Click on graph for larger image in new window.

Click on graph for larger image in new window.Here are the probabilities from the Cleveland Fed. As of yesterday, the market was still expecting no move in June - with the odds of a 25 bps rate hike increasing only slightly.

But all the tough talk about inflation and supporting the dollar is getting some attention.

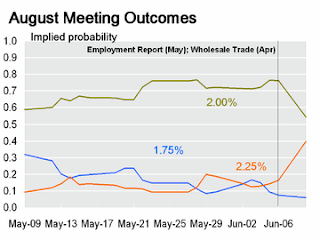

The 2nd graph shows the August meeting probabilities as of yesterday.

As of yesterday, the implied probability of a 25 bps rate hike in August was below 40%.

However, according to a private calculation (using the August Fed Funds future contract), the odds of a 25 bps rate hike increased to over 70% today!

However, according to a private calculation (using the August Fed Funds future contract), the odds of a 25 bps rate hike increased to over 70% today!Raising rates with unemployment rising, and the economic risks to the downside, seems very unusual - but that is what the market expects.