From Goldman Sachs economists:

We expect a 0.23% increase in June core CPI (vs. +0.3% consensus), corresponding to a year-over-year rate of 2.93% (vs. +3.0% consensus). We expect a 0.30% increase in headline CPI (vs. +0.3% consensus), reflecting higher food prices (+0.25%) and energy prices (+1.2%).From BofA:

...

Going forward, tariffs will likely provide a somewhat larger boost to monthly inflation, and we expect monthly core CPI inflation between 0.3-0.4% over the next few months.

We forecast headline and core CPI to print at 0.3% m/m in June, which would be a notable acceleration from the recent trend. Stronger price hikes for core goods, discretionary services, and medical services should drive the pickup in core inflation. Based on our forecast, we project core PCE to print at 0.22% m/m in June, which would lower the likelihood of a September cut.Note that month-to-month inflation was soft in May and June 2024.

Click on graph for larger image.

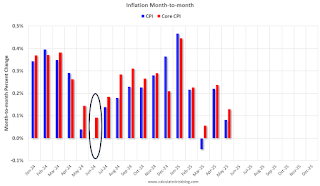

Click on graph for larger image.This graph shows the month-to-month change in both headline and core inflation since January 2024.

The circled area is the change for last when inflation was soft. CPI was down fractionally in June 2024, and core CPI was up 0.09%.

So even a somewhat benign reading in June will push up year-over-year inflation.

Starting in July, the tariff related inflation is expected to kick in.