by Calculated Risk on 3/05/2010 03:36:00 PM

Friday, March 05, 2010

Update on Post Bubble Real Estate Swindle in San Diego

This is an update on a great series by Kelly Bennett of Voice of San Diego.

First a little background: According to Kelly, in 2008 - after the bubble burst - James McConville bought distressed condos from developers in bulk, and then sold them to straw buyers at inflated prices (individuals with solid credit records who agreed to sign for the loans for a fee). McConville pocketed the difference between the straw buyer price and the bulk price - approximately $12.5 million.

McConville promised to rent the properties, and pay the mortgages from the rental income. Good luck!

This was happening in 2008.

And the update from Kelly Bennett at Voice of San Diego: A Year Later, Losses Pile Up in Complexes Ravaged by Swindle

All of the 81 condos from the Sommerset Villas, Sommerset Woods and Westlake Ranch complexes involved in the scam have been repossessed. Twenty-four have yet to find new buyers. But the other 57 have resold for prices drastically lower than the mortgages were worth, let alone the initial purchase prices.There is much more in the article, but this ties into another article today from Bloomberg: Fannie, Freddie Ask Banks to Eat Soured Mortgages

The U.S. taxpayer is paying for the mounting losses. Across the complexes, the cost to taxpayers is at least $7.8 million.

When the units were just in the beginning stages of foreclosure, it was too soon to tell whether the government-sponsored mortgage companies, Freddie Mac and Fannie Mae, had definitely purchased the shaky loans.

Fannie Mae and Freddie Mac may force lenders including Bank of America Corp., JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. to buy back $21 billion of home loans this year as part of a crackdown on faulty mortgages.

That’s the estimate of Oppenheimer & Co. analyst Chris Kotowski, who says U.S. banks could suffer losses of $7 billion this year when those loans are returned and get marked down to their true value.

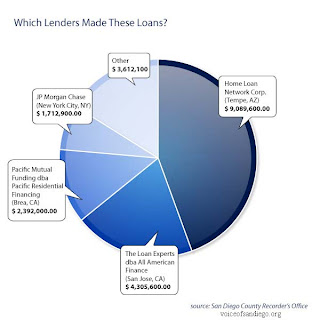

Click on graph for larger image.

Click on graph for larger image.Kelly provided me with this graphic on the San Diego swindle. This shows the lenders that were swindled. Since most of these loans were sold to Fannie and Freddie, there is a good chance the loans will be pushed back on the lenders - if they still exist. We know JPMorgan is still around!

More from Bloomberg:

The banks have to buy back the loans at par, and then take an impairment, because borrowers usually have stopped paying and the price of the underlying home has plunged. JPMorgan said in a presentation last month that it loses about 50 cents on the dollar for every loan it has to buy back.The losses will be much higher than 50 cents on the dollar on these loans.

Thursday, October 15, 2009

U.S. Charges 41 with Mortgage Fraud

by Calculated Risk on 10/15/2009 10:13:00 PM

This includes lawyers, mortgage brokers, and loan officers ...

From the NY Times: 41 Charged With Widespread Mortgage Fraud

Federal prosecutors announced charges on Thursday against 41 lenders, lawyers and others in the real estate industry who they said used fraud to obtain more than $64 million in loans connected to more than 100 residential properties in New York State.It is hard to believe how callous and greedy some people are (assuming the charges are true).

....

[One case involved] a Bronx real estate company called MTC, 10 people were accused of participating in a $5.6 million “foreclosure rescue” scheme in which they sought out troubled mortgage holders facing foreclosure, running radio ads in which they presented themselves as saviors.

An indictment said that the defendants in that case ... duped troubled homeowners into selling their properties at low prices or persuaded them to transfer the deeds to their homes, promising to help solve their financial problems and then return the properties.

Instead, prosecutors said, Ms. Bills and other defendants flipped those properties to straw buyers at inflated prices subsidized by unaffordable loans that the defendants persuaded lenders to issue based on false documentation.

Sunday, July 26, 2009

Herald Tribune: Lenders Ignored Mortgage Fraud Red Flags

by Calculated Risk on 7/26/2009 09:33:00 PM

From the Herald Tribune series on mortgage fraud in Florida: Lenders failed to heed red flags

Fraudulent property flippers had an unlikely accomplice during the real estate boom -- the lending industry."It is difficult to get a man to understand something, when his salary depends upon his not understanding it!"

A yearlong Herald-Tribune investigation into thousands of suspicious Florida flip deals found that lenders of all kinds approved risky deals and ignored obvious red flags for mortgage fraud.

...

What makes the flipping fraud so egregious is not just that it happened, but that it would have been so easy to stop.

