by Calculated Risk on 6/30/2024 07:54:00 PM

Sunday, June 30, 2024

Monday: ISM Mfg, Construction Spending

Weekend:

• Schedule for Week of June 30, 2024

• Final Look at Local Housing Markets in May and a Look Ahead to June Sales

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for June. The consensus is for the ISM to be at 49.0, up from 48.7 in May.

• Also at 10:00 AM, Construction Spending for May. The consensus is for a 0.3% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are up slightly (fair value).

Oil prices were mixed over the last week with WTI futures at $81.54 per barrel and Brent at $85.00 per barrel. A year ago, WTI was at $71, and Brent was at $75 - so WTI oil prices are up about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.48 per gallon. A year ago, prices were at $3.50 per gallon, so gasoline prices are down $0.02 year-over-year.

Final Look at Local Housing Markets in May and a Look Ahead to June Sales

by Calculated Risk on 6/30/2024 02:05:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in May and a Look Ahead to June Sales

A brief excerpt:

In May, sales in these markets were down 0.1% YoY. In April, these same markets were up 7.6% year-over-year Not Seasonally Adjusted (NSA).There is much more in the article.

Sales in all of these markets are down compared to May 2019.

This was a 0.1% year-over-year decrease NSA for these markets. This is close to the 1.0% year-over-year decline NSA reported by the NAR reported by the NAR.

June sales will be mostly for contracts signed in April and May, and mortgage rates increased slightly to an average of 7.06% in May. My early expectation is we will see existing home sales at above the same level in June as compared to May, on a seasonally adjusted annual rate basis (SAAR).

Note for next month (June sales): There were two fewer working days in June 2024 compared to June 2023 (19 vs 21), so seasonally adjusted sales will be much higher than the NSA data suggests.

Hotels: Occupancy Rate Decreased 2.5% Year-over-year

by Calculated Risk on 6/30/2024 08:21:00 AM

The U.S. hotel industry reported lower performance results from the previous week and mixed comparisons year over year, according to CoStar’s latest data through 22 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

16-22 June 2024 (percentage change from comparable week in 2023):

• Occupancy: 69.5% (-2.5%)

• Average daily rate (ADR): US$159.88 (+0.1%)

• Revenue per available room (RevPAR): US$111.17 (-2.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, June 29, 2024

Real Estate Newsletter Articles this Week: New Home Sales Decrease to 619,000 Annual Rate in May

by Calculated Risk on 6/29/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Decrease to 619,000 Annual Rate in May

• Case-Shiller: National House Price Index Up 6.3% year-over-year in April

• Inflation Adjusted House Prices 2.3% Below Peak

• Watch Months-of-Supply!

• Freddie Mac House Price Index Increased in May; Up 5.9% Year-over-year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 30, 2024

by Calculated Risk on 6/29/2024 08:11:00 AM

The key report scheduled for this week is the June employment report to be released on Friday.

Other key reports include the June ISM Manufacturing survey, June Vehicle Sales and the Trade Deficit for May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 49.0, up from 48.7 in May.

10:00 AM: Construction Spending for May. The consensus is for a 0.3% increase in construction spending.

9:30 AM: Discussion, Fed Chair Jerome Powell, Policy Panel Discussion, At the European Central Bank (ECB) Forum on Central Banking 2024, Sintra, Portugal

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in April to 8.06 million from 8.36 million in March.

The number of job openings (yellow) were down 19% year-over-year and quits were down 3% year-over-year.

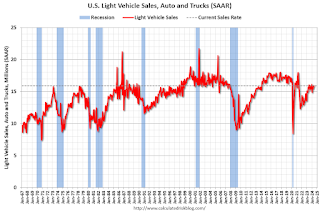

Late in the day: Light vehicle sales for June.

Late in the day: Light vehicle sales for June.The consensus is for light vehicle sales to be 15.9 million SAAR in June, unchanged from 15.9 million in May (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

Wards Auto is forecasting sales of 15.9 million SAAR in June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in June, up from 152,000 in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, down from 233 thousand last week.

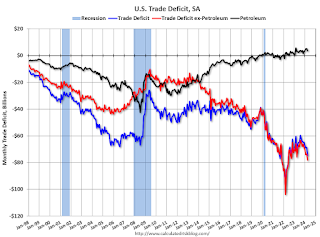

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $72.2 billion. The U.S. trade deficit was at $74.6 billion the previous month.

