by Calculated Risk on 11/12/2010 06:09:00 PM

Friday, November 12, 2010

Bank Failures #144 & 145: Georgia

One on top of another

To the moon, Alice!

by Soylent Green is People

From the FDIC: Ameris Bank, Moultrie, Georgia, Acquires All of the Deposits of Two Georgia Institutions

As of September 30, 2010, Tifton Banking Company had total assets of $143.7 million and total deposits of $141.6 million, and Darby Bank & Trust Co. had total assets of $654.7 million and total deposits of $587.6 million.More Georgia ...

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24.6 million for Tifton Banking Company, and $136.2 million for Darby Bank & Trust Co. ... The two closed institutions were the 144th and 145th banks to fail in the nation this year, and the 17th and 18th banks to close in Georgia.

Saturday, November 06, 2010

Unofficial Problem Bank list at 894 Institutions

by Calculated Risk on 11/06/2010 09:08:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 5, 2010.

Changes and comments from surferdude808:

The number of institutions on the Unofficial Problem Bank List remained unchanged this week at 894 as there were four additions and four removals. However, aggregate assets increased to $416.5 billion from $410.7 billion.As always, thanks to surferdude808 for compiling this list!

Removals this week are the failures that include K Bank, Randallstown, MD ($592 million); Pierce Commercial Bank, Tacoma, WA ($242 million); Western Commercial Bank, Woodland, CA ($111 million); and First Vietnamese American Bank, Westminster, CA ($52 million).

Additions this week are Superior Bank, Tampa, FL ($3.4 billion Ticker: SUPR); The Suffolk County National Bank of Riverhead, Riverhead, NY ($1.7 billion Ticker: SUBK); Essex Bank, Tappahannock, VA ($1.2 billion Ticker: BTC); and Community Central Bank, Mount Clemens, MI ($543 million Ticker: CCBD).

Friday, November 05, 2010

Bank Failure #143: First Vietnamese American Bank, Westminster, California

by Calculated Risk on 11/05/2010 09:22:00 PM

There were 140 failures in 2009. This makes 143 and counting in 2010 ...

someday this war's gonna end

today is that day

by Soylent Green is People

From the FDIC: Grandpoint Bank, Los Angeles, California, Assumes All of the Deposits of First Vietnamese American Bank, Westminster, California

As of September 30, 2010, First Vietnamese American Bank had approximately $48.0 million in total assets and $47.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $9.6 million. ... First Vietnamese American Bank is the 143rd FDIC-insured institution to fail in the nation this year, and the twelfth in California.

Bank Failure #142: Pierce Commercial Bank, Tacoma, Washington

by Calculated Risk on 11/05/2010 08:22:00 PM

There were 140 failures in 2009. This makes 142 and counting in 2010 ...

Cataclysmic cash cloudburst

Poor panacea

by Soylent Green is People

From the FDIC: Heritage Bank, Olympia, Washington, Assumes All of the Deposits of Pierce Commercial Bank, Tacoma, Washington

As of September 30, 2010, Pierce Commercial Bank had approximately $221.1 million in total assets and $193.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $21.3 million. ... Pierce Commercial Bank is the 142nd FDIC-insured institution to fail in the nation this year, and the eleventh in Washington..

Bank Failure #140: K Bank, Randallstown, Maryland

by Calculated Risk on 11/05/2010 06:47:00 PM

Plenipotentiaries

Could not save K Bank

by Soylent Green is People

From the FDIC: Manufacturers and Traders Trust Company (M&T Bank), Buffalo, New York, Assumes All of the Deposits of K Bank, Randallstown, Maryland

As of September 30, 2010, K Bank had approximately $538.3 million in total assets and $500.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $198.4 million. ... K Bank is the 140th FDIC-insured institution to fail in the nation this year, and the fourth in Maryland.One down today ...

Saturday, October 30, 2010

Unofficial Problem Bank list increases to 894 Institutions

by Calculated Risk on 10/30/2010 08:37:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 29, 2010.

