by Calculated Risk on 6/12/2009 10:54:00 PM

Friday, June 12, 2009

Study: Home Equity Borrowers in Danger

"The conventional view is that housing appreciation is good because it reduces (default) risk. Not according to my theory, which is housing appreciation is bad. It encourages junior-lien borrowing. When appreciation stops, somebody is going to be left in a bad position."From Matt Padilla at the O.C. Register: Second mortgages: Lines of danger?

Michael LaCour-Little, finance professor at Cal State Fullerton (emphasis added)

Record foreclosures hitting Orange County involve more than just newbie buyers who got in over their heads.And look at these numbers:

Some housing watchers say evidence is mounting that even veteran homeowners got caught up in housing euphoria and now are paying for it.

The latest argument comes from Michael LaCour-Little, a finance professor at Cal State Fullerton. He is lead author of a new study, which found that during the housing boom some long-time owners borrowed against all their property's equity gain, or paper profits. They treated their houses like cash machines.

...

It's long been assumed that homebuyers who purchased at housing's peak with little money down are among the most likely to face foreclosure. They owed more than their property was worth once prices tanked.

But the study concludes 'cashing-out' is about as predictive of foreclosure for the same reason: negative equity.

Professor LaCour-Little tracked all houses and condos set for foreclosure auctions, known as trustee's sales, in the first two weeks of November 2006, 2007 and 2008 in Orange, Los Angeles, Riverside, San Bernardino and San Diego counties. ...There will be many foreclosures of homes bought before the bubble (or in the early stages of the bubble), because the homeowners extracted too much equity from the home. This is not surprising, but probably means more foreclosures than policymakers expect.

For the early November 2008 data sample, he tracked 2,358 properties and found 79 percent of borrowers had at least a second mortgage. Some also had third and fourth liens. ...

The 2008 foreclosures were purchased in "median" year 2004, meaning half the purchases were before and half after. That suggests more than half the purchases were before housing's peak in 2005 and 2006.

UK: One in Ten Homeowners with Negative Equity

by Calculated Risk on 6/12/2009 08:49:00 AM

From The Times: One in ten homeowners fall into negative equity

One in ten homeowners fell into negative equity during the first three months of the year, the highest proportion for 15 years, the Bank of England said today.The UK has about 10 million homeowners with mortgages; the U.S. has about 51.6 million.

The Bank estimated that between 7 and 11 per cent of homeowners with a mortgage owed more to their lender than their property was worth, the equivalent of 700,000 to 1.1 million householders.

...

Around 200,000 buy-to-let investors were also estimated to owe more on their mortgage than their property was worth ...

The research said that the overall number of those in negative equity during the first quarter of 2009 was comparable with those who suffered the problem in the mid-1990s, during the last housing market correction.

The Bank said house prices had fallen by around 20 per cent between the autumn of 2007 and the spring of 2009, the largest nominal fall in property values on record. In contrast, it took six years for house prices to fall by 15 per cent between 1989 and 1995.

Moody's has estimated there 14.8 million homeowners with negative equity in the U.S. (just under 30% of homeowners with mortgages) so the problem seems more severe in the U.S.

Tuesday, May 05, 2009

Homeowners Underwater

by Calculated Risk on 5/05/2009 09:47:00 PM

There is substantial disagreement on the number of homeowners underwater (they owe more than their homes are worth). At the end of 2008, American CoreLogic estimated there were 8.2 million homeowners underwater.

Zillow.com is now estimating 26.9 million homeowners with negative equity.

From the WSJ: House-Price Drops Leave More Underwater

Real-estate Web site Zillow.com said that overall, the number of borrowers who are underwater climbed to 26.9 million at the end of the first quarter from 16.3 million at the end of the fourth quarter.This is a substantial difference. Apparently Zillow assumes that borrowers with HELOCs have drawn down the maximum amount, and I suppose they use their house price software. My guess is Economy.com's estimate is closer.