Using public records and Internet searches, the Herald-Tribune identified hundreds of deals that exhibited classic red flags for fraud. They include sales between family members and business partners in which prices increased $100,000 or more overnight. In other cases, flippers repeatedly traded properties from their company to their own name, each time increasing the price and the amount they borrowed.

Lenders knew they were writing bad loans, but did it anyway because they were making so much money on underwriting fees, said Jack McCabe, a Deerfield Beach-based real estate consultant ...

Upton Sinclair, 1935, "I, Candidate for Governor: And How I Got Licked"

Thursday, July 23, 2009

More on Foreclosure Modification Scams

by Calculated Risk on 7/23/2009 09:22:00 PM

From Matt Padilla at the O.C. Register: DA raids Ladera homes tied to alleged loan-aid scam

Investigators with the Orange County District Attorney early Thursday morning searched three Ladera Ranch homes tied to an alleged foreclosure rescue scam.Once again some of these scamsters are former subprime mortgage brokers. I bet many people hope Ms. Henderson is successful!

...

Attorney General Jerry Brown last week said he has filed suit against the men for allegedly charging homeowners $4,000 in upfront fees and then failing to get them cheaper payments on their home loans.

...

Earlier in the week District Attorney Tony Rackauckas told a group of community leaders his office is expanding investigations into real estate fraud.

Elizabeth Henderson, an assistant DA who spoke at the same event in Garden Grove, said 30% of the cases handled by the office’s major fraud unit are tied to real estate, up from an average 10% in past years ...

“We want to send people to jail,” she said.

Wednesday, July 22, 2009

Herald Tribune: Flipping Fraud Ignored

by Calculated Risk on 7/22/2009 10:24:00 AM

From the Herald Tribune series on mortgage fraud in Florida: Flipping fraud ignored by police and prosecutors

In November 2005, when the real estate market in Florida had just begun to slow, the state’s top law enforcement agency issued a warning that mortgage fraud was about to wreak financial havoc.Here are the first three in the series:

In sober language, a 36-page Florida Department of Law Enforcement report explained that banks would collapse and losses would be counted in “hundreds of billions of dollars.”

...

The report, which was not released to the public but was sent to prosecutors and law enforcement officials across the state, laid out a series of responses to help prevent or lessen the disaster.

But instead of heeding the warning, most law enforcement officials ... did nothing.

Even the most basic recommendation in the FDLE assessment — posting a notice at the county courthouse warning that mortgage fraud is a criminal offense — was ignored in Sarasota County.

Today ... the scope of fraud has overwhelmed state and federal law enforcement agencies to the point that only the most egregious cases are likely to be prosecuted.

In addition to the FBI’s 2,500 cases, state agencies, including the Attorney General and FDLE, have pursued a few hundred more dating back to 2000.

But the amount of fraud dwarfs the number of cases being pursued, the Herald-Tribune found. The Herald-Tribune analyzed nearly 19 million property transactions looking for one type of housing fraud — illegal property flipping. The newspaper found more than 50,000 transactions in which prices increased so much, so quickly, that fraud experts interviewed by the newspaper deemed them highly suspicious.

'Flip that house' fraud cost billions

Flippers' toll: On Gulf Coast, half a billion in defaults

The king of the Sarasota flip

Note: And from Tanta in 2007 (my former co-blogger): Unwinding the Fraud for Bubbles

Tuesday, July 21, 2009

Mortgage Fraud in Florida

by Calculated Risk on 7/21/2009 10:11:00 PM

The Herald Tribune has a series of article on mortgage fraud in Florida (ht Ed)

Here are the first three in the series:

'Flip that house' fraud cost billions

Fraudulent property flipping ran rampant during this decade's housing boom, with $10 billion in suspicious deals in Florida alone, a Herald-Tribune investigation has found.Flippers' toll: On Gulf Coast, half a billion in defaults

The deals -- many of them inflated sales among friends, family and business associates -- drove up property values and tax bills during the boom, fed bank bailouts and failures after the boom, and fueled the foreclosure wave that has gutted property values.

Unscrupulous property flippers would buy houses or condos, then drive up the price in a few days or weeks by selling it to someone they knew. Buyers used the inflated price to get bank loans for more than the property was worth, leaving money for flippers to split as profit.

More than 100 properties from Palmetto to North Port doubled in price in a single day during the recent real estate boom. Proposed condos -- no more than ideas on paper -- flipped two or three times before anyone moved in.The king of the Sarasota flip

Instead of selling properties to outside buyers, [Craig Adams] created a real estate market where his hand-picked buyers and sellers could set the price they wanted, and repeated flips made Adams hundreds of thousands of dollars in real estate sales commissions.The Herald Tribune has a graphic on hot spots for flipping fraud in Florida, and some supporting documents.