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions for September this week contributing to many changes to the Unofficial Problem Bank List. This week there were 26 additions and three removals, which results in the list having 894 institutions with $410.7 billion of assets, up from 871 institutions and $402.1 billion of assets last week.

The three removals are for action termination and include First Carolina State Bank, Rocky Mount, NC ($113 million); State Bank of Burnettsville, Burnettsville, IL ($39 million); and The Citizens Bank of Weir, Weir, KS ($6 million).

Among the additions are CNLBank, Orlando, FL ($1.5 billion); Colorado Capital Bank, Castle Rock, CO ($870 million); Malvern Federal Savings Bank, Paoli, PA ($691 million); The Delaware County Bank and Trust Company, Lewis Center, OH ($644 million Ticker: DCBF); County Bank, Rehoboth, DE ($400 million Ticker: CBFD); Bank of Alameda, Alameda, CA ($245 million Ticker: NCLC); Old Harbor Bank, Clearwater, FL ($232 million Ticker: OHBK); and Charter Oak Bank, Napa, CA ($139 million Ticker: CHOB). The FDIC also issued a Prompt Corrective Action order against Charter Oak Bank.

Other changes include Prompt Corrective Actions orders against four institutions already on the list including Firstier Bank, Louisville, KY ($809 million); Nevada Commerce Bank, Las Vegas, NV ($194 million); Valley Community Bank, St. Charles, IL ($142 million); and First Vietnamese American Bank, Westminster, CA ($52 million). Strangely, the FDIC just published the action against Firstier Bank although it is dated April 21, 2010.

Saturday, October 23, 2010

Number of Bank Failures: 2010 about to surpass 2009

by Calculated Risk on 10/23/2010 05:28:00 PM

I haven't updated these graphs for some time ...

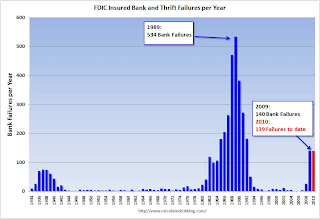

There have been 307 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | |

|---|---|

| 2007 | 3 |

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 139 |

| Total | 307 |

Click on graph for larger image in new window.

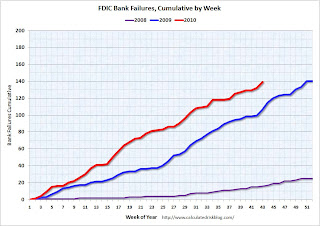

Click on graph for larger image in new window.This graph shows bank failures by week in 2008, 2009 and 2010.

At this time last year, there were 106 bank failures - on the way to 140 total failures in 2009. This year there are 139 failures so far, and, at this pace, it looks like there will be around 175 total failures in 2010.

That would be the highest total since the 181 bank failures in 1992.

That would be the highest total since the 181 bank failures in 1992.Bank failures peaked at 534 in 1989 during the S&L crisis.

And on total assets from the December Congressional Oversight Panel’s Troubled Asset Relief Program report:

[A]lthough the number of failed banks was significantly higher in the late 1980s than it is now, the aggregate assets of failed banks during the current crisis far outweighs those from the 1980s. At the high point in 1988 and 1989, 763 banks failed, with total assets of $309 billion. Compare this to 149 banks failing in 2008 and 2009, with total assets of $473 billion.Note: This is in 2005 dollars and doesn't include the failures in 2010 (only estimates are available so far for 2010). However this does include the failure of WaMu in 2008 with $307 billion in assets that didn't impact the DIF.

Unofficial Problem Bank List at 871 Institutions

by Calculated Risk on 10/23/2010 08:39:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 22, 2010.

Changes and comments from surferdude808:

Failures contributed to the Unofficial Problem Bank List changes this week. There were eight removals, with seven because of failure, and four additions, which leaves the list at 871 institutions with assets of $402.2 billion.

