by Calculated Risk on 9/06/2008 06:35:00 PM

Saturday, September 06, 2008

More Fannie and Freddie

First, several people sent me this article from the NY Times. I'm skeptical of the accusation of accounting issues causing the deal to be rushed. Notice the phrase "not necessarily in violation of accounting rules" - I doubt Freddie violated any accounting rules this time:

From the NY Times: Loan Giant Overstated the Size of Its Capital Base (hat tip Sam & Devang)

The government’s planned takeover of Fannie Mae and Freddie Mac, expected to be announced as early as this weekend, came together hurriedly after advisers poring over the companies’ books for the Treasury Department concluded that Freddie’s accounting methods had overstated its capital cushion, according to regulatory officials briefed on the matter.And another update from the WSJ: Treasury to Outline Fan-Fred Plan

...

The company had made decisions that, while not necessarily in violation of accounting rules, had the effect of overstating the companies’s capital resources and financial stability.

The U.S. Treasury is expected to announce early Sunday afternoon details of a plan under which regulators will effectively take temporary control over government-sponsored mortgage investors Fannie Mae and Freddie Mac.

The Treasury won't necessarily make a large injection of capital immediately into the ailing companies ...

Dividends on the companies' preferred stock are likely to be suspended, people familiar with the plan say, and those on common shares to be eliminated. Any injection of capital by the Treasury would likely greatly reduce or wipe out the value of common shares currently outstanding.

Rep. Frank Confirms Treasury Plan

by Calculated Risk on 9/06/2008 03:01:00 PM

From the WSJ: Frank Confirms Treasury Intervention To Shore Up Fannie Mae, Freddie Mac

Rep. Barney Frank (D., Mass.) [chairman of the House Financial Services Committee] said in a statement Saturday that Mr. Paulson "intends to use the powers that Congress provided it" in a law passed in July to keep Fannie Mae and Freddie Mac stable and functioning. But Mr. Frank said he didn't "know the details of the proposed interventions,"With all this publicity, the plan will have to be announced Sunday.

Fannie and Freddie

by Calculated Risk on 9/06/2008 09:08:00 AM

More details will leak out today, but the plan will probably be announced Sunday afternoon a few hours before the Asian markets open. (like with Bear Stearns). I wonder if the Fed will make some sort of announcement too ...

Stories (some contradictory on the Preferred shares):

Bloomberg: Paulson Plans to Bring Fannie, Freddie Under Government Control

WSJ: U.S. Near Deal on Fannie, Freddie

WaPo: U.S. Nears Rescue Plan For Fannie And Freddie

NY Times: U.S. Rescue Seen at Hand for 2 Mortgage Giants

LA Times: Fannie, Freddie takeover possible

Friday, September 05, 2008

WSJ: Fannie, Freddie to be put in `Conservatorship'

by Calculated Risk on 9/05/2008 09:20:00 PM

Update2: WaPo says preferred protected: Fannie Mae, Freddie Mac to be Put Under Federal Control, Sources Say

Under the plan, the federal government would place the firms in a legal state known as conservatorship, the sources said. The value of the company's common stock would be diluted but not wiped out while the holdings of other securities, including company debt and preferred shares, would be protected by the government.That makes more sense than the NY Times article.

Update: Here is the NY Times story: U.S. Plans Takeover of Fannie and Freddie

Senior officials from the Bush administration and the Federal Reserve on Friday informed top executives of Fannie Mae and Freddie Mac, the mortgage-finance giants, that the government is preparing a plan to seize the two companies and place them in a conservatorship ...A little thread music:

Under a conservatorship, most if not all of the remaining value of the common and preferred shares of Fannie and Freddie would be worth little or nothing, and any losses on mortgages they own or guarantee could be paid by taxpayers.

The WSJ has update their story: U.S. Near Deal on Fannie, Freddie

The Treasury Department is putting the finishing touches to a plan designed to shore up Fannie Mae and Freddie Mac ... a move that would essentially result in a government takeover of the mortgage giants.This weekend will be interesting.

The plan is expected to involve putting the two companies into the conservatorship of their regulator, the Federal Housing Finance Agency ...

It is also expected to involve the government injecting capital into Fannie and Freddie. ... Daniel H. Mudd, chief executive of Fannie Mae, and Richard Syron, his counterpart at Freddie Mac, are expected to step down from their posts eventually.

WSJ: Treasury Close to Final Fannie & Freddie Plan

by Calculated Risk on 9/05/2008 04:55:00 PM

From the WSJ: Treasury Is Close to Finalizing Plan to Backstop Fannie, Freddie

Precise details of Treasury's plan couldn't be learned. The plan is expected to involve a creative use of Treasury's new authority to make a capital injection into the beleaguered giants.Another Sunday announcement (like for Bear Stearns)?

