by Calculated Risk on 2/02/2010 09:03:00 PM

Tuesday, February 02, 2010

NYTimes: More Homeowners Just Walk Away

“We’re now at the point of maximum vulnerability. People’s emotional attachment to their property is melting into the air.”From David Streitfeld at the NY Times: No Aid or Rebound in Sight, More Homeowners Just Walk Away. A few excerpts:

Sam Khater, senior economist at First American CoreLogic.

New research suggests that when a home’s value falls below 75 percent of the amount owed on the mortgage, the owner starts to think hard about walking away, even if he or she has the money to keep paying.Streitfeld is referring to the recent negative equity report from First American CoreLogic, see: Negative Equity Report for Q3

...

The number of Americans who owed more than their homes were worth was virtually nil when the real estate collapse began in mid-2006, but by the third quarter of 2009, an estimated 4.5 million homeowners had reached the critical threshold, with their home’s value dropping below 75 percent of the mortgage balance.

Some excerpts from that report:

Nearly 10.7 million, or 23 percent, of all residential properties with mortgages were in negative equity as of September, 2009. An additional 2.3 million mortgages were approaching negative equity, meaning they had less than five percent equity. Together negative equity and near negative equity mortgages account for nearly 28 percent of all residential properties with a mortgage nationwide. The rise in negative equity is closely tied to increases in pre-foreclosure activity. At one end of the spectrum, borrowers with equity tend to have very low default rates. At the other end, investors tend to default on their mortgages once in negative equity more ruthlessly: their default rate is typically two to three percent higher than owner-occupied homes with similar degrees of negative equity. For the highest level of negative equity, investors and owners behave very similarly and default at similar rates (Figure 4). Strategic default on the part of the owner occupier becomes more likely at such high levels of negative equity.

Here is figure 4 from the report.

Here is figure 4 from the report. The default rate increases sharply for homeowners with more than 20% negative equity.

As Streitfeld noted, there are an estimated 4.5 million homeowners with more than 25% negative equity. According to the chart, maybe only 10% of them are currently in default. If, as First American CoreLogic senior economist Sam Khater said, "people's emotional attachment to their property is melting into the air", then we might see a surge in defaults by homeowners with negative equity.

And more from the NY Times:

In 2006, Benjamin Koellmann bought a condominium in Miami Beach. By his calculation, it will be about the year 2025 before he can sell his modest home for what he paid. Or maybe 2040.

Benjamin Koellmann paid $215,000 for his apartment in Miami Beach in 2006, but now units are selling in foreclosure for $90,000. “There is no financial sense in staying,” he said.

“People like me are beginning to feel like suckers,” Mr. Koellmann said. “Why not let it go in default and rent a better place for less?”

Thursday, September 03, 2009

Junk Bond Default Rate Passes 10 Percent

by Calculated Risk on 9/03/2009 08:09:00 PM

From Rolfe Winkler at Reuters: U.S. junk bond default rate rises to 10.2 pct -S&P

The U.S. junk bond default rate rose to 10.2 percent in August from 9.4 percent in July ... Standard & Poor's data showed on Thursday.Bad loans everywhere ...

The default rate is expected to rise to 13.9 percent by July 2010 and could reach as high as 18 percent if economic conditions are worse than expected, S&P said in a statement.

...

In another sign of corporate distress, the rating agency has downgraded $2.9 trillion of company debt year to date, up from $1.9 trillion in the same period last year.

Wednesday, July 22, 2009

DataQuick: California Mortgage Defaults Edge Down in Q2

by Calculated Risk on 7/22/2009 02:08:00 PM

Please see graph at bottom of post ...

From DataQuick: California Second Quarter Mortgage Defaults Edge Down

The number of foreclosure proceedings started against California homeowners fell slightly in the April-through-June period compared with the prior three months, but remained higher than last year. The dip from earlier this year occurred as lenders and their loan servicers took time to revise procedures and priorities in an environment of continuing home price depreciation, economic distress and mortgage defaults, a real estate information service reported.There is a lot of interesting data in this report. A few key points:

Lenders sent out a total of 124,562 default notices during the second quarter (April through June). That was down 8.0 percent from the prior quarter's record 135,431 default notices, and up 2.4 percent from 121,673 in second quarter 2008, according to MDA DataQuick.

"There is a perception that the housing market is dragging along bottom, that it probably won't get much worse, and that the lenders need to get serious about processing the backlog of delinquencies, either with work-outs or foreclosure. We're hearing that some lenders and servicers are doing just that, hiring more people to do the necessary paperwork. That means the foreclosure numbers will probably shoot back up during the third quarter," said John Walsh, DataQuick president.

The median origination month for last quarter's defaulted loans was July 2006, the same as during the first quarter. A year ago the median origination month was April 2006, so the foreclosure process has moved three months forward during the past 12 months.

"Either the mid 2006 loans were particularly nasty, or lenders and servicers haven't kept up with new delinquencies. Looking below the surface statistics it appears likely that it's both," Walsh said.

...

While most first quarter 2009 foreclosure activity was still concentrated in affordable inland communities, there were signs that the foreclosure problem was intensifying in more expensive areas. The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for more than 52.0 percent of all default activity in 2008. In first quarter 2009 it fell to 47.5 percent, and last quarter it dipped to 45.0 percent.

emphasis added

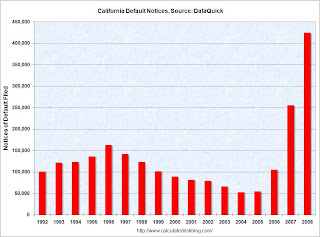

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Notices of Default (NOD) by year through 20091 in California from DataQuick.

1 2009 estimated as twice Q1 and Q2 NODs.

Clearly 2009 is on pace to break the record of 2008, and the pace will probably pickup in the 2nd half of 2009. I'd expect somewhere in the 550 thousand to 600 thousand range for the entire year.