Among the removals was the unassisted merger of Citizens National Bank of Springfield ($254 million) into cross-town Empire Bank, Springfield, MO. The failures included Hillcrest Bank ($1.6 billion); First Arizona Savings, a FSB ($272 million); First Suburban National Bank ($149 million); The First National Bank of Barnesville ($136 million); Progress Bank of Florida ($111 million); First Bank of Jacksonville ($81 million); and The Gordon Bank ($29 million).

The First National Bank of Barnesville opened its doors in 1902; thus, it survived the Great Depression but it was not able to weather the Great Recession.

The FDIC could not find a buyer for First Arizona Savings so they will mail insured depositors a check; however, its cost estimate of only 12 percent of assets is the lowest of the night and one-third lower than the next cheapest deposit payoff in this cycle, which was Arcola Homestead Savings Bank at 18.8 percent in June 2010.

The four additions are Gibraltar Private Bank & Trust Co., Coral Gables, FL ($1.6 billion); Wilber National Bank, Oneonta, NY ($929 million Ticker: GIW); Highlands Union Bank, Abingdon, VA ($649 million Ticker: HBKA); and Bank of Maumee, Maumee, OH ($45 million). Gibraltar had purchased about $1.5 billion of assets from Boston Private Bank & Trust Company (Ticker: BPFH) in 2009.

Next week there should be many changes as we expect the FDIC to release its actions for September 2010.

Friday, October 22, 2010

Bank Failure #139: First Arizona Savings, Scottsdale, Arizona

by Calculated Risk on 10/22/2010 09:21:00 PM

First / Arizona / Savings

No / yes / not at all

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of the Insured Deposits of First Arizona Savings, A FSB, Scottsdale, Arizona

As of June 30, 2010, First Arizona Savings, A FSB had approximately $272.2 million in total assets and $198.8 million in total deposits. ... The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $32.8 million. ... The last institution closed in the state was Towne Bank of Arizona, Mesa, on May 7, 2010.No one wanted this one! That makes 7 today ...

Bank Failures #137 & 138: Kansas and Illinois

by Calculated Risk on 10/22/2010 07:11:00 PM

Federal feeding frenzy

Huge heartland heartburn

by Soylent Green is People

From the FDIC: Seaway Bank and Trust Company, Chicago, Illinois, Assumes All of the Deposits of First Suburban National Bank, Maywood, Illinois

As of June 30, 2010, First Suburban National Bank had approximately $148.7 million in total assets and $140.0 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.4 million. .... First Suburban National Bank is the 137th FDIC-insured institution to fail in the nation this year, and the 16th in Illinois.From the FDIC: Hillcrest Bank, National Association, Overland Park, Kansas, Assumes All of the Deposits of Hillcrest Bank, Overland Park, Kansas

As of June 30, 2010, Hillcrest Bank had approximately $1.65 billion in total assets and $1.54 billion in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $329.7 million. ... Hillcrest Bank is the 138th FDIC-insured institution to fail in the nation this year, and the third in Kansas.

Bank Failure #136: The First National Bank of Barnesville, Barnesville, Georgia

by Calculated Risk on 10/22/2010 06:27:00 PM

Far too late for Barnsville now

Money's ridden off

by Soylent Green is People

From the FDIC: United Bank, Zebulon, Georgia, Assumes All of the Deposits of The First National Bank of Barnesville, Barnesville, Georgia

As of June 30, 2010, The First National Bank of Barnesville had approximately $131.4 million in total assets and $127.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.9 million. ... The First National Bank of Barnesville is the 136th FDIC-insured institution to fail in the nation this year, and the 16th in Georgia.Four down ...