...

An announcement could come as early as this weekend.

Thursday, August 28, 2008

Bank of China Reduces Fannie, Freddie Investments

by Calculated Risk on 8/28/2008 07:40:00 PM

From the Financial Times: Bank of China flees Fannie-Freddie

Bank of China has cut its portfolio of securities issued or guaranteed by troubled US mortgage financiers Fannie Mae and Freddie Mac by a quarter since the end of June.This selling is probably why the spread between Fannie and Freddie debt yields and Treasury debt is so high. From the WSJ last week: Deflating Mortgage Rates

The sale by China’s fourth largest commercial bank, which reduced its holdings of so-called agency debt by $4.6bn is a sign of nervousness among foreign buyers of Fannie and Freddie’s bonds and guaranteed securities.

The differences, or spreads, between Fannie's and Freddie's debt yields and Treasury yields have widened considerably since the start of the housing crisis because of jitters about the highly leveraged companies' stability. Last September, Fannie issued three-year debt at 0.55% over Treasury yields. Last week, it paid 1.23% over Treasury yields.So there was probably more foreign selling in July and August.

Saturday, August 23, 2008

More Fannie and Freddie

by Calculated Risk on 8/23/2008 10:13:00 AM

A quote from Bloomberg: Freddie, Fannie Failure Could Be World `Catastrophe,' Yu Says

``If the U.S. government allows Fannie and Freddie to fail and international investors are not compensated adequately, the consequences will be catastrophic,'' [Yu Yongding, a former adviser to China's central bank] said in e-mailed answers to questions yesterday. ``If it is not the end of the world, it is the end of the current international financial system.'And from the WaPo: Treasury's Vigil On Fannie, Freddie

A top concern of Treasury Secretary Henry M. Paulson Jr. as he ponders whether to pull the trigger on a rescue plan for mortgage financiers Fannie Mae and Freddie Mac is the fate of its "preferred" shareholders, which include regional and community banks across the nation and central banks around the world, according to private analysts who closely follow the department.And from the NY Times: Uncertainty Over Fannie and Freddie

...

Treasury officials are worried that a sell-off of these [preferred] shares poses serious risks to the broader financial system, the analysts said.

“We’re in a Catch 22,” said an executive with one of the mortgage firms who was not authorized to speak to the media. “As long as there is uncertainty over Treasury’s plan, we can’t raise money, and as long as we can’t raise money, there’s going to be more and more speculation about Treasury’s plan.”It seems like just a matter of when - not if - Paulson's hand will be forced and the Treasury will rescue Fannie and Freddie.

...

“You would have to be insane to invest in these companies right now, and we’ve basically told them that,” said an investment professional with one firm that was approached by Freddie Mac, but who is not authorized to speak to the media. “When Treasury comes in, they are guaranteed to get a better deal than us, which would push down the value of our investment. So why would we ever invest before we know what Treasury is going to do?”

Thursday, August 21, 2008

More Fannie and Freddie

by Calculated Risk on 8/21/2008 09:46:00 AM

"FNM and FRE should just have a new single consolidated ticker: FUBAR"From the WSJ: Fannie, Freddie Fears Stifle Stocks

Reader BR

Investors are increasingly concerned about the possibility of a federal bailout that could wipe out holders of the companies' common equity. The uncertainty swirling around the government-sponsored enterprises also may complicate the companies' efforts to win new financing to buy mortgages. Freddie and Fannie have been forced to pay higher yields to investors in recent debt offerings.To me, it seems that bond market participants are trying to force Paulson's hand. That is why Freddie and Fannie have had to pay more in recent debt offerings.

If Fannie and Freddie stumble, it could further cripple the U.S. housing market, a troubling scenario for banks and brokers already struggling under the weight of soured mortgage investments.

My initial reaction to the rescue plan was: "It seems the plan is bad for equity holders, but good for debt holders ... and potentially bad for taxpayers.". That still seems right. I'm not sure what the equity holders expected.

From Bloomberg: Paulson's Fannie-Freddie `Bazooka' Shakes Investors

The powers Paulson won from Congress last month enabling a government rescue of Freddie Mac and Fannie Mae -- authority he likened to a weapon whose mere existence made it unlikely it would have to be fired -- may end up making a bailout more likely, say analysts and investors.

...

