• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 276 thousand the previous week.

• At 10:00 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 0.0, up from -4.5.

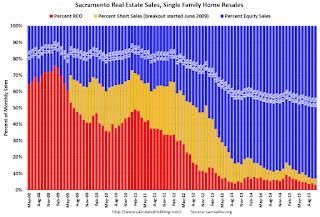

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In October, total sales were up 10.5% from October 2014, and conventional equity sales were up 16.9% compared to the same month last year.

In October, 7.0% of all resales were distressed sales. This was up from 6.9% last month, and down from 12.1% in October 2014.

The percentage of REOs was at 3.3% in October, and the percentage of short sales was 3.7%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales. Distressed sales are so small, the font doesn't fit.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 21.5% year-over-year (YoY) in October. This was the sixth consecutive monthly YoY decrease in inventory in Sacramento (a big recent change).

Cash buyers accounted for 15.3% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying.