Mortgage applications increased 0.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 24, 2022. This week’s results include an adjustment for the observance of the Juneteenth holiday.

... The Refinance Index increased 2 percent from the previous week and was 80 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 0.1 percent from one week earlier. The unadjusted Purchase Index decreased 21 percent compared with the previous week and was 24 percent lower than the same week one year ago.

“Mortgage rates continue to experience large swings. After increasing 65 basis points during the past three weeks, the 30-year fixed rate declined 14 basis points last week to 5.84 percent. Rates are still significantly higher than they were a year ago, when the 30-year fixed rate was at 3.2 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The decline in mortgage rates led to a slight increase in refinancing, driven by an uptick in conventional loans. However, refinances are still 80 percent lower than a year ago and more than 60 percent below the historical average.”

Added Kan, “Overall purchase activity has weakened in recent months due to the quick jump in mortgage rates, high home prices, and growing economic uncertainty. Purchase applications were essentially flat last week but were supported by a 6 percent increase in government loans. The average purchase loan amount declined to $413,500, which is an ongoing downward trend since it hit a record $460,000 in March 2022.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.84 percent from 5.98 percent, with points decreasing to 0.64 from 0.77 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

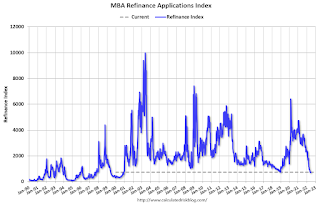

Click on graph for larger image.The first graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index has declined sharply over the last several months.

The refinance index is just above the lowest level since the year 2000.

The second graph shows the MBA mortgage purchase index