Tuesday, June 30, 2009

Modifications and Re-Default

by Calculated Risk on 6/30/2009 04:42:00 PM

Earlier I posted some graphs on the surge in prime delinquecies from the OCC and OTS Release Mortgage Metrics Report for First Quarter 2009

See: OCC and OTS: Prime Delinquencies Surge in Q1

Here is some info on types of modifications:

While 185,156 mortgages were modified in the first quarter of 2009, 122,398 were “combination modifications” that changed more than one term of the loan. Of the modifications made in the first quarter of 2009, 70.2 percent included a capitalization of missed payments and fees, 63.2 percent included a reduction in interest rate, and 25.1 included an extended term. By comparison, 12.6 percent of the mortgages received modifications that froze the interest rate, 1.8 percent included a reduction of principal, and 1.1 percent included a deferral of principal. All modification actions during the quarter are indicated in the table below. Since nearly two-thirds of the modifications changed more than one loan term, the sum of the percentages in the table exceeds 100 percent.

The types of actions taken have different effects on the borrower’s principal and interest payments and may, over time, have different effects on the long-term sustainability of the loan.

Of the nearly two-thirds of modifications that were combination modifications that involved two or more changes to the terms of the loan, 83.4 percent of them included capitalization of missed payments and fees, 86.1 percent included reduced interest rates, 36.3 percent included extended maturities, 12.4 percent included interest rate freezes, 2.8 percent included principal reductions, and 1.6 percent included principal deferrals.

Click on graph for larger image.

Click on graph for larger image.In normal times, a capitalization of missed payments and fees is effective - because usually the homeowner fell behind for a short period because of a lost job or an emergency expense.

However, in these times with many homeowners underwater (with negative equity), capitalization isn't very effective. A reduced interest rate or longer term might be helpful.

And here are the re-default rates.

And here are the re-default rates. This graph shows that about 30% of modified loans re-default in the first quarter after modification and about half within the first year. This suggests modifications have not been very effective.

The percentage of loans that were 60 or more days delinquent or in the process of foreclosure rose steadily in the months subsequent to modification for all vintages where data were available. It is noteworthy that modifications implemented in the first two quarters of 2008 re-defaulted at a lower rate than those in the third quarter, measured at the same number of months after modification. Those modifications implemented in the fourth quarter of 2008 have re-defaulted at a slightly lower rate than the preceding quarter. However, it is too early to determine whether the data for the fourth quarter portend a sustained improvement in performance resulting from recent changes to modification practices.

Thursday, April 23, 2009

NY Times Norris: "Subprime Loans, Corporate-Style"

by Calculated Risk on 4/23/2009 10:09:00 PM

From Floyd Norris at the NY Times: Subprime Loans, Corporate-Style, Will Fuel Defaults

It appears that defaults on leveraged loans and corporate bonds will soon rise to levels not seen since the Great Depression.Just another area with rapidly rising defaults. Norris also discusses toggle-PIKs (kind of like Option ARMs for corporations).

...

The default rate on leveraged loans and speculative grade bonds is rising rapidly. “We expect the default rate to get to the range of 14 percent by the end of the year,” said Kenneth Emery, a senior vice president of Moody’s. That compares to peak default rates of 10 to 12 percent during the last two recessions ...

How did we get into this mess? The story is remarkably similar to the tale of subprime mortgages.

Note: PIK stands for Payment-in-kind (i.e. pay interest with more debt). These were used in the '80s LBO craze with predictable results (high defaults). Toggle means the borrower has the choice of paying in cash or PIK.

There were negatively amortizing loans everywhere: Option ARMs for homeowners, toggle PIKs for corporations, and of course interest reserves for Construction & Development loans (always common, but are blowing up on lenders).

Wednesday, April 22, 2009

DataQuick: Mortgage Defaults Hit Record in California

by Calculated Risk on 4/22/2009 01:38:00 PM

From DataQuick: Golden State Mortgage Defaults Jump to Record High

Lenders filed a record number of mortgage default notices against California homeowners during the first three months of this year, the result of the recession and of lenders playing catch-up after a temporary lull in foreclosure activity ...There is a lot of interesting data in this report. A few key points:

A total of 135,431 default notices were sent out during the January- to-March period. That was up 80.0 percent from 75,230 for the prior quarter and up 19.0 percent from 113,809 in first quarter 2008, according to MDA DataQuick.

Last quarter's total was an all-time high for any quarter in DataQuick's statistics, which for defaults go back to 1992. There were 121,673 default notices filed in second quarter 2008 and 94,240 in third quarter 2008, during which a new state law took effect requiring lenders to take added steps aimed at keeping troubled borrowers in their homes.

"The nastiest batch of California home loans appears to have been made in mid to late 2006 and the foreclosure process is working its way through those. Back then different risk factors were getting piled on top of each other. Adjustable-rate mortgages can be good loans. So can low- down-payment loans, interest-only loans, stated-income loans, etcetera. But if you combine these elements into one loan, it's toxic," said John Walsh, DataQuick president.

The median origination month for last quarter's defaulted loans was July 2006. That's only four months later than the median origination month for defaulted loans a year ago, in first quarter 2008. That suggests a period where underwriting criteria were particularly lax.

Of the 3.7 million home loans made in 2004, less than 1 percent have since resulted in a lender filing a default notice. Of the 3.7 million loans originated in 2005, 4.9 percent have triggered a default notice so far. Of the 3 million in 2006, 8.5 percent have so far resulted in default. A particularly toxic period appears to have been August through November 2006 which had more than a 9 percent default rate. Of the 2.1 million loans made in 2007, it's 4.6 percent - a percentage that's likely to rise significantly during the rest of this year.

The lending institutions with the highest default rates for loans originated in August to November 2006 include ResMAE Mortgage (69.9 percent of loans resulting in a default notice), Master Financial (64.6 percent) and Ownit Mortgage Solutions (63.6 percent). Of the major lenders, IndyMac has a default rate on those loans of 18.9 percent, World Savings 8.0 percent, Countrywide 7.7 percent, Washington Mutual 6.3 percent and Wells Fargo 3.4 percent. Less than 1 percent of the home loans originated in late 2006 by Citibank and Bank of America have since gone into default.

...

While most first quarter 2009 foreclosure activity was still concentrated in affordable inland communities, there are signs that the problem is slowly migrating into other areas. The affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for more than 52.0 percent of all default activity in 2008. Last quarter it fell to 47.5 percent.

emphasis added

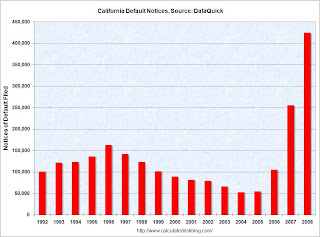

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Notices of Default (NOD) by year through 2008 in California from DataQuick.

