by Calculated Risk on 8/10/2023 10:20:00 AM

Thursday, August 10, 2023

MBA: "Mortgage Delinquencies Decrease in the Second Quarter of 2023"; Lowest Level on Record

From the MBA: Mortgage Delinquencies Decrease in the Second Quarter of 2023

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter of 2023, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 19 basis points from the first quarter of 2023 and down 27 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the second quarter fell by 3 basis points to 0.13 percent.

“The seasonally-adjusted mortgage delinquency rate fell to its lowest level since MBA’s survey began in 1979, reaching 3.37 percent in the second quarter of 2023,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Buoyed by a resilient job market, homeowners are continuing to make their mortgage payments.”

Walsh noted that delinquencies fell across all mortgage types – conventional, FHA, and VA. Both foreclosure starts and foreclosure inventory also declined relative to the previous quarter.

Added Walsh, “Despite low delinquency rates, there are early signs of possible consumer credit stress. Delinquencies are rising for other forms of credit such as credit cards and car loans[1]. In addition, FHA delinquencies rose 10 basis points compared to year ago levels. On a non-seasonally adjusted basis, FHA delinquencies rose 13 basis points year-over-year and 71 basis points from the first quarter of 2023. As the economy slows and labor market cools, homeowners with FHA loans are likely to feel the distress first.”

emphasis added

Click on graph for larger image.

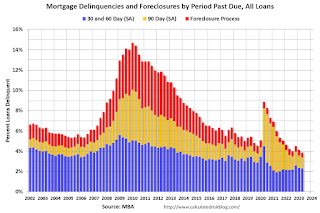

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q2.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 2 basis points to 1.75 percent, the 60-day delinquency rate remained unchanged at 0.55 percent, and the 90-day delinquency bucket decreased 17 basis points to 1.07 percent.The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.53 percent, down 4 basis points from the first quarter of 2023 and 6 basis points lower than one year ago.

The percent of loans in the foreclosure process decreased slightly year-over-year in Q2 even with the end of the foreclosure moratoriums and are historically low.