In some cases, Adams and his associates bought a house, marked up the price and quickly sold it to another associate ... Using the inflated sale price, they qualified for a mortgage that more than covered the actual purchase, then divided the remaining cash among themselves, according to seven people familiar with the deals.

...

"They had a joke," said Melone, who did property deals with one of Adams' associates. "They said: 'We're getting low on money. Let's go buy a property.'"

Wednesday, July 08, 2009

More Mortgage Fraud

by Calculated Risk on 7/08/2009 07:18:00 PM

This is definitely "brazen" ...

From CNN: 25 charged in $100 million mortgage fraud

The D.A.'s office said the following banks were ripped off over a four-year period, ending in April: Countrywide, New Century Bank, Saxon Bank, Greenpoint Bank, ABC Bank, Bank of America, Wells Fargo and SunTrust. Some of the defendants were bank employees, according to the D.A.For more mortgage fraud, here is the Mortgage Fraud blog.

"The conspirators caused the banks to front millions of dollars to finance purchases of the properties," read a statement from the D.A.'s office. "They then walked away with most of the cash, leaving behind over-valued properties and worthless mortgage papers."

The D.A.'s office described a "particularly brazen sham transaction" where one of the suspects, Stephen Martini, allegedly wrote up a bogus appraisal of $500,000 for a two-family home, but "in reality, the location was a vacant lot."

FBI: U.S. Mortgage Fraud "Rampant" and "Escalating"

by Calculated Risk on 7/08/2009 10:27:00 AM

The FBI released their 2008 Mortgage Fraud Report today. (ht Bob_in_MA)

Mortgage fraud trends in 2008 reflected the overall downturn in the US economy ... the mortgage loan industry reported a spike in foreclosures and defaults; and financial markets continued to contract, diminishing credit to financial institutions, businesses, and homeowners. These combined factors uncovered and fueled a rampant mortgage fraud climate fraught with opportunistic participants desperate to maintain or increase their current standard of living. Industry employees sought to maintain the high standard of living they enjoyed during the boom years of the real estate market and overextended mortgage holders were often desperate to reduce or eliminate their bloated mortgage payments.Committing fraud to "maintain their high standard of living" ... hopefully these guys will enjoy some free state accomodations for a few years.

Mortgage fraud continues to be an escalating problem in the United States and a contributing factor to the billions of dollars in losses in the mortgage industry.

emphasis added

There is some state specific data and some discussion of some common schemes. Here are a few (there is much more detail in the report):

Builder-Bailout Schemes: Builders are employing builder-bailout schemes to offset losses, and circumvent excessive debt and potential bankruptcy, as home sales suffer from escalating foreclosures, rising inventory, and declining demand. Builder-bailout schemes are common in any distressed real estate market and typically consist of builders offering excessive incentives to buyers, which are not disclosed on the mortgage loan documents. Builder-bailout schemes often occur when a builder or developer experiences difficulty selling their inventory and uses fraudulent means to unload it. In a common scenario, the builder has difficulty selling property and offers an incentive of a mortgage with no down payment. For example, a builder wishes to sell a property for $200,000. He inflates the value of the property to $240,000 and finds a buyer. The lender funds a mortgage loan of $200,000 believing that $40,000 was paid to the builder, thus creating home equity. However, the lender is actually funding 100 percent of the home’s value. The builder acquires $200,000 from the sale of the home, pays off his building costs, forgives the buyer’s $40,000 down payment, and keeps any profits. If the home forecloses, the lender has no equity in the home and must pay foreclosure expenses.

Short-Sale Schemes: Short-sale schemes are desirable to mortgage fraud perpetrators because they do not have to competitively bid on the properties they purchase, as they do for foreclosure sales. Perpetrators also use short sales to recycle properties for future mortgage fraud schemes. Short-sale fraud schemes are difficult to detect since the lender agrees to the transaction, and the incident is not reported to internal bank investigators or the authorities. As such, the extent of short sale fraud nationwide is unknown. A real estate short sale is a type of pre-foreclosure sale in which the lender agrees to sell a property for less than the mortgage owed. In a typical short sale scheme, the perpetrator uses a straw buyer to purchase a home for the purpose of defaulting on the mortgage. The mortgage is secured with fraudulent documentation and information regarding the straw buyer. Payments are not made on the property loan causing the mortgage to default. Prior to the foreclosure sale, the perpetrator offers to purchase the property from the lender in a short-sale agreement. The lender agrees without knowing that the short sale was premeditated. The mortgage owed on the property often equals or exceeds 100 percent of the property’s equity.

Foreclosure Rescue Schemes: Foreclosure rescue schemes are often used in association with advance fee/loan modification program schemes. The perpetrators convince homeowners that they can save their homes from foreclosure through deed transfers and the payment of up-front fees. This “foreclosure rescue” often involves a manipulated deed process that results in the preparation of forged deeds. In extreme instances, perpetrators may sell the home or secure a second loan without the homeowners’ knowledge, stripping the property’s equity for personal enrichment.

