by Calculated Risk on 3/09/2023 11:15:00 AM

Thursday, March 09, 2023

February Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.4%.

From BofA economists:

"[W]e expect nonfarm payroll growth moderated to 230k, reversing much of the acceleration seen in January. This should still be enough to put downward pressure on the unemployment rate since we expect the labor force participation rate to be unchanged at 62.4%. As a result, we look for the unemployment rate to remain unchanged at 3.4%, but there is a meaningful risk that it rounds down to 3.3%."From Goldman Sachs:

"We left our nonfarm payroll forecast unchanged at +250k (mom sa)."

Click on graph for larger image.

Click on graph for larger image.• First, as of January there were 2.70 million more jobs than in February 2020 (the month before the pandemic).

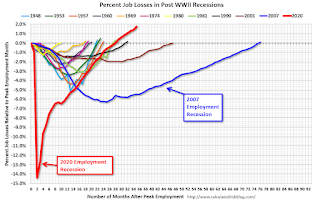

This graph shows the job losses from the start of the employment recession, in percentage terms. As of June 2022, the total number of jobs had exceeded pre-pandemic levels.

• ADP Report: The ADP employment report showed 242,000 private sector jobs were added in February. This suggests job gains slightly above consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in February to 49.1%, down from 50.6% last month. This would suggest 25,000 jobs lost in manufacturing. The ADP report indicated 43,000 manufacturing jobs added in February.

The ISM® services employment index increased in February to 54.0%, from 50.0% last month. This would suggest service employment increased 180,000 in February.

Combined, the ISM surveys suggest 155,000 jobs added in February (below the consensus forecast).

• Unemployment Claims: The weekly claims report showed no change in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 192,000 in January to 192,000 in February. This would usually a similar number of layoffs in February as in January. In general, weekly claims were below expectations in February.

• COVID: As far as the pandemic, the number of weekly cases during the reference week in January was around 262,000, down from 317,000 in January.

• Weather: In January, the San Francisco Fed estimated that weather adjusted employment gains added 125 thousand to the employment report, and there should be some payback in February.

• Other Factors: The settlement of a labor dispute at the University of California boosted payrolls by about 40 thousand in January. Seasonal factors could also impact this report. In February 2022, the consensus was for 400 thousand jobs added, and the BLS reported 678 thousand jobs gained (since revised up to 904 thousand). And in February 2021, the consensus was for 148 thousand jobs added, and the BLS reported 379 thousand jobs added (since revised up to 575 thousand). Although the consensus has been way too low in February for the last two years, the new seasonal adjustments might negatively impact job gains in the February 2023 report.

• Conclusion: Accounting for weather and the end of the labor dispute, January employment gains were around 350 thousand - close to the gains for the previous 5 months. Reversing the January special factors, my guess is the employment report will be close to the consensus forecast.