``The common shareholders will probably be completely wiped out,'' Paul Miller, an analyst at FBR Capital Markets, said in a Bloomberg Television interview. ``Preferred will also see a lot of pain. But that is up in the air because a lot of banks own the preferred. You put a lot of banks in trouble if you just wipe out the preferred also.''

Wednesday, August 20, 2008

Cliff Diving: Fannie and Freddie

by Calculated Risk on 8/20/2008 03:59:00 PM

Fannie and Freddie were the story of the day. Here are the most recent quotes:

FNM 4.47 off 1.54 (25.62%)

FRE 3.23 off 0.94 (22.54%)

From Bloomberg: Fannie, Freddie Slump on Concern Bailout Is Likely

Fannie Mae and Freddie Mac tumbled in New York trading to the lowest levels since at least 1990 as speculation increased that the U.S. Treasury will bail out the mortgage-finance companies, wiping out shareholders.It seems like market participants are trying to force Paulson's hand.

...

Freddie paid its highest yields over U.S. Treasuries on record in a debt sale yesterday amid concern that credit losses are depleting the capital of the beleaguered mortgage-finance companies.

Fannie and Freddie have $223 billion of bonds due by the end of the quarter and their success in rolling over that debt may determine whether they can avoid a federal bailout. Fannie has about $120 billion of debt maturing through Sept. 30, while Freddie has $103 billion ...

Tuesday, August 12, 2008

WSJ: Freddie Mac to Stop Buying NY Subprime Mortgages

by Calculated Risk on 8/12/2008 12:31:00 PM

From the WSJ: Freddie Mac Will Stop Buying New York Subprime Mortgages

Freddie Mac said it will not purchase subprime mortgages secured by properties in New York state with note dates on or after Sept. 1.This is in response to a new New York law aimed at curbing abusive lending practices.

Freddie said the pending law "creates the potential for heightened legal and business risk exposures for the purchasers or assignees of these loans," ...

Sunday, August 10, 2008

Paulson Interview: No Plans to Insert Money in Fannie and Freddie

by Calculated Risk on 8/10/2008 04:10:00 PM

Paulson interview starts at about 1 min 30 secs and runs to about 28 minutes. Brokaw ask him what happened to "containment" and about President Bush's comment about Wall Street getting drunk.

Thursday, August 07, 2008

Another Version of the Infamous Syron Memo Dust-Up

by Tanta on 8/07/2008 09:40:00 AM

From the Boston Globe:

The credit warnings reported by the Times came not long after Syron arrived in 2004 to fix Freddie, reeling from an accounting scandal in which executives misstated some $5 billion in earnings. In addition, Freddie's commitment to affordable housing had declined to the point it employed gimmicks to meet congressional goals.This certainly puts matters in a different light. Syron is claiming that when he arrived at Freddie Mac, Freddie was "gaming the system" on affordable housing loans. It was buying pools of these loans, but carrying them only long enough to count them in its year-end affordable housing goals. In the new year, it would sell them back to lenders.

For example, said Syron, Freddie would essentially rent loans to meet affordable housing goals, buying them from lenders to carry on the books at year end, then selling them back. Syron ended that practice and re-emphasized the housing mission.

That put him in conflict with other executives, who believed Freddie's most important duty was to ensure investments were safe and sound. The chief risk officer at the time, David A. Andrukonis, warned Syron the loans Freddie was buying risked the financial position and reputation of the company and the country, the Times reported.

But Freddie had to balance the risks against affordable housing goals, Syron said. Andrukonis and other executives disagreed on that balance, he said. Andrukonis was later fired, Freddie officials said.

"The place didn't have enough orientation towards its housing mission," Syron said, "and he disagreed with that approach." Andrukonis couldn't be reached.

In Syron's version of the story, Andrukonis was advocating that Freddie continue this practice in the name of reducing the risk to Freddie Mac. Syron, on the other hand, felt that Freddie had to take the risk of keeping the affordable housing loans it bought, since that was the whole point of the mandate for the GSEs to buy a certain amount of these loans every year. In this version of events, what Syron was "ignoring" was not the claim that these loans were risky, but the claim that Freddie could avoid this risk just by engaging in "round-trip" transactions that served no economic purpose except fluffing up Freddie Mac's affordable housing goal numbers.

If Syron's version is anywhere near the truth, we have yet more evidence that no good deed ever does go unpunished.

(Thanks, Arnold!)

Wednesday, August 06, 2008

Fannie and Freddie: High LTV, Low FICO by Year

by Calculated Risk on 8/06/2008 04:03:00 PM

UPDATE: Newer table showing round trip on lending standards.