With 135,431 default notices filed in Q1 2009 (even with the lenders playing catch-up), 2009 is clearly on pace to break the 2008 record of 424 thousand NODs.

Wednesday, April 15, 2009

Mortgage Defaults Spreading to Higher Priced Areas

by Calculated Risk on 4/15/2009 05:46:00 PM

From Zach Fox at the North County Times: Mortgage defaults hit new high, spread to upscale neighborhoods

Mortgage delinquencies hit a new high in March ... according to a report released Tuesday.Defaults: Movin' on up!

The report also showed that notices of default, the first step in the foreclosure process, have spiked in the region's tonier neighborhoods ---- places that, until now, have avoided the mass foreclosures elsewhere ---- while appearing to have reached a plateau in lower-end regions, which have already been hammered.

In fact, areas such as Valley Center and Rancho Bernardo shot up to be among the leaders in North County for most foreclosure notices per 1,000 houses.

...

Default notices shot to new highs in areas of Carlsbad, Rancho Bernardo and Rancho Penasquitos. On the other hand, notices in foreclosure-prone neighborhoods such as Oceanside and Escondido were below peaks reached earlier.

In fact, one region of Rancho Bernardo saw more default notices in March per 1,000 homes than Oceanside's 92057 ZIP code ---- the most foreclosure-prone neighborhood in North County over the last two years.

Wednesday, April 01, 2009

Moody's Warns of Worst Corporate Default Rate since WWII

by Calculated Risk on 4/01/2009 06:09:00 PM

From Reuters: Moody's downgraded $1.76 trln U.S. corp debt in Q1

... Moody's Investors Service downgrading an estimated $1.76 trillion of debt, a record high ...Hopefully the bank stress tests have all these defaults factored in ...

The downgrades included a record number to the lowest rating categories, signaling the approach of the worst defaults since at least World War Two ...

"The most prominent new driving force behind credit rating reductions would be deterioration of commercial real estate," [Moody's chief economist John Lonski] said. ...

Moody's has forecast that the U.S. default rate will peak around 14.5 percent in November.

emphasis added

Monday, March 30, 2009

FHA Mortgage Defaults Increase

by Calculated Risk on 3/30/2009 09:23:00 AM

From the WSJ: Mortgage Defaults, Delinquencies Rise

... A spokesman for the FHA said 7.5% of FHA loans were "seriously delinquent" at the end of February, up from 6.2% a year earlier. Seriously delinquent includes loans that are 90 days or more overdue, in the foreclosure process or in bankruptcy.

...

The FHA's share of the U.S. mortgage market soared to nearly a third of loans originated in last year's fourth quarter from about 2% in 2006 as a whole, according to Inside Mortgage Finance, a trade publication. That is increasing the risk to taxpayers if the FHA's reserves prove inadequate to cover default losses.

Tuesday, January 27, 2009

DataQuick: Temporary Drop in California Foreclosure Activity

by Calculated Risk on 1/27/2009 01:40:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year in California from DataQuick.

There were a record 423,962 NODs filed in 2008, breaking the old record of 254,824 NODs in 2007.

The previous record had been in 1996 with 162,678 NODs filed. That was during the previous California housing bust in the early to mid-90s.

From DataQuick: Temporary Drop in California Foreclosure Activity

The number of mortgage default notices filed against California homeowners fell last quarter to its lowest level in more than a year, the temporary result of a procedural change that took effect in September, a real estate information service reported.

Lending institutions sent homeowners 75,230 default notices during the October-through-December period. That was down 20.2 percent from 94,240 for the prior three months, and down 7.7 percent from 81,550 for fourth-quarter 2007, according to MDA DataQuick.

Recorded default notices peaked in second-quarter 2008 at 121,673.

...

While recordings were back up to 39,993 in December it's unclear whether lenders were mainly playing catch-up, or whether a new wave of foreclosure activity was building.

"No one expected defaults to stay at the much lower levels we saw immediately after the new law took effect last fall. The bigger question is whether or not the housing market has hit a low and is dragging along bottom, or if the markets that so far have remained unaffected by the foreclosure problem are due for a fall. With today's atypical market trends, it's impossible to predict," said John Walsh, DataQuick president.

Most foreclosure activity was still concentrated in affordable inland areas where the availability of so-called subprime financing fueled a buying and refinancing frenzy in 2005/2006. Those sub-markets, which represent about 25 percent of the state's housing stock, account for more than 50 percent of the default activity. That ratio is the same now as a year ago, indicating that the problem has not yet migrated into more established, expensive markets.

Most of the loans that went into default last quarter were originated between October 2005 and January 2007. The median age was 29 months, up from 21 months a year earlier. More than three million home loans were originated in 2006. That dropped to two million in 2007, and 1.1 million last year.

Friday, December 12, 2008

Ecuador Defaults on Bonds

by Calculated Risk on 12/12/2008 02:41:00 PM

From Bloomberg: Ecuador Defaults on Bonds, Seeks Restructuring

Ecuador won’t make a $30.6 million bond interest payment due Dec. 15, putting the country in default for a second time this decade, President Rafael Correa said. ... His decision comes as a deepening global economic slump throttles demand for oil, the country’s biggest export. Ecuador, which defaulted in 1999, owes about $10 billion to bondholders, multilateral lenders and other countries.Ecuador exported about 400 thousand barrels of oil per day (2004 data) so the recent $100 per barrel drop in oil prices would be about $40 million per day less revenue. Other oil exporters will have problems too, although many oil exporters have significant foreign reserves.

Wednesday, September 03, 2008

C&D Loans: Lender BB&T Forecloses on Comstock Properties

by Calculated Risk on 9/03/2008 09:01:00 AM

From the WaPo: BB& T Deal Eases Comstock's Debt (hat tip Don)

Comstock Homebuilding of Reston said yesterday it has reached a deal with lender BB&T to wipe $32.7 million worth of troubled development loans from its books as it struggles to rebound in an ailing housing market.Delinquency rates are rising quickly on C&D (construction and development) loans, and many mid-size institutions (assets in the $1 billion to $10 billion range) have excessively high concentration of C&D loans. This is a serious problem and these C&D loan defaults will probably lead to many of the bank failures of the next couple of years.

