by Calculated Risk on 10/20/2014 08:09:00 PM

Monday, October 20, 2014

Tuesday: Existing Home Sales

From Dina ElBoghdady at the WaPo: How a top housing regulator plans to make it easier to get a mortgage. Excerpts:

It’s unclear if Watt's downpayment plan will do much to ease access to credit. The average downpayment remains lower today than it was in more normal, pre-housing bubble times, said Sam Khater, chief deputy economist at CoreLogic. That’s because the Federal Housing Administration – which backs loans with as little as 5 percent down -- has a larger share of the mortgage market than usual, Khater said. Having Fannie and Freddie also accept downpayments as low as 5 percent would only help on the fringes, Khater said.From David Stevens, MBA President: MBA’s Stevens Applauds FHFA Steps to Ease Credit for Homebuyers

...

Today, the average credit score on a loan backed by Fannie and Freddie is close to 745, versus about 710 in the early 2000s, according to Moody’s Analytics.

“Offering lenders better clarity around representation and warranty requirements will ensure lenders are accountable for any material mistakes they may make in the loan process, yet acknowledges the fact that minor, immaterial loan defects should not automatically trigger a repurchase request. As a result, lenders will be more confident in offering mortgages to qualified borrowers within the full boundaries of the GSEs’ credit requirements.Tuesday:

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.09 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.05 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.14 million SAAR. A key will be the reported year-over-year increase in inventory of homes for sale.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for September 2014

Lawler: Updated Table of Distressed and All-Cash Share for September

by Calculated Risk on 10/20/2014 04:22:00 PM

CR Note: Existing Home Sales for September will be released tomorrow by the National Association of Realtors (NAR). The consensus is for sales of 5.09 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.05 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.14 million SAAR.

Housing economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in September. Lawler notes: "Note the jump in the foreclosure sales share in Orlando."

On distressed: Total "distressed" share is down in these markets due to a decline in short sales.

Short sales are down in all these areas.

Foreclosures are up slightly in several of these areas - and up significantly in Orlando.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep-14 | Sep-13 | Sep-14 | Sep-13 | Sep-14 | Sep-13 | Sep-14 | Sep-13 | |

| Las Vegas | 10.4% | 23.0% | 8.8% | 7.0% | 19.2% | 30.0% | 34.3% | 47.2% |

| Reno** | 7.0% | 20.0% | 7.0% | 5.0% | 14.0% | 25.0% | ||

| Phoenix | 3.8% | 8.8% | 5.8% | 8.0% | 9.6% | 16.8% | 25.7% | 33.4% |

| Sacramento | 5.3% | 12.1% | 6.5% | 3.9% | 11.8% | 16.0% | 19.4% | 23.6% |

| Minneapolis | 3.4% | 6.0% | 9.4% | 16.0% | 12.8% | 22.0% | ||

| Mid-Atlantic | 5.5% | 7.7% | 9.7% | 8.2% | 15.2% | 15.9% | 19.1% | 18.4% |

| Orlando | 7.1% | 18.0% | 24.8% | 18.0% | 31.8% | 36.0% | 41.9% | 43.5% |

| California * | 5.9% | 10.8% | 5.3% | 7.1% | 11.2% | 17.9% | ||

| Bay Area CA* | 3.6% | 7.5% | 2.8% | 3.6% | 6.4% | 11.1% | 20.9% | 23.3% |

| So. California* | 6.0% | 10.9% | 4.7% | 6.4% | 10.7% | 17.3% | 24.3% | 28.7% |

| Hampton Roads | 19.6% | 26.1% | ||||||

| Tucson | 26.7% | 29.8% | ||||||

| Toledo | 31.4% | 38.1% | ||||||

| Wichita | 27.8% | 28.6% | ||||||

| Des Moines | 16.8% | 19.2% | ||||||

| Peoria | 24.7% | 20.7% | ||||||

| Georgia*** | 27.4% | N/A | ||||||

| Omaha | 19.9% | 19.1% | ||||||

| Pensacola | 29.2% | 27.3% | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| Springfield IL** | 9.5% | 14.1% | 22.6% | N/A | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

