by Calculated Risk on 2/22/2023 12:00:00 PM

Wednesday, February 22, 2023

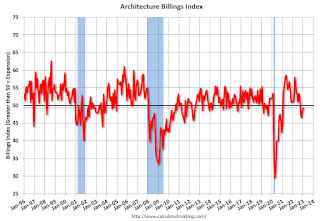

AIA: Architecture Billings "Continue to Contract" in January

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architectural billings continue to contract in 2023

Fewer architecture firms report declining billings in January compared to billing activity in December, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for January was 49.3* compared to 48.4 in December (any score below 50 indicates a decline in firm billings). Last month’s score indicates overall revenue at U.S architecture firms continued to decline from December to January, however, the pace of decline slowed. Inquiries into new projects during January grew, with a score of 55.2 compared to 52.6 in December. The value of new design contracts also reflected an easing in the pace of decline, rising to a score of 53.4 in January from 50.0 the previous month.

“While the downturn in design activity extended to four months in January, there are signs of easing,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “In particular, architecture firms reported that new project work has begun to increase, signifying that this decline in billings may reverse in the coming months.”

...

• Regional averages: Midwest (51.6); West (51.3); Northeast (50.9); South (46.9)

• Sector index breakdown: mixed practice (56.0); institutional (48.6); commercial/industrial (46.8); multi-family residential (45.9)

*Every January the AIA research department updates the seasonal factors used to calculate the ABI, resulting in a revision of recent ABI values.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.3 in January, up from 48.4 in December. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had been positive for 20 consecutive months but indicated a decline the last four months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment in early 2023, but a slowdown in CRE investment later in 2023.

Note that multi-family billing turned down in September and has been negative for five consecutive months. This suggests we will see a downturn in multi-family starts this year (multi-family starts probably have already peaked).