Bank Failures #133 to 135: Florida and Georgia

by Calculated Risk on 10/22/2010 05:09:00 PM

Florida, Georgia failures

A phantom luster

by Soylent Green is People

From the FDIC: Ameris Bank, Moultrie, Georgia, Assumes All of the Deposits of First Bank of Jacksonville, Jacksonville, Florida

As of June 30, 2010, First Bank of Jacksonville had approximately $81.0 million in total assets and $77.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $16.2 million. ... First Bank of Jacksonville is the 133rd FDIC-insured institution to fail in the nation this year, and the 26th in Florida.From the FDIC: Bay Cities Bank, Tampa, Florida, Assumes All of the Deposits of Progress Bank of Florida, Tampa, Florida

As of June 30, 2010, Progress Bank of Florida had approximately $110.7 million in total assets and $101.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $25.0 million. ... Progress Bank of Florida is the 134th FDIC-insured institution to fail in the nation this year, and the 27th in Florida.From the FDIC: Morris Bank, Dublin, Georgia, Assumes All of the Deposits of The Gordon Bank, Gordon, Georgia

As of June 30, 2010, The Gordon Bank had approximately $29.4 million in total assets and $26.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $9.0 million. ... The Gordon Bank is the 135th FDIC-insured institution to fail in the nation this year, and the 15th in Georgia.

Saturday, October 16, 2010

Unofficial Problem Bank List at 875 Institutions

by Calculated Risk on 10/16/2010 09:09:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 15, 2010.

Changes and comments from surferdude808:

The Unofficial Problem Bank List shrank this week in both the number of institutions and assets. There were eight removals and six additions leaving the list at 875 institutions, down from 877 last week.

The removal of mid-size regional contributed to the decline in aggregate assets to $401.6 billion from $417.3 billion.

The removals include two of the three failed banks -- Security Savings Bank, F.S.B. ($508 million) and Westbridge Bank and Trust ($91 million). Interestingly, the other failure this week -- Premier Bank ($1.2 billion) was not subject to a published enforcement action.

Eastern National Bank ($446 million) had its action terminated. Carolina First Bank ($11.6 billion) merged into TD Bank, N.A. at the end of September. Three subsidiaries of Lauritzen Corporation (Ticker FINN) -- First National Bank, Fort Collins, CO ($1.9 billion); Castle Bank, National Association, Dekalb, IL ($1.1 billion); and First National Bank of Kansas, Overland, KS ($745 million) merged into their affiliate First National Bank of Omaha, which leaves one affiliate, First National Bank South Dakota, still on the list. We anticipate other multi-bank holding companies such as Premier Financial Bancorp (Ticker: PFBI) to merge its weak subsidiaries into a stronger affiliate. The other removal was an unassisted merger of First Bank, Farmersville, TX ($95 million) into Independent Bank, McKinney, TX.

As anticipated last week, the OCC released its enforcement actions for late August/early September. Six national banks were added this week include First Texoma National Bank, Durant, TX ($215 million); The First National Bank of Eagle River, Eagle Rover, WI ($158 million); North Georgia National Bank, Calhoun, GA ($142 million); The Camden National Bank, Camden, AL ($119 million); First National Bank, Groesbeck, TX ($50 million); and Nevada National Bank, Las Vegas, NV ($39 million).

Other modifications this week include a Prompt Corrective Action order issued by the OTS against Appalachian Community Bank ($90 million), and a name change and charter flip for Bay Cities National Bank ($273 million) to Opus Bank and state non-member status.

Friday, October 15, 2010

Bank Failure #132: Premier Bank, Jefferson City, Missouri

by Calculated Risk on 10/15/2010 07:07:00 PM

Bank C.E.O.'s breath relief sigh.

Joe "Coors" hangs his head.

by Soylent Green is People

From the FDIC: Providence Bank, Columbia, Missouri, Assumes All of the Deposits of Premier Bank, Jefferson City, Missouri

As of June 30, 2010, Premier Bank had approximately $1.18 billion in total assets and $1.03 billion in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $406.9 million. ... Premier Bank is the 132nd FDIC-insured institution to fail in the nation this year, and the sixth in Missouri.That makes 3 today ... almost 40% loss on Premier.