10:00 AM: the ISM Services Index for June. The consensus is for a reading of 52.5, down from 53.8.

2:00 PM: FOMC Minutes, Meeting of June 11-12, 2024

US markets will close at 1:00 PM ET prior to the Independence Day Holiday.

All US markets will be closed in observance of Independence Day

8:30 AM: Employment Report for June. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 4.0%.

8:30 AM: Employment Report for June. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 4.0%.There were 272,000 jobs added in May, and the unemployment rate was at 4.0%.

This graph shows the jobs added per month since January 2021.

Friday, June 28, 2024

June 28th COVID Update: Wastewater Measure Increasing Sharply

by Calculated Risk on 6/28/2024 07:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week✅ | 300 | 329 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Freddie Mac House Price Index Increased in May; Up 5.9% Year-over-year

by Calculated Risk on 6/28/2024 01:41:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in May; Up 5.9% Year-over-year

A brief excerpt:

On a year-over-year basis, the National FMHPI was up 5.9% in May, down from up 6.4% YoY in April. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in April 2023. ...

As of May, 15 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-4.0%), Montana (-2.8%), Wyoming (-1.7%), D.C. (-1.7%), Utah (-1.3%), and Florida (-1.2%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city.

Q2 GDP Tracking: 1.7% to 2.2%

by Calculated Risk on 6/28/2024 11:07:00 AM

From BofA:

Since our last weekly publication, 2Q GDP tracking is down from 1.8% q/q saar to 1.7% q/q saar and 1Q GDP came in at 1.4% in the third print. Here is a rundown of changes to our tracking estimate. [June 28th estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged on net at +1.9% (qoq ar) and lowered our Q2 domestic final sales forecast by 0.4pp to +1.6%. [June 28th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 2.2 percent on June 28, down from 2.7 percent on June 27. After this morning's personal income and outlays release from the U.S. Bureau of Economic Analysis , the nowcasts of second-quarter real personal consumption expenditures growth and second-quarter real gross private domestic investment growth decreased from 2.5 percent and 8.8 percent, respectively, to 1.8 percent and 8.7 percent. [June 28th estimate]

PCE Measure of Shelter Slows to 5.5% YoY in May

by Calculated Risk on 6/28/2024 08:57:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through May 2024.

Since asking rents are mostly flat year-over-year, these measures will slowly continue to decline over the next year.

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 3 months (annualized):

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 3 months (annualized):Key measures are slightly above the Fed's target on a 3-month basis. Note: There appears to be some residual seasonality distorting PCE prices in Q1, especially in January.

PCE Price Index: 2.4% (3 month annualized)

Core PCE Prices: 2.7%

Core minus Housing: 2.2%

Personal Income increased 0.5% in May; Spending increased 0.2%

by Calculated Risk on 6/28/2024 08:30:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income income increased $114.1 billion (0.5 percent at a monthly rate) in May, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $94.0 billion (0.5 percent) and personal consumption expenditures (PCE) increased $47.8 billion (0.2 percent).The May PCE price index increased 2.6 percent year-over-year (YoY), down from 2.7 percent YoY in April, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index decreased less than 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent. Real DPI increased 0.5 percent in May and real PCE increased 0.3 percent; goods increased 0.6 percent and services increased 0.1 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through May 2024 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations, and PCE was below expectations.

Using the two-month method to estimate Q2 real PCE growth, real PCE was increasing at a 1.8% annual rate in Q2 2024. (Using the mid-month method, real PCE was increasing at 1.8%). This suggests decent PCE growth in Q2.

Thursday, June 27, 2024

Friday: Personal Income & Outlays, Chicago PMI

by Calculated Risk on 6/27/2024 08:34:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, May 2024. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending.

• At 9:45 AM: Chicago Purchasing Managers Index for June.

• At 10:00 AM: University of Michigan's Consumer sentiment index (Final for June).

Las Vegas May 2024: Visitor Traffic Up 4.6% YoY; Convention Traffic Up 2%

by Calculated Risk on 6/27/2024 04:32:00 PM

From the Las Vegas Visitor Authority: May 2024 Las Vegas Visitor Statistics

With festivals such as EDC, coupled with convention attendance ahead of last year, May saw the destination host more than 3.6M visitors, showing a healthy 4.6% YoY gain for the month.

