This was below the consensus forecast of 16.0 million SAAR (seasonally adjusted annual rate).

For the year, most forecasts were for auto sales growth to slow in 2013 to around 4% growth or 15.0 million units. Actually sales growth were up about 7.5% to 15.5 million.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2000 | 17.4 | 2.7% |

| 2001 | 17.1 | -1.3% |

| 2002 | 16.8 | -1.8% |

| 2003 | 16.6 | -1.1% |

| 2004 | 16.9 | 1.4% |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.5 | 7.5% |

| 1Initial estimate. | ||

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 15.53 million SAAR from WardsAuto).

December sales were a little disappointing, but overall 2013 was solid.

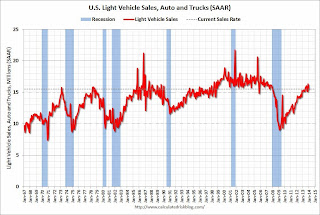

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales, and most forecasts are for around a 4% sales gain in 2014 to around 16.1 million light vehicles.