by Calculated Risk on 4/15/2008 01:40:00 PM

Tuesday, April 15, 2008

Orange County House Prices Off 20% YoY, Back to March 2004 Levels

The DataQuick numbers for SoCal will be available soon.

From Jon Lansner at the O.C. Register: March home price ($506,000) is a 4-year low

DataQuick’s final count of Orange County home-buying activity last month shows the median selling price for all residences at $506,000 — the lowest since March ‘04 and off 19.6% from a year ago. Buyers grabbed 1,663 homes last month down 46.9% from a year ago. It’s the 30th consecutive month where total sales failed to beat the year-ago level.

Friday, March 14, 2008

California Bay Area Homes: "Spectacularly low sales counts"

by Calculated Risk on 3/14/2008 10:12:00 AM

From DataQuick: Bay Area home sales remain at two-decade low

A total of 3,989 new and resale houses and condos sold in the nine- county Bay Area in February. That was up 11.2 percent from 3,586 in January, and down 36.7 percent from 6,305 for February 2007, DataQuick Information Systems reported.

January and February are the two slowest months in DataQuick's statistics, which go back to 1988. They are the only months with sales below 4,000.

"The lending system has been in lockdown mode the last half year, especially when it comes to so-called jumbo mortgages which have traditionally been the majority of Bay Area loans. Sure there are price declines out there, especially in inland markets. But it's not realistic to think many sellers are going to drop a $600,000 or $700,000 asking price down to $550,000 just so a buyer can finance with a conforming loan. We can only conclude that a lot of activity is just on hold, hence the spectacularly low sales counts," said Marshall Prentice, DataQuick president.

...

The median price paid for a Bay Area home was $548,000 last month, down 0.4 percent from $550,000 in January, and down 11.6 percent from $620,000 in February last year. Last month's median was 17.6 percent lower than the peak median of $665,000 reached last June and July.

...

Foreclosure activity is at record levels ...

Thursday, March 13, 2008

DataQuick: SoCal Home Sales "UItra-Low"

by Calculated Risk on 3/13/2008 02:06:00 PM

From DataQuick: Southland home sales still ultra-low; median price slips again

Southern California home sales limped along last month at the slowest pace ever for a February, the result of a market crippled by uncertainty and credit constraints. The median sale price dropped by a record 17.6 percent from a year ago, a real estate information service reported.If it wasn't for foreclosures, the sales number would really be awful.

A total of 10,777 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in February. That was up 8 percent from 9,983 the previous month but down 39 percent from 17,680 in February last year, according to DataQuick Information Systems.

Last month's sales total was the second-lowest for any month in DataQuick's statistics, which go back to 1988. The prior month's total of 9,983 was the lowest ever. Since September, sales each month have been a record low for that particular month.

Of the homes that resold in February, about one-third, 33.5 percent, had been foreclosed on at some point since January 2007. A year earlier the figure was 3.5 percent. At the county level, the percent of homes resold in February that had been foreclosed on since January 2007 ranged from 25.3 percent in Orange County to 48.1 percent in Riverside County.

"Sales remained extraordinarily low, and a significant portion of what did sell was in areas beset by foreclosure activity. That's where sellers are the most motivated and price cuts are largest. Mainly it's in the inland markets, often in newer suburbs, where prices got pumped up artificially with the sort of crazy loans that no longer exist," said Marshall Prentice, DataQuick president.

...

The median price paid for a Southland home was $408,000 last month, the lowest since $402,500 in October 2004. Last month's median was down 1.7 percent from January's $415,000, and down a record 17.6 percent from $495,000 in February 2007.

Last month's median fell 19.2 percent shy of the $505,000 peak reached last spring and summer. ...

Foreclosure activity is at record levels...

Thursday, February 14, 2008

DataQuick: Record Low California Bay Area Sales, Median Price off 17% from Peak

by Calculated Risk on 2/14/2008 01:59:00 PM

From DataQuick: Bay Area home sales lowest for any month in two decades

Bay Area home sales plunged below 4,000 transactions for the first time in over 20 years last month as the market remained hamstrung by the credit crunch and uncertainty among buyers, sellers and lenders. Price declines steepened, especially in inland markets hit hard by foreclosures, a real estate information service reported.

A total of 3,586 new and resale houses and condos sold in the Bay Area in January. That was down 29.2 percent from 5,065 in December, and down 41.9 percent from 6,168 in January 2007, DataQuick Information Systems reported.

Last month's sales were the lowest for any month in DataQuick's statistics, which go back to 1988. Sales have decreased on a year-over-year basis for 36 consecutive months. Prior to last month the slowest January was in 1995, when 4,326 homes sold. The strongest January, in 2005, posted 8,298 sales. The average for the month is 6,319 sales.

The median price paid for a Bay Area home was $550,000 last month, down 6.4 percent from $587,500 in December, and down 8.5 percent from $601,000 in January last year. Last month's median was 17.3 percent lower than the peak $665,000 median, last reached in July, and was the lowest since February 2005, when the median was $549,000.

... Foreclosure activity is at record levels, financing with adjustable-rate mortgages or with multiple mortgages has dropped sharply.

emphasis added

Wednesday, February 13, 2008

DataQuick: SoCal Sales at Record Low

by Calculated Risk on 2/13/2008 02:01:00 PM

From DataQuick: Southland home sales slowest for any month in 20 years

Southern California home sales dipped below 10,000 transactions for the first time in more than 20 years last month as most potential buyers and sellers appear to be waiting out market turbulence, a real estate information service reported.

A total of 9,983 new and resale houses and condos were sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in January. That was down 24.6 percent from 13,240 for the previous month, and down 44.9 percent from 18,128 for January last year, according to DataQuick Information Systems.

Last month's sales total was the lowest for any month in DataQuick's statistics, which go back to 1988. Since September, sales for each calendar month were a record low for that particular month.

...

The median price paid for a Southland home was $415,000 last month, the lowest since $414,000 in January 2005. Last month's median was down 2.4 percent from December's $425,000, and 14.4 percent below $485,000 for January 2007.

Last month's median was 17.8 percent below the $505,000 peak reached last spring and summer. While the steep decline in median sales price does reflect a drop in prices, it also reflects significant shifts in the types of homes selling. Particularly noticeable is a drop-off in sales of more expensive homes financed with "jumbo" mortgages.

...

Foreclosure activity is at record levels, financing with adjustable-rate mortgages or with multiple mortgages has dropped sharply.

Tuesday, January 15, 2008

DataQuick: SoCal Record Low December Sales, Prices off 15.8% From Peak

by Calculated Risk on 1/15/2008 01:24:00 PM

From DataQuick: Continued nose-dive for Southland home sales

A total of 13,240 new and resale houses and condos were sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in December. That was up 0.5 percent from 13,173 for the previous month, and down 45.3 percent from 24,209 for December last year, according to DataQuick Information Systems.I'd call that Cliff Diving!

Last month's sales were by far the lowest for any December in DataQuick's statistics, which go back to 1988. The sales count was 23.5 percent below the previous December low of 17,272 in 1990. The average December over the past 20 years is 25,543, the all-time peak for the month was reached in 2003 when 36,865 homes were sold.

The median price paid for a Southland home was $425,000 last month, the lowest since $420,000 in February 2005. Last month's median was down 2.4 percent from November's $435,000, and 13.3 percent below $490,000 for December 2006.UPDATE: Mathew Padilla at the O.C. Register has the foreclosure activity for Orange County: O.C. foreclosures approach record high. Data for all of California will probably be released next week.

Last month's median was 15.8 percent below the $505,000 peak reached last spring and summer. While the steep decline in median sales price does reflect a drop in prices, it also reflects significant shifts in the types of homes selling. Particularly noticeable is a drop-off in sales of more expensive homes financed with "jumbo" mortgages.

...

Foreclosure activity is at record levels ...

Thursday, December 20, 2007

DataQuick: California Bay Area Home Sales in "Deep Freeze"

by Calculated Risk on 12/20/2007 03:10:00 PM

From DataQuick: Bay Area home sales stuck at two-decade low; price picture mixed

The Bay Area's housing market remained in a bit of deep freeze in November, when sluggish demand kept sales at a two-decade low for the third straight month. Prices continued to hold up best in the region's core markets, while some outlying areas posted more double-digit annual declines, a real estate information service reported.

A total of 5,127 new and resale houses and condos sold in the Bay Area in November. That was down 6.5 percent from 5,486 in October, and down 36.2 percent from 8,042 in November 2006, DataQuick Information Systems reported.

Sales have decreased on a year-over-year basis for 34 consecutive months. Last month was the slowest November in DataQuick's statistics, which go back to 1988. Until last month, the slowest November was in 1990, when 6,015 homes sold. The strongest November, in 2004, saw 11,906 sales. The average for the month is 8,367.

...

The median price paid for a Bay Area home was $629,000 last month, down 0.3 percent from $631,000 in October, and up 1.5 percent from $620,000 in November last year. Last month's median was 5.4 percent lower than the peak median of $665,000 reached last June and July.

Prices in the core metro markets close to large job centers or the coast are holding up relatively well, while areas far from the core are experiencing the most price erosion. Individual counties have seen their median prices decline from peak levels by as little as 2.4 percent in San Francisco and by as much as 21.9 percent in Solano.

...

Foreclosure activity is at record levels ...

Tuesday, December 18, 2007

DataQuick: SoCal House Prices Fall, Slowest November Sales in 20+ Years

by Calculated Risk on 12/18/2007 01:40:00 PM

From DataQuick: Southland prices fall again; sales perk up

... Sales were the slowest for a November in at least 20 years and the median sale price posted a record 10.3 percent year-over-year decline ...Record low sales, record falling year-over-year decline in prices, record foreclosure activity - sounds like a broken record.

A total of 13,173 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in November. That was up 2 percent from 12,913 sales in October, and down 42.7 percent from 23,005 in November last year, according to DataQuick Information Systems.

Last month's sales were the lowest for any November in DataQuick's statistics, which go back to 1988. The previous low was in November 1992, when 15,446 homes sold. November has averaged 22,749 sales over the last 20 years.

...

The median price paid for a Southland home was $435,000 last month, down 2.2 percent from $445,000 in October, and down 10.3 percent from $485,000 in November last year. That year-over-year decline is the largest for any month in DataQuick's records. Last month's $435,000 median was the lowest since March 2005, when it was also $435,000.

Foreclosure activity is at record levels ...

Thursday, November 15, 2007

DataQuick: California Bay Area Home Sales Slump Continues

by Calculated Risk on 11/15/2007 02:58:00 PM

From DataQuick: Bay Area home sales drag along bottom

Bay Area home sales remained at their lowest level in decades last month, the result of mortgage market turbulence and hesitant buyers. Prices continued to hold up best in core markets, while declines steepened in some inland areas, a real estate information service reported.

A total of 5,486 new and resale houses and condos were sold in the nine-county Bay Area in October. That was up 9.4 percent from 5,014 in September, and down 35.7 percent from 8,532 for October a year ago, DataQuick Information Systems reported.

Sales have decreased on a year-over-year basis the last 33 months. Last month was the slowest October in DataQuick's statistics, which go back to 1988. Until last month, the slowest October was in 1990 when 6,443 homes were sold. The strongest October was in 2003 when sales totaled 13,392. The average for the month is 8,930.

...

The median price paid for a Bay Area home was $631,000 last month, up 1.0 percent from $625,000 in September, and up 2.4 percent from $616,000 for October last year. The median peaked at $665,000 last June and July.

...

Foreclosure activity is at record levels ...

Wednesday, November 14, 2007

DataQuick: Record Low SoCal Home Sales

by Calculated Risk on 11/14/2007 01:32:00 PM

From DataQuick: Southland home sales plummet

Southern California home sales remained at their lowest level in more than 20 years last month ... Prices have dropped back to spring 2005 levels, a real estate information service reported.Also, from Mathew Padilla at the O.C. Register: O.C foreclosures highest in decade

A total of 12,999 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in October. That was up 4.4 percent from 12,455 for the previous month, and down 45.3 percent from 23,745 for October last year, according to DataQuick Information Systems.

Last month's sales were the slowest for any October in DataQuick's statistics, which go back to 1988. The previous low was in October 1992 when 16,887 homes sold. The October sales average over the past 20 years is 24,725.

...

The median price paid for a Southland home was $444,000 last month, down 3.9 percent from $462,000 in September, and down 8.0 percent from $482,750 for October last year. The year-over-year decline reflects depreciation as well as the recent change in market mix - fewer mid-to-high-priced homes selling with jumbo mortgages. When adjusted for shifts in mix, home values dropped 6.7 percent compared with a year ago. Last month's median sales price was the lowest since $440,000 in April 2005.

Foreclosure activity is at record levels ...

Amid a slumping housing market and a shortage of available loans, banks foreclosed on 530 homes in Orange County last month, the highest monthly total in more than a decade ...