Monday, July 06, 2009

Loan Mod Frauds

by Calculated Risk on 7/06/2009 12:27:00 AM

The scamsters are thriving ...

From Jessica Garrison at the LA Times: In California, mortgage scammers find easy pickings

Maricela Castellanos sat at her desk, the telephone pressed to her ear, a chill running through her body.These scamsters pretended to be from Castellanos bank. They offered her an attractive loan modification that lowered her monthly payments, and instructed her to send the payments to a "Payment Processing Department" at a P.O. Box. They even had a 1-800 number. Amazing.

A representative from her mortgage company was on the line with troubling information about the loan on Castellanos' Hesperia home.

No one at the company had previously been in contact with her, Castellanos recalled the man saying. The bank had no record of a new loan agreement with her, he said, nor had it received cashier's checks for $2,260 and $1,408.23 she said she had sent.

Castellanos had been a victim of an alleged loan modification swindle -- a financial crime in which scammers pretend to help distressed borrowers renegotiate their mortgages with their banks but instead pocket the money and leave the homeowners in worse straits than before.

Law enforcement officials say the scams are becoming increasingly prevalent, especially in California, where the Department of Real Estate has reported an explosion from 10 open cases a year ago to more than 750 this spring. Nationally, U.S. Atty. Gen. Eric Holder has said that the FBI's "rescue scam" caseload is up 400% from five years ago.

Monday, April 13, 2009

Mortgage Fraud in 2008: Part II

by Calculated Risk on 4/13/2009 06:29:00 PM

Here is the 2nd part of the VoiceofSanDiego article: A Staggering Swindle: How It Could Happen in 2008

In 2008, when the loans were made to McConville's buyers, some of the only companies still willing to buy these bundles of mortgages were Fannie Mae and Freddie Mac, even though the mortgage mess had affected them, too.Ask Wall Street what happens when they push back loans to the small lenders - they just close up shop.

At the tail end of McConville's deals, last September, the federal government took over Fannie and Freddie, assuming more direct control of the companies' day-to-day operation and pumped in funding to absorb their losses. Now the taxpayers own 79.9 percent of Fannie Mae and Freddie Mac.

"You and I are getting stuck with these inflated loans, via Fannie and Freddie," [Real estate appraiser Todd Lackner] said.

There is a way out, as long as the smaller lenders who made the loans to McConville's buyers still exist. On any loans Fannie and Freddie bought, if they discover fraud or faults in underwriting in the loans, they'll send them down the chain, requiring the investor that sold the loans to the giants to buy them back. Ultimately, the original lenders might face those buybacks, said Michael Lea, a former chief economist for Freddie Mac.

But the small lenders who made these mortgages might not be in business anymore -- like Nazari's All American Finance.

Here was Part I: Rented Identities, Extravagant Prices and Foreclosure: A Post-Boom Real Estate Scam

And a related article: Mafia-Esque Charges Brought Against Alleged Mortgage Fraud Ring

Mortgage Fraud: RICO Charges Filed Against Straw Buyers

by Calculated Risk on 4/13/2009 01:49:00 PM

Here is another story from VoiceofSanDiego: Mafia-Esque Charges Brought Against Alleged Mortgage Fraud Ring

Federal prosecutors on Tuesday announced unprecedented charges against individuals involved in an alleged mortgage fraud ring involving 220 properties in San Diego County, with total purchase prices topping $100 million.This is a different case than the previous story, but notice that the straw buyers are facing charges too. "Lend" out your good credit, sign false documents - and face prosecution and jail time.

The 24 defendants were all charged with participating in a "corrupt enterprise" under a federal law created by the Racketeer Influenced and Corrupt Organizations (RICO) Act...

... defendants include several real estate professionals ... a public notary ... a licensed real estate agent ... a licensed real estate appraiser ... a CPA; and ... registered tax preparers.

...

Prosecutors also name several straw buyers as participants in the corrupt enterprise ...

Mortgage Fraud in 2008

by Calculated Risk on 4/13/2009 11:24:00 AM

Kelly Bennett and Will Carless at the VoiceofSanDiego investigate: Rented Identities, Extravagant Prices and Foreclosure: A Post-Boom Real Estate Scam

Over the course of several months last year, [James D. McConville] picked up at least 81 condo conversions from distressed developers and orchestrated their sale to more than 20 buyers who'd rented him their identities ...McConville bought distressed condos from developers in bulk, and then sold them to straw buyers (individuals with solid credit records who agreed to sign for the loans for a fee). McConville pocketed the difference between the straw buyer price and the bulk price - approximately $12.5 million.

