by Calculated Risk on 2/10/2010 12:26:00 PM

Wednesday, February 10, 2010

Freddie Mac to Buy Out Seriously Delinquent Loans

Press Release: Freddie Mac To Purchase Substantial Number of Seriously Delinquent Loans From PC Securities

Freddie Mac (NYSE: FRE) announced today that it will purchase substantially all 120 days or more delinquent mortgage loans from the company's related fixed-rate and adjustable-rate (ARM) mortgage Participation Certificate (PC) securities.This makes sense (since the costs are lower to buy the nonperforming loans back), and this has been in the works since Treasury increased the GSE portfolio limits in December. Back in December, Credit Suisse analysts argued this would happen (from Bloomberg):

The company's purchases of these loans from related PCs should be reflected in the PC factor report published after the close of business on March 4, 2010, and the corresponding principal payments would be passed through to fixed-rate and ARM PC holders on March 15 and April 15, respectively. The decision to effect these purchases stems from the fact that the cost of guarantee payments to security holders, including advances of interest at the security coupon rate, exceeds the cost of holding the nonperforming loans in the company's mortgage-related investments portfolio as a result of the required adoption of new accounting standards and changing economics. In addition, the delinquent loan purchases will help Freddie Mac preserve capital and reduce the amount of any additional draws from the U.S. Department of the Treasury. The purchases would not affect Freddie Mac's activities under the Making Home Affordable Program.

“This announcement increases the prospect of large-scale voluntary buyouts by removing the portfolio cap hurdle and helping funding by potentially increasing debt-investor confidence,”

Monday, October 26, 2009

SF Fed: Recent Developments in Mortgage Finance

by Calculated Risk on 10/26/2009 03:30:00 PM

From San Francisco Fed Senior Economist John Krainer: Recent Developments in Mortgage Finance

As the U.S. housing market has moved from boom in the middle of the decade to bust over the past two years, the sources of mortgage funding have changed dramatically. The government-sponsored enterprises—Fannie Mae, Freddie Mac, and Ginnie Mae—now own or guarantee an overwhelming share of originations. At the same time, non-agency mortgage securitization and loans retained in lender portfolios have largely dried up.

Click on graph for slightly larger in new window.

Click on graph for slightly larger in new window.This is figure 3 from the Economic Letter. This shows the surge in non-agency securitized loans, and loans held in bank portfolios, in 2004 through 2006 (the worst loans).

[T]he sources of mortgage finance have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade. Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations. Finally, the share of mortgages retained in the originating institution's portfolio averaged about 15% throughout the boom, but has fallen considerably since.Although Krainer doesn't mention it, notice the increase in bank portfolio loans in early 2007 - that was probably because the banks were stuck with loans when the securitization market seized up.

...

In the present day, when Ginnie Mae's activities are included, the three GSEs are providing unprecedented support to the housing market—owning or guaranteeing almost 95% of the new residential mortgage lending.

Krainer concludes:

With the vast majority of current mortgage lending now intermediated in some form by the GSEs, it will be difficult for the housing market to return to normal.Note: Tanta wrote this last year on the naming of the GSEs: On Maes and Macs. An excerpt:

Trivia buffs will know that once upon a time there were three "agencies": the Government National Mortgage Association, the Federal National Mortgage Association, and the Federal Home Loan Mortgage Corporation. It didn't take all that long for market participants to start coming up with pronunciations for the abbreviations GNMA (Ginnie Mae), FNMA (Fannie Mae), and FHLMC (Freddie Mac, which makes no sense whatsoever except that nobody liked "Filly Mac." ... Old farts whose favorite childhood treat was a box of Pixies will remember the old-time candy company Fannie May, whose name is said to have inspired the whole thing, probably in the throes of a major sugar rush.

