by Calculated Risk on 11/02/2020 04:00:00 PM

Monday, November 02, 2020

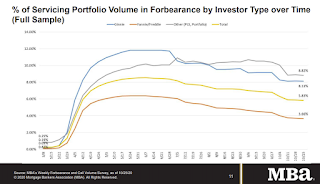

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.83%"

Note: This is as of October 25th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.83%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020. According to MBA’s estimate, 2.9 million homeowners are in forbearance plans.

...

“With more borrowers exiting forbearance in the prior week, the share of loans in forbearance declined across all loan types. Almost half of forbearance exits to date have been from borrowers who remained current while in forbearance, or who were reinstated by paying back past-due amounts,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The share of loans in forbearance has returned to levels last seen in early April, but it still remains remarkably high. Further improvement will require ongoing recovery in the job market, as well as additional fiscal stimulus.”

...

By stage, 23.95% of total loans in forbearance are in the initial forbearance plan stage, while 74.49% are in a forbearance extension. The remaining 1.56% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.10%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits, but improvement might haved slowed.