By arranging purchase prices well above market value, McConville was able to pay off the developers and capture what the developers' records state as more than $12.5 million. Now, 74 of the 81 homes involved in the deals in Sommerset Villas and Sommerset Woods in Escondido and Westlake Ranch in San Marcos are in the first stage of foreclosure.

McConville promised to rent the properties, and pay the mortgages from the rental income.

The individuals had pristine credit, and one mortgage lender said:

"Everything was just absolutely perfect -- some of the cleanest loans we'd seen."Of course the relationship with McConville was apparently never disclosed.

This was happening in 2008. Lenders were supposed to be back to the three C's: creditworthiness, capacity, and collateral. These straw buyers - who apparently were willing to falsely sign that they were the actual buyers - satisfied the creditworthiness and capacity criteria. But this raises serious questions about the appraisals.

Also McConville timed the multiple applications perfectly so the lender wouldn't see the other loans apps when they performed a credit check - that is pretty amazing.

Part II will be out today tonight ...

Monday, March 16, 2009

Report: Mortgage Fraud Increased in 2008

by Calculated Risk on 3/16/2009 03:21:00 PM

Update: Housing Wire has more: Mortgage Fraud at All-Time High: Report

This report appears to deal with Fraud for Housing, and not Fraud for Profit (what most people think of as mortgage fraud).

From Dina ElBoghdady at the WaPo: Mortgage Fraud Rises Even as Loans Decline

Mortgage fraud rose last year even though fewer loans were issued nationwide ... Fraud jumped by 26 percent in 2008 from the previous year, the study concluded, based on data collected from roughly 70 percent of the nation's lenders as well as mortgage insurance companies and mortgage investors. The study was prepared by the Mortgage Asset Research Institute, an arm of LexisNexis, for the Mortgage Bankers Association.Historically there have been two types of mortgage fraud: fraud for housing, and fraud for profit. The MBA/MARI report focuses on fraud for housing (and that probably includes refinance fraud because borrowers are desperate).

...

"With fewer loan originations today, the data suggest that the economic downturn may have created more desperation, causing more people than ever before to try to commit mortgage fraud," said Denise James, one of the study's authors.

The most common type of fraud continues to be application misrepresentation, which includes falsifying a borrower's income. That kind of fraud represented about 61 percent of all the reported cases last year, followed by fraud on tax returns and financial statements. The volume of reported fraud related to credit reports dropped from 9 percent to 4 percent in the past year.

...

The study noted that the spike in fraudulent activity cases can be partially attributed to more vigorous reporting and investigations.

Tanta explained this well: Unwinding the Fraud for Bubbles

There is a tradition in the mortgage business of distinguishing between two major types of mortgage fraud, called “Fraud for Housing” and “Fraud for Profit.” The former is the borrower-initiated fraud—inflating income or assets, lying about employment, etc.—that is motivated by the borrower’s desire to get housing (not the same thing as “real estate”), by means of getting a loan he or she doesn’t actually qualify for. It may require some collusion by the loan originator or appraiser, but it may not. It is usually the least expensive kind of fraud to lenders and investors, since the goal is getting (and keeping) the property, so the borrower is at least usually motivated to make the payments. The problems come about, of course, because these borrowers failed to qualify honestly for a reason. Borrower-initiated fraud loans may be considered “self-underwritten,” and such loans do have a much higher failure rate than the “lender-underwritten” ones. Their only saving grace is that the lender tends to recover more in a foreclosure than in a fraud for profit case. Penalties to the borrower rarely ever come in the form of prosecution; losing the home and becoming a subprime borrower for the next four to seven years—with the credit costs that implies—are the borrower's punishment.As Tanta noted, during the housing bubble, these two frauds merged, and that is probably not happening now. I suspect most of the fraud today is "fraud for housing" by homeowners desperate to refinance.

Fraud for profit is simply someone trying to extract cash—not housing—out of the transaction somewhere. If it is borrower-initiated fraud, it’s not a borrower who wants a house; it’s a borrower who wants to flip a piece of real estate or launder money or in some other way grab the cash and leave the lender holding the bag. Most of it, however, is initiated by a seller, real estate broker, lender, or closing agent (or all of them in collusion). It generally requires additional collusion by bribable appraisers, although it can certainly be initiated by a corrupt appraiser looking for a kickback, or can merely take advantage of a trainee or gullible appraiser. This is the flip scam, straw borrower, equity skimming, misappropriation of payoff funds, identity theft kind of fraud. It may not be as common as fraud for housing, at least in some markets, but it’s much, much more expensive to the bagholder. At minimum, the fraud-for-housing borrower wants to take clear, merchantable title to the property and maintain it at an acceptable level. That’s either unnecessary expense or (in the case of title) a hurdle to be gotten over by the fraud-for-profit participant.