Tuesday, August 25, 2009

Will Mortgage Insurers Limit the Housing Market?

by Calculated Risk on 8/25/2009 06:46:00 PM

From Matt Padilla at the O.C. Register: Housing demand could snag on mortgage insurance

Matt quotes an article from the National Mortgage News:

The GSEs can purchase single-family mortgages with loan-to-value ratios higher than 80% only if the homebuyer gets mortgage insurance. The FHFA Mortgage Market Note issued a few days after Mr. Lockhart’s departure projects that the demand for such high LTV loans could hit $230 billion in 2009. The ability of the MIs to meet that level of demand is “remote,” FHFA report says. “The industry’s ability to build and maintain sufficient capital to meet the needs of the enterprises over the short term without some federal assistance or an infusion of private capital is unclear,” the report concludes.Another goverment program?

emphasis added

Thursday, July 30, 2009

Regulator: GSEs Unlikely to Fully Repay Bailout

by Calculated Risk on 7/30/2009 01:51:00 PM

From the WSJ: GSEs Unlikely to Repay U.S. in Full

... "My view is that some assets in the senior preferred will have to be left behind as they come out of conservatorship," Federal Housing Finance Agency Director James B. Lockhart said Thursday in response to a question at a panel discussion in Washington. "That will mean that some of the losses will never be repaid."I'm shocked!

The Treasury has agreed to pump $200 billion into each company in order to keep them solvent. In exchange, the government receives senior preferred stock that pays a 10% dividend. So far, it has injected $85 billion in total into the companies, but Lockhart said that figure was likely to rise in the coming months.

Fannie and Freddie together own or guarantee $5.4 trillion in mortgages. ...

Mr. Lockhart said Fannie and Freddie would likely see their reserves continue to decline next year, but could return to strong profits in two to three years.

Monday, January 26, 2009

New Mortgage Data Requirements from FHFA

by Calculated Risk on 1/26/2009 02:48:00 PM

This was from about 10 days ago, but I missed it. Starting Jan 1, 2010, all loans purchased by Freddie and Fannie are required to have loan-level identifiers so that performance can be tracked by orginators and appraisers.

FHFA Announces New Mortgage Data Requirements

Washington, DC – James B. Lockhart, Director of the Federal Housing Finance Agency, announced today that, effective with mortgage applications taken on or after Jan. 1, 2010, Freddie Mac and Fannie Mae are required to obtain loan-level identifiers for the loan originator, loan origination company, field appraiser and supervisory appraiser. ...

FHFA’s requirement is consistent with Title V of the Housing and Economic Recovery Act of 2008, the S.A.F.E. Mortgage Licensing Act, enacted July 30. With that Act, Congress required the creation of a Nationwide Mortgage Licensing System and Registry. In prior years, both Enterprises worked with the Mortgage Bankers Association of America (MBAA) and the National Association of Mortgage Brokers (NAMB) on a similar initiative. However, that effort was thwarted due to the absence of a national registration and identification system. With enactment of the S.A.F.E. Mortgage Licensing Act, identifiers will now be available for each individual loan originator.

“This represents a major industry change. Requiring identifiers allows the Enterprises to identify loan originators and appraisers at the loan-level, and to monitor performance and trends of their loans,” said Lockhart. “If originators or appraisers have contributed to the incidences of mortgage fraud, these identifiers allow the Enterprises to get to the root of the problem and address the issues.”

The purpose of FHFA’s requirement is to prevent fraud and predatory lending, to ensure mortgages owned and guaranteed by the Enterprises are originated by individuals who have complied with applicable licensing and education requirements under the S.A.F.E. Mortgage Licensing Act, and to restore confidence and transparency in the credit markets. In addition, the Enterprises will use the data collected to identify, measure, monitor and control risks associated with originators’ and appraisers’ performance, negligence and fraud.

...

To implement the requirement, FHFA has been working with the Conference of State Bank Supervisors (CSBS) and the FFIEC Appraisal Subcommittee. Within the next 30 days, both Fannie Mae and Freddie Mac will be issuing guidance related to implementation of the requirement.