Among the churn of rotational shows, Waste Expo returned to Las Vegas in May (14k attendees, last here in May 2022), and the destination hosted the Advanced Clean Transportation (ACT) Expo for the first time (10k+ attendees).

Overall hotel occupancy reached 86.1% (up 1.7 pts), as Weekend occupancy reached 93.4% (up 0.2 pts) and Midweek occupancy reaching 82.5% (up 1.7 pts). ADR exceeded $200 with RevPAR over $172, showing YoY increases of 9.1% and 11.3%, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (dark blue), 2021 (light blue), 2022 (light orange), 2023 (dark orange) and 2024 (red).

Visitor traffic was up 4.6% compared to last May. Visitor traffic was down 0.9% compared to the same month in 2019.

Realtor.com Reports Active Inventory Up 36.1% YoY

by Calculated Risk on 6/27/2024 03:47:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending June 22, 2024

• Active inventory increased, with for-sale homes 36.1% above year-ago levels.

For the 33rd week in a row, the number of for-sale homes grew compared with one year ago. This past week, the inventory of homes for sale grew by 36.1% compared with last year, essentially the same gap as in recent weeks. While recent inventory growth is substantial compared to a year ago, it highlights just how far inventory had fallen. Even after recent growth, active inventory in May was down more than 30% from typical pre-pandemic levels.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 7.4% from one year ago.

Seller activity is up compared to one year ago, but momentum has waned from recent weeks and earlier this year. Realtor.com analysis shows that 87% of outstanding mortgages have a rate below 6%. If these homeowners sell, they are relinquishing relatively inexpensive debt for today’s roughly 7% mortgage rates, a costly proposition. As rates ease, they will cause less drag on the ‘move or stay’ calculus, and we are likely to see an increase in seller interest.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 32nd consecutive week.

Inflation Adjusted House Prices 2.3% Below Peak; Price-to-rent index is 7.6% below 2022 peak

by Calculated Risk on 6/27/2024 12:46:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.3% Below Peak

Excerpt:

It has been 18 years since the bubble peak. In the April Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 73% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $432,000 today adjusted for inflation (44% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 2.3% below the recent peak, and the Composite 20 index is 3.0% below the recent peak in 2022. Both indexes were mostly unchanged in April in real terms.

NAR: Pending Home Sales Decrease 2.1% in May; Down 6.6% Year-over-year

by Calculated Risk on 6/27/2024 10:00:00 AM

From the NAR: Pending Home Sales Dropped 2.1% in May

Pending home sales in May slipped 2.1%, according to the National Association of REALTORS®. The Midwest and South posted monthly losses in transactions while the Northeast and West recorded gains. Year-over-year, all U.S. regions registered reductions.This was well below expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 70.8 in May. Year over year, pending transactions were down 6.6%. An index of 100 is equal to the level of contract activity in 2001.

“The market is at an interesting point with rising inventory and lower demand,” said NAR Chief Economist Lawrence Yun. “Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.”

...

The Northeast PHSI ascended 1.1% from last month to 63.6, a decline of 2.3% from May 2023. The Midwest index dropped 0.4% to 70.4 in May, down 5.6% from one year ago.

The South PHSI lowered 5.5% to 83.7 in May, falling 10.4% from the prior year. The West index increased 1.4% in May to 56.7, down 2.1% from May 2023.

emphasis added

Weekly Initial Unemployment Claims Decrease to 233,000

by Calculated Risk on 6/27/2024 08:35:00 AM

The DOL reported:

In the week ending June 22, the advance figure for seasonally adjusted initial claims was 233,000, a decrease of 6,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 238,000 to 239,000. The 4-week moving average was 236,000, an increase of 3,000 from the previous week's revised average. The previous week's average was revised up by 250 from 232,750 to 233,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 236,000.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Q1 GDP Growth Revised Up to 1.4% Annual Rate

by Calculated Risk on 6/27/2024 08:30:00 AM

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, First Quarter 2024

Real gross domestic product (GDP) increased at an annual rate of 1.4 percent in the first quarter of 2024 (table 1), according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2023, real GDP increased 3.4 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 2.0% to 1.5%. Residential investment was revised up from 15.4% to 16.0%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.3 percent. The upward revision primarily reflected a downward revision to imports, which are a subtraction in the calculation of GDP, and upward revisions to nonresidential fixed investment and government spending. These revisions were partly offset by a downward revision to consumer spending (refer to "Updates to GDP").