...

Moody's Economy.com estimates that of 78.2 million owner-occupied single-family homes, 14.8 million borrowers, or 19%, owed more than their homes were worth at the end of the first quarter, up from 13.6 million at the end of last year.

No matter - the number is huge. And many of these borrowers are in danger of default if they experience a negative event (death, disease, divorce, unemployment, etc.)

Thursday, March 05, 2009

More on Negative Equity

by Calculated Risk on 3/05/2009 06:18:00 PM

The First American CoreLogic Negative Equity Report for December 2008 is available on line (ht Ilya, Brian). You have to sign up to read the report.

A few key points:

Going forward, the largest increases in the share of negative equity will most likely occur in states that have not yet experienced deep declines. The reason: the boom/bust states already have very high negative equity shares and incremental declines in home prices will result in smaller negative equity share increases relative to other states given the same decline in prices. This means that as prices continue to decline in 2009, the rise in the negative equity share of states outside the boom/bust regions will begin to accelerate more quickly relative to the boom/bust states.

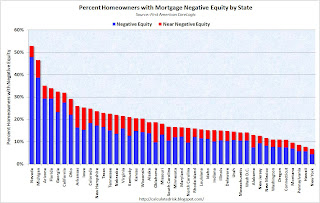

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of households with mortgages underwater by state (and near negative equity defined as with less than 5% equity). As noted above, the largest increases in negative equity going forward will be in states other than California, Nevada, Arizona and Florida.

UPDATE: States with no data from CoreLogic: Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia, Wyoming.

Wednesday, March 04, 2009

Report: 8.3 Million U.S. Homeowners with Negative Equity

by Calculated Risk on 3/04/2009 09:08:00 AM

From Bloomberg: More Than 8.3 Million U.S. Mortgages Are Underwater

More than 8.3 million U.S. mortgage holders owed more on their loans in the fourth quarter than their property was worth as the recession cut home values by $2.4 trillion last year, First American CoreLogic said.Late last year Mark Zandi at Moody's Economy.com estimated that there were "roughly 12 million households, or 16%, owe more than their homes are worth". The difference between the estimates is probably because a large number of homeowners have little equity - and small changes in home price assumptions change the number underwater significantly. The differences in percentages is because CoreLogic is using only households with mortgages; Zandi used all households (about 31% of households have no mortgages).

An additional 2.2 million borrowers will be underwater if home prices decline another 5 percent, First American, a Santa Ana, California-based seller of mortgage and economic data, said in a report today. Households with negative equity or near it account for a quarter of all mortgage holders.

Saturday, February 28, 2009

UK: 500,000 Lloyds Borrowers have Negative Equity

by Calculated Risk on 2/28/2009 01:07:00 AM

From The Times: Lloyds counts cost of HBOS takeover and property slump as 500,000 customers slip into negative equity

HBOS, Britain’s biggest mortgage lender, revealed that 381,669 customers, about 16.8 per cent of its mortgage book, owed more than the value of their homes. At Lloyds TSB, 162,000 homeowners, 15 per cent of its mortgage book, were in the same position.Also on comments: Haloscan crashed hard, so I switched to JS-Kit. I'll try to improve the JS-Kit interface, and hopefully Ken (CR Companion) will be able to provide some help. Thanks to everyone for your patience.

These figures compare with only 0.1 per cent of customers of each bank – a total of less than 4,000 households – being in negative equity at the end of 2007.

...

Michael Saunders, chief economist at Citigroup, said last month that the bank estimated homeowners with negative equity was up to about 1.2 million, from 100,000 a year ago, out of a total of between 11 million and 12 million mortgages. “There is no sign that the decline in house prices – and hence the surge in negative equity – is yet close to ending,” he said.

He said in December that about one owner in four could be in negative equity if prices fell by a total of 30 per cent by 2010, as many analysts expect.

Wednesday, February 18, 2009

The Housing Bailout

by Calculated Risk on 2/18/2009 01:49:00 AM

From Daivd Leonhardt at the NY Times: A Bailout Aimed at the Most Afflicted Homeowners

The long-awaited housing bailout will finally be announced on Wednesday.The details of the housing bailout should be available tomorrow (who qualifies, etc.). I'm not sure why the government is bailing speculators (aka homeowners) who bought homes they really couldn't afford during the housing bubble.

[T]he key to understanding that plan will be remembering that there are two different groups of homeowners who are at risk of foreclosure.

The first group is made up of people who cannot afford their mortgages and have fallen behind on their monthly payments.

...

The second group is far larger. It is made up of the more than 10 million households that can afford their monthly payments but whose houses are worth less than what is owed on their mortgages. In real estate parlance, they are underwater.

...

The administration is betting that few of those 10 million underwater homeowners will walk away. ... If they begin to abandon their homes in large numbers, however, they will aggravate the housing bust ...

Thursday, October 30, 2008

Report: Almost Half of Nevada Homeowners Underwater

by Calculated Risk on 10/30/2008 09:32:00 PM

The WSJ reports on a new report from First American CoreLogic that estimates 48% of homeowners with a mortgage in Nevada owe more than their homes are worth. The WSJ reports that First American CoreLogic estimates 18% of homeowners with a mortgage nationwide are underwater.

Using the Census Bureau 2007 estimate of 51.6 million households with mortgages, 18% would be 9.3 homeowners with negative equity. This is less than the recent estimate from Moody's Economy.com of 12 million households underwater. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the percent of homeowners with mortgages underwater by state (data from First American CoreLogic via the WSJ)

Note: there is no data for Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia and Wyoming.

It's interesting that the two worst states are Nevada and Michigan - one a bubble state, the other devastated by a poor economy. That pattern continues - everyone expects the bubble states of Arizona, Florida and California to be near the top of the list, and Ohio too because of the weak economy - but what about Arkansas, Iowa and even Texas?

The housing problems are everywhere.

Tuesday, October 28, 2008

First Fed: Over 22% of Loan Portfolio to Underwater Households

by Calculated Risk on 10/28/2008 12:02:00 AM

The 8-K filed by First Fed with the SEC today has some interesting information on current LTVs. (hat tip Brian) Click on table for larger image in new window.

Click on table for larger image in new window.

This table shows the original LTV of First Fed's $4.5 billion loan portfolio, and the current LTV using OFHEO House Price Index for price declines.

This shows that about 22.3% of First Fed loans (by dollar) are underwater. It would be a larger percentage using the Case-Shiller price index.

Approximately $1.0 billion in loans are underwater out of $4.5 billion in loans. Using the above table, and the delinquent loans by LTV on page 8, we can determine the percent delinquent by LTV category.

Using the above table, and the delinquent loans by LTV on page 8, we can determine the percent delinquent by LTV category.

As expected, the higher the current LTV, the larger the percentage of delinquent loans. Probably most of the loans listed as 90% to 100% LTV are also currently underwater too since First Fed uses OFHEO (and Case-Shiller is probably worse and I believe more representative of actual price changes).

Also see the bottom of page 7 for delinquencies by borrower documentation type. For Verified Income/Verified Assets loans, 5.7% of loans are delinquent. For Stated Income (and no income) loans, around 20% of loans are delinquent. Not exactly a surprise ...

This is important for the entire industry: the higher the LTV, the higher the delinquency rate. As house prices continue to fall, and more and more households have negative equity - Moody's Economy.com estimates 12 million households currently are underwater, and this will probably increase to 20+ million by the time housing prices bottom - the delinquency rate (and foreclosures) will continue to increase.

