by Calculated Risk on 12/12/2007 07:55:00 PM

Wednesday, December 12, 2007

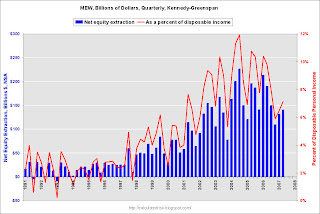

Q3 Mortgage Equity Withdrawal: $133 Billion

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q3 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image.

Click on graph for larger image.

For Q3 2007, Dr. Kennedy has calculated Net Equity Extraction as $133.0 billion, or 5.2% of Disposable Personal Income (DPI). Note that net equity extraction for Q2 2007 has been revised upwards to $159.2 billion.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income. MEW was still strong in Q3 2007, even with tighter lending standards.

As homeowner equity declines sharply in the coming quarters - household real estate equity declined $128 Billion in Q3 - combined with tighter lending standards, equity extraction should decline significantly and impact consumer spending.

Friday, September 21, 2007

Q2 Mortgage Equity Withdrawal: $140.3 Billion

by Calculated Risk on 9/21/2007 03:41:00 PM

Here are the Kennedy-Greenspan estimates of home equity extraction for Q2 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image.

Click on graph for larger image.

For Q2 2007, Dr. Kennedy has calculated Net Equity Extraction as $140.3 Billion, or 7.1% of Disposable Personal Income (DPI). Note that equity extraction for Q1 2007 has been revised upwards to $131.3 Billion.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

It is very likely that MEW will collapse in Q3 2007, based on the tighter lending standards and falling home prices, leading, most likely, to less consumer spending.