Tuesday, September 02, 2008

They Could Call It Moronic

by Anonymous on 9/02/2008 09:01:00 AM

Every time I observe that something or other is the dumbest thing I've ever heard of, something even dumber comes along. You'd think I'd have learned by now. But this is the dumbest thing I've ever heard of:

Here’s a bold idea: Fannie Mae and Freddie Mac should merge.No; having Fannie Mae and Freddie Mac open a counter-cyclical side line of business mowing lawns on each other's REO would be a "bold" idea. This is just another Wall Street plan to solve all of our problems by laying off highly skilled employees with long institutional memories and a high degree of loyalty to their company in order to goose the damned share price. Oh, and it's easier to do that if you make these costly employees sound like fat cats:

Yes, the big benefits of a merger would come at the expense of some the 6,400 employees at Fannie and nearly 5,000 employees at Freddie. And frankly, that’s one reason, among many, such a scenario may not be palatable to folks in Washington — where, it should be noted, many of Fannie and Freddie employees work and live, some as the neighbors of politicians and their friends.Yeah, right. All those mortgage quality control analysts and remittance accounting clerks live next door to a Senator and hobnob with the K-Street Boyz. Especially all the ones who work in the regional field offices.

Fannie and Freddie have, in fact, historically paid decent salaries for skilled workers, and their benefit packages tend to be excellent. They are known for having diverse workforces and for recruiting and promoting women. They even offer family leave and flexible work hours and child-care plans and pinko crap like that. Obviously someone needs to teach these people the real meaning of capitalism, which is that we do not deal with big, structural, complicated problems. We "downsize" and collect bonuses in the M&A houses:

By merging them, they would really become too big to fail. And sometimes size can be a strength."Getting real" like this is what happened to the non-GSE part of the mortgage business over the last several years. Wall Street firms bought up mortgage companies, slashed back rooms and highly-paid experts, offshored collections and account management and swarmed all over the "wholesale" model that substituted "independent" brokers for origination employees whose long-term financial best interests were aligned with the company. The synergy, dude. It was really something.

A merger wouldn’t undo the mess that these two companies have made, nor does it erase the billions of dollars in potentially toxic loans they own or have guaranteed. Nor would it address the question of whether these companies deserve the implicit backing of the government in the future. . . .

But let’s get real: no matter what solution is chosen for Fannie and Freddie, pink slips are bound to be a part of any fix.

And since that worked so well at outfits like Countrywide or the Street-owned firms, let's try it again on the GSEs? I have had a theory for a long time that the very subject of the GSEs just makes a whole lot of people utterly insane, pretty much regardless of what they do or what the context of the conversation is. Being a hybrid of a private corporation and a government agency, they will always be ideologically intolerable to purists on one or the other side of any of the more annoying political arguments of our time. But this kind of thing is beyond the usual sloganeering about private vs. government sectors and competition and monopoly and so on. This is just a naked appeal to the Street's desire to eliminate skilled jobs to enrich consultants and executives. If you thought they learned anything by the fiasco of the mortgage securitization machine--put any dumb old loan in the deal because someone's got a spreadsheet showing hockey sticks on it--think again.

Monday, August 25, 2008

NYT: The GSEs Invent the Risk Premium

by Anonymous on 8/25/2008 09:59:00 AM

Either I've finally lost what passes for my mind, or business press's increased fixation on blaming every problem in the mortgage market on Fannie Mae and Freddie Mac has just about jumped the shark. I don't know how else to explain this, from the NYT:

MORTGAGE rates are typically driven by the financial market’s outlook for long-term interest rates, but not always. Policy changes at Fannie Mae and Freddie Mac, the two government-sponsored companies that buy most mortgages issued by United States lenders, recently helped drive that point home.Um, what kind of profound mental confusion could make someone write those first two sentences? Mortgage rates have always been driven by the market "outlook for long-term interest rates," they still are, and they always will be. So have Treasury rates and the yield the local bank offers you on your certificate of deposit. That yield curve thingy. You've heard of it, maybe.

