by Calculated Risk on 5/22/2023 10:31:00 AM

Monday, May 22, 2023

What Happened to "Paying off the National Debt"?

At the turn of the millenium, the concern was that the US was paying off the debt too quickly!

Here are a few excerpts from a speech by then Fed Chair Alan Greenspan in April 2001: The paydown of federal debt

"Today I want to address a subject in which your group and the Federal Reserve share a keen interest--the paydown of the federal debt and its implications for the economy and financial markets. While the magnitudes of future federal unified budget surpluses are uncertain, they are highly likely to remain sizable for some time. ...What went wrong over the last 20+ years?

[C]urrent forecasts suggest that under a reasonably wide variety of possible tax and spending policies, the resulting surpluses will allow the Treasury debt held by the public to be paid off. Moreover, well before the debt is eliminated--indeed, possibly within a relatively few years--it may become difficult to further reduce outstanding debt to the public because the remaining obligations will mostly consist of savings bonds, well-entrenched holdings of long-term marketable debt, and perhaps other types of debt that could prove difficult to reduce."

Here is a list of events and policy choices that significantly increased the debt after 2000:

1) The 2000 projections were overly optimistic.

2) The 2001 recession.

3) The 2001 and 2003 Bush Tax Cuts.

4) 9/11, Homeland Security Spending and the War in Afghanistan

5) The War in Iraq

6) The Finacial Crisis and Great Recession

7) The Trump Tax Cuts

8) The Pandemic.

Here is a brief discussion ... (books have been written on each of these topics):

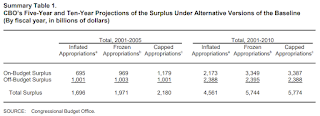

1) Overly Optimistic Projections: Here are the CBO projections from July 2000: The Budget and Economic Outlook: An Update

Click on graph for larger image.

Click on graph for larger image.

The CBO projections showed an almost $6 Trillion in debt reduction in the 2001 through 2010 period.

I argued in 2000 that these projections ignored possible negative events such as an investment led recession due to the bursting of stock bubble. These projections were clearly overly optimistic.

2) The 2001 Recession: Although Greenspan mentioned "the current slowdown in economic activity" in his April 2001 speech, he didn't realize the economy was already in a recession. From the May 2000 FOMC minutes:

3) Bush Tax Cuts: These tax cuts were sold as slowing the growth of the surpluses (using Greenspan's speech for cover)! Instead, the tax cuts (mostly for the wealthy) turned the surpluses into deficits and reduced revenue by $1.5 trillion or more over the 2001 - 2010 period.

There were various Inspector General reports that the Fed and FDIC field examiners were expressing significant concerns in 2003 and 2004, but Greenspan was blocking all efforts to tighten standards - and the Bush Administratio was loosening bank regulations!

There were various Inspector General reports that the Fed and FDIC field examiners were expressing significant concerns in 2003 and 2004, but Greenspan was blocking all efforts to tighten standards - and the Bush Administratio was loosening bank regulations!

This photo shows John Reich (then Vice Chairman of the FDIC and later at the OTS) and James Gilleran of the Office of Thrift Supervision (with the chainsaw) and representatives of three banker trade associations: James McLaughlin of the American Bankers Association, Harry Doherty of America's Community Bankers, and Ken Guenther of the Independent Community Bankers of America.

1) Overly Optimistic Projections: Here are the CBO projections from July 2000: The Budget and Economic Outlook: An Update

Click on graph for larger image.

Click on graph for larger image.The CBO projections showed an almost $6 Trillion in debt reduction in the 2001 through 2010 period.

I argued in 2000 that these projections ignored possible negative events such as an investment led recession due to the bursting of stock bubble. These projections were clearly overly optimistic.

2) The 2001 Recession: Although Greenspan mentioned "the current slowdown in economic activity" in his April 2001 speech, he didn't realize the economy was already in a recession. From the May 2000 FOMC minutes:

"The information reviewed at this meeting suggested that economic growth had remained rapid through early spring.."The economy was already in a recession!