The increase in real GDP primarily reflected increases in consumer spending, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by a decrease in private inventory investment. Imports increased.

emphasis added

Wednesday, June 26, 2024

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 6/26/2024 07:26:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2024 (Third estimate). The consensus is that real GDP increased 1.3% annualized in Q1, unchanged from the second estimate of a 1.3% increase.

• Also at 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.3% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 0.3% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for June.

AIA: Architecture Billings Declined in May; Multi-family Billings Decline for 22nd Consecutive Month

by Calculated Risk on 6/26/2024 01:46:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: ABI May 2024: Business conditions at architecture firms continue to soften

The AIA/Deltek Architecture Billings Index (ABI) score declined to 42.4 for the month, as more firms reported a decrease in billings in May than in April. In addition, there is increasing softness in the pipeline of new work coming into firms. While inquiries into new projects continued to increase, they did so at a slower pace than in recent months. And the value of new signed design contracts declined further in May, following a small decrease in April. Despite the fact that the high inflation of the last few years has largely receded, elevated interest rates continue to cause hesitation among many clients.• Northeast (47.7); Midwest (41.7); South (46.0); West (46.3)

Firm billings remained soft across all regions and sectors as well in May. Billings declined at firms in all regions of the country for the fourth consecutive month, as conditions remained weakest at firms located in the Midwest. Business conditions also softened further in May at firms with an institutional specialization, while fewer firms with commercial/industrial and multifamily residential specializations reported a decline in billings in May than in April. However, a majority of firms of both specializations still reported weak business conditions.

...

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

emphasis added

• Sector index breakdown: commercial/industrial (48.2); institutional (43.2); multifamily residential (47.3)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 42.4 in May, down from 48.3 in April. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.

New Home Sales Decrease to 619,000 Annual Rate in May; Median New Home Price is Down 9% from the Peak

by Calculated Risk on 6/26/2024 10:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decrease to 619,000 Annual Rate in May

Brief excerpt:

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 619 thousand, however the three previous months were revised up sharply.There is much more in the article.

...

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in May 2024 were down 16.5% from May 2023.

This year-over-year decline followed 13 consecutive months with a year-over-year increase. In May 2023, seasonally adjusted sales hit the high for the year, so this was a difficult comparison.

New Home Sales Decrease to 619,000 Annual Rate in May

by Calculated Risk on 6/26/2024 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 619 thousand.

The previous three months were revised up sharply.

Sales of new single‐family houses in May 2024 were at a seasonally adjusted annual rate of 619,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.3 percent below the revised April rate of 698,000 and is 16.5 percent below the May 2023 estimate of 741,000.

emphasis added

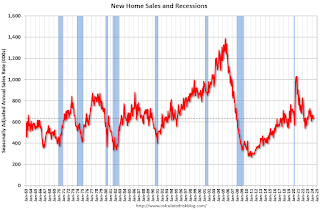

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

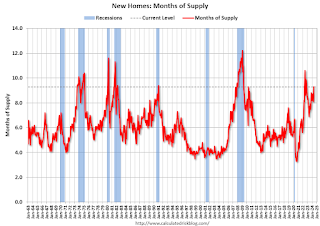

The second graph shows New Home Months of Supply.

The months of supply increased in May to 9.3 months from 8.1 months in April.

The months of supply increased in May to 9.3 months from 8.1 months in April. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of May was 481,000. This represents a supply of 9.3 months at the current sales rate."Sales were well below expectations of 650 thousand SAAR, however sales for the three previous months were revised up significantly. I'll have more later today.

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 6/26/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 21, 2024. This week’s results include an adjustment for the Juneteenth holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 10 percent compared with the previous week. The Refinance Index was essentially unchanged from the previous week and was 26 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 10 percent compared with the previous week and was 13 percent lower than the same week one year ago.

“Mortgage rates were mostly lower last week, with the 30-year fixed rate declining slightly to 6.93 percent, the lowest level in more than three months,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Lower rates, however, were still not enough to entice refinance borrowers back, as most continue to hold mortgages with considerably lower rates.”

