The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier and is at its lowest level since the week ending December 28, 2012.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.77 percent from 3.78 percent, with points increasing to 0.48 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

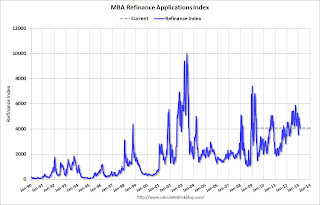

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is down over the last five weeks. Activity is still very high, but is declining from the levels of 2012.

There has been a sustained refinance boom for over a year, and 77 percent of all mortgage applications are for refinancing.

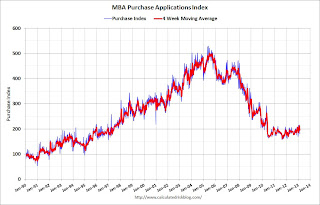

The second graph shows the MBA mortgage purchase index. The purchase index was at the low for the year last week, but the 4-week average of the index has generally been trending up over the last six months.

The second graph shows the MBA mortgage purchase index. The purchase index was at the low for the year last week, but the 4-week average of the index has generally been trending up over the last six months.This index will probably continue to increase as conventional home purchase activity increases.