The title of this post is from a report by Oregon Office of Economic Analysis economist Josh Lehner on the Portland housing market. Josh was kind enough to allow me to use a couple of his graphs for my appearance on Bloomberg.

Here are the three graphs I'm planning on discussing:

Click on graph for larger image.

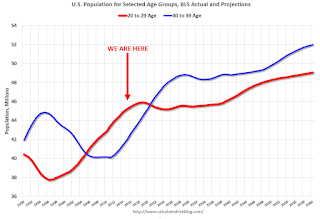

Click on graph for larger image.The first graph is from my post yesterday: Demographic Impacts: Renting vs. Owning, Labor Force Participation, GDP

This graph shows the long term trend for two key age groups: 20 to 29, and 30 to 39.

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

Note: I used a similar graph five years ago to argue there would be a surge in rentals from both demographics, and also from people losing their homes to foreclosure.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

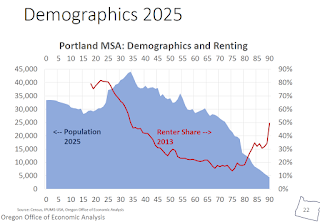

This graph from Josh Lehner shows the population in Portland by age. And the red line is the percent of the population that rents by age (for 2013).

This graph from Josh Lehner shows the population in Portland by age. And the red line is the percent of the population that rents by age (for 2013). Renting peaks when people are in their 20s, and then steadily falls off (behavior may change a little going forward).

The second graph from Lehner shows population projections for 2025.

The peak in population has moved past the peak renting years.

The peak in population has moved past the peak renting years.This doesn't mean 2015 is "peak renter". But this does suggest growth will slow for multi-family, but not a sharp decline.

The recent Reis survey on apartment vacancies and rents also suggests some slowdown, but overall the rental market is still very tight.