Sunday, October 19, 2008

UK: Negative Equity to Reach 2 Million

by Calculated Risk on 10/19/2008 12:33:00 AM

From The Times: Negative equity ‘to reach 2 million’

Collapsing house prices are plunging 60,000 homeowners a month into negative equity, which means the country is on course for a worse crisis than the 1990s crash.The population of the UK is about 20% of the U.S., so using a ratio of population, this would compare to about 10 million homeowners in the U.S. with negative equity. Moody's estimates there are already 12 million homeowners in the U.S. with negative equity in the U.S. - so the problem appears to be worse in the U.S. than in the U.K.

At current trends, 2m households will enter negative equity by 2010, outstripping the 1.8m affected at the bottom of the last housing slump.

...

Economists believe house prices will fall by up to 35% from their peak by 2010. This compares with a drop of only 20% in the early 1990s.

...

Capital Economics, the City consultancy, expects up to 2m properties will be in negative equity by 2010 — more than in the recession of the early 1990s.

Tuesday, October 14, 2008

Research: Housing Busts and Household Mobility

by Calculated Risk on 10/14/2008 12:01:00 PM

Early this year I wrote:

Less worker mobility [due to negative equity] is kind of like arteriosclerosis of the economy. It lowers the overall growth potential.In a new research paper, Fernando Ferreira, Joseph Gyourko (both from Wharton) and Joseph Tracy (New York Fed) quantify the impact of negative equity on household mobility: Housing Busts and Household Mobility, NBER, © 2008

Perhaps as many as 15 to 20 million households will be saddled with negative equity by 2009. Even if most of these homeowners don't "walk away", there might still be a negative impact on the economy due to less worker mobility.

How do housing busts affect residential mobility? The current market downturn has raised fears that local communities will suffer as social capital is depleted due to foreclosures forcing defaulting homeowners to move. One recent media report indicates that 220,000 homes were lost to foreclosure just during the second quarter of 2008, which is nearly triple the number over the same time period in 2007. Default-induced moves always are the first mobility-related impact observed during a downturn, but they need not be the last or the most importantly economically. In fact, much previous research indicates that factors such as falling home prices or rising interest rates that typically are associated with housing market declines can ‘lock-in’ people to their homes—reducing, not raising mobility.And their conclusion:

Having negative equity in one’s home reduces mobility rates ... by nearly 50 percent from its baseline level according to our estimates. That the net impact of negative equity is to reduce, not raise, mobility certainly does not mean that defaults and foreclosures are insignificant consequences of this condition. However, it does signify that the preponderant effect is for owners to remain in their homes for longer periods of time, not to default and move to another residence.The economic impact from less household mobility isn't quantified in the paper.

Finally, reduced mobility has its own unique set of consequences which have not been clearly identified or discussed in the debate about the current housing crisis. Substantially lower household mobility is likely to have various social costs including poorer labor market matches, diminished support for local public goods, and lesser maintenance and reinvestment in the home.

emphasis added

To size the problem: According to the Census Bureau, from 2005 to 2006, approximately 1.7 million owner-occupied households, moved to a different county or state. If approximately 1 in 6 households (the same proportion as with negative equity according to Moody's) will not accept a transfer now because of depressed home values that would be almost 300,000 households per year that will be reluctant to accept job transfers.

This will not only impact the earning potential of these households, but this could also impact the performance of various companies. A significant majority of households that migrate have incomes above the median - and negative equity situations will limit the ability of companies to transfer these senior employees. Less household mobility could be a signficant drag on the economy for several years.

Sunday, October 12, 2008

Recent Home Buyers Underwater

by Calculated Risk on 10/12/2008 10:03:00 AM

Here are a couple of articles that suggest a number of recent home buyers are already underwater (owe more than their homes are worth). Here is a graphic from the South Florida NewsPress.com: ‘Underwater’ borrowers sign of more trouble

Here is a graphic from the South Florida NewsPress.com: ‘Underwater’ borrowers sign of more trouble

Click on graph for larger image in new window.

