This gives a total of 3.86% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: Low Interest Rates Make Housing Most Affordable in Two Years Despite Accelerating Price Growth; Buying Power Up 16% since Late 2018

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. Drawing upon the latest data from the Black Knight Home Price Index (HPI), this month’s report examined home price growth and affordability in the context of today’s lower-interest-rate environment. As Black Knight Data & Analytics President Ben Graboske explained, low interest rates throughout much of the back half of 2019 contributed to sharply accelerating home price growth – but also to improving affordability.

“After falling from nearly 7% year-over-year appreciation in early 2018 to a trough of 3.8% in August 2019, the national home-price-growth rate gained a good deal of steam as mortgage interest rates declined throughout the second half of last year,” said Graboske. “In fact, December marked four consecutive months of home price growth acceleration and the largest single-month acceleration in more than 6.5 years, while the annual rate of appreciation saw nearly a full percentage point increase over the last four months of 2019, closing out the year at 4.7%. The low end of the market, those homes in the bottom 20% by price, saw 6.6% annual growth, nearly three times the rate of the top 20%. That said, higher-priced homes have been more reactive to recent rate declines. The annual growth rate among the top price tier has more than tripled over the past four months – from 0.7% year-over-year in August to 2.3% as of December – while there’s been very little acceleration at the lowest end of the market.

“Still, even with home price growth accelerating, today’s low-interest-rate environment has made home affordability the best it’s been since early 2018. At that time, the housing market was red-hot, with national home price growth at 6.6% and climbing – before rising rates and tightening affordability triggered a pullback in growth rates. That’s not the case today. Despite the average home price increasing by nearly $13,000 from just over a year ago, the monthly mortgage payment required to buy that same home has actually dropped by 10% over that same span due to falling interest rates.

It now requires 20.6% of median monthly income to purchase the same home as it did just over a year ago, the smallest payment-to-income ratio we’ve seen in two years. Put another way, prospective homebuyers can now purchase a home that is $48,000 more expensive than a year ago, while still paying the same in principal and interest. That’s a 16% increase in buying power. Recent history at comparable levels of affordability suggest acceleration in home price growth may well continue in the coming months as this increased buying power puts upward pressure on home prices across the country.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows Black Knight's estimate of the mortgage payment to income ratio.

From Black Knight:

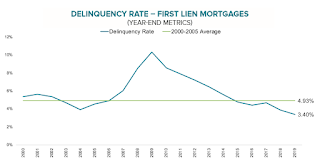

• Even with home price growth accelerating, today’s low interest-rate environment has made home affordability the best it’s been since early 2018The second graph shows the year end national delinquency rate since 2000:

• At that time, the housing market was red-hot, with national home price growth at 6.6% and climbing – before rising rates and tightening affordability triggered a pullback in growth rates

• It now requires 20.6% of median monthly income to purchase the same home as it did just over a year ago, the smallest payment-to-income ratio we’ve seen in two years

• Put another way, prospective homebuyers can now purchase a $48K more expensive home than a year ago while still paying the same in principal and interest, a 16% increase in buying power

• Recent history at comparable levels of affordability suggest acceleration in home price growth may well continue in the coming months as this increased buying power puts upward pressure on home prices across the country

• The national delinquency rate closed out 2019 at 3.4%, the lowest year-end rate of the century and down 12.4% from last yearThere is much more in the mortgage monitor.

• That's also more than 1.5% below the pre-recession average - the largest such spread in the years since the financial crisis

• When the rate of improvement slowed in mid-2019, it appeared the market was approaching a trough in mortgage delinquencies

• However, the rate of improvement picked back up again late in the year, suggesting delinquency rates could fall even further, potentially surpassing the record low hit in May 2019 by early 2020