FHFA Director Watt: Reps and Warrants to be Clarified in Coming Weeks, "sensible and responsible guidelines" for Lower Downpayments

by Calculated Risk on 10/20/2014 02:56:00 PM

From FHFA Director Melvin Watt: Prepared Remarks of Melvin L. Watt, Director, FHFA, At the Mortgage Bankers Association Annual Convention

On lower downpayments:

To increase access for creditworthy but lower-wealth borrowers, FHFA is also working with the Enterprises to develop sensible and responsible guidelines for mortgages with loan-to-value ratios between 95 and 97 percent. Through these revised guidelines, we believe that the Enterprises will be able to responsibly serve a targeted segment of creditworthy borrowers with lower-down payment mortgages by taking into account “compensating factors.” While this is a much more narrow effort than our work on the Representation and Warranty Framework, it is yet another much needed piece to the broader access to credit puzzle. Further details about these new guidelines will be available in the coming weeks as we continue to advance FHFA’s mission of ensuring safety, soundness and liquidity in the housing finance markets.On Reps and Warrants:

We know that the Representation and Warranty Framework did not provide enough clarity to enable lenders to understand when Fannie Mae or Freddie Mac would exercise their remedy to require repurchase of a loan. And, we know that this issue has contributed to lenders imposing credit overlays that drive up the cost of lending and also restrict lending to borrowers with less than perfect credit scores or with less conventional financial situations.

To address this problem, FHFA and the Enterprises have worked to revise the Framework to ensure that it provides clear rules of the road that allow lenders to manage their risk and lend throughout the Enterprises’ credit box. These revisions are consistent with our broader efforts to place more emphasis on upfront quality control reviews and other risk management practices that provide feedback on the quality of loans delivered to the Enterprises earlier in the process.

...

As I committed FHFA to do when I announced these refinements in May, we have continued to engage in an ongoing process to address the issue of life-of-loan exclusions. Life-of-loan exclusions are designed to protect Fannie Mae and Freddie Mac from instances of fraud or other significant noncompliance, and, as a result, they allow the Enterprises to require lenders to repurchase loans at any point during the term of the loan. The current life-of-loan exclusions are open-ended and make it difficult for a lender to predict when, or if, Fannie Mae or Freddie Mac will apply one of them.

So, we have continued to address this issue, and I can report that we have reached an agreement in principle on how to clarify and define the life-of-loan exclusions. These changes are a significant step forward that will result in a better Representation and Warranty Framework and facilitate market liquidity without compromising the safety and soundness of the Enterprises.

First, we are more clearly defining the life-of-loan exclusions, so lenders will know what they are and when they apply to loans that have otherwise obtained repurchase relief. These exclusions fall into six categories: 1) misrepresentations, misstatements and omissions; 2) data inaccuracies; 3) charter compliance issues; 4) first-lien priority and title matters; 5) legal compliance violations; and 6) unacceptable mortgage products.

Second, for loans that have already earned repurchase relief, we are clarifying that only life-of-loan exclusions can trigger a repurchase under the Framework. This is a straightforward clarification, but one that we believe will reduce confusion and risks to lenders.

The Enterprises will provide details about the updated definitions for each life-of-loan exclusion in the coming weeks ...

emphasis added

Is Mortgage Credit too Tight?

by Calculated Risk on 10/20/2014 11:04:00 AM

I frequently hear stories from prime borrowers about their horrible experiences getting mortgages right now. Yes, the process is difficult because of all the extra checks because the lenders are afraid the loans will be put back to them in a few years.

At the same time, loan officers are telling me it is easy for prime borrowers to get a loan.

This isn't a contradiction - an onerous process isn't "tight credit", it is just risk management. But that is for prime borrowers.

First, here is a piece today from Mark Fleming, chief economist at CoreLogic, writes: Is Credit Too Tight, Too Loose or Just Right?