Brian has sent me this table (from UBS) summarizing the percentage of high LTV (loan to value), and low FICO loans made by Fannie and Freddie each year. Click on table for larger image in new window.

Click on table for larger image in new window.

UBS commented:

"We expect the delinquencies to rise considerably further, given the deterioration of the GSE book of business in 2007. As the non-Agency markets shut down in 2007, conforming product that had risk layering came into Agency space.

...

No matter what box one looks at, the results are the same - in the first 8 months of 2007, the % of Freddie and Fannie issuance with risky characteristics rose considerably. ... It is well documented that increased risk layering causes losses to multiply."

Pimco's Gross: Treasury to Buy Fannie/Freddie Preferred by End of Quarter

by Calculated Risk on 8/06/2008 03:43:00 PM

From Bloomberg: Pimco's Gross Says U.S. Will Rescue Fannie, Freddie (hat tip Yal)

``By the end of the third quarter, the preferred stock in Fannie and Freddie will be issued, the Treasury will have bought it,'' Gross, co-chief investment officer at Pacific Investment Management Co., said today in an interview on Bloomberg Television. ``We'll be on our way toward a joint Treasury-agency combination.''This will probably happen the first week of September since I'll be on a hiking trip! No worries - Tanta and friends will have it covered.

...

The government will probably buy $10 billion to $30 billion of preferred stock, Gross said.

Freddie: Alt-A and Default by Year

by Calculated Risk on 8/06/2008 12:18:00 PM

On Alt-A from Brian:

[Freddie has] $190B of Alt-A in the guarantee portfolio, $93B of which is in their 7 high DQ states (CA, FL, AZ, VA, NV, GA, MI, MD), and $115 of which is 06/07 vintage. 29% have current LTV>90% and 17% have current LTV >100% (chart 27 has a matrix of different cuts at the guarantee portfolio - there are quite a few high risk loan categories where the % of loans with current LTV>100% is in the range of 15-30% of the portfolio - with more to come as house prices decline further - chart 28 is worth a look too - there is going to be a lot of loss content in some of the cells on that matrix)

90+ day DQ's on their Alt-A book increased from 2.32% in Q1 to 3.72% in Q2!

They have $82B of uninsured 1st Lien subprime ABS, $65B of which is 06/07 vintage. The have $21B of ALT-A ABS.

On the credit enhancement question from before, for their guarantee portfolio as a whole, 18% has credit enhancement, but 92% of the loans with >90% LTV have enhancement, but only 16% of the Alt-A have it, only 14% of the IO loans have it, and 13% of option ARMs have it.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from the Freddie investor's slides shows the default rates of Alt-As vs. the rest of the portfolio.

As we've been discussing, the 2nd wave of defaults it just starting, and Alt-A will be ground zero this time.

The second graph shows delinquencies by year, and shows the impact of the credit crunch.

From Brian:

From Brian: Finally, Chart 32 is a great graphical depiction of moral hazard in action. It shows delinquencies by book year and 2006 is looking very good, but 2007 (on a relative basis) is off the charts because they caved to political pressure and took on all those crappy loans when the private label MBS market shut down.

Freddie Conference Call Notes

by Calculated Risk on 8/06/2008 11:18:00 AM

A few notes from the Freddie Mac conference call (hat tip Brian):

They are now expecting nation HPD (home price depreciation) of 18-20% vs prior assumption of 15% (using their national index). They think we are halfway through the price decline.

Severity assumptions in loan loss provision increased from 22% in Q1 (ending March) to 26% in Q2 (ending June).

Until their credit raising options clarify, they will approach growth of their mortgage portfolio cautiously. They acknowledged that the market realizes that it will be difficult for them to grow and that has probably contributed to increase in mortgage spreads. Their base case forecast is that their portfolio has no growth.

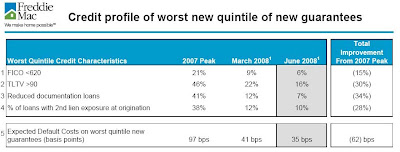

They have a chart of the credit profile of their guarantees at various points over the last year or so (chart 13 in the slide deck) that is worth a look. The worst quintile of loans (from a credit characteristics standpoint) from the 2007 peak had the following characteristics (they don’t say when the peak is, but my guess is that it would be late Q2 or early Q3):

Click on table for larger image in new window.

Click on table for larger image in new window.Their “expected default costs” on this bucket of guarantees is 97bp – it does not detail how that number is calculated, but I can’t imagine how it would be that low if its similar to a realized loss number on that portfolio (don’t know what if any PMI is on that group).