This month, Fannie and Freddie increased the fees they charge lenders for many loans, effectively bumping up interest rates for many borrowers who have marginal credit. The companies also tightened their policies on refinance loans that enable an owner to take cash out of a home.

But mortgage rates have never been "purely" about the bond market's outlook for benchmark yields, since the benchmarks, like U.S. Treasuries, are credit risk-free investments. Treasuries are backed by the full faith and credit of the U.S. Government, which has financial resources that Joe Blow the homebuyer doesn't have. Mortgage loans, like corporate bonds, have credit risk: the borrower might default and you might not get all your money back.

This is why interest rates on home mortgages are always higher than the rate on risk-free bonds of equivalent duration, like Treasury notes. If they weren't, nobody would invest in mortgages, they'd just buy the risk-free bonds. Are you still with me, everyone?

So there are always two main ingredients of mortgage rates, comparable-duration bond yields and the credit risk premium. And the credit risk premium, theoretically as well as practically, can fluctuate pretty widely, depending on, well, one's "outlook" for credit risk.

Fannie and Freddie have always guaranteed the credit risk of the mortgage-backed securities they issue. That is what they do and why they're here. In the "required yields" they establish for the loans they securitize, there has always been this little extra bit that they do not pass through to investors; it's the part they keep for themselves to cover credit losses, because they do not pass credit losses on to investors. You can call it a guarantee fee or a loan-level pricing adjustment or a post-settlement fee, if you want to be technical, or you can just call it a "credit risk premium."

One possibility here is that the GSEs are increasing their credit risk premium--which, in the absence of marked changes in required net yield to the end investor, will appear to make mortgage rates rise "independently" of other long-term interest rates--because, well, current conditions in the housing and mortgage market suggest that mortgages are pretty risky right now, credit-wise. One thing that indicates the extent of this risk, of course, is that by and large nobody but the GSEs are buying mortgage loans right now. Perhaps this is what is confusing the Times reporter: if Fannie and Freddie had any competition right now--if there were anyone else out there buying loans--it might be more obvious that everyone increases risk premiums when perceived credit risk rises. But really, you know. When nobody else but the government-chartered investors are in the market, that can be understood to mean that risk is so high that nobody else is even feeling strong enough to be willing put a price on it. The absence of competitors in a market often suggests that risk has risen in that market. If you've ever tried to get flood insurance, you may have noticed this phenomenon.

Of course, there's another way to look at this, which is that in the last five to seven years it did not "appear" that there was much of a risk premium in mortgage rates because, well, there wasn't much of one. Since we cannot actually open a newspaper or get on the internet without another story of horrible losses taken by investors in mortgages whose "cushion" for defaults--their credit risk premium--was ludicrously low given the riskiness of the mortgages they were investing in, we might have concluded by now that things like the increased risk premiums that the GSEs are now charging are something along the lines of a return to "normal" interest rates. Normal rates being ones that have a realistic risk premium in them.

These two issues do, actually, converge: if the GSEs are the only ones buying loans right now, then they are likely to be buying more of the kinds of loans that private investors used to buy before they quit buying anything. Unless they want to go the same way their private competitors have gone, they have to either tighten standards or raise risk premiums or a combination of both, since it's pretty obvious that the private investor loans of the last few years--mostly subprime, Alt-A, and jumbo--were pretty seriously underpriced. Mortgage markets really aren't that weirder than any other market: you can't make up a negative margin on volume.