Worst off are those who bought homes in 2006, just as the housing boom was ending: 78.5 percent of those now have home values less than the original loan amount, according to second-quarter statistics compiled by real estate data provider Zillow.com.But look at 2007 and even 2008. In Lee County Florida, according to NewsPress.com, 14.5% of homeowners who bought this year owe more than their homes are worth. And almost two-thirds of homebuyers in 2007 are underwater.

And the MercuryNews.com has a sad tale of a neighborhood devasted by foreclosures: Financial crisis: Homeowners in Manteca neighborhood cope with foreclosures.

The math alone is humiliating. The house was worth $770,000 after the Cantrells bought it [in 2006] and upgraded the back yard. They spent $250,000 for the down payment and pool but still owe about $520,000. They've had four offers on the house — the highest was $355,000.In October 2007 the home builder sold some of the homes at auction.

Representing his neighborhood with a promise to report back, [Dave Cantrell] attended the auction in a Pleasanton hotel ballroom last October. ... While Cantrell had paid a base price of $658,500 for his house, a nearly identical one sold for $391,000.Even the buyers who paid $391,000 last October have clearly lost money and with a 10% downypayment are close to being underwater.

Tuesday, October 07, 2008

Homeowners with Negative Equity

by Calculated Risk on 10/07/2008 11:41:00 PM

From the WSJ: Housing Pain Gauge: Nearly 1 in 6 Owners 'Under Water'

About 75.5 million U.S. households own the homes they live in. After a housing slump that has pushed values down 30% in some areas, roughly 12 million households, or 16%, owe more than their homes are worth, according to Moody's Economy.com.This is close to my estimate of homeowners with negative or no equity. These homeowners are at risk for default if they experience a negative event (like divorce or health problems) or they simply decide to mail in the keys. The number will probably rise to 20 million or more by the time house prices bottom.

Monday, September 29, 2008

Homeowners with Negative Equity

by Calculated Risk on 9/29/2008 07:09:00 PM

The following analysis is based on data from the Census Bureau (for 2007) and First American CoreLogic at the end of 2006. Although some of this data is a little old, it provides us with an estimate of the number of Americans household underwater (with negative equity).

According to the Census Bureau's 2007 American Community Survey there were 51,615,003 households with a mortgage in the U.S. at the end of 2007. Click on chart for larger image in new window.

Click on chart for larger image in new window.

For prices, using Case-Shiller, by the end of 2006 U.S. home prices had fallen just over 1% from the peak, but a number of homeowners were already underwater because they bought their homes with more than 100% LTV financing.

By the end of 2007, prices had fallen 10% from the peak, and 8.2 million homeowners owed more on their mortgages than their homes were worth.

As of Q2 2008, prices had fallen almost 18% from the peak, and for the graph, I estimated that prices will decline about 22.5% from the peak by the end of 2008. (this seems conservative). This means about 15.4 million households will be underwater or already foreclosed on by the end of 2008.

The last two categories are based on various estimates for the price bottom (peak-to-trough). The 30% decline was suggested by Paul Krugman in December 2007: What it takes). The 35% decline is close to the "severe recession" case presented by JPMorgan last week.

Not every homeowner with negative equity will default, in fact many of these homeowners will only be underwater by a few percent. But if we estimate one half of homeowners with negative equity will eventually default, use a 50% loss severity, and a 35% price decline (23.6 million households with negative equity), and use the median house price from the Census Bureau of $216 thousand, we get $1.3 trillion in mortgage losses for lenders.

I think this is probably high (probably fewer than 50% will default), but this does give a general idea of the potential losses. If we use one third of homeowners, the mortgage losses with a 35% peak-to-trough price decline would be about $840 billion.

Monday, June 16, 2008

More on the Housing Bust and Labor Mobility

by Calculated Risk on 6/16/2008 04:09:00 PM

On Saturday I wrote about how the housing bust is impacting labor mobility. Here is some more ...

