From Reis Economist Barbara Denham: Office Vacancy Holds Steady at 15.8%; Rents Increase 0.5% in the Quarter. Vacancy Increases in 42 U.S. Metros, but only 10 See Effective Rent Decline.

The Office Vacancy Rate remained flat in the second quarter at 16.0%. Asking rents increased 0.4% in the quarter and only 1.6% since the second quarter of 2016 – the lowest annual rate since 2011.

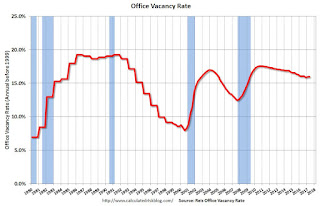

Continuing its lackluster pace, the Office market recorded the lowest quarterly net absorption in three years as the vacancy rate remained flat at 16.0%. One year ago, the vacancy rate was 16.1%. In the last expansion, the U.S. vacancy rate had fallen from a high of 17.0% in 2003 to a low of 12.5% in 2007. In the current expansion that is now seven quarters longer than the previous expansion, the vacancy rate has fallen from a high of 17.6% to only 16.0% as tenants have leased far fewer square feet per added employee than in past cycles.

New construction of 7.5 million square feet was also low by historic standards, but developers have been cautious throughout these last few years and have expanded the office supply at a less aggressive rate than in previous cycles. Net absorption, or occupancy growth, of 3.3 million square feet was the lowest since the second quarter of 2014. ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.0% in Q2. The office vacancy rate is moving sideways at an elevated level.

Office vacancy data courtesy of Reis.