by Calculated Risk on 3/04/2023 08:11:00 AM

Saturday, March 04, 2023

Schedule for Week of March 5, 2023

The key report scheduled for this week is the February employment report.

Fed Chair Powell presents the Semiannual Monetary Policy Report to the Congress on Tuesday and Wednesday.

No major economic releases scheduled.

8:00 AM: Corelogic House Price index for January.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 195,000 payroll jobs added in February, up from 106,000 added in January.

10:00 AM ET: Job Openings and Labor Turnover Survey for January from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in December to 11.0 million from 10.4 million in November.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the U.S. House Financial Services Committee

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 195 thousand initial claims, up from 190 thousand last week.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for February. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.4%.

8:30 AM: Employment Report for February. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.4%.There were 517,000 jobs added in January, and the unemployment rate was at 3.4%.

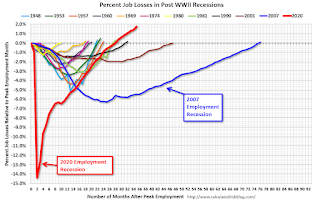

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

As of January, total jobs were 2.70 million above pre-pandemic levels. This was the last update for this graph this employment cycle.