Under the deal, BB&T foreclosed on four of Comstock's properties in the Atlanta area yesterday. Two properties in Northern Virginia -- a condominium project in Manassas and a single-family home project in western Loudoun County -- are scheduled to go into foreclosure by Sept. 30, according to Comstock.

BB&T will probably have significant losses on these loans as they try to dispose of these properties. I'll post some FDIC graphs on this issue later today.

Thursday, August 21, 2008

CRE Loan Concerns Grow

by Calculated Risk on 8/21/2008 11:12:00 PM

From the NY Times: Some Fear Commercial Property Loans Will Be Next Stage in Downturn

“The fear is the next shoe to drop may be commercial real estate,” said Jeffrey Harte, a banking analyst at Sandler O’Neil. “When consumer credit goes south, commercial will follow.”And the biggest concern are the CRE equivalent of stated income loans and Option ARMs. Some loans were made on pro forma income (aka wishful thinking like stated income), and the loans included reserves to pay interest until rents increased (like a negatively amortizing option ARM).

At the end of the second quarter, Deutsche Bank held $25.1 billion worth of commercial loans. Morgan Stanley held $22.1 billion and Citigroup had $19.1 billion.

Lehman Brothers, which has the largest exposure to this type of security, is shopping about $40 billion worth of commercial real estate assets, as well as its entire commercial real estate business.

From Bloomberg: Commercial-Mortgage Bond Spreads Soar on Harlem Loan (hat tip Bob_in_MA)

Yields on commercial real estate securities relative to benchmarks rose to near record highs amid concern that Riverton Apartments, a high-rise complex in Manhattan's Harlem neighborhood, will default on a loan.Who coodanode.

...

At Riverton, income projections (pro forma) factored in converting rent- stabilized apartments to market rates. ... The borrower burned through a $19 million reserve to cover the shortfall in cash flow that was expected from initially lower rent payments ...

``We expect that additional pro forma loans will likely suffer a fate similar to Riverton Apartments,'' ... Lehman analysts wrote.

Wednesday, August 20, 2008

FDIC: Loan Modification Program for Distressed Indymac Mortgage Loans

by Calculated Risk on 8/20/2008 02:03:00 PM

From the FDIC: Loan Modification Program for Distressed Indymac Mortgage Loans. A couple of excerpts:

What loans are eligible?This seems to provide an incentive for IndyMac borrowers to stop making their mortgage payments until they are "seriously delinquent or in default". Then the borrower - especially Alt-A borrowers who stated their income originally - would apply for a loan modification based on their actual income. The borrower could then receive an interest rate reduction and principal forbearance.

The streamlined loan modifications will be available for most borrowers who have a first mortgage owned or securitized and serviced by IndyMac Federal where the borrower is seriously delinquent or in default. IndyMac Federal also will seek to work with others who are unable to pay their mortgages due to payment resets or changes in the borrowers’ repayment capacities. This streamlined approach applies only to mortgages for the borrower’s primary residence. As with all modifications, borrowers will have to demonstrate their financial hardship by documenting their income.

...

What modification options will be available to borrowers?

Under the IndyMac Federal program, eligible mortgages would be modified into sustainable mortgages permanently capped at the current Freddie Mac survey rate for conforming mortgages (now about 6.5%). Modifications would be designed to achieve sustainable payments at a 38 percent debt-to-income (DTI) ratio of principal, interest, taxes and insurance. To reach this metric for affordable payments, modifications could adopt a combination of interest rate reductions, extended amortization, and principal forbearance.

Note: I didn't see any restriction on borrowers that overstated their income originally.

Saturday, August 16, 2008

Default Statistics, Or Mortgage Math Is Hard

by Anonymous on 8/16/2008 09:15:00 AM

I am very pleased to offer you this post, which is actually a "Guest Nerd" offering by our regular commenter and expert mort_fin, who works on undisclosed mortgage matters in an undisclosed location and often straightens us out in the comment threads when the conversation gets to technical matters of statistical analysis of mortgages. I helped a little bit with this post (any errors in the tables are mine), but the bulk of this is mort_fin's.

Some important context for the genesis of this: it came about after dear mort_fin, and a number of our other regulars, spent most of a frustrating Saturday afternoon arguing with another commenter about this post on the FHA "DAP" program (the infamous seller-money-laundered-downpayment-assistance-program). We basically came to the conclusion that a lot of people who defend the DAPs are not arguing in good faith about the performance of these loans--they pick out statistics they don't ever define clearly and wield them in misleading ways.

Because things like the FHA DAP are such important public policy questions, it seemed to mort_fin that there was much to be gained by helping non-specialists get a better grip on the various default statistics that are available and what they do (and do not) actually tell you. This is UberNerditude at its finest, and I thank mort_fin for taking the time and effort to help us move the intellectual ball a few yards in the never-ending battle with the DAP shills.

*************

Mort_fin says:

A recent flap in the comments surrounding default rates in FHA, especially with respect to down payment assistance programs, showed how easy it is to misunderstand and abuse mortgage default rates. So I thought I’d take a shot at writing The Fairly Intelligent Person’s Guide to Default Statistics.

The first issue to note is just the words. Default, as Tanta has noted in a previous excellent UberNerd, has a fairly precise legal definition, and a fairly vague usage in the popular and financial press. To a lawyer, if you move and rent out your abode you are probably in default, even if you keep making your mortgage payment every month, since you have violated the clause in the note that says you will occupy the premises. When reading the trade press, delinquency usually means not paying the mortgage, and default might mean that foreclosure proceedings have started, have finished, are being negotiated, etc. You can’t understand the analysis if you don’t read the fine print in the definitions. I’m going to stick with default meaning “foreclosure has happened” for the following examples.