Bank Failure #130 & 131: Kansas and Missouri

by Calculated Risk on 10/15/2010 06:16:00 PM

Collides with the Hindenburg

It's really that bad.

by Soylent Green is People

From the FDIC: Simmons First National Bank, Pine Bluff, Arkansas, Assumes All of the Deposits of Security Savings Bank, F.S.B., Olathe, Kansas

As of June 30, 2010, Security Savings Bank, F.S.B. had approximately $508.4 million in total assets and $397.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $82.2 million. .... Security Savings Bank, F.S.B. is the 130th FDIC-insured institution to fail in the nation this year, and the second in Kansas.From the FDIC: Midland States Bank, Effingham, Illinois, Assumes All of the Deposits of WestBridge Bank and Trust Company, Chesterfield, Missouri

As of June 30, 2010, WestBridge Bank and Trust Company had approximately $91.5 million in total assets and $72.5 million in total deposit ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $18.7 million. ... WestBridge Bank and Trust Company is the 131st FDIC-insured institution to fail in the nation this year, and the fifth in Missouri.The FDIC is back to work ...

Saturday, October 09, 2010

Unofficial Problem Bank List 877 Institutions

by Calculated Risk on 10/09/2010 07:27:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 8, 2010.

Changes and comments from surferdude808:

The number of institutions on the Unofficial Problem Bank List remained unchanged this week at 877 but assets rose slightly from $416.1 billion to $417.3 billon.

Three institutions were removed with one because of action termination -- First National Bank and Trust Company ($296 million), and two others -- First National Bank & Trust Company in Larned ($34 million) and Clear Creek National Bank ($24 million) because they merged into other banks that are on the Unofficial Problem Bank List.

Additions this week include Valley Bank, Roanoke, VA ($763 million Ticker: VYFC); Fullerton Community Bank, FSB, Fullerton, CA ($705 million); and Fort Lee Federal Savings Bank, FSB, Fort Lee, NJ ($75 million), which received about $1.3 million of TARP capital in May 2009.

We anticipate for the OCC to release its actions from mid-August through mid-September next Friday.

Saturday, October 02, 2010

Unofficial Problem Bank List increases to 877 institutions

by Calculated Risk on 10/02/2010 01:27:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 1, 2010.

Changes and comments from surferdude808:

The number of institutions on the Unofficial Problem Bank List rose this week but assets fell with the removal of a large publicly traded bank.

Removals include the failed Shoreline Bank ($104 million), an affiliate of the failed Chicago-based ShoreBank; and Sterling Savings Bank ($9.1 billion Ticker: STSA), which said in an 8-K that its enforcement action had been terminated.

There were six additions this week including First Savings Bank Northwest, Renton, WA ($1.3 billion Ticker: FFNW); Brooklyn Federal Savings Bank, Brooklyn, NY ($523 million Ticker: BFSB); Diamond Bank, FSB, Schaumburg, IL ($278 million); The Bank of Asheville, Asheville, NC ($214 million Ticker: WFSC); Alaska Pacific Bank, Juneau, AK ($177 million Ticker: AKPB), which is the first Alaska-based institution to make an appearance on the Unofficial Problem Bank List; and Wawel Savings Bank, Wallington, NJ ($96 million Ticker: WAWL).

After these changes, the Unofficial Problem Bank List includes 877 institutions with assets of $416.1 billion compared to 872 institutions with assets of $422.4 billion last week.

Transition Matrix

With the passage of another quarter, it is time to update the transition matrix. The Unofficial Problem Bank List debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table).

Over the past 13 months, 144 institutions have been removed from the original list with 103 due to failure, 29 due to action termination, and 12 due to unassisted merger. Thus, about 72 percent of the removals are from failure.

Nearly 27 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List. Failed bank assets have totaled $159 billion or nearly 58 percent of the $276.3 billion on the original list.

