007.

• Current listing price: $294,900

• Discount from sales price: 39.2%

Friday, May 02, 2008

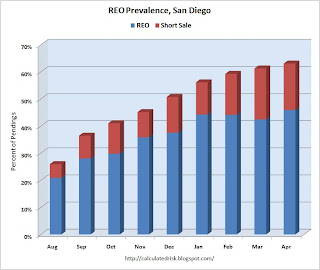

REO / Short Sale Prevalence Reaches 63% in San Diego

by Calculated Risk on 5/02/2008 01:39:00 PM

According to San Diego REO broker Ramsey Su, the percent of REOs and Short Sales reached 63% of all pending sales in San Diego in April. Click on graph for larger image.

Click on graph for larger image.

From Ramsey:

"I do not have historical data, [but] it would be reasonable to assume the percentage of REOs and SSs is unprecedented. ... Short sales are typically still occupied by sellers, enjoying their “free rent” period. That explains why vacant listings are not moving up."The percent of listings vacant has been steady for the last 6 months at about 38% - historically a very high level.

Update: Note that only a few of the pending short sales actually close. (hat tip Schahrzad)

Ramsey has just started tracking the percentage of Notice of Defaults (NODs) for higher priced homes (with original loan amounts above $500K in San Diego). In April, 21.3% of NODs were for homes with these larger loans. Ah yes, we're all subprime now!

Tuesday, April 29, 2008

S&P Downgrades $41 Billion mostly Alt-A Deals

by Calculated Risk on 4/29/2008 07:50:00 PM

From Reuters: S&P cuts $41 bln of mostly higher-rated Alt-A deals

Standard & Poor's cut the ratings on about $41 billion of mostly higher-rated U.S. residential mortgage-backed securities backed by so-called Alt-A loans on Tuesday.And here is a key statement on foreclosures and REOs:

The rating agency's action affected 2,183 RMBS classes from 334 Alt-A deals originated during 2006.

"Due to current market conditions, we are assuming that it will take approximately 15 months to liquidate loans in foreclosure and approximately eight months to liquidate loans categorized as real estate owned (REO)."So homes going into foreclosure today - in S&P's view and on average - will be liquidated 15 months from now, or in the summer of '09. So much for the '09 spring selling season - it will be dominated by REOs from the record foreclosure activity today.

Friday, April 18, 2008

The foreclosure 'discount'

by Calculated Risk on 4/18/2008 12:01:00 PM

Peter Viles at the LA Times has put together a collection of foreclosure listings in LA.

Viles features one house on his blog L.A. Land: The foreclosure 'discount': 45% in Glassel Park. Check it out! Here is another:

Source: LA Times.

FORECLOSED: GLENDALENote that the discount is to the asking price for the REO.

3732 Mayfield Ave., Glendale 91214

Agent's description: Bank-owned. Sold for $640,000 in 2007. Beautiful remodeled house on zero traffic tree lined street. Raised foundation, refinished hardwood floors, newer roof ... private yard.

• Sales history (from PropertyShark.com): Sold for $640,000 in February 2007.

• Current listing price: $449,900

• Discount from sales price: 29.7%

Here is the listing at Realtor.com. This is a 2 Bed, 1 Bath, 1,054 Sq. Ft. house, on a 5,000 sq ft. lot built in 1951.

What the heck were people thinking in Feb 2007? $640K? Ouch.

Saturday, January 05, 2008

Jingle Liens

by Tanta on 1/05/2008 07:45:00 AM

Hat tip to Disempowered Paper Pusher (the backbone of our industry!) for this excellent BusinessWeek piece on homes abandoned by both borrower and lender, "Dirty Deeds."

An anecdote with all the right motifs:

In 1998, Elizabeth M. Manuel obtained a $34,500 mortgage on the property from IMC Mortgage (since acquired by Citibank). By 2002, the loan had been sold into a securitization trust administered by Chase Manhattan (now JPMorgan Chase) as trustee. It also went into default, and Chase began foreclosure proceedings. In a court filing, Manuel (who could not be located for comment) said she left the home while the foreclosure action was pending. More than five years later, though, the title remains in her name. The house, although still standing, has become a fire-gutted wreck.Besides amusing myself by trying to figure out just what documents I'd have to give Judge Boyko to prove standing to foreclose in this case, I am of course deeply impressed by the social acceptability of "just walking away."

In May 2007, Nowak issued a default judgment against Chase for $9,000. But these cases can be notoriously difficult to untangle. Thomas A. Kelly, a spokesman for the bank, notes that Chase sold its trustee business to the Bank of New York Mellon (BK) in October, 2006, and couldn't locate anyone at Chase able to comment. But he reiterates the industry view that Chase can't be held responsible for maintaining a property it never owned. He acknowledges that if a home didn't seem worth taking as collateral, the bank may have made a decision to "just walk away."