One of the most pressing issues in housing finance today is the availability of credit. The lack of access to credit has been cited as a reason for the slower-than-hoped-for growth in home sales. The often cited Federal Reserve Loan Officer Survey tells us whether lenders are tightening or loosening credit, but tells us much less about the overall level of availability of credit. Furthermore, terms like tight credit or loose credit imply a normative goal of the right amount of credit. In fact, when discussing this topic, one can’t help but think of Goldilocks and the Three Bears: one bed is too hard, another too soft, and the last one is just right.

In order to determine whether credit is too tight, too loose, or just right CoreLogic has developed the Housing Credit Index (HCI) that measures the range and variation of residential mortgage credit over time and multiple housing credit underwriting attributes. The index includes attributes that are relevant to the assessment of credit risk for a borrower applying for credit. ...

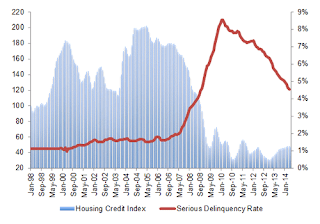

So is credit currently too loose, too tight or just right? In Figure 1, the HCI is shown from 1998 to early 2014 measured on the left axis along with the overall serious delinquency rate measured on the right axis. In the refinance boom of the early aughts, credit availability expanded significantly and then declined, but to a level moderately elevated compared to before the refinance boom. The result of increased credit availability was a modest rise from about 1 percent to 1.25 percent in the overall serious delinquency rate. The mid-aughts saw the significant expansion of credit to double the normal level and the very quick and dramatic contraction with which we are all far too familiar. Credit availability reached its tightest point in late 2010 at only one-third the normal level of the late 1990s. It is safe to say that credit was too tight. Of course, this was a natural response to the quickly rising serious delinquency rate that turned upward dramatically starting in 2006. Since 2010 credit availability has eased in fits and starts with the utilization of modification and refinance programs aimed at struggling homeowners. Most recently, the index is indicating a slight easing, but remains tight by historic standards.According to the CoreLogic index, credit is easing a little, but remains tight.

emphasis added

Below are some other measures. Note: Some less qualified borrowers are using FHA, but that involves high fees (high G-Fees), and the share of FHA loans is at the lowest level in 5 years according to Campbell/Inside Mortgage Finance HousingPulse. But most less qualified borrowers just can't qualify now. Two indicators of this are:

This graph from Black Knight's mortgage monitor shows the share of purchase and refinance originations with credit scores at or above 720.

This graph from Black Knight's mortgage monitor shows the share of purchase and refinance originations with credit scores at or above 720.As Black Knight notes: "The share of purchase originations with high borrower credit scores is at an all time high". This suggests credit is tight for less qualified borrowers.

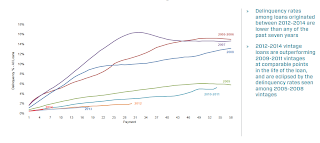

The second graph, also from Black Knight's mortgage monitor, shows that the recent loans are performing very well.

The second graph, also from Black Knight's mortgage monitor, shows that the recent loans are performing very well.This graph only includes loans originated in 2005 through 2014, but older data shows the recent loans are the best performing ever. The loan performance suggests lending is currently tight (I believe this is better loan performance than even during the 2001 through 2005 period when house prices were rising quickly).

DOT: Vehicle Miles Driven increased 0.4% year-over-year in August

by Calculated Risk on 10/20/2014 08:58:00 AM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 0.4% (1.0 billion vehicle miles) for August 2014 as compared with August 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 267.8 billion vehicle miles.

Cumulative Travel for 2014 changed by 0.6% (11.1 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways ...

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 81 months - almost 7 years - and still counting. Currently miles driven (rolling 12 months) are about 2.0% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In August 2014, gasoline averaged of $3.57 per gallon according to the EIA. That was down from August 2013 when prices averaged $3.65 per gallon.

In August 2014, gasoline averaged of $3.57 per gallon according to the EIA. That was down from August 2013 when prices averaged $3.65 per gallon. Prices will really be down year-over-year for September and October.

Of course gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it does seem like miles driven is now increasing.