Freddie Mac: $821 million in Losses, Cuts Dividend

by Calculated Risk on 8/06/2008 09:24:00 AM

From MarketWatch: Freddie Mac loses $821 million on housing, credit markets

Freddie Mac, the second-biggest U.S. buyer of mortgages, reported Wednesday a second-quarter loss of $821 million ... [Freddie] is planning to slash its dividend to five cents a share or less for the third quarter, down from a previous payout of 25 cents a share.Here is the Bloomberg story: Freddie Mac Posts Fourth Straight Loss, Cuts Dividend

...

Freddie said provisions for credit losses in the June quarter were $2.5 billion, wider than the $1.2 billion for the first three months of 2008, reflecting increases in delinquency rates, foreclosures and the estimated severity of losses driven by the continued fall in home prices.

And from the WSJ: Freddie Swings to Loss

Tuesday, August 05, 2008

Freddie Fights Back

by Tanta on 8/05/2008 01:45:00 PM

And I give Freddie extra points for not writing the kind of puling corporate-robot-speak PR most companies do in this situation. This is what we call "frank":

Charles Duhigg's story ("At Freddie Mac, Chief Discarded Warning Signs," August 5) fell far short of the standards New York Times readers have every right to expect from the paper. Given the consequence of the subject, readers deserved more than a superficial tale spun on the purported comments of a collection of anonymous former employees and unspecified "others" – likely including the well-worn band of ideologues and self-interested detractors who have opposed the GSE model for years.There is much more.

Readers deserve more. The story is apparently based on the word of David Andrukonis, a former employee who was involuntarily terminated in 2005. It describes a memorandum – one we can't confirm the existence of, one we don't believe Mr. Syron ever saw, and one that Mr. Duhigg never produced for us. Although the reporter was aware of these facts, he cited the individual's account without mentioning them, instead portraying the former employee as having left amicably to become a schoolteacher.

Readers also deserve more than a highly selective cherry-picking of quotes from extensive interviews and information the reporter received over several hours and weeks, including interviews with Mr. Syron. . . .

(Hat tip to bacon dreamz, Lord of the Commenters Who Never Gets Enough Credit)

NYT Hit Job on Freddie Mac

by Tanta on 8/05/2008 08:23:00 AM

This has to be read to be believed.

More than two dozen current and former high-ranking executives at Freddie Mac, analysts, shareholders and regulators said in interviews that Mr. Syron had ignored recommendations that could have helped avoid the current crisis.Actually, all but two of the "more than two dozen" were given anonymity to damage Richard Syron's career while protecting their own, by my reading of this. One former Freddie Mac executive and one industry consultant are named. Nobody else is. And we are given no idea how many of the "more than two dozen" are shareholders. (Who need to protect their careers?) Or how many of them were found on Yahoo! message boards. (Hey! We don't know that they weren't!)

Many of those interviewed were given anonymity for fear of damaging their careers by speaking publicly.

The Times reporter, Charles Duhigg, can't even bring himself to include Syron's full bio:

Mr. Syron joined Freddie Mac as chief executive and chairman in 2003, after the company revealed it had manipulated earnings by almost $5 billion. He came to Freddie Mac after serving as chairman of the Thermo Electron Corporation, a scientific instruments firm, and of the American Stock Exchange. An economist with a Ph.D. and the first in his family to graduate from high school, Mr. Syron was welcomed as an unpretentious but politically astute leader.I have to wonder why the Times leaves off the part about how Syron is a former deputy assistant Treasury Secretary, asssistant to Federal Reserve chairman Paul Volker, and president of the Federal Reserve Bank of Boston in the late 80s and 90s, which included being a member of the Open Market Committee. None of that makes him perfect or infallible or anything else, of course. But why does the Times leave it out? If Syron is as clueless as the Times wants us to believe, isn't it relevant that Syron had a very influential role in restructuring failed banks and the FSLIC during the last major banking crisis? I remember all that being quite relevant when Freddie hired him in 2003 after the accounting scandal.

No, but a former employee wrote a memo in 2004 that apparently didn't impress Syron all that much. A lot of us wrote memos in 2004 that didn't impress a lot of people all that much. I can relate to the urge to say "I tolja so." I'm not sure I can relate to the claim that if this one memo had been taken seriously, all this "crisis" could have been averted.

But the Times story just isn't interested in plausibility:

By the time both men [Syron and Fannie Mae's Mudd] took over, the firms had perfected the art of making money by capitalizing on the perception they were implicitly backed by the government. That belief allowed Fannie and Freddie to borrow at relatively low rates and use those funds to buy mortgages as investments. The companies also collected fees in exchange for guaranteeing that borrowers would repay other home loans."By the time both men took over." As far as I know the market has believed in the implicit guarantee of the GSEs since the day the GSEs were chartered. To say they "made money by capitalizing" on that fact is to say they operated as GSEs--government/private hybrids--since they were chartered as GSEs.

