by Calculated Risk on 5/24/2023 12:38:00 PM

Wednesday, May 24, 2023

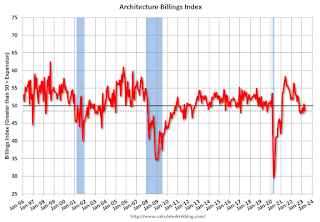

AIA: Architecture Billings Decreased in April

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AIA/Deltek Architecture Billings Index Reflects Continued Weakness in Business Conditions in April

Architecture firms reported a modest decrease in April billings. However, there was a slight increase in inquiries into future project activity according to a report released today from The American Institute of Architects (AIA).

The billings score for March decreased from 50.4 in March to 48.5 in April (any score below 50 indicates a decrease in firm billings). However, firms reported that inquiries into new projects accelerated slightly to 53.9, while most firms continued to report a decline in the value of new design contracts, with a score of 49.8.

“The ongoing weakness in design activity at architecture firms reflects clients’ concerns regarding the economic outlook,” said AIA Chief Economist Kermit Baker Hon. AIA, Ph.D. “High construction costs, extended project schedules, elevated interest rates, and growing difficulty in obtaining financing are all weighing on the construction market.”

...

• Regional averages: Midwest (51.2); West (49.3); South (48.7); Northeast (47.2)

• Sector index breakdown: mixed practice (firms that do not have at least half of their billings in any one other category) (52.1); commercial/industrial (51.8); institutional (50.6); multi-family residential (41.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.5 in April, down from 50.4 in March. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has declined in 6 of the last 7 months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment later in 2023 and into 2024.

Note that multi-family billing turned down in July 2022 and has been negative for TEN consecutive months. At 41.5, this was the weakest reading for multi-family since the start of the pandemic in March and April 2020. This suggests we will see a downturn in multi-family starts this year.