Wednesday, January 28, 2009

Report: FBI saw Mortgage Fraud, Lacked Resources

by Calculated Risk on 1/28/2009 12:43:00 PM

From Paul Shukovsky at the Seattle Post-Intelligencer: FBI saw mortgage fraud early (hat tip John)

It is clear that we had good intelligence on the mortgage-fraud schemes, the corrupt attorneys, the corrupt appraisers, the insider schemes," said a recently retired, high FBI official. Another retired top FBI official confirmed that such intelligence went back to 2002.So apparently the FBI missed the point where the "piece of dung" became a marketable "security".

The problem, according to the two FBI retirees and several other current and former bureau colleagues, is that the bureau was stretched so thin that no one noticed when those lenders began packaging bad mortgages into bad securities.

"We knew that the mortgage-brokerage industry was corrupt," the first of the retired FBI officials told the Seattle P-I. "Where we would have gotten a sense of what was really going on was the point where the mortgage was sold knowing that it was a piece of dung and it would be turned into a security. But the agents with the expertise had been diverted to counterterrorism."

Sunday, October 19, 2008

NY Times: Wave of Financial Fraud Cases

by Calculated Risk on 10/19/2008 11:46:00 AM

From the NY Times: F.B.I. Struggles to Handle Wave of Financial Fraud Cases

Since 2004, F.B.I. officials have warned that mortgage fraud posed a looming threat, and the bureau has repeatedly asked the Bush administration for more money to replenish the ranks of agents handling nonterrorism investigations, according to records and interviews. But each year, the requests have been denied, with no new agents approved for financial crimes, as policy makers focused on counterterrorism.People having been sounding the alarm on mortgage fraud for several years - and the FBI still only has 177 agents devoted to mortgage fraud. Amazing.

According to previously undisclosed internal F.B.I. data, the cutbacks have been particularly severe in staffing for investigations into white-collar crimes like mortgage fraud, with a loss of 625 agents, or 36 percent of its 2001 levels.

...

In 2004, one senior F.B.I. official, Chris Swecker, warned publicly that a flood of fraudulent mortgage deals had the potential to become “an epidemic.” Yet the next year, as public warnings about fraud in the subprime lending markets began to approach their height, the F.B.I. had the equivalent of only 15 full-time agents devoted to mortgage fraud out of a total of some 13,000 agents in the bureau.

That number has grown to 177 agents, who have opened 1,522 cases. But the staffing level is still hundreds of agents below the levels seen in the 1980s during the savings and loan crisis.

Monday, August 25, 2008

LA Times: FBI Saw Mortgage Fraud Threat in 2004

by Calculated Risk on 8/25/2008 09:11:00 AM

From the LA Times: FBI saw threat of mortgage crisis

Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.As the article notes, the FBI had other priorities, and they didn't really have the resources to investigate the growing epidemic of mortgage fraud, and most of the mortgage lenders didn't seem to care:

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Officials said they began approaching mortgage companies and others in an attempt to raise awareness about the growing fraud problem. But the lenders had little incentive to cooperate because they were continuing to make money.More warnings that were ignored.

Tuesday, August 19, 2008

Mortgage Fraud News From Orange County, Nigeria

by Anonymous on 8/19/2008 09:02:00 AM

Here we have a detailed two-parter (part one and part two) on a sorry case of mortgage fraud from the OC Register. Dogged local cop pursues small-balance fraud case, nails crook, unveils huge regulatory failure. But . . .

*********

I have to confess to being as fascinated by the victims in this case as by the perp. Before everybody starts in on me about "blaming the victim," let me point out that yes, fraud is fraud, even when the victim is so lacking in common sense and elementary skepticism as to pass into Darwin Award territory. I do not excuse anyone who preys on the vulnerable, the foolish, or the ignorant.

Nonetheless, it's hard to prevent certain kinds of fraud against homeowners if you do not deal with the extent to which they "work" only because the victim colludes with them, up to and beyond the point where they become so outlandish as to defy belief. The case before us seems to me less a case of "mortgage fraud" than a classic confidence scam that simply takes as its incidental starting point a dubious mortgage offer. In other words, it's like a Nigerian scam email. From part one:Nobody believed in Osborn more than Steve Ryancarz.

My sense is that there will always be someone--a customer of his business who is allowed to rack up a $1.2MM receivable, a mortgage broker, somebody else--able and willing to part Mr. Ryancarz from his money. I am all in favor of prosecuting fraud and tightening up mortgage broker regulations, but I suspect we're kidding ourselves if we think there is any kind of workable law or regulation that will assure that the Ryancarzes of the world are protected from scammers.

