by Calculated Risk on 2/16/2023 11:21:00 AM

Thursday, February 16, 2023

NY Fed Q4 Report: Household Debt Increases, Mortgage and Auto Loan Growth Slows

From the NY Fed: Total Household Debt Reaches $16.90 trillion in Q4 2022; Mortgage and Auto Loan Growth Slows

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows an increase in total household debt in the fourth quarter of 2022, increasing by $394 billion (2.4%) to $16.90 trillion. Balances now stand $2.75 trillion higher than at the end of 2019, before the pandemic recession. The report is based on data from the New York Fed's nationally representative Consumer Credit Panel.

Mortgage balances rose by $254 billion in the fourth quarter of 2022 and stood at $11.92 trillion at the end of December, marking a nearly $1 trillion increase in mortgage balances in 2022.

Credit card balances increased $61 billion in the fourth quarter to $986 billion, surpassing the pre-pandemic high of $927 billion. Auto loan balances increased by $28 billion in the fourth quarter, consistent with the upward trajectory seen since 2011. Student loan balances now stand at $1.60 trillion, up by $21 billion from the previous quarter. In total, non-housing balances grew by $126 billion.

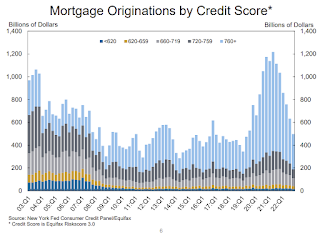

Mortgage originations, which include refinances, fell to $498 billion in the fourth quarter, representing a return to lower levels last seen in 2019. The volume of newly originated auto loans was $186 billion, representing a slight increase from the previous quarter. Aggregate limits on credit card accounts increased by $88 billion in the fourth quarter and now stand at $4.4 trillion.

The share of current debt becoming delinquent increased again in the fourth quarter for nearly all debt types, following two years of historically low delinquency transitions. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.4 percentage points, respectively.

"Credit card balances grew robustly in the 4th quarter, while mortgage and auto loan balances grew at a more moderate pace, reflecting activity consistent with pre-pandemic levels," said Wilbert van der Klaauw, economic research advisor at the New York Fed. "Although historically low unemployment has kept consumer's financial footing generally strong, stubbornly high prices and climbing interest rates may be testing some borrowers' ability to repay their debts."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows aggregate consumer debt increased in Q4. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $394 billion in the fourth quarter of 2022, a 2.4% rise from 2022Q3. Balances now stand at $16.90 trillion and have increased by $2.75 trillion since the end of 2019, just before the pandemic recession.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased in Q4. From the NY Fed:

Aggregate delinquency rates decreased in the fourth quarter of 2022 and remained low, after declining sharply through the beginning of the pandemic, although there has been some shift in the composition, with increases in the share of balances that are 30- 59 days past due and declines in seriously delinquent balances. As of December, 2.5% of outstanding debt was in some stage of delinquency, 2.2 percentage points lower than last quarter of 2019, just before the COVID-19 pandemic hit the United States.

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports, declined to $498 billion in 2022Q4, back to the lower levels seen in 2019. ... The median credit score of newly originated mortgages declined again, to 766, down from a series high in 2021Q1 of 788 and returning to pre-covid levels which remain very high and reflect continuing high lending standards. The median credit score on newly originated auto loans was down slightly, to 711, but remained about level with the past two years.There is much more in the report.