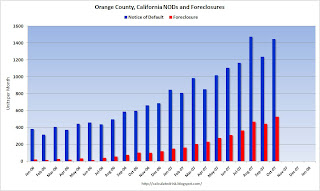

Click on graph for larger image.

Click on graph for larger image.This graph shows the Notice of Default (NOD) and foreclosure data from Padilla's story. Orange County was supposed to be one of those areas immune to a housing bust. I don't think so.

Friday, October 26, 2007

Record California Foreclosure Activity

by Calculated Risk on 10/26/2007 02:35:00 PM

From DataQuick: Record California Foreclosure Activity

Lenders started formal foreclosure proceedings on a record number of California homeowners last quarter, the result of declining home prices, sluggish sales and subprime mortgage distress, a real estate information service reported.It's hard to imagine, but next year will probably be worse.

A total of 72,571 Notices of Default (NoDs) were filed during the July-to-September period, up 34.5 percent from 53,943 during the previous quarter, and up 166.6 percent from 27,218 in third-quarter 2006, according to DataQuick Information Systems of La Jolla.

Last quarter's default level passed the previous peak of 61,541 reached in first-quarter 1996. A low of 12,417 was reached in third-quarter 2004. An average of 34,781 NoDs have been filed quarterly since 1992, when DataQuick's NoD statistics begin.

"We know now, in emerging detail, that a lot of these loans shouldn't have been made. The issue is whether the real estate market and the economy will digest these over the next year or two, or if housing market distress will bring the economy to its knees. Right now, most California neighborhoods do not have much of a foreclosure problem. But where there is a problem, it's getting nasty," said Marshall Prentice, DataQuick's president.

Half the state's default activity is concentrated in 293 zip codes, almost all of which are in the Inland Empire and Central Valley. Grouped together, those zip codes saw year-over-year home price increases that reached 34.0 percent in first quarter 2005. Prices peaked in third-quarter 2006 at $399,000. Last quarter's median of $352,250 is 11.7 percent off that peak.

...

Most of the loans that went into default last quarter were originated between July 2005 and September 2006. The median age was 18 months. Loan originations peaked in August 2005. The use of adjustable-rate mortgages for primary purchase home loans peaked at 77.8% in May 2005 and has since fallen.

Because a residence may be financed with multiple loans, last quarter's 72,751 default notices were recorded on 68,746 different residences.

Thursday, October 18, 2007

DataQuick: Bay Area Record Low Home Sales

by Calculated Risk on 10/18/2007 03:01:00 PM

From DataQuick: Bay Area home sales plummet amid mortgage woes

Bay Area home sales sank to their lowest level in more than two decades in September, the result of a continuing market slowdown and borrowers' increased difficulties in obtaining "jumbo" mortgages, a real estate information service reported.

A total of 5,014 new and resale houses and condos were sold in the nine-county Bay Area in September. That was down 31.3 percent from 7,299 in August, and down 40.1 percent from 8,374 for September a year ago, DataQuick Information Systems reported.

Sales have decreased on a year-over-year basis the last 32 months. Last month was the slowest September in DataQuick's statistics, which go back to 1988. Until last month, the slowest September was in 1991 when 5,735 homes were sold. The strongest September was in 2004 when sales totaled 12,868. The average for the month is 8,961.

"A lot of escrows just didn't close in September because the buyers couldn't get financing. Some of those sales might close this month or next, but many of the deals are going to be put on hold or die on the vine. Jumbo financing has become more available the last few weeks, but lenders are being more cautious than before, and the loans cost more," said Marshall Prentice, DataQuick president.

The number of Bay Area homes purchased with jumbo mortgages dropped from 3,762 in August to 1,935 in September, a decline of 48.6 percent. A jumbo mortgage is a home loan for $417,000 or more. For loans below that threshold, the sales decline was 14.0 percent, from 2,675 in August to 2,301 in September. Historically, sales drop by about 10 percent from August to September.

The median price paid for a Bay Area home was $625,000 last month, down 4.6 percent from $655,000 in August, and up 0.8 percent from $620,000 for September last year.

...

Foreclosure activity is at record levels.

Tuesday, October 16, 2007

DataQuick: SoCal home sales at Record Low

by Calculated Risk on 10/16/2007 01:34:00 PM

From DataQuick: September Southland home sales lowest in more than 20 years

Home sales in Southern California plunged to the lowest level in more than two decades, as financing with "jumbo" mortgages dropped by half. The median price paid for a home dropped sharply as a result ...