This Times piece strikes me as just a somewhat subtler version of the "GSEs Refuse to Save the Day" rhetoric we've seen expressed somewhat more stridently before. What else can we make of this:

Those buying homes will have little choice but to absorb the cost. But the new policies will be felt more by those thinking of refinancing mortgages.Ohhh-kaaay. If you have to buy--apparently people do "have to" buy--you just have to pay a higher interest rate than buyers did until recently. But if you already have a mortgage and refinancing doesn't look promising right now because the rate you have is lower than the rate on a new loan--you're really suffering? Well, OK, what we seem to mean is that if you "have to" refinance--to get cash or to get out of some crazy high-risk ARM--then you will feel some pain. Because apparently Fannie and Freddie aren't willing to take borrowers who "have to" supplement their income with cash-outs or bail out of loans that let them buy too much house without charging extra for it.

Strangely enough, the Times piece makes pretty clear that this "charging extra" doesn't really amount to all that much, relatively speaking. Another eighth of a percent on the annual interest rate isn't exactly going to hit the usury ceiling any time soon. It also provides a nifty little chart showing that one-year ARM rates are still out there with a pretty decent discount. If you don't like paying 6.93% (in New York) for a 30-year fixed, you can always get an ARM for 6.01%. What? You don't want an ARM because you're afraid rates will rise in the future? And we thought rates no longer had anything to do with such expectations . . .

Thursday, August 21, 2008

More Fannie and Freddie

by Calculated Risk on 8/21/2008 09:46:00 AM

"FNM and FRE should just have a new single consolidated ticker: FUBAR"From the WSJ: Fannie, Freddie Fears Stifle Stocks

Reader BR

Investors are increasingly concerned about the possibility of a federal bailout that could wipe out holders of the companies' common equity. The uncertainty swirling around the government-sponsored enterprises also may complicate the companies' efforts to win new financing to buy mortgages. Freddie and Fannie have been forced to pay higher yields to investors in recent debt offerings.To me, it seems that bond market participants are trying to force Paulson's hand. That is why Freddie and Fannie have had to pay more in recent debt offerings.

If Fannie and Freddie stumble, it could further cripple the U.S. housing market, a troubling scenario for banks and brokers already struggling under the weight of soured mortgage investments.

My initial reaction to the rescue plan was: "It seems the plan is bad for equity holders, but good for debt holders ... and potentially bad for taxpayers.". That still seems right. I'm not sure what the equity holders expected.

From Bloomberg: Paulson's Fannie-Freddie `Bazooka' Shakes Investors

The powers Paulson won from Congress last month enabling a government rescue of Freddie Mac and Fannie Mae -- authority he likened to a weapon whose mere existence made it unlikely it would have to be fired -- may end up making a bailout more likely, say analysts and investors.

...

``The common shareholders will probably be completely wiped out,'' Paul Miller, an analyst at FBR Capital Markets, said in a Bloomberg Television interview. ``Preferred will also see a lot of pain. But that is up in the air because a lot of banks own the preferred. You put a lot of banks in trouble if you just wipe out the preferred also.''

Wednesday, August 20, 2008

Cliff Diving: Fannie and Freddie

by Calculated Risk on 8/20/2008 03:59:00 PM

Fannie and Freddie were the story of the day. Here are the most recent quotes:

FNM 4.47 off 1.54 (25.62%)

FRE 3.23 off 0.94 (22.54%)

From Bloomberg: Fannie, Freddie Slump on Concern Bailout Is Likely

Fannie Mae and Freddie Mac tumbled in New York trading to the lowest levels since at least 1990 as speculation increased that the U.S. Treasury will bail out the mortgage-finance companies, wiping out shareholders.It seems like market participants are trying to force Paulson's hand.

...

Freddie paid its highest yields over U.S. Treasuries on record in a debt sale yesterday amid concern that credit losses are depleting the capital of the beleaguered mortgage-finance companies.

Fannie and Freddie have $223 billion of bonds due by the end of the quarter and their success in rolling over that debt may determine whether they can avoid a federal bailout. Fannie has about $120 billion of debt maturing through Sept. 30, while Freddie has $103 billion ...