Added Kan, “Purchase applications did see a small increase after adjusting for the Juneteenth holiday. Government purchase loans, primarily FHA and VA, saw gains of more than 2 percent over the previous week, as homebuyers in those segments sought to take advantage of the recent rate relief.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.93 percent from 6.94 percent, with points unchanged at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.

Tuesday, June 25, 2024

Wednesday: New Home Sales

by Calculated Risk on 6/25/2024 08:48:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for 650 thousand SAAR, up from 634 thousand in April.

• During the day, The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

June Vehicle Sales Forecast: 15.9 million SAAR, Down 1% YoY

by Calculated Risk on 6/25/2024 05:48:00 PM

From WardsAuto: June U.S. Light-Vehicle Sales Likely Reduced by Cyberattack (pay content). Brief excerpt:

Unknown is how many unit sales in June might be lost because of the attack. Not all affected dealers stopped selling vehicles and many that did have since resumed, often manually processing sales and finding alternative ways to deliver vehicles to customers. Another unknown is how many buyers might have switched to an unaffected dealer to make a purchase. The bright side is that any lost sales in June likely will be made up in July.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for May (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.9 million SAAR, would be unchanged from last month, and down 1.0% from a year ago.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 6/25/2024 01:35:00 PM

Two key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2024). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Comments on April House Prices, FHFA: House Prices Increased 0.2% in April

by Calculated Risk on 6/25/2024 09:47:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 6.3% year-over-year in April; FHFA: House Prices Increased 0.2% in April, up 6.3% YoY

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3-month average of February, March and April closing prices). April closing prices include some contracts signed in December, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.26%. This was the fifteenth consecutive MoM increase, but this tied December as the smallest MoM increase in the last 14 month.

On a seasonally adjusted basis, prices increased month-to-month in 16 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 7.8% from the recent peak, Seattle is down 6.0% from the peak, Portland down 3.7%, and Phoenix is down 3.7%.

Case-Shiller: National House Price Index Up 6.3% year-over-year in April

by Calculated Risk on 6/25/2024 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3-month average of February, March and April closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Break Prvious Month's All-Time High in April 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.3% annual gain for April, down from a 6.5% annual gain in the previous month. The 10-City Composite saw an annual increase of 8.0%, down from an 8.3% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 7.2%, dropping from a 7.5% increase in the previous month. San Diego continued to report the highest annual gain among the 20 cities in April with a 10.3% increase this month, followed by New York and Chicago, with increases of 9.4% and 8.7%, respectively. Portland once again held the lowest rank this month for the smallest year-over-year growth, with a 1.7% annual increase in April.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite upward trends decelerated from last month, with pre-seasonality adjustment increases of 1.2%, 1.36% and 1.38%, respectively.

After seasonal adjustment, the U.S. National Index and 10-City Composite posted the same month-over-month increase of 0.3% and 0.5% respectively as last month, while the 20-City reported a monthly increase of 0.4%.

“For the second consecutive month, we’ve seen our National Index jump at least 1% over its previous all-time high,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “2024 is closely tracking the strong start observed last year, where March and April posted the largest rise seen prior to a slowdown in the summer and fall. Heading into summer, the market is at an all-time high, once again testing its resilience against the historically more active time of the year.

“Thirteen markets are currently at all-time highs and San Diego reigns supreme once again, topping annual returns for the last six months. The Northeast is the best performing market for the previous nine months, with New York rising 9.4% annually. Sustained outperformance of the Northeast market was last observed in 2011. For the decade that followed, the West and the South held the top posts for performance. It’s now been over a year since we’ve seen the top region come from the South or the West.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in April (SA). The Composite 20 index was up 0.4% (SA) in April.

The National index was up 0.3% (SA) in April.

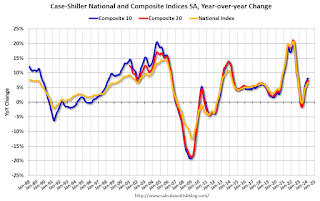

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 8.0% year-over-year. The Composite 20 SA was up 7.2% year-over-year.

The National index SA was up 6.3% year-over-year.

Annual price changes were slightly above expectations. I'll have more later.

Monday, June 24, 2024

Tuesday: Case-Shiller House Prices

by Calculated Risk on 6/24/2024 07:08:00 PM

... ever since last Monday, the average top tier conventional 30yr fixed rate hasn't moved mover than 0.02% on any single day and for the past 3 days, not more than 0.01%. That's a staggering level of "sideways-ness." [30 year fixed 7.02%]Tuesday:

emphasis added

• At 8:30 AM ET, Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 9:00 AM, S&P/Case-Shiller House Price Index for April. The National index was up 6.5% year-over-year in March.