Since the publication of the original list, another 740 institutions have been added. However, only 632 of those 740 additions remain on the current list as 108 institutions have been removed in the interim. Of the 108 interim removals, 88 were due to failure, 15 were due to unassisted merger, 4 from action termination, and one from voluntary liquidation.

Again, failure represents a disproportionate 81.5 percent of the reason for removal. In total, 1,129 institutions have made an appearance on the Unofficial Problem Bank List and 191 or 16.9 percent have failed.

The average asset size of removals because of failure is $1.2 billion. Currently, the average asset size of institutions on the current list is $474 million versus $710 million on the original list. This would suggest the asset size of future failures will likely be lower.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 29 | (4,038,439) | |

| Unassisted Merger | 12 | (1,762,072) | |

| Failures | 103 | (159,037,514) | |

| Asset Change | (11,891,765) | ||

| Still on List at 7/02/2010 | 245 | 99,583,639 | |

| Additions | 632 | 316,517,379 | |

| End (10/01/2010) | 877 | 416,101,018 | |

| Interperiod Deletions1 | |||

| Action Terminated | 4 | 12,881,783 | |

| Unassisted Merger | 15 | 2,545,683 | |

| Voluntary Liquidation | 1 | 119,082 | |

| Failures | 88 | 70,091,963 | |

| Total | 108 | 85,638,511 | |

| 1Institution not on 8/7/2009 or 10/01/2010 list but appeared on a list between these dates. | |||

Friday, October 01, 2010

Bank Failure #128: Wakulla Bank, Crawfordville, Florida

by Calculated Risk on 10/01/2010 06:08:00 PM

Some day these failures will end

Today's not that day

by Soylent Green is People

From the FDIC: Centennial Bank, Conway, Arkansas, Assumes All of the Deposits of Wakulla Bank, Crawfordville, Florida

As of June 30, 2010, Wakulla Bank had approximately $424.1 million in total assets and $386.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $113.4 million. ... Wakulla Bank is the 128th FDIC-insured institution to fail in the nation this year, and the twenty-fifth in Florida.Twenty five in Florida alone this year ...

Saturday, September 25, 2010

Unofficial Problem Bank List increases to 872 institutions

by Calculated Risk on 9/25/2010 11:31:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 24, 2010.

Changes and comments from surferdude808:

The Unofficial Problem Bank List underwent significant changes this week from failures and the FDIC releasing its enforcement actions for August 2010. The list finished the week at 872 institutions with assets of $422.4 billion, up from 854 institutions with assets of $416 billion last week.The list just keeps growing.

Changes this week include three removals and 21 additions. The removals are the two failures -- Haven Trust Bank Florida ($149 million) and North County Bank ($289 million) and one from an unassisted merger -- Sunrise Bank of Atlanta ($50 million).

Most notable among the additions are Lydian Private Bank, Palm Beach, FL ($1.96 billion); Universal Bank, West Covina, CA ($537 million); TruPoint Bank, Grundy, VA ($484 million); First Guaranty Bank and Trust Company of Jacksonville, Jacksonville, FL ($460 million); and First South Bank, Spartanburg, SC ($456 million Ticker: FSBS).

Other changes include Prompt Corrective Action Orders issued against Peoples State Bank ($445 million), LandMark Bank of Florida ($320 million), First Arizona Savings, a FSB ($272 million), American Patriot Bank ($108 million), and Idaho First Bank ($82 million).

Friday, September 24, 2010

Bank Failure #127: North County Bank, Arlington, Washington

by Calculated Risk on 9/24/2010 09:07:00 PM

From the FDIC: Whidbey Island Bank, Coupeville, Washington, Assumes All of the Deposits of North County Bank, Arlington, Washington

As of June 30, 2010, North County Bank had approximately $288.8 million in total assets and $276.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $72.8 million. ... North County Bank is the 127th FDIC-insured institution to fail in the nation this year, and the ninth in Washington.Just 2 this week? The unofficial problem bank list will be increasing ...