Ryancarz, 62, an Ohio businessman, wanted to refinance his 5,000-square-foot luxury house on a 5-acre lot to get some cash out for his refrigeration company. A major customer had gone belly up, owing Ryancarz's firm $1.2 million, he said.

Ryancarz wasn't just trying to get a loan for himself. He also was trying to do a favor for a friend, Kim Koslovic.

Ryancarz was engaged to Koslovic's mother. Koslovic, 38, and her husband had filed for Chapter 13 bankruptcy protection while he was unable to work because of an injury. In order to keep her modest, $107,000 house, she needed to refinance, but she couldn't find a lender in Ohio who would take a chance on her.

Ryancarz said he found Osborn online in 2003 through HomeLoanAdvisors.com. Ryancarz, who had good credit, figured that by bundling a loan for himself with one for Koslovic, Osborn might find a lender willing to take both.

"No matter how much money I had, I always help people out," Ryancarz said. "That's just how I am. Everybody needs a break. What I could do to help them – could help them get to a point where they turn their lives around, it's worth it."

There were warning signs, even early on. The first loan Osborn delivered for Ryancarz was bungled, resulting in much higher payments than Ryancarz had expected. Osborn blamed the problem on his boss.

Ryancarz said he called Osborn's boss, but the man wouldn't speak to him, so Ryancarz believed Osborn.

"It just snowballed after that," Ryancarz said.

Osborn said he would help Ryancarz sue the first lender, but he wanted money up front to pay for the lawsuit. Ryancarz sent thousands in fees.

Here's how much sway Osborn was able to exert over his victim: Ryancarz sent Osborn money to bail him out of jail when he was arrested for driving without a license. He also sent Osborn money to pay off a purported fine from the Department of Real Estate, according to records Ryancarz provided.

Ryancarz even sent $5,000 to pay for Osborn, his girlfriend and their children to take mini-vacations at the Loews Coronado Bay Resort.

"He said, 'I've done all this work for you. You owe me a favor. How about putting us up for the weekend?'" Ryancarz recalled.

Ryancarz said he believed that Osborn was working very hard trying to get loans for him and Koslovic, and if these loans didn't come through, well, that was understandable.

"I just thought they were axing the loans because of Kim's credit," he said.

Ryancarz never met Osborn in person. Over the phone, he sometimes heard Osborn use abusive language to office assistants, calling them nasty names if they made a mistake or didn't have the right paperwork.

"He was smooth to the clients, but as far as the people that done his work for him, he wasn't too kind," Ryancarz said.

To dispel any doubts about Osborn, Ryancarz would call the lenders that Osborn said he was working with.

Each time, Ryancarz said, he got confirmation.

"You gotta figure he's gotta be on the up and up. He's not going to be jeopardizing his reputation talking to these people or lying to you and saying he did," Ryancarz said. "You fall back on the sense of well, he's doing his job, it's just a little tougher than you thought it would be and blah blah blah."

Or, as Koslovic put it, "It's easy to push time away with the excuse of paperwork and glitches and technicalities, with all those words that everyone uses."

Ultimately, Ryancarz and Koslovic lost their houses.

It turned out that Ryancarz could have done a much better deed for Koslovic if he'd simply paid off her mortgage rather than trying to get her a new loan through Osborn.

Her house was worth $107,000. Ryancarz paid Osborn more than $370,000, court records show.

"I almost done it and I decided, no, that's not getting them where they want to be," Ryancarz said. "So I didn't do that. Hindsight indicates I should have."

I argued last year in this post, Unwinding the Fraud for Bubbles, that it was getting a bit difficult during the boom to tell the difference between the victimizers and the victims in a lot of cases. Now that we're deep into the horrors of the unwind, it is becoming increasingly fashionable in a lot of quarters to accept at face value many people's claims to have been nothing but innocent victims of the mortgage industry, and certainly with poster children like this Osborn character, the mortgage industry doesn't have much of a case for the defense. But some frauds just won't work without the greed, irresponsibility, or outright collusion of the mark. And not all of these cases are as blatantly clear as the Osborn-Ryancarz debacle. Reader Gary sent me this one, from Crain's New York Business: Noel, a 28-year-old math teacher from Harlem who asked that his last name not be used, always thought it would be smart to invest in real estate. So when his cousin introduced him to a mortgage broker who promised he wouldn't have to put a penny down on a $1 million piece of property in New Rochelle, he jumped at the chance. Then, the same broker told him about a home in Yonkers. Again, he didn't have to put any money down.

I agree that Noel should never have been approved for the loan. I am perfectly willing to believe that the broker misrepresented Noel's income without his knowledge. But I am not quite willing to believe that Noel did not realize that mortgage loans have to be paid back. How did he think he was going to make payments on $1.5MM in loans out of a $50,000 salary? I mean, the lender probably didn't know what Noel's actual income was, but surely Noel did. Noel is a math teacher.