• Also at 9:00 AM, FHFA House Price Index for April. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for June.

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for May 2024.

MBA Survey: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.21% in May

by Calculated Risk on 6/24/2024 04:07:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.21% in May

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance declined slightly to 0.21% as of May 31, 2024. According to MBA’s estimate, 105,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.2 million borrowers since March 2020.At the end of May, there were about 105,000 homeowners in forbearance plans.

In May 2024, the share of Fannie Mae and Freddie Mac loans in forbearance declined 1 basis point to 0.10%. Ginnie Mae loans in forbearance remained the same relative to the previous month at 0.39%, and the forbearance share for portfolio loans and private-label securities (PLS) also stayed flat at 0.31%.

“The performance of servicing portfolios in May was solid, with about 96 percent of borrowers making their mortgage payments on time,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “There was a slight decline in the performance of post-forbearance loan workouts, but the results were relatively strong with 75 percent of homeowners making their payments in accordance with the workout terms.”

emphasis added

Watch Months-of-Supply!

by Calculated Risk on 6/24/2024 10:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Watch Months-of-Supply!

A brief excerpt:

Although inventory is well below normal levels, so are sales. I think we need to keep an eye on months-of-supply. Historically nominal prices declined when months-of-supply approached 6 months - and that is unlikely this year - but we could see months-of-supply back to 2019 levels later this year.There is much more in the article.

What would it take to get months-of-supply back to 2019 levels by mid-year? The following table is a simple exercise. If sales stay depressed at 2023 levels, how much would inventory have to increase to put months-of-supply at 2019 levels?

Housing June 24th Weekly Update: Inventory up 2.2% Week-over-week, Up 37.7% Year-over-year

by Calculated Risk on 6/24/2024 08:12:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 23, 2024

Sunday Night Futures

by Calculated Risk on 6/23/2024 06:36:00 PM

Weekend:

• Schedule for Week of June 23, 2024

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for June.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are little changed (fair value).

Oil prices were up over the last week with WTI futures at $80.73 per barrel and Brent at $85.24 per barrel. A year ago, WTI was at $69, and Brent was at $74 - so WTI oil prices are up about 17% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.42 per gallon. A year ago, prices were at $3.56 per gallon, so gasoline prices are down $0.14 year-over-year.

Hotels: Occupancy Rate Decreased 0.6% Year-over-year

by Calculated Risk on 6/23/2024 01:04:00 PM

The U.S. hotel industry reported higher performance results from the previous week but mixed comparisons year over year, according to CoStar’s latest data through 15 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

9-15 June 2024 (percentage change from comparable week in 2023):

• Occupancy: 70.3% (-0.6%)

• Average daily rate (ADR): US$161.70 (+0.9%)

• Revenue per available room (RevPAR): US$113.62 (+0.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, June 22, 2024

Real Estate Newsletter Articles this Week: Single Family Starts Down Slightly Year-over-year in May; Multi-Family Starts Down 50%

by Calculated Risk on 6/22/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Single Family Starts Down Slightly Year-over-year in May; Multi-Family Starts Down 50%

• NAR: Existing-Home Sales Decreased to 4.11 million SAAR in May

• Lawler: Early Read on Existing Home Sales in May

• 4th Look at Local Housing Markets in May; California Home Sales Down 6% YoY in May

• Comparing the Current Housing Market to the 1978 to 1982 period

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 23, 2024

by Calculated Risk on 6/22/2024 08:11:00 AM

The key reports this week are May New Home sales, the third estimate of Q1 GDP, Personal Income and Outlays for May and the April Case-Shiller house price index.

For manufacturing, the June Dallas, Kansas City and Richmond Fed manufacturing surveys will be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for April.

9:00 AM: S&P/Case-Shiller House Price Index for April.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The National index was up 6.5% year-over-year in March.

9:00 AM: FHFA House Price Index for April. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June.

10:00 AM: State Employment and Unemployment (Monthly) for May 2024.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 650 thousand SAAR, up from 634 thousand in April.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2024 (Third estimate). The consensus is that real GDP increased 1.3% annualized in Q1, unchanged from the second estimate of a 1.3% increase.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.3% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.3% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for June.