By the end of 2007, the firms held mortgages worth more than $1.4 trillion combined, and guaranteed payments on loans worth $3.5 trillion more.

Both firms had sophisticated systems to hedge against risks. But they remained exposed to one unlikely, but potentially catastrophic possibility: a wide-scale decline in national home prices.

Also, what's with this exposure to the "unlikely, but potentially catastrophic possibility" of home price declines? What are we saying here? The article seems to want us to believe that all the probabilities had in fact been laid out for Syron (by his trusty memo-writer) and he ignored them. But it was also "unlikely"?

I suggest that the Times reporter and his anonymous sources (whose self-interest, of course, we cannot measure) are in a bind here: as they all, including the Times, spent so many years denying the reality of the housing bubble, they have to stick to the hoocoodanode line. But the currently popular narrative is about the GSEs being front and center of goofball lending--as hard to swallow as most of that is--so we have to shade this into "the GSEs coodanode, but not the rest of us."

There will be analysts, shareholders, industry experts, and professionals in financial services and housing--not to mention a couple of economists--who will, anonymously, comment on this blog that this reporter is a clueless hit-man. Starting with me. I wonder if that will make it true for the NYT.

Sunday, August 03, 2008

Freddie Mac Foreclosure Timelines

by Tanta on 8/03/2008 09:38:00 AM

I had intended to write a follow-up to CR's post the other day on Freddie Mac's changes to its foreclosure timelines, but . . . I had to extend my timeline. So sue me instead of Freddie Mac.

I was going to suggest that my friend P.J.'s (of Housing Wire fame) use of the term "whopping" to describe those timeline changes is a little hyperbolic. But it takes some major UberNerdity to show why that is. As I was winding up to a major Nerdfest on the subject, I see that Mish and Aaron at Implode-O-Meter have seen P.J.'s "whopping" and raised it to "doubling" in the great game of GSE Scold 'Em. I have no idea where "doubling" came from, although it appears that Mish just misread the original sentence from the Housing Wire report:

The mortgage finance giant also said that it was increasing its allowable foreclosure timeline in 21 states to a whopping 300 days from last of date payment, and 150 days from initiation of foreclosure, effective on Friday.This is not saying that the total FC timeline used to be 150 days in these states and is now 300, and you cannot make the English language make it say that. It says that the total allowable (which word does not rhyme with "required") timeline is 300 days in total from last payment made to FC sale. Within that total 300 days, the allowable time from actual referral to an FC attorney to the FC sale is 150 days. Which means that the allowable time from date of last payment to referral to an FC attorney is 150 days. 150 plus 150 equalling 300 in base ten.

But what does all this really mean? Is it significant? Why? Are these measures expressed in terms you are used to seeing, or in rather specialist terms that may mislead the unwary? And why would only 21 states be affected? Can we have some context, Tanta?

********

The first thing we need to clear up is the question of what a "foreclosure timeline" is and why Freddie Mac (and Fannie Mae) have them.

Foreclosure law is made by the states, and there are 50 different sets of state FC law out there, plus one for DC and three for the territories Freddie Mac buys loans in, giving them a total of 54 sets of laws. It is very hard to generalize about FC law, given that many different approaches, but you can basically say that all jurisdictions set a minimum timeline for completing a foreclosure (meaning, from the original filing to the FC sale) by virtue of the requirements that the law makes for various steps in the process and when they must be initiated and what has to happen before they are completed. For example, most states have some requirement that notice of the FC sale be published for three consecutive weeks prior to the actual sale date. Obviously this cannot happen until the FC sale is scheduled, which may take a long time (in a judicial FC state) or a fairly short time (in a non-judicial or "deed of trust" or "statutory FC" state). Therefore, the "timeline" always has a matter of 21 days or so added after one thing happens (sale is scheduled) and before another thing can happen (sale is held). If a given state lacked this requirement, or had a much longer or much shorter publication requirement, that state's minimum legally allowable timeframe would be longer or shorter.

I know of no state or jurisdiction that legislates "maximum" timeframes. By this, I mean that the law might say you cannot hold an FC sale less than 21 days after the sale date is determined (to allow for publication), but that doesn't mean you cannot hold the sale more than 21 days afterwards. The law might say you cannot initiate FC filings until a borrower is at least 30 days past due, but that doesn't mean you have to do that, and in reality few servicers initiate FC until a borrower is at least 90 days past due.

