Last week, Goldman Sachs economists wrote:

“Following this morning’s strong CPI print, we are raising our Fed forecast to include seven consecutive 25bp rate hikes at each of the remaining FOMC meetings in 2022 (vs. five hikes in 2022 previously).”And Merrill Lynch economists noted:

emphasis added

"For the Fed, this report provides another wake-up call. Inflation is here and it continues to make its presence known everywhere. We remain comfortable with our hawkish call for the Fed to hike seven times this year ..."This is a significant outlook change from just a few months ago.

The FOMC will likely announce a rate hike at the March meeting, and perhaps even raise rates by 50bps (some analysts think the FOMC might announce an emergency hike before the FOMC meeting).

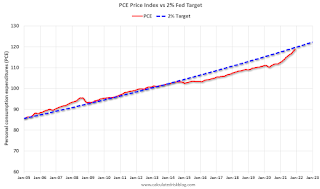

Click on graph for larger image.

Click on graph for larger image.This graph is from January 2005 (just an arbitrary date) through December 2022.

This shows that inflation had been below target for years. If we were doing price targeting (we aren't), then prices would just be getting back to the target.

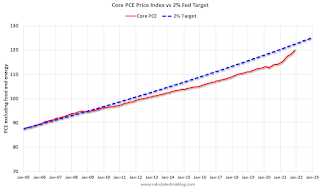

The second graph is for core PCE inflation shows the same pattern, but core PCE is even further below the trend line.

The question is not will some prices "stick", but rather will YoY inflation ease back towards the Fed's target? Or will inflation stay elevated?

The question is not will some prices "stick", but rather will YoY inflation ease back towards the Fed's target? Or will inflation stay elevated?My sense is once the pandemic slows significantly; inflation will ease back towards the Fed's target.

Of course, the pandemic is still contributing significantly to the surge in inflation (supply constraints, labor shortages, shift in buying patterns), and the FOMC cannot control the pandemic.