Before he realized what he was getting into, Noel says, he was scammed into signing two mortgages totaling more than $1.5 million. The mortgage broker even provided a lawyer for the closing.

"I make $50,000 as a schoolteacher," he says. "There's no way I should have been approved for loans that big."

Hemmed in by monthly payments totaling more than $10,000 and bills for maintaining a third property on Long Island, Noel had no choice but to file for bankruptcy, he says. He filed without the help of a lawyer—he couldn't afford one—and he plans to walk away from the three homes and get a fresh start, this time without dreams of making it big.

"I thought real estate was a good business," he says. "But I guess it's not for me. I'm not buying property again—ever again."

Noel could be scammed because Noel bought into the idea that real estate investing is a magical kind of business unlike any other kind of business in which you can put nothing down and make no loan payments and strike it rich. This does not excuse Noel's mortgage broker. It explains Noel's mortgage broker.

Wednesday, July 30, 2008

Fraud in the 2008 Mortgage Vintage

by Anonymous on 7/30/2008 10:04:00 AM

If you haven't yet had a chance to read this article by John Gittelsohn in the Orange County Register about a real estate sale that was financed by Wells Fargo in January of this year, please do so now. And if you were, like most people, working on the assumption that lenders and other industry participants had at least cleaned up their acts in time for the 2008 mortgage vintage to be worth something, think again.

There isn't any significant fact about this transaction I can identify that isn't a red flag. A home in a foreclosure-wracked neighborhood was purchased at foreclosure auction in October of 2007 for $304,500, just over half what the defaulted buyer had paid in 2006. In January of 2008, the house was flipped to a non-English-speaking couple for an apparent sales price of $625,000 after some "sprucing up" by the property seller.

Ridiculous? Sure. It turns out that the seller provided the $125,000 down payment, and also executed an "addendum" to the sales contract agreeing to pay the buyers $30,000 in cash, cover the borrowers' first three mortgage payments, and toss in a 52-inch TV. Subtract out all that, and the true sales price of the property was $460,000. But apparently nobody did subtract out any of that, because Wells Fargo made a $500,000 loan to these buyers to purchase this property.

The OC Register reporter, bless his heart, tracked down the various parties who had their hands in this transaction, and got the following comments:

From the mortgage broker who put the deal together: "Whatever agreement the buyer and seller made, it was between them."

From the appraiser who dutifully came up with a value of $625,000: "Like Sanchez, she had no knowledge of the terms of the sale."

From the escrow agent who closed this loan: "It sounds to me like the seller helped out," she said. "If someone gave them $125,000, what's the problem? That's a beautiful thing, if you ask me."

From Wells Fargo: "In many instances, borrowers are able to use gifts from family members or friends for a portion of their down payment, provided the amount and source of the gifts are documented."

Excellent point, Wells Fargo. Too bad in this case the down payment didn't come from friends or family members and wasn't documented. Too bad that the broker who originated the loan seems to think the details of the purchase contract aren't any of his business. Too bad your escrow agent doesn't care where the down payment money came from, either. Too bad your appraiser has apparently never heard of the Uniform Standards of Professional Appraisal Practice, to which she is obligated to conform if she wants to do appraisals for Wells Fargo, that say she is required to inquire into "the terms of the sale."

I don't think the real issue with this story is the problem of whether or not to use foreclosure or "distressed" sales as comparables in an appraisal report. The problem is that there are no comparable sales of any kind that are a reliable measure of market value if they all involved transactions in which nobody ever actually bothered to verify and analyze the terms of the sale.

If this is the level of elementary due diligence we can expect after the most atrocious mortgage blowup in history, what will it take to scare people into doing their jobs?

Friday, July 25, 2008

Appraisal Fraud at IndyMac

by Anonymous on 7/25/2008 03:25:00 PM

A very interesting post today at The Big Picture.

Hopefully this means the FDIC will be monitoring Barry more closely and I can get some sleep.

Thursday, June 12, 2008

FBI Diverting Resources to Mortgage Fraud

by Anonymous on 6/12/2008 11:30:00 AM

Reports Bloomberg:

June 12 (Bloomberg) -- The U.S. Federal Bureau of Investigation, confronting a surge in mortgage fraud, has ordered more than two dozen of its field offices to stop probing some financial crimes so agents can focus on the subprime crisis. . . .If I weren't afraid of sounding cynical, I'd say there's a new career in mass marketing and environmental crimes for all those out-of-work mortgage bottom-feeders. So I'll just think it instead.

The 26 field offices were told to temporarily suspend opening new cases dealing with price fixing, mass marketing, wire fraud, mail fraud and environmental crimes, Carter said. Current cases aren't being dropped, he said. The FBI has 56 field offices and about 12,000 agents.