It helps, then, to think of FC laws as a matter of setting the shortest possible timeline for foreclosures. This will never be equal to the actual average timeline in a given state, nor will it be equal to the "optimal" or "best practices" timeline for a given state. What Freddie Mac and other investors care about is an "optimal" FC timeline.

Before we talk about this issue of what is "optimal," we also need to clear up the issue of when FC is initiated. Most states do not legislate a minimum number of days of delinquency before an FC action can be filed; there must simply be a legal default under the note and security instrument. Theoretically, in most states you can start FC when a borrower is only one month down, but it is very rare to see servicers do that, and in fact most of us would probably call such a practice "predatory servicing." FC is your last resort for resolving a delinquency, not your first resort.

On the other hand, no investor wants a servicer who dorks around and doesn't commence FC filing until the borrower is a whole year down. Therefore, investors like Freddie Mac set maximum timelines for servicers to commence FC. That deals with the dorking around problem. They do not set minimum timelines for commencing FC other than the statutory minimum, on the whole. The way they deal with the problem of a servicer foreclosing too quickly is by compensating servicers for successful foreclosure avoidance: they pay up in bonuses to servicers who resolve modest delinquencies with collection efforts, repayment plans, or other workouts, and they penalize servicers whose FC rates are much higher than they should be (since that costs investors money).

In order to establish investor timelines, there must be some definition of the starting point. Freddie Mac's rules on this subject are and have always been based on the time elapsed from "Due Date of Last Paid Installment," or DDLPI. There are very good reasons for this; it's a more dependable number than days of delinquency, and given that mortgage interest is always paid in arrears, a number of days since DDLPI will tell you exactly how many days of past-due interest have accrued on a loan. But you do not want to confuse it with days of delinquency. If a borrower makes his May payment, skips his June payment, and today is June 30 or July 1, depending on how you calculate these things, the borrower is 30 days delinquent and 60 days from DDLPI. Thus, if Freddie Mac says that a servicer must initiate FC by 150 days from DDLPI, that means by no later than the 120th day of delinquency.

It does not mean that a servicer may not initiate FC before 150 days DDLPI/120 days DQ. "No later than" means "no later than." I remarked earlier that in general servicers initiate FC around the 90th day of delinquency on average. This is true. Freddie does not require the servicer to wait until the 120th day; it allows the servicer to wait that long and still be considered acceptable to Freddie Mac.

The fact of the matter is that Freddie's timeline for DDLPI-to-initiation has been 150 days on most first lien loans since more or less forever. This is not something new. Freddie did just "standardize" this so it is now true for all loans. It used to be that second liens and some weirder first liens (like previously modified loans) had a 120 day DDLPI rule (90th day of DQ). For that small group of loans, the timeline has extended by 30 days. For the overwhelming majority of Freddie-owned loans, the pre-filing timeline has not changed.

What has changed, for 21 states, is the maximum acceptable timeline for initiation of FC to completion of FC. In Freddie-speak, "initiation" means "referral to FC attorney" and "completion" means FC sale completed. (In some states, it isn't over on the day of sale; there may be a "validation" period afterwards before title actually transfers, or there may be a post-sale redemption period. So a foreclosure sale is "completed" on or sometimes after the "sale date," but never before.)

Again, we need to bear in mind that there are three timelines floating around here: the statutory minimum (the quickest a foreclosure can be in a given state under the law), the real-world average (which is always greater than the statutory minimum, given backlogs and bottlenecks and holidays and other real-life stuff), and the recommended maximum (which is best understood as how high your "average" can get until your investor considers you inefficient or not trying hard enough).

Freddie has always published for its servicers a table of timelines for each state. They vary by state because some states have very short statutory minimums and some have very long ones. The idea was that servicer expectations would take into account those legal limits. I assume this idea is uncontroversial.

According to a very important paper published earlier this year by Freddie Mac economists Amy Crews Cutts and William A. Merrill, Interventions in Mortgage Default: Policies and Practices to Prevent Home Loss and Lower Costs, the national average "optimal statutory timeline" from FC referral to completion as of 2007 was 120 days from FC referral to sale date; taking into account post-sale issues like redemption or confirmation periods, and adding pre-referral days since DDLPI, the national average optimal statutory total timeline was 292 days. The actual average (real world) number of days was 355. ("Optimum statutory" here is a kind of hybrid of statutory minimums and practical additions; the authors calculate a plausible number of days for certain steps in the process to take that aren't controlled by law. For instance, in calculating these timelines they provide for five days for title work to be completed. The law simply requires that title work be completed; it doesn't say how long that will take.)