8:30 AM ET: Personal Income and Outlays, May 2024. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending.

9:45 AM: Chicago Purchasing Managers Index for June.

10:00 AM: University of Michigan's Consumer sentiment index (Final for June).

Friday, June 21, 2024

June 21st COVID Update: Wastewater Measure Increasing

by Calculated Risk on 6/21/2024 07:02:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week✅ | 316 | 316 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q2 GDP Tracking: 1.8% to 3.0%

by Calculated Risk on 6/21/2024 02:36:00 PM

From BofA:

Our 2Q tracking estimate is two tenths higher at 1.8% q/q saar largely due to stronger than expected May payrolls and weaker than expected May CPI and PPI [June 20th estimate]From Goldman:

emphasis added

We lowered our Q2 GDP tracking estimate by 0.1pp to +1.9% (qoq ar) and our Q2 domestic final sales forecast by the same amount to +2.0%. [June 20th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.0 percent on June 20, down from 3.1 percent on June 18. After this morning's housing starts report from the US Census Bureau, the nowcast of second-quarter real gross private domestic investment growth decreased from 8.8 percent to 8.3 percent. [June 18th estimate]

NAR: Existing-Home Sales Decreased to 4.11 million SAAR in May; Median House Prices Increased 5.8% Year-over-Year

by Calculated Risk on 6/21/2024 10:48:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.11 million SAAR in May

Excerpt:

Sales Year-over-Year and Not Seasonally Adjusted (NSA)There is much more in the article.

The fourth graph shows existing home sales by month for 2023 and 2024.

Sales declined 2.8% year-over-year compared to May 2023. This was the thirty-third consecutive month with sales down year-over-year.

NAR: Existing-Home Sales Decreased to 4.11 million SAAR in May

by Calculated Risk on 6/21/2024 10:00:00 AM

From the NAR: Existing-Home Sales Edged Lower by 0.7% in May as Median Sales Price Reached Record High of $419,300

Existing-home sales slightly declined in May as the median sales price climbed to a record high, according to the National Association of REALTORS®. In the four major U.S. regions, sales slid month-over-month in the South but were unchanged in the Northeast, Midwest and West. Year-over-year, sales rose in the Midwest but receded in the Northeast, South and West.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – retreated 0.7% from April to a seasonally adjusted annual rate of 4.11 million in May. Year-over-year, sales waned 2.8% (down from 4.23 million in May 2023).

...

Total housing inventory registered at the end of May was 1.28 million units, up 6.7% from April and 18.5% from one year ago (1.08 million). Unsold inventory sits at a 3.7-month supply at the current sales pace, up from 3.5 months in April and 3.1 months in May 2023.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in May (4.11 million SAAR) were down 0.7% from the previous month and were 2.8% below the May 2023 sales rate.

According to the NAR, inventory increased to 1.28 million in May from 1.20 million the previous month.

According to the NAR, inventory increased to 1.28 million in May from 1.20 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 18.5% year-over-year (blue) in May compared to May 2023.

Inventory was up 18.5% year-over-year (blue) in May compared to May 2023. Months of supply (red) increased to 3.7 months in May from 3.5 months the previous month.

This was close to the consensus forecast. I'll have more later.

Thursday, June 20, 2024

Friday: Existing Home Sales

by Calculated Risk on 6/20/2024 07:51:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, down from 4.14 million.

Realtor.com Reports Active Inventory Up 36.0% YoY

by Calculated Risk on 6/20/2024 12:45:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending June 15, 2024

• Active inventory increased, with for-sale homes 36.0% above year-ago levels.

For the 32nd straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. This past week, the inventory of homes for sale grew by 36.0% compared with last year, maintaining the same rate of growth as the previous week.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 8.0% from one year ago.

Seller activity continued to climb annually last week, matching last week’s annual growth rate of 8%. These past few months sellers have been particularly sensitive to mortgage rates, with newly listed homes being one of the first metrics to respond to the small fluctuations seen in mortgage rates in recent months. If the promising inflation readings seen in May continue, it could lead to softening rates and increase in seller interest toward the latter half of the year. Meanwhile, newly listed homes remained approximately 22% below pre-pandemic (2017 to 2019) levels.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 32nd consecutive week.