by Calculated Risk on 9/26/2023 09:00:00 AM

Tuesday, September 26, 2023

Case-Shiller: National House Price Index Up 1.0% year-over-year in July; New all-time High

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3-month average of May, June and July closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Continues to Trend Upward in July

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported 1.0% annual change in July, up from a 0% change in the previous month. The 10- City Composite showed an increase of 0.9%, which improves from a -0.5% loss in the previous month. The 20-City Composite posted a year-over-year increase of 0.1%, improving from a loss of -1.2% in the previous month.

...

Before seasonal adjustment, the U.S. National Index, 10-City and 20-City Composites, all posted a 0.6% month-over-month increase in July.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.6%, while the 10-City posted a 0.8% increase and 20-City Composite a 0.9% increase.

“U.S. home prices continued to rally in July 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “Our National Composite rose by 0.6% in July, and now stands 1.0% above its year-ago level. Our 10- and 20-City Composites each also rose in July 2023, and likewise stand slightly above their July 2022 levels.

“We have previously noted that home prices peaked in June 2022 and fell through January of 2023, declining by 5.0% in those seven months. The increase in prices that began in January has now erased the earlier decline, so that July represents a new all-time high for the National Composite. Moreover, this recovery in home prices is broadly based. As was the case last month, 10 of the 20 cities in our sample have reached all-time high levels. In July, prices rose in all 20 cities after seasonal adjustment (and in 19 of them before adjustment).

“That said, regional differences continue to be striking. On a year-over-year basis, the Revenge of the Rust Belt continues. The three best-performing metropolitan areas in July were Chicago (+4.4%), Cleveland (+4.0%), and New York (+3.8%), repeating the ranking we saw in May and June. The bottom of the leader board reshuffled somewhat, with Las Vegas (-7.2%) and Phoenix (-6.6%) this month’s worst performers.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.8 in July (SA) and is at a new all-time high.

The Composite 20 index is up 0.9% (SA) in July and is also at a new all-time high.

The National index is up 0.6% (SA) in July and is also at a new all-time high.

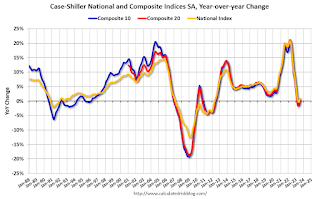

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 0.9% year-over-year. The Composite 20 SA is up 0.1% year-over-year.

The National index SA is up 1.0% year-over-year.

Annual price changes were close to expectations. I'll have more later.