My guess is that Chase never completed the foreclosure precisely because it never wanted to held accountable for taxes, insurance, and maintenance on a nearly worthless property; the "tangle" of securitization and trustee swaps and so on undoubtedly contributes to the mess but at some level that's smoke. So the city of Buffalo is working out a new process to tie those properties around the lenders' necks precisely to forestall this game. It will certainly be interesting to see whether it catches on elsewhere.

Reading things like this also always makes me think of the endless complaining you get over FHA appraisal and property inspection practices. Every time you're tempted to think those are silly and bureaucratic--delaying closing for another 30 days while an attic window pane is repaired--and in need of "modernization," remember these properties that were decrepit at the time they were first mortgaged by those modernized conventional subprime lenders, nearly worthless at the point the borrower could no longer carry the payments, and then nothing more than urban blight after years of the lender refusing to take title. FHA, for all its flaws, never walks away from title.

Sunday, November 04, 2007

Damaged REOs in Las Vegas

by Calculated Risk on 11/04/2007 12:28:00 PM

From the Las Vegas Review-Journal: Foreclosure Fallout: Home Sour Home

Housing crisis leads some former owners, tenants to take anger out on property

...

As many as 25 percent of Las Vegas' bank-foreclosed homes suffer intentional damage, according to an informal R-J survey of valley appraisers and real estate agents. According to Thomas Blanchard, owner/broker of First Realty Group, this damage -- most of which is inflicted in the four to 12 months between the notice of default and the constable's knock at the door -- typically requires $3,000 to $10,000 to repair. However, it can approach or exceed 10 percent of a home's total value.

This is a video I found of a vandalized REO in Las Vegas."Some of the time, the house's worth is a detriment to the land value," says Blanchard. "It's amazing what some people will do to their houses." |

Wednesday, October 10, 2007

Virginia: Foreclosed Homes Flood Auction

by Calculated Risk on 10/10/2007 04:37:00 PM

Ramsey Su reported on an auction in San Diego (see REO Auction in San Diego).

Here is a report on an auction in Virginia from the Washington Times: Foreclosed homes flood auction (hat tip X)

Auctioneer Hudson & Marshall sold nearly 240 foreclosed homes in the Washington area last weekend, making a small dent in a large backlog of homes abandoned by buyers who couldn't keep up with escalating payments.Here are a couple of recent amateur videos on auctions:

...

Many sold for 20 percent below market value. About 75 of the properties offered at auction failed to sell.

Northern Virginia Auction

San Diego Foreclosure Sale Oct 3, 2007

And check out the Vandalized REO too. WARNING: Foul language on walls.

Tuesday, October 09, 2007

REO Auction in San Diego

by Calculated Risk on 10/09/2007 10:10:00 PM

My friend Ramsey Su sent me an update tonight:

This is the 3rd San Diego REO auction of its kind in 5 months, 4th, if you count the DHI auction by the same auctioneer. Fortunately, of the 83 properties, only 7 were not previously listed in the MLS so this is an easy batch of properties to research.I noted yesterday that unlisted REOs are one of the reasons the reported inventory level is currently too low. In this case, over 90% of the REOs were listed.

REOs are now an integral part of the real estate market. Appraisals have come down to earth and REO brokers are selling properties in record volume, though not matching the pace of acquisitions.Lenders are now aggressively cutting prices on REOs. The average LIST price is almost 20% off the previous selling price! Ouch. Ramsey also notes that many of these homes were previously purchased with 100% LTV, so the homeowners were substantially underwater and workouts were near impossible.

...

Similar to the homebuilders, as the REOs force the price down, it "impairs" the neighborhood and homeowners in default are even more likely to be foreclosed upon now.

...

"Previously Valued To"

REDC abandoned previous practice of using the last sold price as their "Previously Valued To" price. I use available tax record and recreated that value. It appears the last average list price of these properties is 81.4% of the last sold price.

If someone is thinking the lenders are working down the REO inventory in San Diego, Ramsey Su offers the following graph:

Click on graph for larger image.

Click on graph for larger image.This graph shows:

NODs: Notice of Default,

NOTs: Notice of Trustee’s sale,

and

REOs: Real Estate Owned by the Lender.

After a NOD is filed, the lender must wait 3 months before filing a NOT. Then the foreclosure sale happens 3 weeks later. Ramsey has shifted the graph to account for these lags.

The graph of NODs shows where NOTs and REOs will go over the next 3 months.

Ramsey adds this comment:

719 REOs in San Diego during the last 4 weeks, comparing to just 1,239 sales reported so far by the MLS for September, are we going to see over 50% REO prevalence next quarter?It's about to get ugly.