by Calculated Risk on 10/28/2011 03:55:00 PM

Friday, October 28, 2011

Report: Mortgage Settlement deal could be reached within a month

From Reuters: Analysis: Mortgage probe may open new path for housing relief

Settlement talks continue with the banks, state attorneys general and some federal agencies over foreclosure shortcuts and other abuses. A deal could be struck within a month, according to people familiar with the matter.It appears there will be two more housing related announcements soon: this mortgage settlement, and an REO disposition program for Fannie/Freddie/FHA (also the changes to the HARP refinance program were announced this week).

...

Five major banks could be required to commit roughly $15 billion to reduce principal balances for struggling homeowners and modify loans in other ways under a proposed deal to settle allegations linked to the "robo-signing" scandal.

That amount would be part of broader sanctions that could total $25 billion ... Much of the exact language has yet to be hashed out but it could provide for the first broad use of principal writedowns ...

Q3 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

by Calculated Risk on 10/28/2011 01:21:00 PM

The BEA released the underlying detail data today for the Q3 Advance GDP report. As expected, the recent pickup in non-residential structure investment has been for power and communication. Here is a look at office, mall and lodging investment:

Click on graph for larger image.

Click on graph for larger image.

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and then declined sharply. Investment has increased a little recently (probably mostly tenant improvements as opposed to new office buildings).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). Mall investment declined in Q3.

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by over 80%.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). This is happening again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

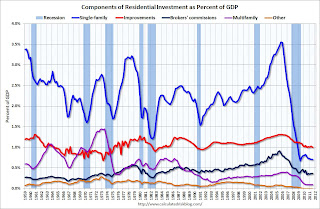

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $151 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (about 1.0% of GDP), significantly above the level of investment in single family structures of $106 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions increased slightly in Q3, and are moving sideways as a percent of GDP.

And investment in multifamily structures is still moving sideways as a percent of GDP (increasing slowly in dollars). This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging - and for residential investment.

Consumer Sentiment increases in October, still very weak

by Calculated Risk on 10/28/2011 09:55:00 AM

The final October Reuters / University of Michigan consumer sentiment index increased to 60.9, up from the preliminary October reading of 57.5, and up from 59.4 in September.

Click on graph for larger image.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate.

This was still very weak, but above the consensus forecast of 58.0.

Personal Income increased 0.1% in September, Spending increased 0.6%

by Calculated Risk on 10/28/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $17.3 billion, or 0.1 percent ... in September ... Personal consumption expenditures (PCE) increased $68.7 billion, or 0.6 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.5 percent in September, in contrast to a decrease of less than 0.1 percent in August. ... PCE price index -- The price index for PCE increased 0.2 percent in September, compared with an increase of 0.3 percent in August. The PCE price index, excluding food and energy, decreased less than 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.PCE increased 0.6 in September, and real PCE increased 0.5%.

Note: The PCE price index, excluding food and energy, decreased 0.2 percent.

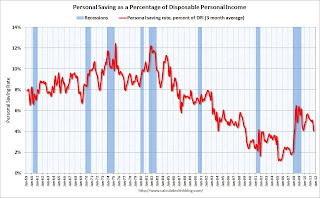

The personal saving rate was at 3.6% in Setpember.

Personal saving -- DPI less personal outlays -- was $419.8 billion in September, compared with $479.1 billion in August. Personal saving as a percentage of disposable personal income was 3.6 percent in September, compared with 4.1 percent in August.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the September Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the September Personal Income report.Spending is growing faster than incomes - and the saving rate has been declining. That can't continue for long ...

Thursday, October 27, 2011

California Gov. Jerry Brown proposes State Pension Changes

by Calculated Risk on 10/27/2011 11:52:00 PM

If this moves forward, this might become a model for other states. A big "if" ...

From the LA Times:

Gov. Jerry Brown risks backlash on pension planBrown's 12-point plan, announced Thursday, would require that all public workers have at least half the cost of their pensions deducted from their paychecks. ...Earlier on GDP:

The governor also wants future employees to receive up to a third of their retirement income from a 401(k)-style plan rather than a traditional guaranteed pension. And he urged that the retirement age for most new public workers be raised from 55 to 67.

• GDP slightly above pre-recession peak, Investment Contributions

• Advance Estimate: Real Annualized GDP Grew at 2.5% in Q3

• GDP Graphs