But nobody works to national averages; everybody works to a timeline for a given state. Per Cutts and Merrill, the longest timeline belongs to Maine, with "optimal statutory" days from FC referral to completed sale of 209 days, "optimal" total number of days from DDLPI to completion of 359 days, and "actual average" of 598 days DDLPI to completion. (Freddie Mac's current allowable maximum for Maine is 505 days, which means that on average servicers are not doing that well in Maine.)

The shortest timeline belongs to Tennessee, with "optimal statutory" days from FC referral to completed sale of 33 days, "optimal" total number of days from DDLPI to completion of 183 days, and "actual average" of 248 days DDLPI to completion. I do not know what Freddie's old timeline used to be for TN, because the current online Servicing Guide has now been updated and I don't have access to the old version. But TN is one of the 21 states that just got changed to 300 days total (150 days from referral to completion), which means the old timeline for TN was less than 300 days.

Since TN had the shortest timeline, I think we can conclude that of the 21 states that got an increase to 300 days, TN got the biggest increase. California, for instance, per Crews and Cutts had a "statutory" total timeline of 266 days and an average total, again as of last year, of 268 days. Freddie's new timeline for CA is 300 days. Given that it is possible that the average has increased markedly since 2007 with record numbers of foreclosures, it seems possible to me that CA's actual average as of mid-2008 is now pretty darned close to 300 days, or even more than that. This provides some context for how "whopping" the increase in the allowable timeframe for CA is.

So now we can think about why it might be that Freddie decided to increase the timelines in the fast-foreclosure states. Obviously, the main rationale is to allow servicers to continue to make workout efforts during the FC process, which will in the nature of things increase the time a loan spends in the FC process, without penalizing them for failing to meet Freddie's standards.

Perhaps, though, the better question is why Freddie upped the limit on these 21 states to only 300 days. Why not give everyone 400 days? Or 505 days, like Maine gets? What's so special about 300 days?

I suspect the answer to that is found in the research that Cutts and Merrill did on foreclosure timing:

[T]he costs associated with foreclosure rise significantly with the length of the foreclosure timeline, by as much as 12 percent for every 50 days added to the timeline. Perhaps more importantly, we find that the likelihood a borrower will reinstate her loan out of foreclosure falls as the length of time in the legal foreclosure process increases – by our estimates, states with excessively long legislated foreclosure timelines could increase the probability of successful reinstatement of delinquent borrowers by 3 to 9 percentage points by shortening their statutory timelines to match the national median timeline. Timelines that give the borrowers too much time in the legal foreclosure process tip the balance from the threat of imminent home loss from perfected foreclosure towards the benefit of “free” rent for the duration of the process, providing an incentive for borrowers to forego reinstatement of the loan even if they have the means to do so. By the same reasoning, some very short timeline states may find that lengthening their legal foreclosure timelines may improve cure rates out of foreclosure by giving delinquent borrowers enough time to cure the delinquency once the formal legal foreclosure process has been initiated.The authors posit that the "sweet spot" for foreclosure timelines--long enough to allow borrowers to cure, short enough to correct incentives and control costs to investors--is "roughly 270 days" from DDLPI to completion.

It looks to me like Freddie just rounded up "roughly 270" to 300. In other words, for the states with a too-short statutory timeline, Freddie set its timeline into the "sweet spot." Because it is not really possible for Freddie to set the too-long states into the "sweet spot," they are unchanged. Only state legislatures can shorten the statutory process; Freddie Mac can't.

But why have this distinction between pre-filing (150 days from DDLPI in the "short states") and post-filing (another 150 days)? Well, any investor wants servicers to focus their loss mitigation efforts early in the delinquency process. In Freddie Mac's view, if you make the FC referral too early in the process, you are incurring unnecessary legal expenses for a lot of loans that will "cure" short of foreclosure. You may also be putting too much pressure on borrowers. That's a fine line to hold: if you don't threaten some borrowers with FC, they'll never do anything about the problem they have. On the other hand, if you start the judicial machinery too soon, some borrowers who could cure will give up because they think it's hopeless. Economically and psychologically, it's a delicate balance.

I realize that for a lot of people (like Mish), nothing any of the GSEs do will ever be anything except wrong. But still. It would be helpful to try to understand what they are actually doing before going off on doomsday scenarios. I am not claiming that the Freddie Mac changes were just a "nothingburger," but they are hardly anything to freak out over in my view. If you want to freak out, you need to at least read the reporting correctly.