The housing starts report released this morning showed starts were down in April compared to March, and were up 0.7% year-over-year compared to April 2016.

Note that multi-family is frequently volatile month-to-month, and has seen especially wild swings over the last year.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Click on graph for larger image.

Click on graph for larger image.Starts were up 0.7% in April 2017 compared to April 2016, and starts are up 5.3% year-to-date.

Note that single family starts are up 7.0% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess is starts will increase around 3% to 7% in 2017.

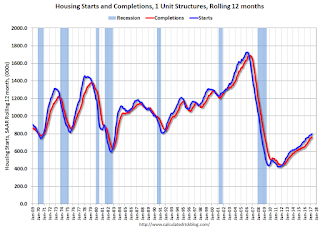

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has been moving more sideways recently. Completions (red line) have lagged behind - but completions have been generally catching up (more deliveries). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect a few years of increasing single family starts and completions.