To keep everything clear, and countable on fingers without resorting to toes, let’s say 10 people all get mortgages in a year (a group all getting mortgages at the same time is a “vintage” or a “cohort”). All the initial examples will relate to these 10 people. They are color coded based on their mortgage status. The first thing to notice is that life is complicated, and there are a lot of possible outcomes. Some loans end in foreclosure (default), some are refinanced into another mortgage (which can then end in a variety of ways), some people sell the house and pay off the mortgage, and some people just sit there paying the monthly nut for 10 years or more. And you don’t follow people forever—who knows what happened to any of these folks after 10 years?

In our sample pool of ten loans, each originated in 2000, we have the following outcomes:

• Fred: Purchase mortgage for 1 year, 1 year foreclosure process, foreclosed, becomes renter

• Matilda: Purchase mortgage for 1 year, refinanced mortgage for 2 years, 1 year foreclosure process, foreclosed, becomes renter

• Jose: Purchase mortgage for 3 years, refinanced mortgage for 5 years, sells home, becomes renter

• Rashid: Purchase mortgage for 4 years, foreclosure for 1 year, foreclosed, becomes renter

• Seamus: Purchase mortgage for 4 years, foreclosure process for 2 years (stayed because of a bankruptcy filing), foreclosed, becomes renter

• LuAnne: Purchase mortgage for 4 years, refinanced mortgage for 1 year, refinanced mortgage again for 1 year, foreclosure process for 1 year, foreclosed, becomes renter

• Saty: Purchase mortgage for 2 years, purchases new home

• Mitko: Purchase mortgage for 5 years, refinanced mortgage for 5 years

• Bob: Purchase mortgage for 10 years

This may or may not be a “typical” set of outcomes for any given pool of ten mortgages. But these are all very possible outcomes, and the point of this little exercise is to see clearly just how these possible outcomes are—or are not—reflected in the default statistics we have come to rely on for measuring mortgage performance.

A vintage of loans something like this would get sliced and diced in various ways by analysts. You might see a “lifetime projected default rate” or a “cumulative to date default rate” or a “conditional default rate” or a “foreclosure initiated rate" (also sometimes call the “foreclosure inventory”). None of them is right or wrong, but any of them can be misunderstood or abused.

Start with the “cumulative to date default rate.” (Remember that this counts foreclosures completed, not started.) If these are loans originated in December of 2000, you might ask in 2000 or 2001 “what percent have gone bad?” and the answer would be zero. For most borrowers, it is rare to miss payments in the first year (the fact that it wasn't rare starting about 2 years ago should have been an enormous alarm bell for people), and it takes very roughly a year between the time people stop missing payments and the time they finish foreclosure (timeline varies widely by state). But at the end of the 2002, you have one default, Fred, for a cumulative to date default rate of 10% (1 in 10). At the end of 2003 it’s still 10%, but by the end of 2004 it’s risen to 20% because Matilda has also gone bad. But, wait a minute, Matilda refinanced in 2001, so she never defaulted on a 2000 originated mortgage. I guess it stays at 10%. The “to date” cumulative rate eventually rises to 30% as first Rashid, and then Seamus, go to default.

At the end of 2009 the “to date” is 30%, and assuming that these are 30 year mortgages, we still do not know the “lifetime projected default rate” since Bob is still out there with an active loan. You know that the lifetime cumulative rate will be at least 30% since it can’t go down (well, actually in states with rights of redemption, it theoretically could go down, but those are pretty rare events) and it can’t be more than 40%. If Bob stays good it’s 30% and if he goes bad it’s 40%. Since few people go bad after 10 good years you would probably project a 30% lifetime cumulative default rate for these loans. Matilda and LuAnne don’t count, since they refinanced and are a “success” as far as the original lender is concerned (although they might be failures from the perspective of a policy to promote homeownership). And if you’ve taken comfort in the fact that the “to date” cumulative default rate is zero at the end of 2002 you’re in for an uncomfortable surprise next year.

Note that if you want to assess what these things will cost you from a credit cost perspective, the relevant figure is lifetime cumulative defaults. When you originate the loans (which is the date that matters, since you can’t retroactively up the interest rate or the insurance premium, the horse is out of the barn at that point) all you have are projections. You don’t know what anyone has done, since they just started. After 5 or 6 years you can make a pretty good projection, but it’s far too late at that point. In this business you have two and only two options: highly uncertain knowledge when it’s useful, or very precise knowledge long after it’s useful. That’s why this business is so much fun. And the projections are sensitive not only to the quality of the underwriting (how did Fred manage to get a loan in the first place???) but also to future house prices and unemployment rates, and refinancing opportunities (a rolling loan gathers no loss).

But cumulative defaults aren’t the only, or even the most commonly presented, statistics. The commenter in the aforementioned Haloscan thread was led astray by the Foreclosures Initiated (or Foreclosure Inventory) statistic. This counts how many foreclosures are “in process.” Foreclosure is a process, not an event. The details vary by state, but a common method of judicial foreclosure is the filing of a “notice of default” in which the servicer tells the seriously delinquent borrowers that they are headed to court. This may start the foreclosure clock. Motions and countermotions are filed, court dates are scheduled and postponed, and a date for the sale of the property is set. This is the process that can take, in very rough terms, a year to play out.

In 2001 the foreclosure initiation rate in our example pool would be zero, but in 2002 it would be 11%. Why 11% you ask? Well, one loan (Fred) is in process, and there are 9 loans still active (Matilda refinanced, remember). So 1 out of 9 is 11% (with a little rounding). In 2005 the foreclosure initiation rate is 40%. Only 5 loans are still active, and two of them are in the process of being foreclosed upon.

Note that the foreclosure initiation rate tells you very little about how much of an insurance premium you needed to charge to cover the credit risk, or even whether you had a bunch of good loans or bad loans. This rate depends on the denominator as well as the numerator, and the denominator can change for all sorts of reasons, like borrowers moving and borrowers refinancing, that don’t have any direct bearing on whether these were good loans or bad loans. The inventory rate has its uses, but summarizing credit quality or expected costs isn’t one of them. It is a pretty sensitive number for summarizing current conditions – it tends to rise rapidly when things get bad, and fall back to earth when things get good.