Friday, August 08, 2008

Fannie Mae: Books $5.35 billion in credit-costs, to Halt Alt-A

by Calculated Risk on 8/08/2008 09:42:00 AM

From the WSJ: Fannie Posts Deep Loss, Slashes Dividend Payment

Fannie Mae swung to a second-quarter loss as the largest buyer of home loans booked $5.35 billion in credit-costs from boosting loss provisions and charge-offs. ... eliminating higher-risk loans -- namely newly originated Alt-A acquisitions ... As of June 30, Alt-A mortgage loans represented 11% of Fannie's total mortgage book of business and 50% of its second-quarter credit losses.And from Bloomberg: Fannie Mae, Battling Losses, to Stop Accepting Alt-A Mortgages

Fannie Mae, the largest U.S. mortgage- finance company, will stop buying or guaranteeing Alt-A home loans, such as those that require little or no documentation of borrower incomes or assets, by yearend.

...

``Over 60 percent of our losses have come from a small number of products, but especially Alt-A loans,'' ... the Washington-based company said in a statement.

Thursday, August 07, 2008

2007 Vintage Mortgages

by Calculated Risk on 8/07/2008 05:21:00 PM

Update: Tanta comments:

I think the chart would be more helpful if it also included CLTV over this period.Original post:

(I'm sure CR didn't do that because UBS didn't report that data.)

My sense is that those spikes in 2007 in high LTV are telling you the Day the Second Lien Lenders Died. (And the drop-off in high LTVs is telling you the Day the MIs Backed Off.)

In other words, my theory is that Freddie was mostly buying 80% LTV loans in 2003-2006 because that's what people were making. Nobody wanted a high LTV loan with MI when they could get these piggyback deals. If you looked at CLTV over this same period, I think it would show that.

So everybody's share of high LTV loans increased in 2007, because the supply of subordinate financing dried up.

End of the day, it doesn't explain the early DQ of the 2007 vintage for me because I suspect the CLTVs on the 2006 vintage were just as high.

Click on table for larger image in new window.

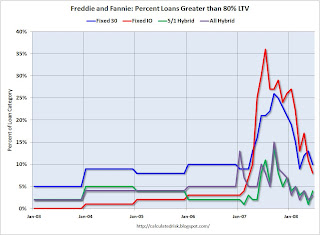

Click on table for larger image in new window.This is a graph of the percent of Freddie Mac and Fannie Mae loans with a LTV greater than 80% (by loan category). The data is annual through 2006, and monthly starting in January 2007.

The graphs for low FICO loans, and greater than 90% LTV loans, are of similar shape, although the percentages are not as high.

This suggests that lending standards at Fannie and Freddie were relaxed in 2007, and have been tightened in 2008.

For the complete table, see: Fannie and Freddie: High LTV, Low FICO by Year

The WSJ's article on 2007 delinquencies: Mortgages Made in 2007 Go Bad at Rapid Clip

For Tanta's take on the WSJ article: 2007 Vintage: Nowhere to Go?

Tanta is suggesting 2007 vintage borrowers had nowhere to go - they couldn't refi, they couldn't sell, they couldn't access their HELOC - and this might be causing the higher delinquencies in 2007. The graph above suggests that the looser lending standards at Fannie and Freddie might have contributed too.

Wednesday, August 06, 2008

Fannie and Freddie: High LTV, Low FICO by Year

by Calculated Risk on 8/06/2008 04:03:00 PM

UPDATE: Newer table showing round trip on lending standards.

Brian has sent me this table (from UBS) summarizing the percentage of high LTV (loan to value), and low FICO loans made by Fannie and Freddie each year. Click on table for larger image in new window.

Click on table for larger image in new window.

UBS commented:

"We expect the delinquencies to rise considerably further, given the deterioration of the GSE book of business in 2007. As the non-Agency markets shut down in 2007, conforming product that had risk layering came into Agency space.

...

No matter what box one looks at, the results are the same - in the first 8 months of 2007, the % of Freddie and Fannie issuance with risky characteristics rose considerably. ... It is well documented that increased risk layering causes losses to multiply."

