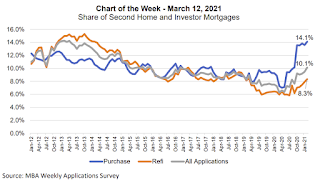

From the MBA:

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a

second home or investment property. In February 2021, 10.1 percent of all applications in the retail and

consumer direct channels were for a non‐primary residence. This was an increase from 9.5 percent the

previous month. 2019 and 2020 saw annual averages of approximately 8 percent. Breaking down the

categories, second‐home transactions accounted for 3.6 percent of all applications and investment

properties were 6.5 percent, totaling 10.1 percent. Average loan sizes as of February 2021 were $430,000

for second homes and $263,000 for investment properties.

Within purchase mortgages, the second home and investment property share was 14.1 percent of

applications in February 2021, an increase from 13.6 percent in January and up from the annual averages of

9 percent in 2019 and 10 percent in 2020. Purchase activity in these property types has been increasing

with the start of the spring buying season. Furthermore, demand is rising because of the rise in remote

work and the desire to live further away from more densely populated urban areas. Refinancing of second

homes and investment properties has also seen an increase – the result of homeowners taking advantage

of record‐low mortgage rates.

Click on graph for larger image.

Click on graph for larger image.

Recognizing that compositional measures are impacted by the mix of applications, we also examined the

year‐over‐year trends in the number of applications for these loan categories. Second home applications

were up 37 percent compared to February 2020 and investor applications were up 110.6 percent, while

overall applications were up 26.8 percent, which highlights the fact that the pace of growth has been higher

for second homes and investment properties.

Lenders were focused this week on announcements from Fannie Mae and Freddie Mac to limit the share of

loans they could sell to the GSEs to 7 percent of their portfolios, well below the run ‐rate in the market at

this time.

CR Note: The

Fannie and Freddie announcement will push up mortgage rates on 2nd homes and investor buying.

Click on graph for larger image.

Click on graph for larger image.