The other commonly cited statistic is the CDR, the Conditional Default Rate. It is “conditional” because it is “conditioned by survival.” The denominator consists of all the loans that have survived until today, neither prepaying in the past nor defaulting in the past. Again, for the first two years, the CDR is zero. In 2002 it is 13% since 8 loans are still alive, and 1 is defaulting. In 2003 and 2004 it is back to zero, and then in 2005 it skyrockets up to 33%, as only 3 loans still survive, and one of them has gone bad. The CDR is useful as an input to complicated cash flow models, but by itself it doesn’t tell you much about credit quality, since, again, it depends on the denominator as much as it does on the numerator, and for older pools of loans the denominator can be pretty small.

Returning to our little pool of ten loans, these are the values we get for these three measures over ten years. (Click on the table to enlarge.) You can see how confused a conversation at any given point in time would be that tossed these numbers around without context:

The big analytical mistake you do not want to make here, of course, is the one Tanta likes to complain about in the work of various apologists for high-risk lending: assuming that if 30% of the loans in a given vintage fail, then 70% of the borrowers were “successful.” Here’s another way of looking at our example pool that contrasts the results of a standard vintage analysis (what happened to the loans that were originated in 2000?) with an actual borrower analysis (what was the mortgage performance of these ten borrowers over ten years?). You get very different numbers:

Now try a more complicated graphic, which looks a lot more like an active portfolio of loans than a static vintage. Imagine that 10 people a year are flowing into your sights as an analyst, and the world looks boringly the same from year to year—each new vintage performs just like the previous one.

Here's the tabular result:

In the first year, foreclosures (cumulative to date, inventory, and CDR) are all zero again. In year 2 the foreclosure rate, cumulative and CDR, are still zero, but the inventory is now 1/19. There are 9 loans still active from the first cohort, and 10 new loans have come into the picture. Of course, new loans are almost never in foreclosure, so letting new loans flow into the picture lowers the foreclosure inventory rate substantially. It is still the case that 30% of loans in each vintage and 50% of borrowers will ultimately go bad, but now the foreclosure inventory is a little over 5%, and the cumulative default rate and CDR are still zero. Go out one more year, and 10 new loans have flowed into the picture. 30 loans have come in, 3 have left via prepayment, and 1 of the remaining 27 is a foreclosure that has happened in that year. So the CDR is now a little under 4% (1 out of 28), and the cumulative claim rate is a little over 3% (1 out of 30). Interpreting the numbers from a dynamic pool of mortgages (loans constantly flowing into the system) is harder than interpreting a static pool (always looking at the same set of loans).

A great real-life example of cumulative (to-date and projected) default rates and CDRs can be found in FHA’s Actuarial studies. Go down to Appendix, and click on Econometric Results in Excel. There are tabs for All_Orig_CumC (All Originations Cumulative Claims – to FHA, a foreclosure is a claim, since they are an insurer, not a mortgage investor) and tabs for All_Orig_ConC for the Conditional Claim Rates. In the cumulative tab, note that FHA projects 15.89% of 2007 originations will ultimately go bad, and this is entirely a projection. For 2000, they project 7.61% will go bad – as these loans are now 7 years old, this is based on actuals of 6.73% having gone bad, and a projection that there will only be a few more foreclosures left to go. On the Conditional Claims rate tab, note that the expectation over the next year is that 0.5% out to 3% of loans are expected to go bad in the next year, depending on how old the loans are (which cohort they are in). It is these annual rates, properly accumulative (you have to adjust the figures so your denominator is always originated loans, not surviving loans), that get you anywhere from 6% to 22% lifetime foreclosure rates, for the good years vs. the bad years. You may want to revisit the HUD site next year to see how projections get revised. These are based on an August 2007 house price forecast. I suspect that has now been rendered inoperative.

The lesson to learn here is to ask questions. 1) What are the definitions in use? 2) Are you looking at a static or a dynamic population? 3) What are you trying to measure? 4) What is happening to the denominator in your ratio?

If you’re trying to ascertain credit costs, failures to date or failures over the past year won’t get you where you want to go. And if you’re trying to ascertain homeownership success, mortgage failures alone won’t give you an answer. Matilda and LuAnne “succeeded” on their first mortgages, but still had a sheriff evict them eventually. Jose and Tania didn’t get foreclosed—the statistics would simply count them as a “voluntary prepayment”—but it’s hard to say that homeownership was a success for them since they ultimately found the cost of owning impossible to maintain and were simply “lucky” enough to sell before they were foreclosed. And even if you’re trying to do an apples to apples comparison—like “Did the CDR for this pool exceed the CDR for that pool?”—it’s important to keep in mind that numerators and denominators can shift because of prepayments, not just defaults. We really don’t know what was motivating the refinances in our pool—lowering interest rates? Taking cash out? We don’t really know whether the refinances improved or worsened the borrower’s actual financial position, but we do know that higher or lower prepayments in a pool can certainly make statistics like CDR “look” more or less frightening.

The unfortunate truth is that mortgage analysts simply do not in any normal circumstances have access to a dataset like the one we have made up for this post. Whether you are looking at a static pool with a single vintage or a dynamic portfolio with multiple vintages, you are tracking loans, not borrowers or properties, and you are tracking “prepayments” of those loans. You simply do not know whether that prepayment was a refinance or a sale of the home; you don’t know what that borrower did after the prepayment. This information simply isn’t in the standard databases. The bottom line about making claims regarding borrower “success” by reference to mortgage default statistics is “you can’t necessarily get there from here.”

Thursday, August 07, 2008

2007 Vintage: Nowhere to Go?

by Anonymous on 8/07/2008 08:51:00 AM

The Wall Street Journal continues our run of bad news about the 2007 mortgage vintage:

An analysis prepared for The Wall Street Journal by the Federal Deposit Insurance Corp. shows that 0.91% of prime mortgages from 2007 were seriously delinquent after 12 months, meaning they were in foreclosure or at least 90 days past due. The equivalent figure for 2006 prime mortgages was just 0.33% after 12 months. The data reflect delinquencies as of April 30. . . .No doubt all of these factors are in play, even though I'm not yet convinced that they were that much more in evidence in 2007 than in 2006.

Data on other classes of mortgages suggest the same trend. Freddie Mac reported Wednesday that 1.38% of the 2007-vintage loans it purchased were seriously delinquent after 18 months compared with 0.38% of 2006 loans at the same point in their life. Freddie Mac generally purchases loans made to creditworthy borrowers.