Pimco's Gross: Treasury to Buy Fannie/Freddie Preferred by End of Quarter

by Calculated Risk on 8/06/2008 03:43:00 PM

From Bloomberg: Pimco's Gross Says U.S. Will Rescue Fannie, Freddie (hat tip Yal)

``By the end of the third quarter, the preferred stock in Fannie and Freddie will be issued, the Treasury will have bought it,'' Gross, co-chief investment officer at Pacific Investment Management Co., said today in an interview on Bloomberg Television. ``We'll be on our way toward a joint Treasury-agency combination.''This will probably happen the first week of September since I'll be on a hiking trip! No worries - Tanta and friends will have it covered.

...

The government will probably buy $10 billion to $30 billion of preferred stock, Gross said.

Thursday, July 31, 2008

Freddie Mac Changes Servicer Guidelines

by Calculated Risk on 7/31/2008 06:09:00 PM

HousingWire has the story: Freddie Mac Pushes Out Foreclosure Timelines

Perhaps the boldest move by Freddie Mac on Thursday — and one that won’t get much press attention — was its decision to eliminate foreclosure timeline compensation altogether for servicers, effective immediately. In other words, servicers will no longer earn a bonus based on how quickly they can foreclose.There is much more.

If that doesn’t scream “modify more loans,” then the GSE’s decision to double compensation for servicers in completing workouts certainly will. Freddie said it will now pay servicers $800 for a loan modification, $2,200 for a short payoff or make-whole preforeclosure sale, and $500 per repayment plan. Deeds-in-lieu of foreclosure didn’t get Freddie’s same endorsement, however, and will remain at the current incentive level of $250, the GSE said.

The decision to eliminate timeline compensation, however, was only part of a much broader program change rolled out by Freddie; the mortgage finance giant also said that it was increasing its allowable foreclosure timeline in 21 states to a whopping 300 days from last of date payment, and 150 days from initiation of foreclosure, effective on Friday.

Saturday, July 26, 2008

Senate Passes Housing Bill

by Calculated Risk on 7/26/2008 06:01:00 PM

From the NY Times: Congress Sends Housing Relief Bill to Bush

Here is the WSJ version: Congress Passes Housing Bill

First, I think the impact of the original part of the housing bill will be minimal. The provision allows the FHA to insure up to $300 billion in new mortgages for certain borrowers. The key is that the current lender has to voluntarily agree to write down the loan balance to 85% of the current appraised value before the FHA will insure the new loan.

The CBO has estimated that the FHA will only insure $68 billion in loans for about 325,000 homeowners. The number will be limited because only certain homeowners actually qualify, and also because lenders probably will not be eager to write down loans to 85% of the current appraised value.

My biggest concerns with this provision are appraisal fraud and adverse selection.

The other major provision of the housing bill is the Paulson Plan to support Fannie and Freddie. The cost to taxpayers is very uncertain, although I doubt it will be zero (the CBO's base case). The GSE support does appear to be almost unlimited (limited only by the debt ceiling that was increased to $10.6 trillion from $9.815 trillion).

The actual cost of the Paulson Plan is a huge concern.

There are many other provisions. As the NY Times mentions:

There are provisions, for example, that grant or extend Section 8 federal housing subsidy eligibility to residents of specific properties in Malden, Mass., and San Francisco. And there is a provision tailored narrowly for Chrysler to ensure that it can benefit from a corporate tax incentive even though the company is now structured as a partnership not a corporation. The bill does not name Chrysler but rather describes an unnamed automobile manufacturer “that will produce in excess of 675,000 automobiles” between Jan. 1 and June 30, 2008.Weird.

The bill also has a tax credit for new home buyers (up to $7,500). This appears to be structured as a no interest loan that has to be repaid within 15 years.

The bill has many other provisions too, including permanently increasing the conforming loan limit to 115% of the local area median home price (with a ceiling of $625,000, from $417,000), and eliminating FHA related Downpayment Assistance Programs (DAPs). Tanta and I have been advocating eliminating DAPs for years.