A total of 12,455 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in September. That was down 29.9 percent from 17,755 for the previous month, and down 48.5 percent from 24,195 for September last year, according to DataQuick Information Systems.

Last month's sales were the slowest for any month in DataQuick's statistics, which go back to 1988. The previous low was in February 1995 when 12,459 homes sold. The September sales average is 25,258.

...

The number of Soouthland homes purchased with jumbo mortgages dropped from 5,359 in August to 2,681 in September, a decline of 50.0 percent. A jumbo mortgage is a home loan for $417,000 or more. For loans below that threshold, the sales decline was 19.3 percent, from 9,237 in August to 7,459 in September. Historically, sales drop by about 10 percent from August to September.

The median price paid for a Southland home was $462,000 last month, down 7.6 percent from $500,000 in August, and down 4.0 percent from $481,000 for September last year. If the jumbo-financed portion of the market had remained stable, last month's median would have been $487,000.

...

Foreclosure activity is at record levels ... emphasis added

Thursday, September 13, 2007

Bay Area home sales slowest since 1992

by Calculated Risk on 9/13/2007 03:01:00 PM

From DataQuick: Bay Area home sales slowest since early 1990s, flat prices

Bay Area homes sold at the slowest pace in 15 years last month as market uncertainty intensified, forcing more buyers, sellers and lenders to the sidelines. Prices remained flat at the regional level but there were local variations, a real estate information service reported.And on prices:

A total of 7,299 new and resale houses and condos were sold in the nine-county Bay Area in August. That was down 1.7 percent from 7,423 in July, and down 24.9 percent from 9,713 for August a year ago, according to DataQuick Information Systems.

Sales have decreased on a year-over-year basis the last 31 months. Sales last month were the lowest for any August since 1992 when 6,688 homes were sold. The strongest August in DataQuick's statistics, which go back to 1988, was in 2004 when 13,940 homes were sold. The August average is 10,170.

"Homes in the Bay Area are more expensive than elsewhere and most of them are financed with 'jumbo' mortgages. The turbulence in the mortgage markets has made it more difficult to get this type of financing. The question is: does this pull the plug on some market activity, or does it just slow things down? We won't know the answer for a few months," said Marshall Prentice, DataQuick president.On foreclosures:

The median price paid for a Bay Area home was $655,000 last month. That was down 1.5 percent from the June and July peak of $665,000, and up 4.0 percent from $630,000 for August a year ago.

Foreclosure resales accounted for 4.8 percent of August's sales activity, up from 4.5 percent in July, and up from 1.2 percent in August of last year. Foreclosure resales do not yet have a regional effect on prices.These numbers are for both new and existing homes. For existing homes, sales that closed in August were actually signed in June or July - before the credit market turmoil. That is why we have to wait a couple of months to know the answer to DataQuick's question: "The question is: does this pull the plug on some market activity, or does it just slow things down?"

Wednesday, September 12, 2007

DataQuick: SoCal home sales at 15-year low

by Calculated Risk on 9/12/2007 02:12:00 PM

From DataQuick: SoCal home sales at 15-year low, prices edge down

Home sales in Southern California dropped to their lowest level since 1992 as buyers, sellers and lenders held back in an environment of market uncertainty. Prices are off their peak, markedly so in lower cost neighborhoods, a real estate information service reported.For existing homes August typically has more sales than July, so on a seasonally adjusted basis, this report is worse than it appears.

A total of 17,755 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 0.6 percent from 17,867 for the previous month, and down 36.3 percent from 27,857 for August last year, according to DataQuick Information Systems.

Last month's sales were the slowest for any August since 1992, when 16,379 homes sold, the lowest for any August in DataQuick's statistics, which go back to 1988. The strongest August was in 2003, when 39,562 homes sold. The August sales average is 28,160.

On prices:

The median price paid for a Southland home was $500,000 last month, down 1.0 percent from $505,000 in July, and up 2.7 percent from $487,000 for August last year.On foreclosures:

When adjusted for shifts in market mix (i.e. fewer lower-cost homes selling now), year-over-year price changes went negative in January and are now 3.5 percent below year-ago levels.

Foreclosure resales accounted for 8.8 percent of August's sales activity, up from 8.3 percent in July, and up from 2.2 percent in August of last year. Foreclosure resales do not yet have a marketwide effect on prices, although foreclosure discounts appear to be emerging in some local Inland Empire and High Desert markets.