Last month, J.P. Morgan Chase & Co. said it expects losses on prime mortgages that weren't securitized and remain on its books to triple from current levels. The increase in bad loans is driven mostly by jumbo mortgages originated in the second half of 2007, a company spokesman said. . . .

Economists and industry officials say several factors may account for the dismal performance of the class of 2007. Home prices were falling sharply in much of the country by 2007, meaning many borrowers who took out loans in that year for nearly the full price of the home now owe more than the home is worth. These borrowers are particularly vulnerable to a weakening economy, and have difficulty selling or refinancing if they lose their job.

Questionable business practices may have played a role, too. Some of the 2007 loans "were knowingly originated as really bad loans," says Chris Mayer, a professor of real estate at Columbia University's business school. Mortgage originators who profited handsomely from the housing boom "realized the game was completely over" and pushed mortgages out the door, says Mr. Mayer.

As credit began to tighten last year, some mortgage brokers and borrowers tried to circumvent tougher restrictions by inflating borrowers' credit scores and appraisal values, says Jay Brinkmann, vice president of research and economics for the Mortgage Bankers Association.

It seems to me that one thing that would help us understand this marked difference in performance between these two vintages is an analysis of the "cure" rate and method of cure of the 2006 vintage delinquent loans, as well as some analysis of the actual loan life (number of months to payment in full) of the higher-risk 2006 loans. I think we need this before we conclude that either the 2007 vintage contained worse loans than 2006 or that house price depreciation itself is an unproblematic "cause" of the elevated early delinquencies in 2007.

What I am saying is that when you compare two vintages like this, you want to know whether the loans in the earlier vintage experienced a lower serious delinquency rate because fewer of those loans were "bad," or because more of those loans had an "exit" short of foreclosure when they went bad. Another way to say this is that we are not simply asking about what origination practices or loan characteristics were at the time of origination of these loans; we are looking at what mortgage market (and RE market) conditions are at the time of first delinquency of these loans.

I am personally not ready to believe, without more data, that inflated FICOs, inflated appraisals, fraudulent income claims, etc. were more prevalent in the 2007 vintage than in 2006. I think it's possible that the marked difference in the early serious delinquency rate is more a function of the choices that a delinquent borrower had in mid-2007 compared to mid-2008. Assuming for the sake of argument that these two vintages were of either comparable quality at origination--or that the 2006 vintage was even worse at origination than 2007--you can still get a higher serious delinquency rate at 18 months for the 2007 vintage just because at 18 months out, 2006 borrowers could still refinance, get a HELOC, or sell their homes when they were still current or only mildly delinquent. No doubt some of those 2006 borrowers refinanced--in 2007, meaning that they just got "revintaged." But the 2007 vintage is hitting its 18-month history right now, when they cannot "escape" into the 2008 vintage or sell or get a HELOC to make first-lien mortgage payments with.

That's just a way of saying that credit tightening will in the nature of things--along with home price drops--increase the serious delinquency rate of a book of mortgages compared to earlier books even if the original credit quality is similar across books. The classic metaphor is "musical chairs."

One thing that was in the Freddie Mac investor slides we didn't look at yesterday was some data on "roll rates" from 2007-2008. I sure wish we had comparable charts from 2006 for comparison purposes. The "roll rate" is the percentage of loans that were in a given status last month and a given status this month. For instance, the "30 to 60" roll rate tells you what percentage of loans that were 30 days delinquent last month became 60 days delinquent this month. You need to bear in mind that a couple of things could have happened to the loans that didn't "roll to 60": they could have become current (the borrower caught up on the missing payment), or stayed at 30 days (the borrower made the next month's payment but never caught up on the missing payment). When you begin to get into the roll rate of serious delinquences, especially 90 to FC, you can also have loans that didn't roll to the next status because of a workout (modification, forbearance, repayment plan).

These roll rates are based on Freddie's total portfolio, not just the 2007 vintage. What they show is that roll rates from 30 to 60 and 60 to 90 increased from January 2007 to June of 2008 for any loan in Freddie's total portfolio in that delinquency category. The 90 to FC roll rate also increased, but seems to have hit a plateau in 2008. I suspect that is because of Freddie's major efforts in the workout department.

But very few if any 30-day or 60-day loans get workouts. Loans that "cure" from a 30-day or 60-day delinquency are almost exclusively a matter of the borrower making up missed payments from his or her own funds, whatever the source of those funds. One possible explanation of the rising roll rates here is that those funds in at least some cases were coming from HELOCs or credit cards until those got maxed out or frozen. Again, that doesn't necessarily mean that the loans that rolled to serious delinquency were "worse" at origination than the loans that cured; it may simply mean that the most recently-originated loans had fewer opportunities to avoid serious delinquency.

Roll rate analysis like this has a major drawback: it doesn't tell you about prepayments. Roll rates are calculated on how many loans you still have on your books today that were in a certain status last month. It is possible to have a rising roll rate but a more stable delinquency rate: the loans you still have on the books get worse (roll to a more serious delinquency at a higher rate), but if at the same time a lot of loans that were mildly delinquent last month paid off this month, your total percentage of seriously delinquent loans can be unchanged or rise at a much slower rate than your roll rate.

We do know that 2006 vintage loans prepaid at a faster rate than 2007 vintage loans. One way of looking at the matter is that you simply have to expect delinquency levels to be higher for 2007 than for 2006 simply due to loan life: the fewer high-risk-at-origination loans in the vintage that refinance (or sell the home) in the first 18 months, the higher the serious delinquency rate will be just because these loans got old enough to go bad.

We have to think about that because we have to understand that the process of credit tightening inevitably forces delinquency rates up. This is the thing that a lot of our politicians just don't get: you cannot "return to sane lending standards" and still prevent the "insane" loans from earlier vintages from ending up in foreclosure. You have to consider the possibility that at least some of the nasty performance of the 2007 vintage is a function of lenders having originated fewer high-risk loans in 2007 than in 2006, not more. It's just that the bad loans they didn't originate in 2007 were things like HELOCs that 2007 borrowers might have used to stave off serious first-lien delinquencies in the first 18 months of their loan lives. Obviously any first-lien loan that basically requires the availability of high-CLTV HELOCs in order to perform for a year and half is not a "good" loan. I'm just not sure that more of that kind of loan was originated in 2007 than 2006. I think it's possible that more of them are getting "flushed out" earlier because of credit tightening in 2008 is putting a stop to their ability to limp along as earlier vintages did.