Note: I could have some of the specifics wrong - I've read several stories, and the details vary.

I think the bill doesn't match the heated rhetoric on the internets (I've seen people write this is the "end of capitalism" and the "dollar is doomed"). Although I'm sure some commenters will confuse me with Pollyanna!

Tuesday, July 22, 2008

CBO: Fannie and Freddie Rescue to Cost $25 billion

by Calculated Risk on 7/22/2008 12:11:00 PM

Here is the letter from the CBO.

[M]any analysts and traders believe that there is a significant likelihood that conditions in the housing and financial markets could deteriorate more than already reflected on the GSEs’ balance sheets, and such continuing problems would increase the probability that this new authority would have to be used. Taking into account the probability of various possible outcomes, CBO estimates that the expected value of the federal budgetary cost from enacting this proposal would be $25 billion over fiscal years 2009 and 2010. That estimate accounts for both the possibility that federal funds would not have to be expended under the new authority and the possibility that the government would have to use that authority to provide assistance to the GSEs.It's important to note the the CBO analysis is a probability-weighted average method; the cost could be zero, the cost could dwarf $25 billion.

Monday, July 21, 2008

Bloomberg: Freddie Mac May Slow Purchases

by Calculated Risk on 7/21/2008 09:46:00 AM

Bloomberg reports that Freddie Mac May Slow Purchases of Mortgages, Bonds

Freddie Mac ... may cut purchases of home loans from banks and bonds backed by housing debt to shore up its capital amid record delinquencies.Less buying by Freddie Mac would probably mean less mortgage lending, and higher mortgage rates.

The government-sponsored company is also considering selling securities and reducing its dividend ...

Friday, July 18, 2008

Agency Mortgage-Bond Spreads Increase

by Calculated Risk on 7/18/2008 01:47:00 PM

From Bloomberg: Agency Mortgage-Bond Spreads Rise as Freddie Mac Ponders Sales

The difference between yields on Fannie Mae's current- coupon, 30-year fixed-rate mortgage bonds and 10-year government notes widened 5 basis points to 206 basis points [a four-month high], according to data compiled by Bloomberg.This is still below the spread in March of 238 bps. The increase today is apparently due to comments made in a Freddie SEC filing.

Freddie Mac is considering selling assets carried below their value to maintain acceptable capital ratios, it said today in a filing with the U.S. Securities and Exchange Commission.Selling of these assets (or less buying) would put pressure on the price. The end result would probably be higher mortgage rates.

WSJ Report: Freddie Considering Stock Sale

by Calculated Risk on 7/18/2008 12:40:00 AM

From the WSJ: Mortgage Giant Freddie Mac Considers Major Stock Sale

Freddie Mac ... is considering raising capital by selling as much as $10 billion in new shares to investors ...A little stock rally, and, well ... this seems extremely unlikely to me.

The main buyers for any new-stock issues are likely to be existing shareholders world-wide, according to one person involved in the discussion, adding that a definitive plan hasn't yet been determined.

In the short term, a sale of new shares might eliminate the need for the Treasury's help, but a government bailout might still be required later.

Tuesday, July 15, 2008

Paulson: Fannie, Freddie Not Planning to Use Rescue Now

by Calculated Risk on 7/15/2008 11:40:00 AM

From MarketWatch: Paulson: Fannie, Freddie don't plan to use U.S. backstop

Troubled mortgage-finance giants Fannie Mae aren't planning to use a U.S. government backstop now, Treasury Secretary Henry Paulson told members of a Senate panel Tuesday."Now" is the key word. How about tomorrow, or maybe next week?

In the very short term, before congressional approval of the Paulson Plan, the only portion of the rescue plan that is operative is that Fannie and Freddie can borrow from the NY Fed. And this probably isn't needed because the Fannie and Freddie problems don't appear to be a short term liquidity issue.