L.M. Sixel and Nancy Sarnoff have a terrific article today in the Houston Chronicle on how the housing bust is impacting the job market in Houston: Poor housing market takes many off the job market (hat tip slmortgagebroker)

Carole Hackett has some high-level management jobs to fill. But the vice president of human resources of The Methodist Hospital is having trouble because of the slumping real estate market.As I noted on Saturday, from 2005 to 2006 (the most recent data), approximately 1.7 million owner-occupied households, moved to a different county or state in the United States. If approximately 1 in 8 households (the same proportion as with negative equity) will not accept a transfer now because of depressed home values that would be about 200,000 households per year that will be reluctant to accept job transfers.

Not in Houston, mind you. Hackett's problems are in Michigan, Illinois and Ohio.

That's because when Hackett identifies promising candidates for the vice president of quality and key nursing director positions, they can't move.

...

"My intuition is that the housing market crisis in the United States is greatly affecting labor mobility," said Barton Smith, director of the Institute for Regional Forecasting at the University of Houston.

One of the strengths of the U.S. labor market has been the flexibility associated with geographical mobility - households can move easily from one region to another for better employment. The housing bust will limit this flexibility.

Saturday, June 14, 2008

Will the Housing Bust Impact Geographical Mobility?

by Calculated Risk on 6/14/2008 06:41:00 PM

The WaPo had a story this morning, Held Back by the House, about a couple who moved from Florida to Washington because of a job change. They have been unable to sell their Florida home, and remarked:

"If we knew then what we know now, we would have stayed where we were."Of course many homeowners now know they are trapped:

[D]epressed sales and sinking home prices in many parts of the country are complicating relocations and transfers for thousands of workers ... A survey last year by Worldwide ERC, a nonprofit association that represents relocation specialists, found that depressed home values emerged as the No. 1 reason for resisting job transfers for the first time in more than 10 years.There are probably close to 10 million households currently with zero or negative equity in the U.S. For these homeowners, it will be very difficult to accept a job transfer to a different county or state.

Of the member organizations that reported employee reluctance to move, 71 percent cited the sluggish real estate market as an impediment to a job-related move, up from 16 percent last year.

"This is a dramatic shift," said Cris Collie, the group's chief executive. "The top issue has consistently been family concerns, such as dual-career couples, children at a critical school age or caring for elderly parents who live nearby.

Definition: Negative Equity: a homeowner owes more than their home is worth.

To size the problem: According to the Census Bureau, from 2005 to 2006 (the most recent data), approximately 1.7 million owner-occupied households, moved to a different county or state. If approximately 1 in 8 households (the same proportion as with negative equity) will not accept a transfer now because of depressed home values that would be about 200,000 households per year that will be reluctant to accept job transfers.

This will not only impact the earning potential of these households, but this could also impact the performance of various companies. A significant majority of households that migrate have incomes above the median - and negative equity situations will limit the ability of companies to transfer these senior employees.

Thursday, June 12, 2008

Boston Fed: Negative Equity and Foreclosure

by Calculated Risk on 6/12/2008 11:18:00 PM

Here is a new research paper with some important conclusions about the percentage of foreclosures among homeowners with negative equity. From Christopher L. Foote, Kristopher Gerardi, and Paul S. Willen at the Boston Fed: Negative Equity and Foreclosure: Theory and Evidence

As a consequence of the recent nationwide fall in house prices, many American families owe more on their home mortgages than their houses are worth—a situation known as “negative equity.” The effect of negative equity on the national foreclosure rate is of obvious interest to policymakers, but this effect is difficult to study with datasets that are commonly used in housing research. In this paper, we exploit unique data from the Massachusetts housing market to make three points. First, during a specific historical episode involving a downturn in housing prices—Massachusetts during the early 1990s—less than 10 percent of a group of homeowners likely to have had negative equity eventually defaulted on their mortgages. Thus, current fears that a large majority of today’s homeowners in negative equity positions will soon “walk away” from their mortgages are probably exaggerated. Second, we show that this failure to default en masse is entirely consistent with economic theory.The authors present a model to explain why homeowners with negative equity, but sufficient cash flow, will not walk away. See section 3: The basic economics of default from the borrower’s perspective

...