3) Bush Tax Cuts: These tax cuts were sold as slowing the growth of the surpluses (using Greenspan's speech for cover)! Instead, the tax cuts (mostly for the wealthy) turned the surpluses into deficits and reduced revenue by $1.5 trillion or more over the 2001 - 2010 period.

4) 9/11, Homeland Security Spending and the War in Afghanistan: The 9/11/2001 attacks led to a sharp increase in homeland security spending and the War in Afghanistan.

5) The War in Iraq: The Bush administration argued the war would cost around $80 billion. VP Dick Cheney said on Meet the Press: "every analysis said this war itself would cost about $80 billion". Instead, the war cost well over $1 trillion (and countless lives were lost). Note: I've mentioned on this blog that "I opposed the Iraq war, and was shouted down and called names like "Saddam lover" for questioning the veracity of the information."

6) The Financial Crisis and Great Recession. This was the worst US recession since the Great Depression. This led to the first $1 trillion annual budget deficit in US history and dramatically increased the national debt. The causes of the bubble were rapid changes in the mortgage lending industry, rating agencies that didn't account for those changes, combined with a lack of regulatory oversight. I was talking with field regulators in 2005 and 2006, and they were all terrified. I was told the appointees at the top of the agencies were blocking any effort to tighten standards.

There were various Inspector General reports that the Fed and FDIC field examiners were expressing significant concerns in 2003 and 2004, but Greenspan was blocking all efforts to tighten standards - and the Bush Administratio was loosening bank regulations!

There were various Inspector General reports that the Fed and FDIC field examiners were expressing significant concerns in 2003 and 2004, but Greenspan was blocking all efforts to tighten standards - and the Bush Administratio was loosening bank regulations!This photo shows John Reich (then Vice Chairman of the FDIC and later at the OTS) and James Gilleran of the Office of Thrift Supervision (with the chainsaw) and representatives of three banker trade associations: James McLaughlin of the American Bankers Association, Harry Doherty of America's Community Bankers, and Ken Guenther of the Independent Community Bankers of America.

7) The Trump Tax Cuts: These tax cuts - mostly for the wealthy - were sold with several promises - all failed. See: The Failed Promises of the 2017 Tax Cuts and Jobs Act (TCJA). A couple of quote:

8) The Pandemic: Deficit spending increased sharply due to the pandemic.

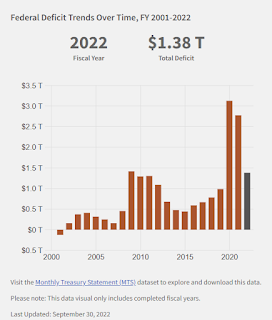

Here is a graph of the actual annual deficits since 2000.

Here is a graph of the actual annual deficits since 2000.

Note: This is not adjusted for the growth of the economy. Later I'll post a graph showing the annual deficit as a percent of GDP.

So, what happened to "paying off the debt"? A series of adverse events (9/11, pandemic), and poor policy choices.

Note that all the "poor policy choices" were by Republicans including tax cuts, the Iraq War, and failure to properly regulate.

“Not only will this tax plan pay for itself, but it will pay down debt,” Treasury Secretary Steve Mnuchin, Sept 2017Complete nonsense.

“I think this tax bill is going to reduce the size of our deficits going forward,” Sen. Pat Toomey (R-PA), November 2017

8) The Pandemic: Deficit spending increased sharply due to the pandemic.

Here is a graph of the actual annual deficits since 2000.

Here is a graph of the actual annual deficits since 2000.Note: This is not adjusted for the growth of the economy. Later I'll post a graph showing the annual deficit as a percent of GDP.

So, what happened to "paying off the debt"? A series of adverse events (9/11, pandemic), and poor policy choices.

Note that all the "poor policy choices" were by Republicans including tax cuts, the Iraq War, and failure to properly regulate.

We cannot always avoid adverse events, but I opposed each of these poor policy choices as they happened - so these are clearly avoidable.

In Joys of Yiddish, Leo Rosten gives the classic definition of "Chutzpah":

“Chutzpah is that quality enshrined in a man who, having killed his mother and father, throws himself on the mercy of the court because he is an orphan.”As far as the budget, the GOP has made a series of poor policy choices and now they want to cut the programs for the poor and middle class. Talk about Chutzpah!