The committee has determined that a peak in monthly economic activity occurred in the U.S. economy in February 2020. The peak marks the end of the expansion that began in June 2009 and the beginning of a recession. The expansion lasted 128 months, the longest in the history of U.S. business cycles dating back to 1854. The previous record was held by the business expansion that lasted for 120 months from March 1991 to March 2001.The NBER will probably wait some time before calling the end of the recession, this process can take from 18 months to two years or longer. It is likely the NBER will date the beginning of the expansion in Q2 2020.

...

The usual definition of a recession involves a decline in economic activity that lasts more than a few months. However, in deciding whether to identify a recession, the committee weighs the depth of the contraction, its duration, and whether economic activity declined broadly across the economy (the diffusion of the downturn). The committee recognizes that the pandemic and the public health response have resulted in a downturn with different characteristics and dynamics than prior recessions. Nonetheless, it concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions.

It will take some time for all major indicators to be above their previous high after the pandemic recession because of the severe contraction as the graphs below show.

GDP is the key measure, as the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.

Click on graph for larger image.

Click on graph for larger image.This graph is for real GDP through Q4 2020.

This is the key measure, and the NBER will probably use GDP and GDI to determine the trough of the recession (likely in April and in Q2 2020).

As of Q4, real GDP was 2.5% below the pre-recession peak.

Most forecasters expect GDP to increase strongly in Q1 2021, but even with a 7% annualized increase, real GDP will be down about 0.8% from Q4 2019.

Real GDP will likely be above Q4 2019 levels in Q2 2021.

The second graph is for monthly industrial production based on data from the Federal Reserve through Mar 2021.

The second graph is for monthly industrial production based on data from the Federal Reserve through Mar 2021.Industrial production is off over 4.5% from the pre-recession peak.

Note that industrial production was weak prior to the onset of the pandemic.

Industrial production usually takes a long time to recover after a significant decline.

The third graph is for employment through March 2021.

The third graph is for employment through March 2021.Historically employment was a coincident indicator for the end of recessions, but that hasn't been true for the previous three recessions (1990-1991, 2001, 2007-2009).

Employment is currently off about 5.5% from the pre-recession peak (dashed line). This is a significant improvement from off 14.6% in April 2020.

There is still a long way to go for employment to recover to pre-pandemic levels.

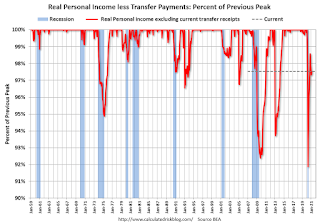

And the last graph is for real personal income excluding transfer payments through Feb 2021.

And the last graph is for real personal income excluding transfer payments through Feb 2021.Real personal income less transfer payments was still off 2.5% in February.

These graphs are useful in trying to identify peaks and troughs in economic activity.

Economic activity bottomed in Q2 (in April).