A foreclosure requires both negative equity and a household-level cash-flow problem that makes the monthly mortgage payment unaffordable to the borrower. Cash-flow problems without widespread negative equity do not cause foreclosure waves. Even if borrowers are having trouble making payments, they will always prefer to sell their homes rather than default, as long as equity in their homes is positive so they can pay off their outstanding mortgage balances with the proceeds of the sales. Similarly, widespread negative equity will not result in a foreclosure boom in the absence of cash-flow problems. Borrowers with negative equity and a stable stream of income will, in most cases, prefer to continue making mortgage payments. Thus, we argue that negative equity does play a key role in the prevalence of foreclosures, but not because (as is commonly assumed) it is optimal for borrowers with negative equity to walk away from affordable mortgages.

emphasis added

I think this model is helpful for understanding the behavior of homeowners with minimal negative equity, but may be flawed for a simple reason: the probabilities in the two state model are what the homeowner believes will happen, and homeowners deep in negative equity will assign probabilities of zero to the good outcome and one to the bad outcome.

Here are the equations as presented by the authors (see paper for description):

But notice what happens when we make the good outcome zero for deep underwater homeowners (instead of 3/4) and the bad outcome 1 instead of 1/4 (and adding stigma term). The choice simplifies to the obvious:

Where Stigma includes "moving costs, default penalties that take the form of limited future access to credit markets, sentimental attachment to the home, or even the presence of moral qualms associated with defaulting on one’s debts".

This is really the problem: deep underwater homeowners who perceive the probabilities of a negative outcome as 1 (and are probably mostly correct), will walk away from their homes unless Stigma is greater than (mpay - rent). And Stigma for many of these homeowners really depends on if it becomes socially acceptable for middle class Americans to walk away (ruthless default).

Finally, there may be problems when comparing to the Boston housing bust of the early '90s - although prices did decline about 30% from the peak in real terms (according to Case-Shiller), lending standards were tighter in the late '80s compared to the recent bubble, and few homeowners bought at the peak with no or negative equity (like during the current boom). Also, the current bubble was much larger than the late '80s bubble in Boston, and some areas in the U.S. will probably see real price declines in excess of 40% (maybe even 50% or more), and these homeowners will be deeply underwater.

This is an interesting paper. I believe it is like that a majority of homeowners with negative equity will not walk away from their homes. But I believe we need to know the number of homeowners deeply underwater, and try to understand their probable behavior.

Monday, March 17, 2008

Krugman Q&A on Housing and the Economy

by Calculated Risk on 3/17/2008 01:14:00 PM

Fortune has a Q&A piece with Professor Krugman: How bad is the mortgage crisis going to get?

Fortune: By year-end, 15 million Americans could have mortgages worth more than the value of their homes. What happens then?Much more in the Q&A.

Krugman: Actually, I think home prices will fall enough for us to produce about 20 million people with negative equity. ... if you have negative equity, you can end up being foreclosed on, and then some people will just find it to their advantage to walk away. We're probably heading for $6 trillion or $7 trillion in capital losses in housing. Some fraction of that will fall on owners of mortgages. I still think the estimates people are putting out there - $400 billion or $500 billion in losses - are too low. I think there'll be $1 trillion of losses on mortgage-backed securities showing up somewhere.

Monday, March 03, 2008

Paulson: Don't Walk Away

by Calculated Risk on 3/03/2008 11:58:00 AM

Remarks from Secretary Paulson:

First, many in Washington and many financial institutions have been floating proposals for a major government intervention in the housing market, with U.S. taxpayers assuming the costs of the riskiest mortgages. Today, 93 percent of American homeowners – 51 million households - pay their mortgages on time. Many are on tight budgets, sacrificing other things in order to make that payment. Only 2 percent are in foreclosure.