Monday, August 04, 2008

Lenders Fear Second Wave of Defaults

by Calculated Risk on 8/04/2008 01:17:00 AM

From Vikas Bajaj at the NY Times: Housing Lenders Fear Bigger Wave of Loan Defaults (hat tip Jasper)

The first wave of Americans to default on their home mortgages appears to be cresting, but a second, far larger one is quickly building.I think the second wave of foreclosures will be smaller in numbers, as compared to the largely subprime first wave, but the price of each home will be much higher. And the second wave will impact prices in the mid-to-high end areas, as opposed to the subprime foreclosures impacting prices in the low end areas.

Homeowners with good credit are falling behind on their payments in growing numbers, even as the problems with mortgages made to people with weak, or subprime, credit are showing their first, tentative signs of leveling off after two years of spiraling defaults.

No area is immune.

Monday, June 23, 2008

DAPs Will Not Die

by Calculated Risk on 6/23/2008 09:30:00 PM

When I first heard of Down-payment Assistance Programs (DAPs), I knew we would see higher default rates on FHA loans. Heck, the IRS has called DAPs a "scam". The FHA has vowed to eliminate DAPs ... and yet, amazingly, the percent of FHA loans using DAPs is still increasing.

DAPs simply will not die.

To understand DAPs in nerdy detail, see Tanta's DAP for UberNerds.

From the WSJ: Government Mortgage Program Fuels Risks

The offers -- including "100% financing" -- are made possible due to down-payment assistance programs run by nonprofit organizations. These programs are funded largely by home builders and also by private homeowners desperate to sell. The seller-funded groups provide enough down-payment money to buyers that they can qualify for a mortgage backed by the Federal Housing Administration, which requires at least a 3% down payment.These are not real down-payments from disinterested third parties. These programs are designed to have the seller (including home builders) funnel money to the buyer through a "nonprofit" to get around the FHA down-payment requirements. The buyer still has no skin in the game.

The FHA estimates that down payments provided by nonprofit groups account for 34% of all 200,000 loans backed by the FHA so far this year, up from 18% in all of 2003 and less than 2% in 2000. And the agency says that borrowers are two to three times as likely to default on their payments when they receive a down payment from a nonprofit.Here are some previous posts by Tanta and I about DAPs:

D.R. Horton Inc., the nation's largest home builder by volume, is touting "100% financing" for its two- and three-bedroom condominiums near the beach in Maui, Hawaii, which start at $498,000. In the Seattle area, local builder Quadrant Corp. is advertising townhouses that can be purchased with as little as $500 down. "Use your coffee budget to move into a new home," says an online promotion.

FHA Going After DAP Again? Tanta, June 10, 2008

DAP for UberNerds, Tanta, Oct 19, 2007 **** READ this one for nerdy details! ****

FHA to Ban DAPs, CR, Sept 29, 2007

Housing: IRS Raps DAPs, June 2, 2006

More on Housing, CR, Feb 24, 2005

Friday, June 06, 2008

Mortgage Defaults Highest Since 1979

by Anonymous on 6/06/2008 08:36:00 AM

Vikas Bajaj and Michael Grynbaum report in the Times:

The first three months of 2008 marked the worst quarter for American homeowners in nearly three decades, according to the report, issued by the Mortgage Bankers Association. The rate of new foreclosures and past-due payments surged to their highest level since 1979, when the group first started collecting the data.It's almost like . . . we're all subprime now.

All told, about 8.8 percent of home loans were past due or in foreclosure, or about 4.8 million loans. That is up from 7.9 percent at the end of December. (About a third of American homeowners do not have mortgages.)

Delinquency and foreclosure rates started rising from historically low levels in late 2006 and have picked up speed in nearly every quarter since. Analysts say at first past due mortgages represented mostly high-risk loans made to borrowers with blemished, or subprime, credit. Now, as the economy has weakened and home prices have fallen in many parts of the country, homeowners with better loans are also falling behind.

Friday, May 30, 2008

More Weird Numbers

by Anonymous on 5/30/2008 04:13:00 PM

My day started with my inability to understand a series of statistics reported in Bloomberg this morning.

Housing Wire follows up on the "methodology change" that purportedly caused the new defaults and cured loan reporting for April to surge and plummet, respectively, in the Mortgage Insurance Companies of America's most recent report. I share HW's sources' skepticism about the explanation given for this change. It simply sounds like a very large lender has been allowed--heretofore--to report fewer delinquencies and more cures than everyone else does, by using different definitions. As that is not something that sounds very good, I would suggest that MICA needs to come up with a better explanation.

Meanwhile, the Hope Now folks released a pathetic set of data charts on mortgage loss mitigation through April 2008. For heaven's sake, we're the financial industry, people. We're supposed to be able to use Excel properly.

There are some really puzzling features of this data, like why the total loan counts have not changed since October (see the first page). Since those loan counts are used to calculate the 60+ day delinquency percentage, the failure to update the total count makes those numbers rather dubious. On page two, I found myself unable to make sense of the completed FC sales/FC starts calculation using any possible definition of "five months" I can think of. Perhaps I am misreading the footnote. In any event, I gave up on my ambition to put this data into a more sensible format for you, after I lost confidence in the data integrity.

So here's from the press release, instead:

The April report from HOPE NOW estimates that on an industry-wide basis:Maybe next month the report will be cleaned up a little and we can look in more detail at these numbers. If we can shame Hope Now into issuing something readable.

• Mortgage servicers provided loan workouts for approximately 183,000 at-risk borrowers in April. This is an increase of 23,000 from the number of workouts in March 2008 and is the largest number of workouts completed in any month since HOPE NOW’s inception.

• The total number of loan workouts provided by mortgage servicers since July 2007 has risen to 1,558,854.

• Approximately 106,000 of the prime and subprime loan workouts conducted by mortgage servicers in April were repayment plans, while approximately 77,000 were loan modifications.

Harrumph. Is it Happy Hour yet?