Most of the proposals I've seen would do more harm than good --- bailing out investors, lenders or speculators who, instead of getting a free-pass, should be accountable for the risks they took. Let me be clear: I oppose any bailout. I believe our efforts are best focused on helping homeowners who want to stay in their homes.

Second, this is a shared responsibility of industry, government and homeowners. We in government are working to expand options through the FHA, and we've worked with the industry to reach as many homeowners as possible to let them know that help is available. There is more that government and industry can do, and our efforts will continue to evolve. Homeowners have responsibilities as well. If borrowers won't ask about solutions, there is only so much that can be done on their behalf.

Third, the current public discussion often conflates the number of so-called "underwater" homeowners – that is, those with mortgages greater than the value of their house – with projections of foreclosures. Let's be precise: being underwater does not affect your ability to pay your mortgage, nor create a government responsibility for assistance. Homeowners who can afford their mortgage should honor their obligations --- and most do.

Obviously, being underwater is not insignificant to homeowners in that position. But negative equity does not necessarily result in foreclosure. Most people buy homes as a long-term investment, as a place to raise a family and put down roots in a community. Homeowners who can afford their payments and don't have to move, can choose to stay in their house. And let me emphasize, any homeowner who can afford his mortgage payment but chooses to walk away from an underwater property is simply a speculator – and one who is not honoring his obligations.

We know that speculation increased in recent years; a resulting increase in foreclosures is to be expected and does not warrant any relief. People who speculated and bought investment properties in hot markets should take their losses just like day traders who speculated and bought soaring tech stocks in 2000.

Friday, February 29, 2008

Economy.com's Zandi on Homeowners with Negative Equity

by Calculated Risk on 2/29/2008 03:47:00 PM

Last week, the NY Times mentioned the recent estimate from Dr. Mark Zandi, chief economist at Economy.com, of 8.8 million homeowers currently with zero or negative equity.

Here is an overview of the calculation from Zandi's Plan to Take Bolder Action on Mortgages (excerpted with permission from Mark Zandi):

By the end of March, an estimated 8.8 million homeowners, equal to 10.3% of the single-family housing stock, are expected to have zero or negative equity. This calculation is based on estimates of homeowner equity across more than 40,000 Zip codes nationwide. The amount of first and second mortgage debt outstanding, including both home equity lines of credit and closed-end second loans, is derived from credit file data. The estimates of housing values are based on repeat-sale house price indices from Fiserv Case Shiller, which are benchmarked to house prices available from the 2000 Census. In those Zip codes where repeat sales price data are not available, Moody’s Economy.com's estimates of county house prices are used. The current distribution of homeowner equity across Zip codes also highlights the risks posed by further price declines. If prices fall 20% from their peak to their expected trough next spring, some 13.8 million households will be under water by then, equal to 15.9% of the stock.The following graph shows my estimates from last December of the number of homeowners with zero or negative equity based on several different price declines. This was based on data from First American.

At the end of 2006, there were approximately 3.5 million U.S. homeowners with no or negative equity. (approximately 7% of the 51 million household with mortgages).

At the end of 2006, there were approximately 3.5 million U.S. homeowners with no or negative equity. (approximately 7% of the 51 million household with mortgages).By the end of 2007, I calculated the number would have risen to about 5.6 million. However, prices fell further than I expected in 2008, and this actually is very close to Zandi's estimate for the end of March 2008.

With a 20% price decline (peak to trough), I calculated 13.6 million homeowners with zero or negative equity; Zandi's updated numbers put that at 13.8 million.

Zandi didn't provide an estimate for a 30% peak to trough price decline, but my 20 million estimate is probably pretty close. Note: I calculated the percent of homeowners with mortgages with no or negative equity; Zandi calculated the percent of the total single-family housing stock.